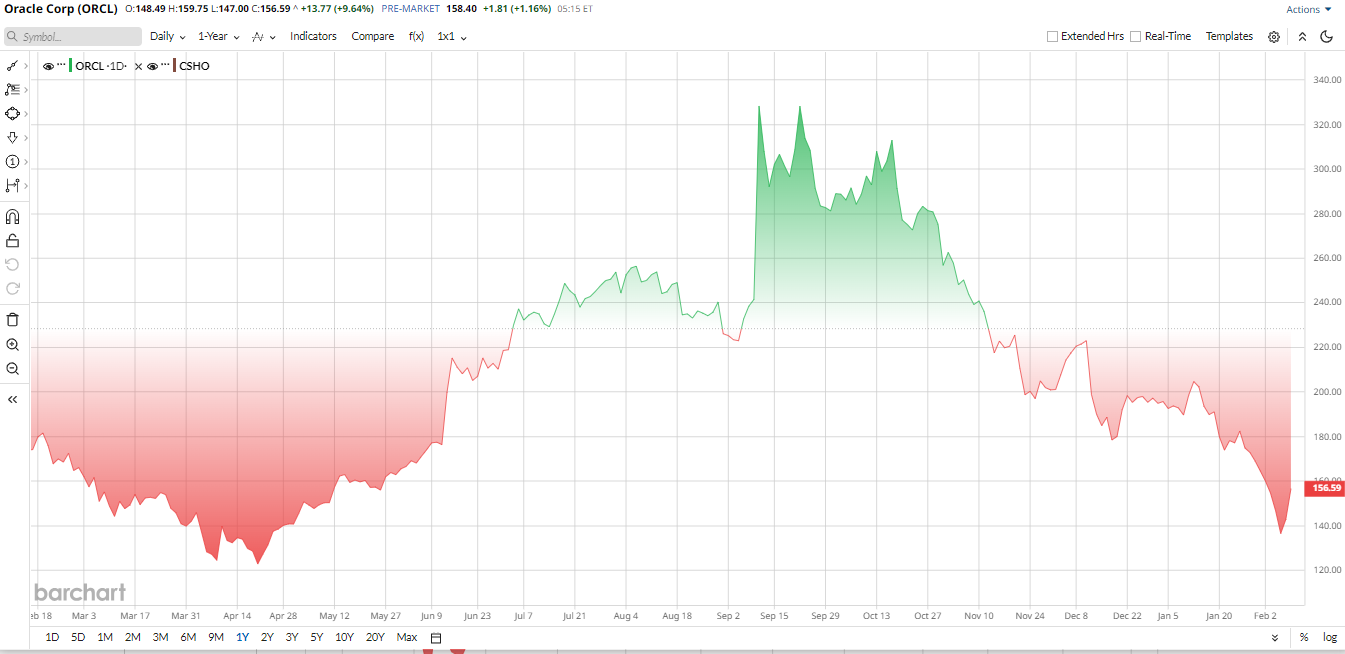

In recent months, broad U.S. software and cloud stocks have tumbled as investors step back from last year’s AI euphoria. According to Barchart data reports, the software sector has fallen roughly 24% behind the S&P 500 ($SPX) over the past three months, with Oracle (ORCL) the “loss leader,” off nearly 50% since late October. That slide reflected concerns about massive cloud capital spending and OpenAI’s uncertain funding.

But on Feb. 9, Oracle suddenly jumped 10% after D.A. Davidson upgraded the stock. Analyst Gil Luria argued that a “revamped OpenAI” will renew demand for Oracle’s cloud services and that new OpenAI funding should finally allow it to honor its commitments to Oracle’s massive AI data centers.

Oracle’s Global Cloud and AI Leadership

Oracle is a global leader in enterprise software and cloud infrastructure. It pioneered the relational database and now offers integrated applications, middleware, and cloud services. Uniquely, Oracle operates 211+ data center regions worldwide, more than any major peer, and pursues a “cloud-neutral” strategy so its tech can run on any public cloud. Management emphasizes embedding AI across its stack, from autonomous databases to analytics and apps. Indeed, Oracle pivoted heavily into AI infrastructure, even landing a multibillion-dollar deal reported at $300 billion with OpenAI to build large-scale cloud centers.

