These days, you can wager on just about any event, be it a sports game, a political outcome, or an earnings report. As a lifelong sports fan and horse racing enthusiast, I am intrigued with how these so-called prediction markets are developing.

Why? Because they are muscling their way into the world of forecasting. And winning. To the tune of potentially $6 billion a week, based on some estimates.

This growth is being fueled by mainstream partnerships (like Robinhood (HOOD) and Coinbase (COIN)), the integration of prediction data into media outlets, and a regulatory environment that has become increasingly permissive following a landmark 2024 court ruling that declared election betting is not “gaming.”

Prediction Markets and My Proprietary ROAR Score

Pardon the pun, but I have a horse in this race.

I recently put the finishing touches on a 6-year research project called ROAR, which stands for “Return Opportunity And Risk.” As I write about here at Barchart, ROAR is a technical analysis system based on how I’ve viewed charts for 45 years. But with a strong risk management tilt.

The layman’s question that ROAR asks of any stock or ETF is “what are the chances that the next 10% move in this security will be up and not down?” The ROAR score of that asset is an estimate of the percentage answer to that question.

It dawned on me that this is very similar to how prediction markets work. At places like Polymarket, Kalshi, and many new entrants, the world of forecasting has fundamentally transformed. We grew up with polls, and academic experts.

Now, this new industry is solving the problem that traditional polling and pundits couldn’t. Prediction markets give us “skin in the game.”

Let’s face it, throughout human history, people have had opinions. But it took until this decade for them to be treated like a formal financial exchange. Now it’s here, and as it appears, it is well on the way to replacing traditional polling, among other inefficient methods of gauging risk. They rely on the proverbial “wisdom of crowds,” for “bettor” or worse.

The more I thought about it, the more I started to realize that the system I created over the years to analyze stocks and ETFs was essentially akin to a prediction market. The main difference is that ROAR relies on technical analysis, price demand, and supply. Prediction markets use opinions expressed by their captive base of subscribers.

What Do They Say About the S&P 500 Right Now?

