As we head into January 2026, investors and analysts are closely scrutinizing UnitedHealth Group (UNH) to determine whether UNH stock merits a buy, sell, or hold stance. Once a perennial outperformer in the healthcare sector, UnitedHealth has faced a challenging 2025 marked by earnings misses, revised profit guidance, elevated medical costs, and operational pressures, particularly in its Medicare Advantage business, which drove the company’s share price to significant lows and raised questions about near-term growth prospects. Yet, recent data points to stabilizing fundamentals that could underpin a rebound in 2026.

So, should you invest in UNH stock now?

About UnitedHealth Stock

UnitedHealth is a leading diversified healthcare company headquartered in Minnesota. Through its two major businesses — the insurance arm UnitedHealthcare and the services business Optum (which includes pharmacy-benefit management, technology and care-delivery) — the company offers a broad spectrum of healthcare products and services to individuals, employers, governments and care providers. Its market capitalization stands at $299 billion, reflecting the company's stature among the largest U.S. healthcare firms.

Over the course of 2025, UNH stock has delivered a notable negative return for the year, with total return showing a decline of around 33%, largely underperforming the broader S&P 500 Index’s (SPX) 17% gain over the past 52 weeks.

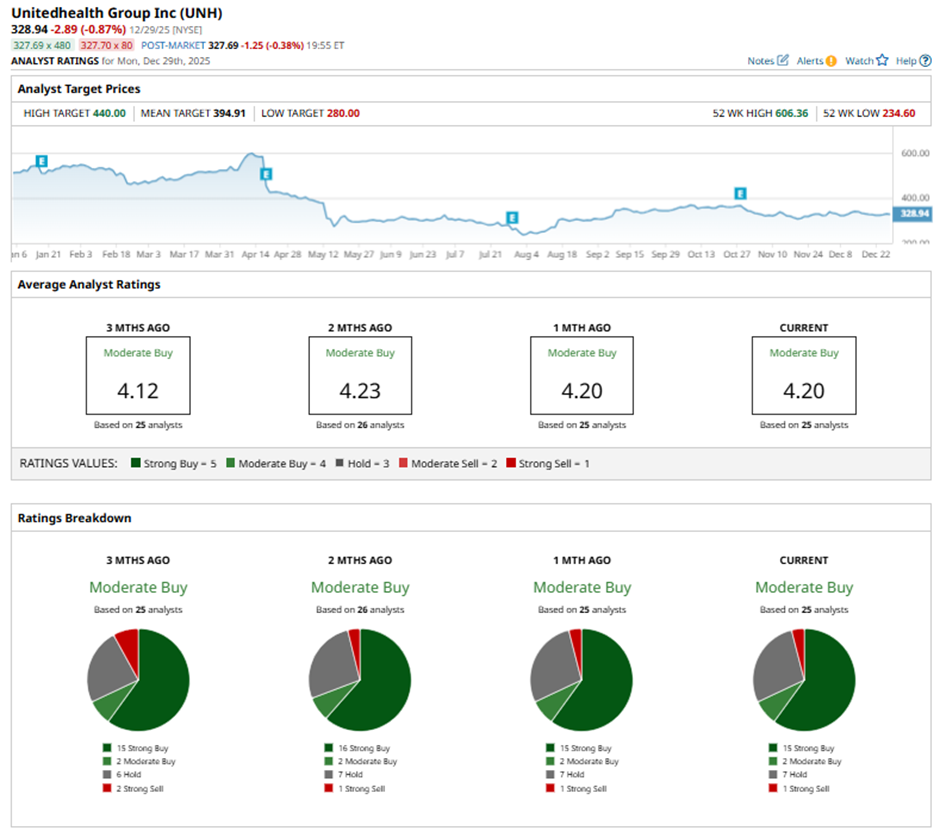

Looking closer at its 52-week performance, UnitedHealth’s share price has experienced a wide swing. The 52-week high sits at $606.36, reached in April, when the company’s outlook and fundamentals were stronger. Currently, the stock is down 44% from that high, reflecting the selloff during periods of heightened regulatory scrutiny, earnings pressures, and management changes earlier in the year.

Notably, UnitedHealth ended a seven-session losing streak with a modest rebound on Dec. 24, closing 0.86% higher at $327.58, although the broader performance picture remains weak. The stock currently trades around the $338 level.

UNH stock is also currently trading at a discount compared to industry peers at 20 times forward earnings.

Mixed Q3 Results

UnitedHealth Group reported its third quarter 2025 results on Oct. 28. In the quarter ended Sept. 30, the company posted $113.2 billion in revenue, representing a 12% year-over-year (YOY) increase, driven by growth across both UnitedHealthcare and Optum segments.

Within the UnitedHealthcare segment, which represents the core health insurance business, revenue grew by about 16% YOY to $87.1 billion. Meanwhile, the broader Optum business saw revenue rise about 8% YOY to roughly $69.2 billion. Within Optum, Optum Rx posted the most notable growth.

However, adjusted EPS came in at $2.92, significantly below the prior year’s $7.15, yet above market expectations.

UnitedHealth reported $4.3 billion in earnings from operations, down roughly 50% compared with about $8.7 billion in Q3 2024, reflecting the impact of elevated medical costs and reimbursement pressures across the business. The net margin compressed significantly to 2.1%, compared with about 6% a year ago.

Despite margin compression, management raised the full-year 2025 earnings outlook, targeting at least $14.90 in EPS and $16.25 in adjusted EPS, signaling confidence in cost management and strategic initiatives.

Analysts predict EPS to be around $16.30 for fiscal 2025, down 41% YOY, before surging by 8% annually to $17.60 in fiscal 2026.

What Do Analysts Expect for UnitedHealth Group Stock?

Bullish views note that UnitedHealth Group has worked through recent headwinds, with recovering profits, and the potential for double-digit returns supported by its scale and diversified healthcare operations. However, more cautious analysts highlight ongoing uncertainty tied to possible changes in ACA subsidies and strategic repositioning planned for 2026.

Earlier in December 2025, Wolfe Research raised its price target on UnitedHealth Group to $375 from $330 while reiterating an “Outperform” rating, citing improving fundamentals and long-term earnings potential. The firm believes margin recovery at UnitedHealthcare and stronger growth at Optum will be key drivers.

Overall, UNH stock has a consensus “Moderate Buy” rating. Of the 25 analysts covering the stock, 15 advise a “Strong Buy,” two suggest a “Moderate Buy,” seven analysts are on the sidelines with a “Hold” rating, and one analyst gives a “Strong Sell" rating.

The average analyst price target for UNH stock is $394.91, indicating 17% potential upside ahead. The Street-high target price of $440 suggests that the stock could rally as much as 31% from here.

On the date of publication, Subhasree Kar did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart