Tech giant Meta Platforms (META) is reportedly in discussions with its partner, eyewear company EssilorLuxottica (ESLOF), to double the production of its AI-enabled Ray-Ban smart eyeglasses by the end of this year. A production target of 20 million units or more has reportedly been set, with the option to increase to more than 30 million if needed.

Meta is experiencing “unprecedented demand” for its eyeglasses, so it has paused the product’s international rollout. While it’s not ideal to delay the international launch of the eyeglasses, the company is expected to overcome this hurdle soon.

These developments are part of Meta’s shifted focus toward artificial intelligence (AI). Recently, the company launched its “Meta Compute” initiative to develop AI infrastructure while managing its worldwide data centers and supplier collaborations in its quest for superintelligence.

Amid this new focus on AI, should you buy, sell, or hold Meta’s stock?

About Meta Platforms Stock

Meta Platforms ranks among the largest tech companies, driving global connectivity through its flagship social media and messaging platforms, including Facebook, Instagram, WhatsApp, and Messenger. Its sophisticated advertising network leverages data-driven targeting to connect businesses with audiences across apps and external sites. The company has a market capitalization of $1.56 trillion.

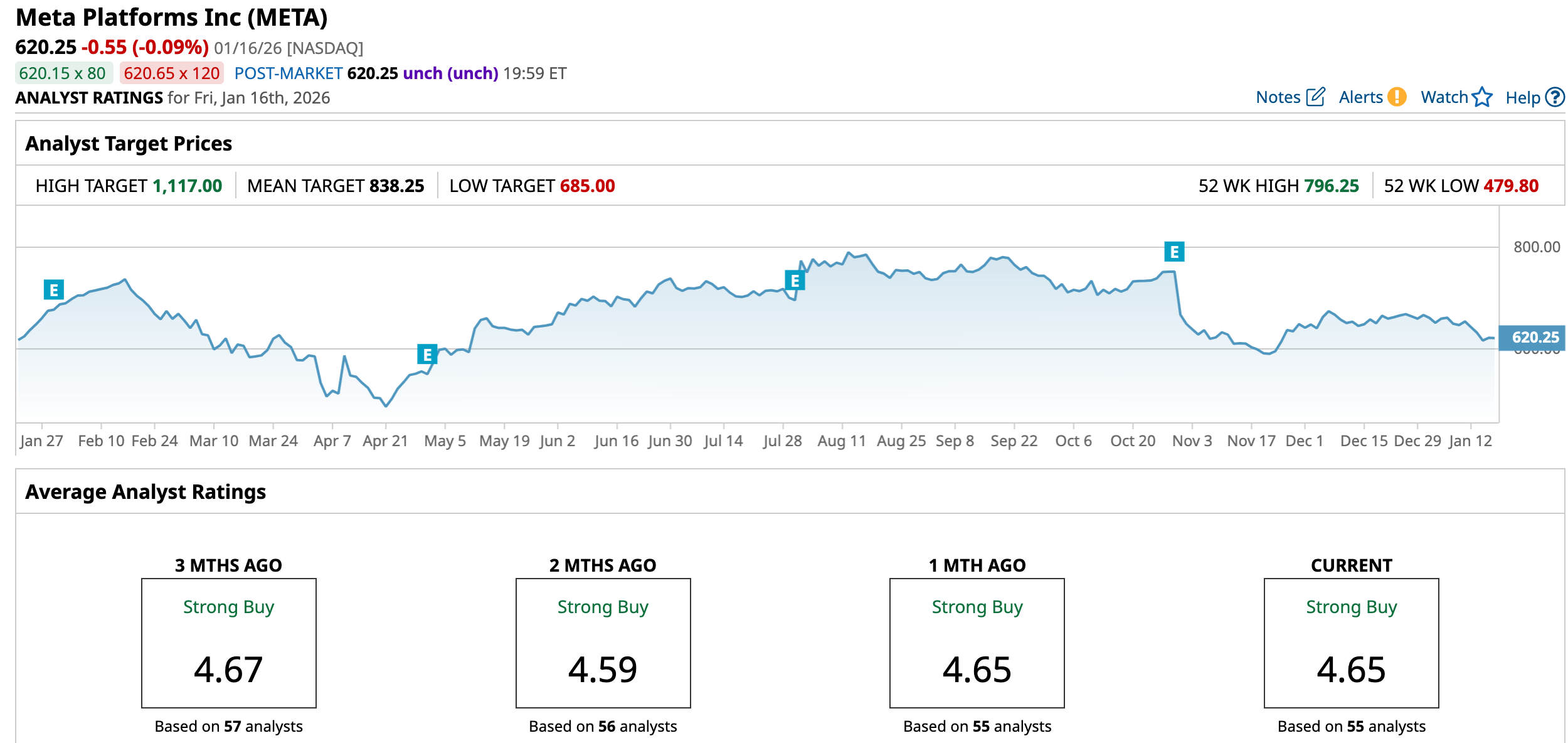

Over the past 52 weeks, the stock has gained only about 1.46%, while over the past six months it has declined by 11.76%. The stock had reached a 52-week high of $796.25 in August 2025, but is down 22% from that level. After the company reported its third-quarter results, the stock dropped 11.3% intraday on Oct. 30, 2025.

Meta’s price-to-earnings GAAP forward ratio of 26.79x is higher than the industry average of 17.55x.

Meta Platforms’ AI Pivot

In October 2021, the company changed its name from Facebook to Meta Platforms, reflecting its shift toward the metaverse, which was marketed as a virtual space where people can work, play, and socialize. Now, over four years later, the company is changing its focus toward AI.

In its third-quarter earnings release, Meta highlighted plans to accelerate its AI infrastructure and increase capital spending. The company plans to nearly double the prior year’s outlay to a range of $70 billion - $72 billion.

While the company is optimistic about its aggressive strategy to become a major player in the AI space, investors were less optimistic. The AI space is now highly competitive, with heavyweight tech players vying for more market share in this buzzing market.

This pivot is also evident in the company’s plan to lay off employees in the virtual reality (VR) division of its Reality Labs business. The layoffs exceed 1,000 positions, affecting roughly 10% of the hardware division responsible for Quest VR headsets and the Horizon Worlds virtual social network.

Meta Platforms’ Q3 Results Were Better Than Expected

On Oct. 29, Meta reported its third-quarter results for fiscal 2025. Despite the stock dropping sharply post the results, the company’s earnings actually surpassed Wall Street analysts’ estimates.

Meta’s revenue increased by 26% year-over-year (YOY) to $51.24 billion, exceeding the Wall Street analysts’ $49.45 billion estimate. The top line growth was driven by a 26% annual increase in revenue from its family of apps to $50.77 billion.

The company continues to see heightened engagement across its apps. Its family daily active people (DAP) were 3.54 billion on average in September 2025, up 8% YOY, and ad impressions over its family of apps in Q3 increased by 14% from the prior-year period.

Meta’s EPS for the quarter was $1.05, down by 83% YOY. However, the company’s net income for Q3 included a one-time, non-cash income tax charge of $15.93 billion related to the implementation of the One Big Beautiful Bill Act. Excluding this impact, EPS would have increased by $6.20 to $7.25. This adjusted EPS exceeded the $6.61 analysts expected.

Wall Street analysts are optimistic about Meta’s future earnings. They expect the company’s EPS to climb by 3.4% YOY to $8.29 for the fourth quarter. For fiscal 2025, EPS is projected to surge 23.2% annually to $29.40, followed by a 4.3% growth to $30.66 in fiscal 2026.

What Do Analysts Think About Meta Platforms’ Stock?