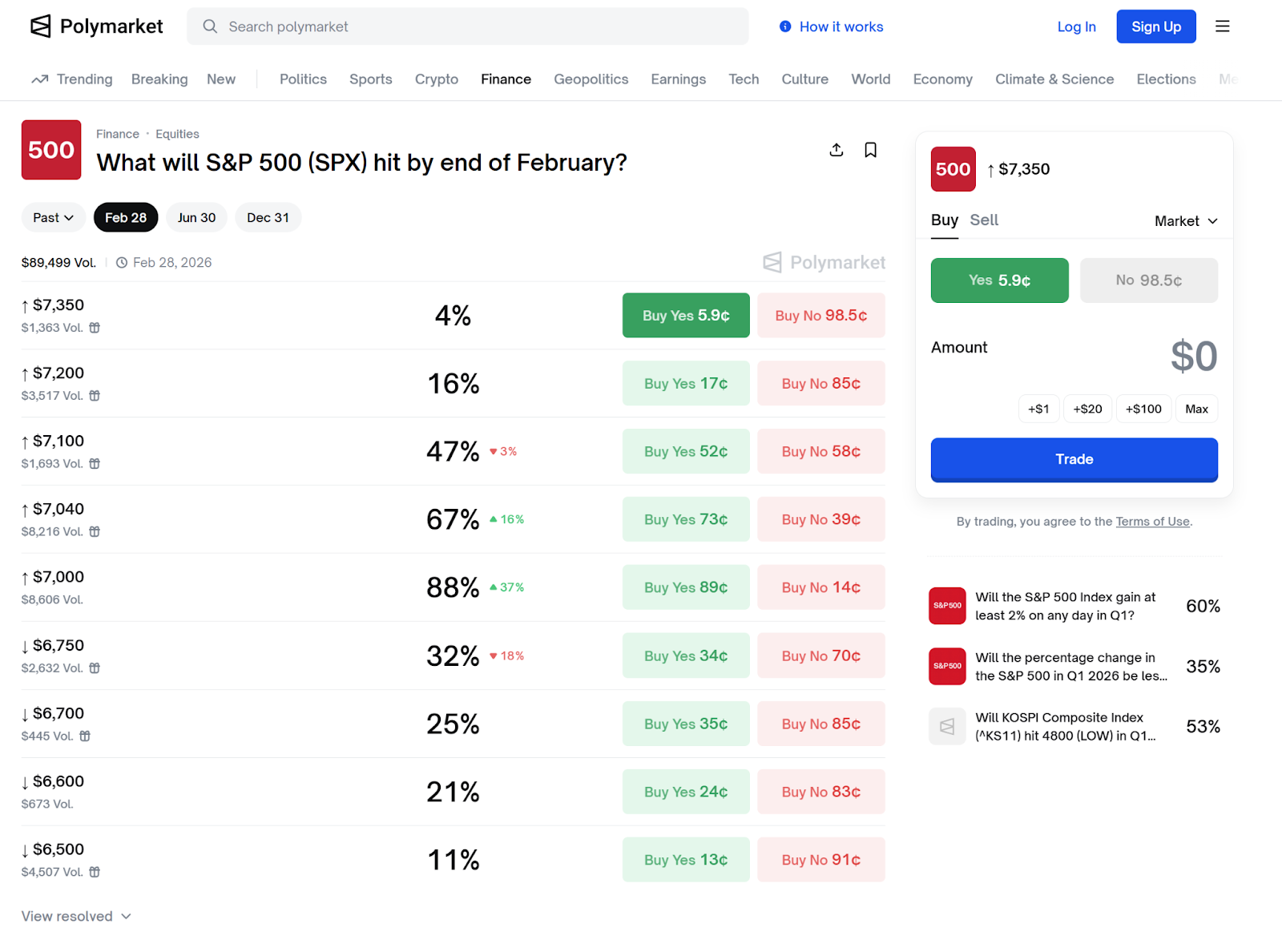

Here’s a page from Polymarket. As of Tuesday morning, this is what its S&P 500 Index ($SPX) page included. I chose this one because it is not a “day trade” on the S&P 500, which is also offered. This one targets the market close in a few weeks, at the end of February.

That busy-but-comprehensive table outlines a range of possibilities. Again, I can’t help but go back to the horse racing analogy. Each potential S&P 500 price as of Feb. 28 has “odds” associated with it.

Those odds, as in horse racing,will fluctuate until the market is, as described by Polymarket, “resolved.” As the platform states in this case:

This market will resolve to ‘Yes’ if, at any point between market creation and market close on the final day of trading for February 2026, any 1-minute candle for S&P 500 (SPX) shows a final ‘High’ price equal to or above the listed price. Otherwise, this market will resolve to ‘No.’

Polymarket closes out this item one minute prior to market close on that date. And in this specific case, since it says “by” the end of February, it just needs to hit that level along the way. Polymarket calls this a “touch” market.

Other bets are settled as of a certain point in time.

How Is ROAR different?

Prediction markets are primarily about a yes or no question. In that sense, they are more like traditional buy/hold/sell calls from Wall Street analysts. You can point to a “Buy” rating, and if the stock is down 30% 6 or 12 months later, you can assume it didn’t work out.

If I thought the world needed another mechanism like that, I would not have devoted so much time to creating ROAR. I’d just eyeball stock and ETF charts as I’ve done for decades.

But in my travels through this industry, I felt there was something missing. Among the deluge of ratings and grades we can get with a single click, I couldn’t find a lot of focus on risk management. The natural thing is to ask “how much can I make?”

Since I’m a very conservative investor, I sought for myself a less time consuming yet consistent and process-driven way to ask:

What are the chances that the next 10% move in this security will be up and not down?

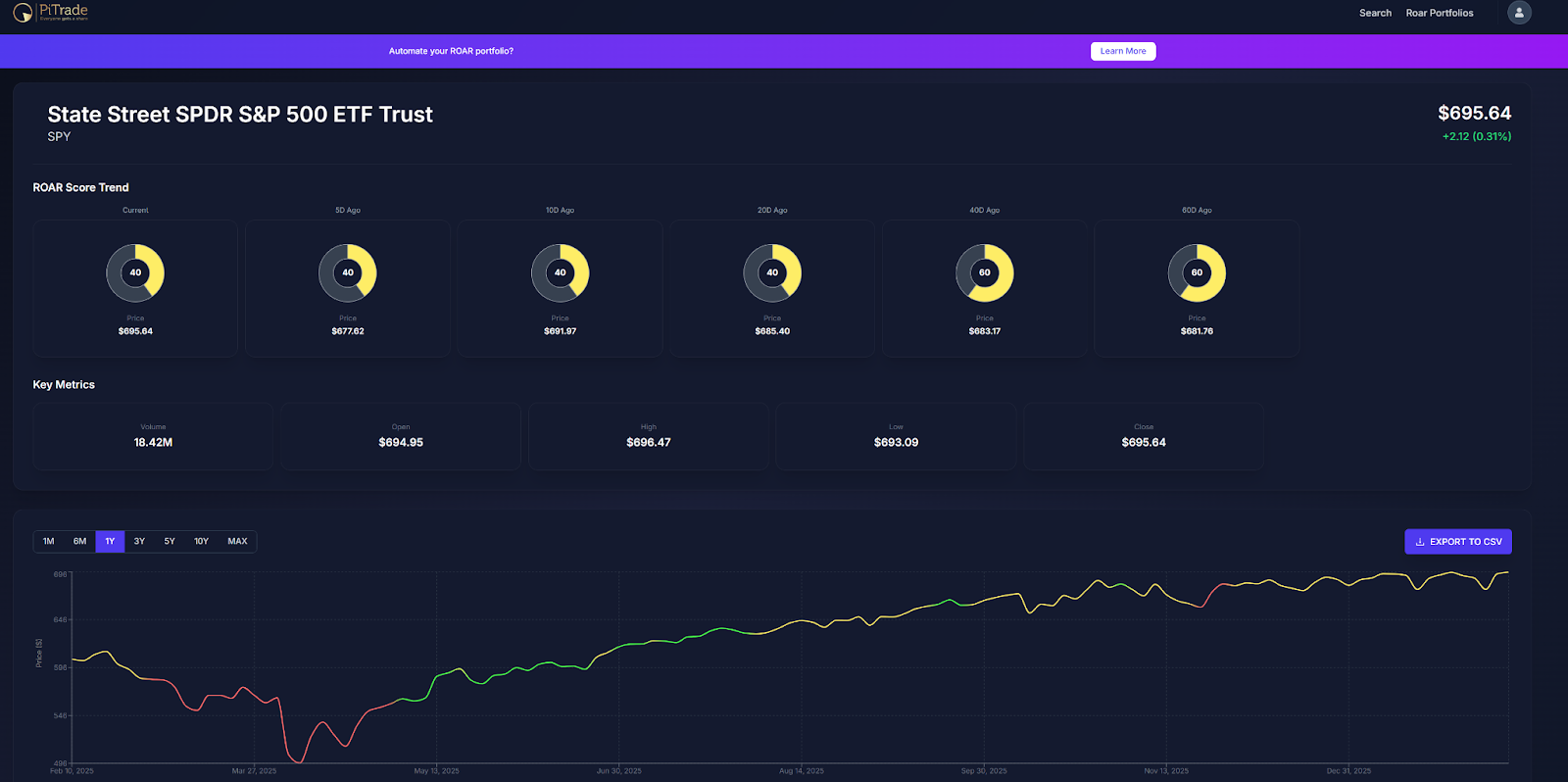

So yes, it is similar to a prediction market, although ROAR looks a bit further out. Like these platforms, ROAR scores continuously adapt to sudden changes in the return/risk tradeoff, as shown by fluctuations in the score over time. Here’s an example using the S&P 500 via the SPY (SPY), so we can compare it with the mission of prediction market systems.

SPY was judged to have a slightly higher risk than normal of the next 10% move being down, not up. That’s implied by the ROAR Score of 40, on a 0 to 100 scale. It has been in that range for a little while, down from 60 a few months ago. And the line chart at the bottom shows SPY’s price, with a color code along the way, to show when the score indicated higher risk (red), lower risk (green) or more average/neutral between a prospective up or down move.

Prediction markets and ROAR are trying to do something very similar: put return potential and risk side by side. So that every investor can decide for themselves what risks to take, and how much to take, as they pursue profits.

The Probabilities and Possibilities Are Endless

Whether it is handicapping the S&P 500, returns on gold (GCJ26) versus Bitcoin (BTCUSD), Treasury rates, or the 2026 U.S. Midterm elections, prediction markets have brought front and center a very intriguing method of taking what we think and allowing us to act on it. I’ve charted financial markets since the 1980s. I used them as the central component of my own investment process back in my days as an investment advisor and fund manager.

So to see transparent, open, organized central locations for financially charged opinions, as prediction markets are doing, makes me very excited.

Rob Isbitts is a semi-retired fiduciary investment advisor and fund manager. Find his investment research at ETFYourself.com. To copy-trade Rob’s portfolios, check out the new PiTrade app.

On the date of publication, Rob Isbitts did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- I Created My Own Prediction Market. What It’s Telling Me About the S&P 500 Now, and What Comes Next.

- Stock Index Futures Muted With U.S. Retail Sales Data in Focus

- Is the Market Running on Borrowed Time? This 1 Statistic Is Flashing a Major Warning Sign.

- Stocks Set for Muted Open as Bond Yields Climb, Key U.S. Economic Data Awaited