With a market cap of $94.6 billion, Robinhood Markets, Inc. (HOOD) operates a digital platform enabling users to invest in stocks, ETFs, options, cryptocurrencies, and other assets with features like fractional trading, recurring investments, and retirement accounts. It also offers education tools, cash and spending products, credit cards, and a global digital currency marketplace.

Shares of the Menlo Park, California-based company have significantly outpaced the broader market over the past 52 weeks. HOOD stock has surged 109.3% over this time frame, while the broader S&P 500 Index ($SPX) has returned 15%. However, shares of the company are down 8.6% on a YTD basis, lagging behind SPX’s 1.9% gain.

Focusing more closely, shares of the payment processing company have outperformed the State Street Financial Select Sector SPDR ETF’s (XLF) 3.3% rise over the past 52 weeks.

Shares of Robinhood tumbled 10.8% following its Q3 2025 results on Nov. 5, 2025 as the company raised its full-year 2025 guidance for combined adjusted operating expenses and SBC to about $2.28 billion. Investors were also concerned that operating expenses rose to $639 million, beating expectations, driven by marketing, growth initiatives, and acquisition-related costs.

Although Robinhood posted strong results with revenue of $1.27 billion (up 100%), EPS of $0.61 (up 259%), and net deposits of $20.4 billion, the higher-than-expected expense outlook pressured the stock.

For the fiscal year that ended in December 2025, analysts expect Robinhood Markets’ EPS to grow 85.3% year-over-year to $2.02. The company’s earnings surprise history is promising. It beat the consensus estimates in the last four quarters.

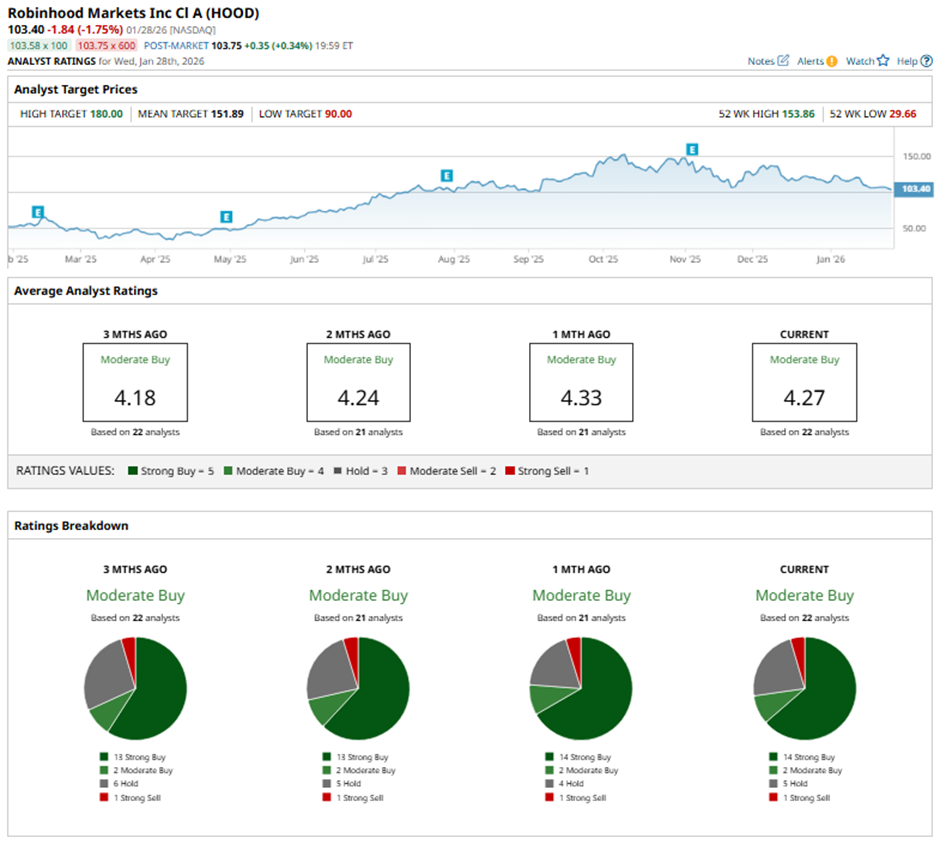

Among the 22 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 14 “Strong Buy” ratings, two “Moderate Buys,” five “Holds,” and one “Strong Sell.”

This configuration is slightly more bullish than three months ago, with 13 “Strong Buy” ratings on the stock.

On Jan. 28, Needham analyst John Todaro reaffirmed a “Buy” rating on Robinhood Markets and maintained a price target of $135.

The mean price target of $151.89 represents a 46.9% premium to HOOD’s current price levels. The Street-high price target of $180 suggests a 74.1% potential upside.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- More Layoffs Are Coming at Citigroup in March. What Does That Mean for C Stock and Its 2% Dividend?

- Kenvue Is Headed for a Merger Vote on January 29. How Should You Play KVUE Stock Here?

- Is This Little-Known Defense Stock the Next Palantir?

- Intel Stock Just Got a New Street-High Price Target. Should You Buy INTC Here?