Oracle has been actively expanding its AI infrastructure and applications. In January 2026, it announced a major contract with the U.K. Ministry of Defence. The MoD will migrate legacy systems onto Oracle Cloud Infrastructure (OCI) and adopt Oracle’s AI-powered tools for defense analytics.

Meanwhile, Oracle’s high‑capacity AI data center builds are progressing. The company’s blog notes active AI infrastructure projects in partnership with OpenAI at two campuses in Texas and sites in New Mexico, Wisconsin, and Michigan. For example, Michigan regulators recently approved a plan to power a 1.4‑gigawatt Oracle/OpenAI data hub in Saline Township. In short, Oracle continues to win new cloud contracts and invest in AI-capable data centers, which could drive the long-term growth that analysts assume.

Valued at around $450 billion by market cap, Oracle’s stock has been on a rough ride lately. It hit an all-time peak of around $345 in Sept. 2025 before retreating. For example, Reuters noted ORCL jumped 14% to $201 in June 2025 on strong AI-cloud demand, and by September it topped $326. Since October, the tone has reversed as ORCL has given back roughly half those gains, sliding back toward its late-2024 levels. This falloff mirrors a broader tech selloff and investor worries about Oracle’s debt and spending on AI data centers. Overall, over the past 52 weeks, ORCL has gone down 9%, moving below where it started, but the late-year swoon erased most of the year’s rally.

Despite the brief haircut, ORCL's valuation is stretched, with its price/sales ratio at 7, notably higher than the sector median of 3, indicating a premium pricing. However, the PEG ratio of 1 demonstrates some relative underpricing compared to the sector of 2, suggesting potential for value.

“Revamped OpenAI” Sparks Upgrade

The key news driving Oracle now is the D.A. Davidson upgrade tied to OpenAI. On Feb. 9, the firm raised ORCL to “Buy,” maintaining a $180 target on the thesis that “a revamped OpenAI will return to its position as Google’s top challenger in the AI space.” Crucially, the analyst pointed out that with fresh funding, OpenAI should finally “fulfill its commitments to Oracle,” removing what he called the “biggest concern for Oracle’s outlook.” In practice, that means if OpenAI resumes rapid growth and pays for the hardware, Oracle stands to benefit from all the planned AI data centers.

The upgrade caused a double-digit spike in ORCL shares that day. It suggests analysts who were worried about OpenAI and Oracle’s $300 billion contract may have overestimated the risk; under this view, Oracle’s clouds could see accelerating demand as AI workloads rebound.

Oracle Shows Solid Growth and Billions of Cash

Oracle’s second fiscal quarter showed decent growth but fell short of beating analysts' expectations on the sales side. Total revenue rose 14% year-over-year (YoY) to $16.06 billion, driven primarily by strength in cloud services and license support. That segment generated about $8 billion in revenue, up 34%, reinforcing Oracle’s position as a major enterprise cloud infrastructure provider. In contrast, legacy software license and other revenue declined roughly 3% to $5.88 billion, reflecting the ongoing shift away from traditional software sales.

Profitability remained strong. On a GAAP basis, net income came in at $6.1 billion, while earnings per share surged to $2.10, up 91% from a year earlier.

Results were partially boosted by a one-time pre-tax gain of $2.7 billion related to Oracle’s sale of its stake in Ampere Computing. Excluding that item, the underlying operating performance was more modest but still solid.

Oracle’s long-term revenue visibility remains a key strength. Remaining performance obligations climbed to $523 billion, up 438% YoY, providing the company with several years of contracted revenue tied largely to cloud infrastructure and enterprise workloads.

Cash flow generation stayed robust. Trailing twelve-month operating cash flow reached $22.3 billion, up 10%, allowing Oracle to continue shareholder returns. The company also declared a $0.50 quarterly dividend.

Management also signaled a significant increase in investment. Capital expenditures were close to $12 billion in the quarter, and Oracle now expects fiscal 2026 capital spending of approximately $50 billion, about $15 billion above its prior outlook. CEO Clay Magouyrk said Oracle is exploring alternative financing structures, including allowing customers to bring their own chips, to manage upfront costs. Oracle maintained its revenue outlook, with CFO Safra Catz reiterating a floor of roughly $67 billion in fiscal 2026 revenue.

Analyst Outlook and Price Targets on ORCL Stock

Wall Street analysts are divided on Oracle's outlook. Notably, on Jan. 23, Morgan Stanley manager Keith Weiss lowered his 12-month forecast by nearly a third, to $320 from $213 with an “Equal-Weight” rating, pointing out that the incredible scale of the Oracle AI build and its debt burden will limit its earnings.

By contrast, Goldman Sachs has upgraded ORCL to “Buy” with a $240 price target. The analyst at Goldman said the Oracle AI compute workload was more advanced and that cloud revenue share will be increased in the future because it is on the verge of hitting a debt ceiling at which spending will likely decelerate.

Piper Sandler is also positive with “Overweight,” but reduced its target to $240 from $290. Other companies lie in the middle, like UBS, which reduced its target to $280 and is holding to “Buy,” whereas Jefferies has a target of $400. Its 12-month outlook is more or less in the mid-$280s.

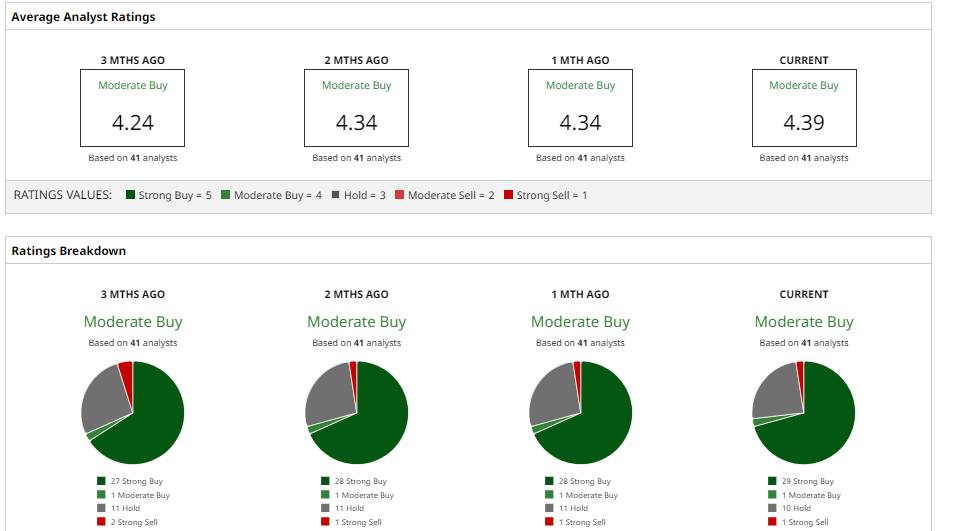

Overall, 41 analysts on Wall Street have the consensus rating of “Moderate Buy” with an average price target of $288.86, which indicates that the company has an upside potential of over 80%, starting at these current levels.

Finally, those who see bulls include the massive backlog of contracts Oracle has closed and its centrality in the AI infrastructure as initial sparkers, but critics warn that an extreme debt and capex growth rate could push the investment to payback.

On the date of publication, Nauman Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Is GoPro Stock a Buy, Sell, or Hold in February 2026?

- Short Sellers Are Making Bank on Oracle Stock. Should You Bet Against ORCL Too?

- What Options Traders Expect from SHOP Stock When Shopify Reports Earnings on February 11

- I Created My Own Prediction Market. What It’s Telling Me About the S&P 500 Now, and What Comes Next.