Michael Saylor isn't backing down from his Bitcoin (BTCUSD) bet, even after the crypto briefly dipped below $62,000 last week and as Strategy (MSTR) faces mounting paper losses. A video from May 2025 has gone viral again after Bitcoin lost half its value from its October peak above $126,000. In the video, Saylor makes a bold claim: “If people in the rest of the world knew what I know […] and they agreed with me, Bitcoin would go to $10 million tomorrow.”

The timing couldn't be worse for that clip to resurface. Strategy just disclosed that it purchased 855 BTC for $75.3 million, paying an average of $87,974 per coin, according to a regulatory filing. With Bitcoin now trading near $69,000, those fresh purchases are already underwater.

Strategy's Bitcoin Position Turns Red

According to a CCN report, Strategy now holds 713,502 BTC acquired for about $54.3 billion at an average cost of $76,052 per coin. At current prices, these holdings are now valued at approximately $50 billion, leaving the firm with more than $4 billion in unrealized losses. Back in October, Strategy's Bitcoin stash showed paper gains approaching $33 billion. The reversal has been brutal.

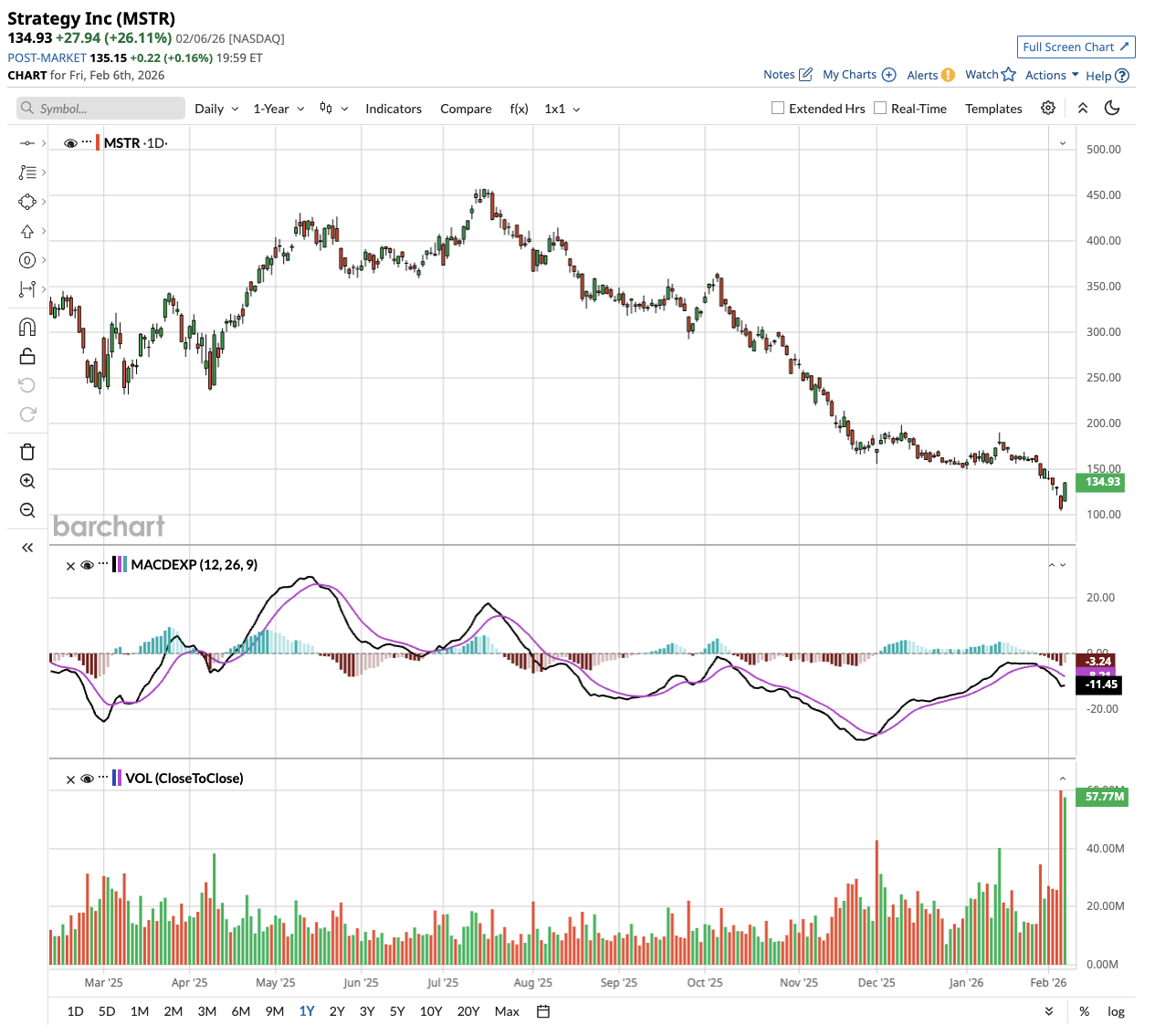

MSTR stock has been hammered, too. Shares have fallen about 12% year-to-date (YTD), 44% over the past three months, and 60% over the past 52 weeks. MSTR stock is also down more than 70% from its July 2025 peak of $457.22.

In the fourth quarter of 2025, Strategy posted a net loss of $12.4 billion, or $42.93 per share on a diluted basis, compared to $670.8 million in the year-ago period. Strategy's operating loss stood at $17.4 billion versus $1 billion a year earlier.

Will Strategy Be Forced to Sell Bitcoin?

Despite the bloodbath, Saylor frames Bitcoin's volatility as an opportunity rather than a problem.

"Volatility was a gift to the faithful," Saylor said in the viral video. “It scares away the tourist. It scares away the lazy. It scares away the people that are already conventionally rich and have all the money.” The Strategy founder argues that wild price swings benefit younger investors who have "more time than money" and can stack Bitcoin over 20 years at lower prices.

Saylor has made clear that he's not selling. In fact, Strategy has bought more Bitcoin amid the recent selloff.

That said, questions about whether the company might have to liquidate Bitcoin have reached a fever pitch. CEO Phong Le acknowledged in late November that Strategy could be forced to sell Bitcoin if shares traded below the value of underlying holdings. Saylor later clarified the company would only contemplate selling if its net asset value (NAV) fell below 1.

As of reporting time, Strategy's NAV is 1.1, still above the threshold. It reflects a small premium but is far below the exuberant multiples seen during Bitcoin rallies. Strategy maintains a $2.25 billion cash reserve, enough to cover dividend payments for two and a half years without touching BTC. The company said it intends to keep the reserve at a level sufficient to fund two to three years of dividends.

The first major debt maturity doesn't hit until September 2028. Strategy's convertible debt is unsecured, meaning a Bitcoin crash can continue for quite a while before becoming a serious problem.

A worst-case scenario would only emerge if a vanishing stock premium over the long term prevents the company from refinancing maturing debt.

The Critics Are Piling On

Saylor's $10 million claim sparked fierce backlash on social media. Users questioned his logic and mindset, with some sarcastically noting that if everyone agreed on an asset's value, anything could be worth trillions.

Critics warn that Strategy's debt-supported Bitcoin accumulation has increased leverage and centralization risks. With Bitcoin now trading below the company's average cost, Strategy's primary financing method of issuing stock becomes less efficient and increases dilution risk.

Some liken the situation to past speculative bubbles, such as Tulip Mania. Others point to technological concerns, including Bitcoin's energy consumption, the impact of halving on miners' economics, and growing centralization.

Wall Street Is Bullish on MSTR Stock

Saylor remains convinced that Bitcoin will surpass gold by 2035. In an interview, Saylor said he has "no doubt" that BTC will become a larger asset class than gold, citing scarcity, widespread adoption, and long-term demand.

Still, Strategy's aggressive focus on BTC accumulation faces real challenges. The company has fought battles for inclusion in the S&P 500 ($SPX), falling short in both September and December. Landing a spot would have meant institutional credibility and passive inflows.

MSCI floated a proposal last year to classify firms like Strategy, whose balance sheets are dominated by digital assets, as non-operating companies. Saylor pushed back hard, arguing that the company remains an active business that uses BTC strategically.

Strategy delivered a 22.8% BTC yield in 2025, beating the lower end of its target range. The company's revenue was $123 million in Q4, with a gross profit of $81.3 million. Cash and cash equivalents reached $2.3 billion as of Dec. 31, up from just $38.1 million a year earlier, reflecting the establishment of the USD reserve.

For now, Saylor shows no signs of wavering from his Bitcoin-first strategy, even as critics grow louder and losses mount. The company has held through a 50% drop before, during the 2022 crypto winter when Bitcoin stayed below its average entry price for 16 months.

"Our long-term focus remains unchanged," CFO Andrew Kang said on the Q4 earnings call. “We are committed to increasing Bitcoin per share and building durable shareholder value over the long term.” Whether that conviction pays off or becomes a cautionary tale depends on Bitcoin's trajectory over the next several years. For Saylor, the bet is all or nothing.

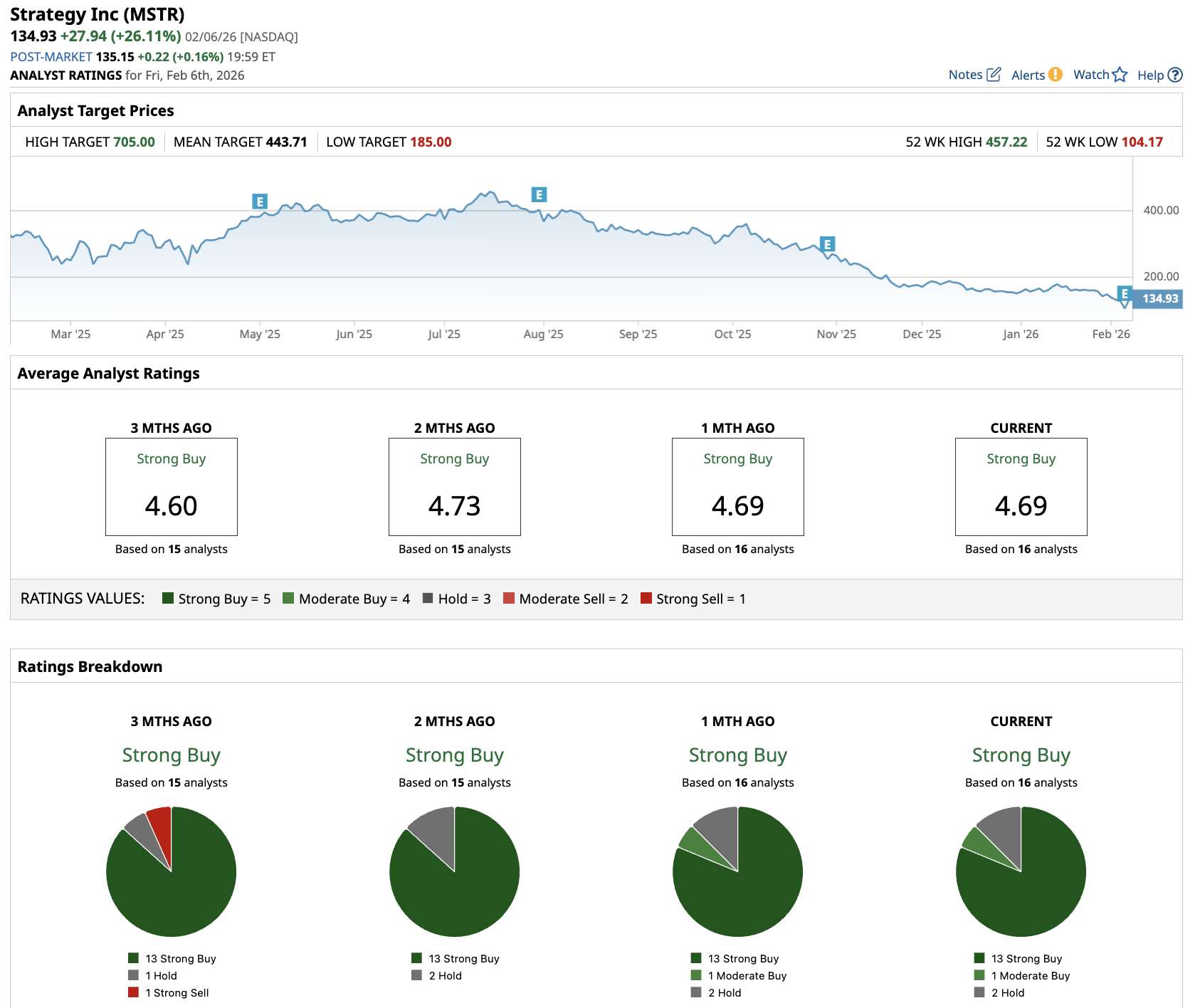

Strategy has a “Strong Buy” consensus rating overall. Out of the 16 analysts covering MSTR stock, 13 recommend a “Strong Buy,” one recommends a “Moderate Buy” rating, and two recommend a “Hold” rating. The average price target of $419.43 implies about 215% potential upside from current levels.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- 'If People in the Rest of the World Knew What I Know': MicroStrategy's Michael Saylor's Viral Message About MSTR Stock and Bitcoin to $10 Million

- As Crypto Prices Plunge, Cathie Wood Is Selling This 1 Bitcoin Stock

- MicroStrategy Is Now Down $4.5 Billion On Its $54 Billion Bitcoin Investment: What Does This Mean For Investors?

- The Best Way To Play Crypto Amid Bitcoin's Stunning Selloff