The software rout that kicked off last week turned into a goldmine for short sellers who've been betting against tech's highest flyers. Data from S3 Partners shows that bears have raked in roughly $24 billion in paper profits year-to-date (YTD) as software stocks have cratered from lofty valuations. While the sector has lost $1 trillion in market value, short sellers are laughing all the way to the bank.

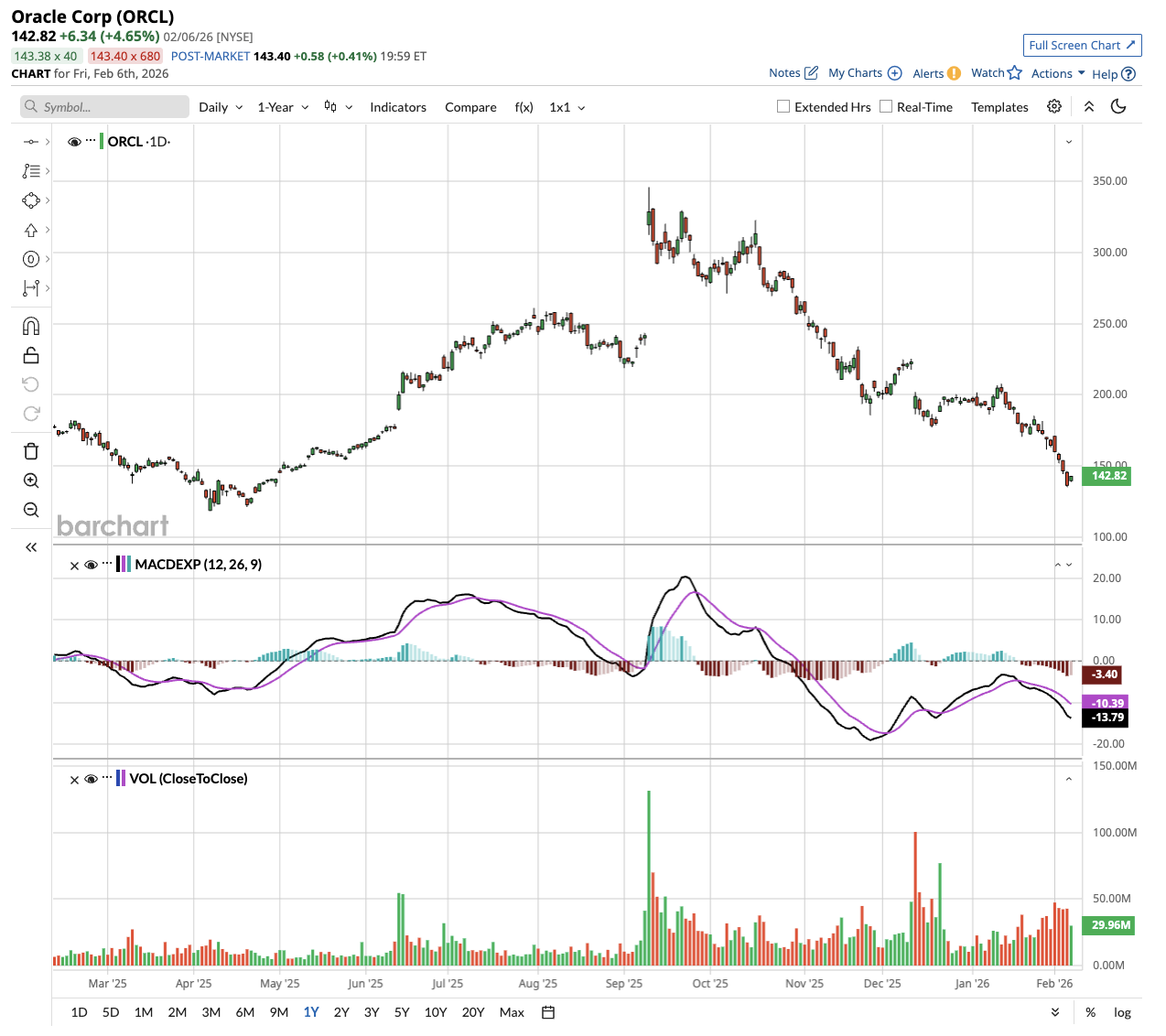

Oracle (ORCL) is the poster child for this reversal, shedding about 54% from its September peak of $345.72. With this drop in mind, let's take a closer look.