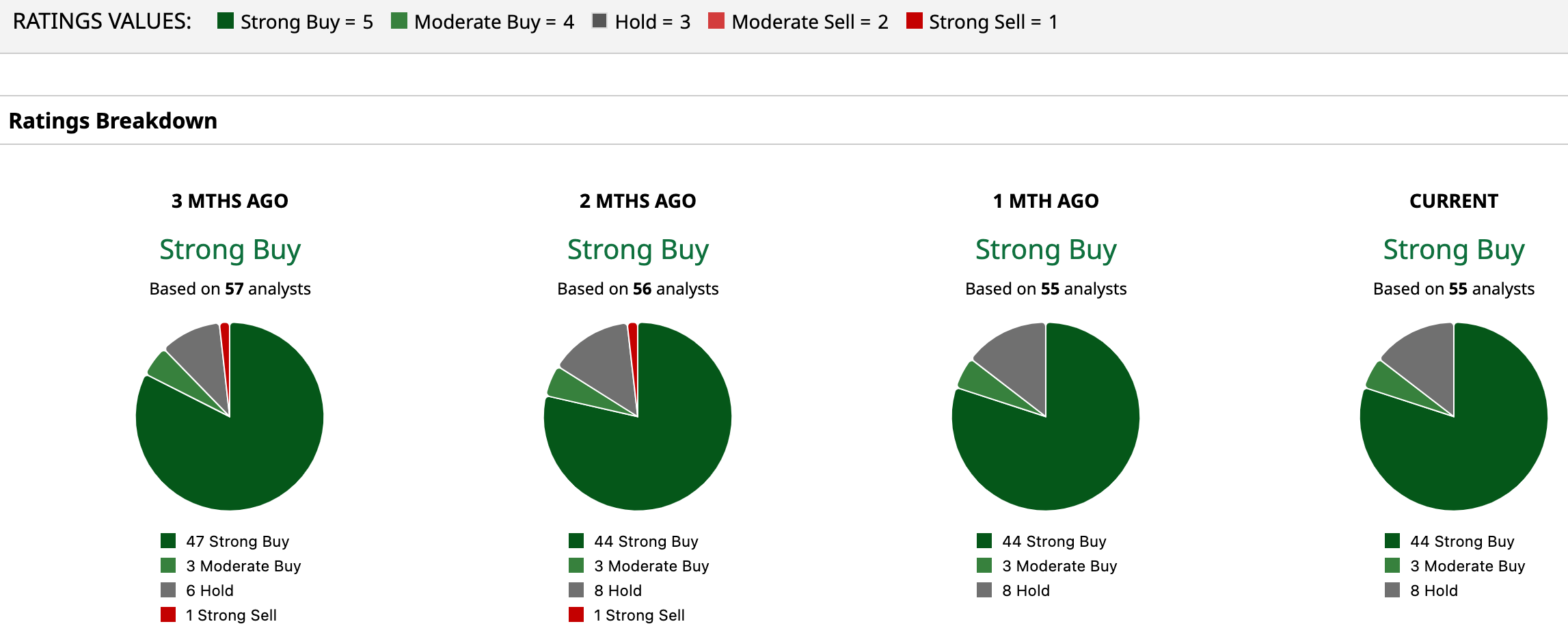

Wall Street analysts are still bullish on Meta’s stock. Recently, Rosenblatt analyst Barton Crockett maintained a “Buy” rating on the stock with a Street-high $1,117 price target. Citing Meta’s cost management and earnings growth potential, analyst John Blackledge of TD Cowen also maintained a “Buy” rating on the company’s stock and kept an $810 price target.

Meta has been in the spotlight on Wall Street, with analysts awarding it a consensus “Strong Buy” rating. Of the 55 analysts rating the stock, a majority of 44 analysts have rated it a “Strong Buy,” three analysts suggest a “Moderate Buy,” while eight analysts are playing it safe with a “Hold” rating. The consensus price target of $838.25 represents a 35.2% upside from current levels. The Street-high Rosenblatt price target of $1,117 indicates a 80% upside.

Key Takeaways

While the AI space is highly competitive, tech behemoth Meta will likely become a major player as it invests heavily in infrastructure. Moreover, the company is well-positioned in the wearables market. Given the robust performance of its core operations and strong analyst sentiments, Meta’s stock might still be a solid investment.

On the date of publication, Anushka Dutta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart