Alumis (ALMS) stock exploded higher on Tuesday after the biotech firm reported promising Phase 3 results for envudeucitinib, its candidate treatment for psoriasis.

In the late-stage trial, envudeucitinib helped patients experience symptom improvement that “rank among the strongest reported for an oral therapy,” the company said in its press release.

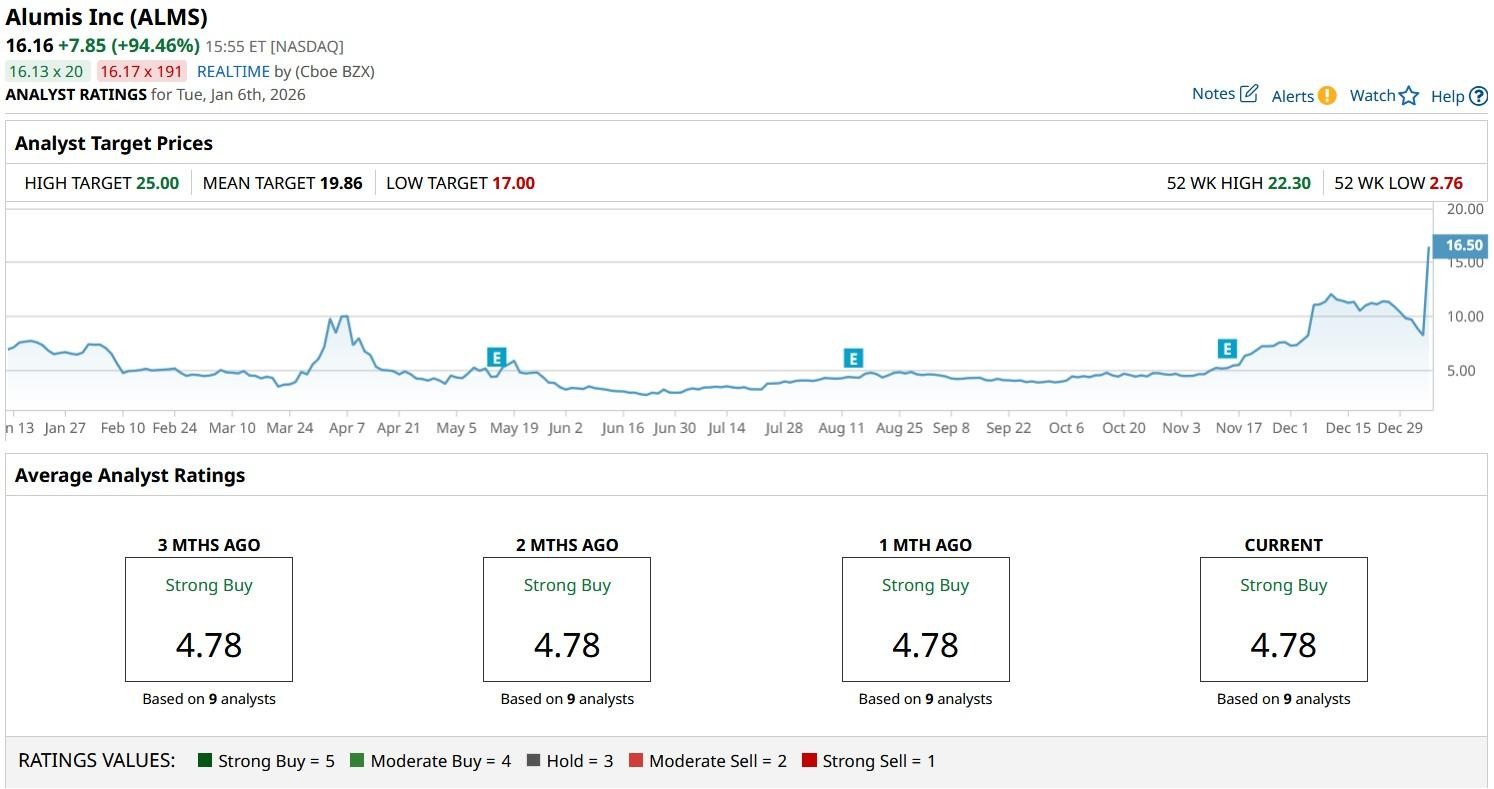

While ALMS shares reversed nearly half of their intraday gains by market close on Jan. 6, at one point, they were seen trading at a high of $22.30.

Does the Envudeucitinib News Warrant Buying Alumis Stock?

The Phase 3 readout is a “game-changer” for Alumis shares as envudeucitinib met all primary and secondary endpoints, delivering superior skin clearance rates compared to existing therapies.

For investors, this isn’t just another clinical win, it positions ALMS as a serious contender in the multibillion-dollar psoriasis market, currently dominated by Bristol Myers (BMY) and Johnson & Johnson (JNJ).

In fact, the rapid onset of efficacy, with meaningful improvements seen as early as week four, underscores the drug’s potential to redefine treatment standards.

If regulatory approval follows, Alumis could secure a foothold in one of the largest immunology markets, transforming its profile from a speculative biotech name to a legitimate growth story.

Where Options Data Suggests ALMS Shares Are Headed

While ALMS stock closed significantly lower than its intraday high on Jan. 6, signaling much of the rally was actually sentiment-driven, there’s reason to own this biotech name for the long term

With psoriasis representing a global market worth tens of billions of dollars annually, even modest penetration could trigger significant upside.

Plus, the firm’s pipeline includes additional immunology assets, offering diversification beyond psoriasis.

In short, Alumis offers early stage exposure to multiple advanced therapeutic markets at a time when the overall sentiment on biotech is seen improving in 2026.

According to Barchart, bullish options contracts expiring mid-April indicate potential for a 15% rally from here, which means ALMS could be trading near $19 within the next four months.

How Wall Street Recommends Playing Alumis

Wall Street analysts also recommend sticking with Alumis stock especially since the biotech firm’s recent capital raises suggest it can fund commercialization efforts in 2026.

The consensus rating on ALMS shares currently sits at “Strong Buy” with the mean target of nearly $20 indicating potential upside of more than 20% from here.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- SoFi Stock Is Breaking Below Key Support Ahead of Q4 Earnings. Should You Buy the Dip or Stay Far Away?

- SanDisk Stock Just Became Overbought After 20% Surge in SNDK. How Should You Play the Top S&P 500 Name Here?

- Should You Chase the Rally in Alumis Stock Today?

- Dear Oklo Stock Fans, Mark Your Calendars for January 7