Oracle Stock Is in Freefall

Over the last three months, ORCL stock has declined some 30%, reprsenting one of its worst quarters since the dot-com bubble.

Oracle reported weaker-than-expected fiscal second-quarter revenue of $16.06 billion in early December, missing the $16.21 billion analysts had expected. The company also reported a free cash outflow of roughly $10 billion, nearly double the $5.2 billion consensus estimate. That's a major red flag for investors concerned about AI bubble risks, since free cash flow indicates whether a company can meet its debt obligations.

Making matters worse, Oracle jacked up its fiscal 2026 capital expenditure forecast to $50 billion from $35 billion just three months earlier. That's more than double the $21.2 billion it spent in fiscal 2025.

ORCL stock soared in September after inking a $300 billion deal with ChatGPT maker OpenAI. The agreement marked a huge vote of confidence for Oracle, but skepticism set in fast. Investors questioned whether OpenAI, a cash-burning startup, could deliver $60 billion in annual payments to Oracle. Any heavy reliance on OpenAI creates risk for Oracle, while GPU rental margins run dramatically lower than the roughly 80% margin in Oracle's core business.

OpenAI CEO Sam Altman said the company will hit $20 billion in annualized revenue in 2025 and reach hundreds of billions by 2030. But that's still a far cry from the $300 billion Oracle is counting on.

The Debt Pile Raises Eyebrows

Oracle raised $18 billion in a jumbo bond sale in September, one of tech's largest debt issuances ever. The company is now seeking to raise an additional $38 billion in debt to fund its AI buildout, according to sources cited by Bloomberg. Oracle has secured billions in construction loans through bank consortiums tied to data centers in New Mexico and Wisconsin.

Citi analyst Tyler Radke estimates the firm will raise $20 billion to $30 billion in debt annually for the next three years.

On the December earnings call, Principal Financial Officer Doug Kehring committed to maintaining Oracle's investment-grade debt rating. But Oracle's credit default swaps have climbed to two-year highs as investors hedge their bets.

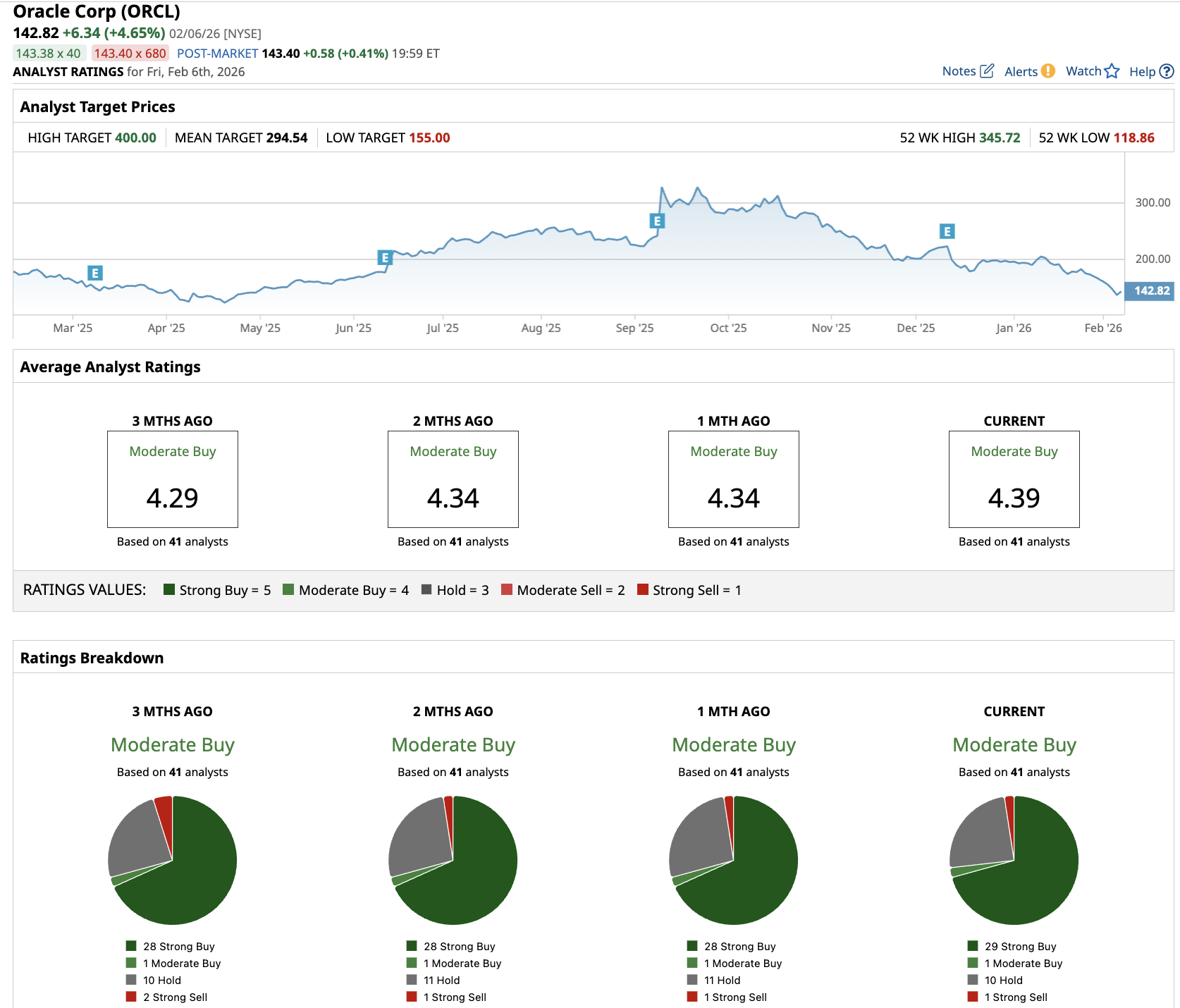

How Do Analysts View ORCL Stock?

Not everyone's ready to bet against Oracle founder Larry Ellison. "You would have gone bankrupt 40 times betting against Larry over the last 50 years," said Zachary Lountzis of Lountzis Asset Management, which held $25 million in ORCL stock as of September. Lountzis called the drop from $340 to $180 a "very healthy correction" and noted that his fund recently picked up another 30,000 shares.

Wells Fargo analyst Michael Turrin recently initiated coverage on ORCL stock with a “Buy” rating and a $280 price target, arguing that Oracle's perception will improve if it delivers for OpenAI. Turrin estimates that OpenAI could account for more than one-third of Oracle's revenue by 2029.

Meanwhile, Wedbush brushed off the weak quarter as a "high class problem that Oracle is dealing with on the AI demand front," calling any selloff a buying opportunity. But with Oracle stock beginning to rebound and short sellers banking billions on the software rout, the debate over whether to join the bears or stick with the bulls is heating up.

Oracle has a “Moderate Buy” consensus rating overall. Out of the 41 analysts covering ORCL stock, 29 recommend a “Strong Buy” rating, one recommends a “Moderate Buy,” 10 recommend a “Hold” rating, and one recommends a “Strong Sell” rating. The average price target for ORCL is $288.86, implying 81% potential upside from current levels.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- As Upwork Plunges Below Key Support Levels, Should You Buy the UPWK Stock Dip?

- Is GoPro Stock a Buy, Sell, or Hold in February 2026?

- Short Sellers Are Making Bank on Oracle Stock. Should You Bet Against ORCL Too?

- What Options Traders Expect from SHOP Stock When Shopify Reports Earnings on February 11