Shopify (SHOP) shares have pushed meaningfully higher heading into the company’s Q4 earnings on Feb. 11, with options traders indicating significant volatility ahead.

Analysts expect the e-commerce giant to earn $0.41 on a per-share basis in its fourth quarter, which would represent a little more than 20% growth year-over-year.

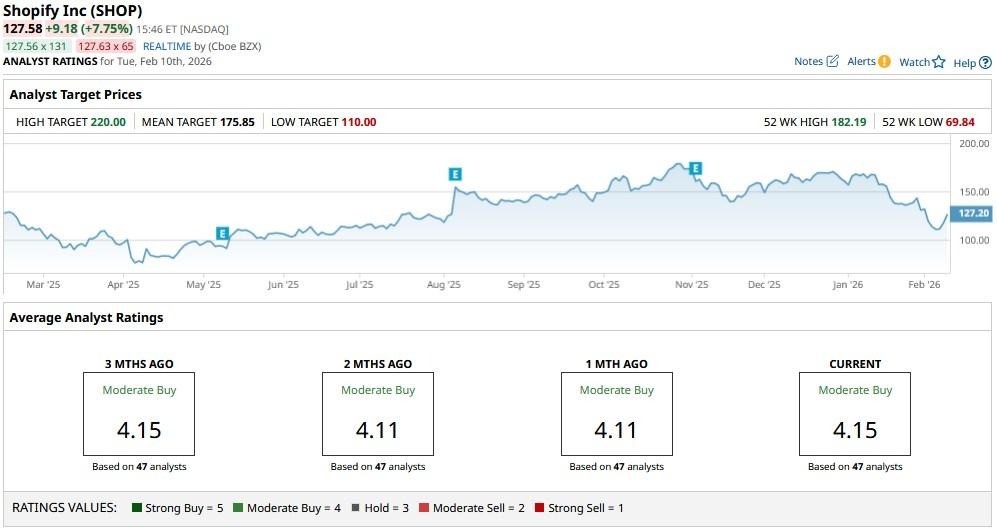

Despite the recent surge, Shopify stock remains down about 25% versus its December high.

Where Options Data Suggests Shopify Stock Is Headed

Options traders are pricing in a 9.68% move in either direction following the earnings report, which could see SHOP stock print a high of about $139 or a low of $114 by the end of this week.

The elevated volatility reflects uncertainty around Shopify’s aggressive pivot toward AI-enabled shopping through its partnerships with Alphabet's (GOOG) (GOOGL) Google and OpenAI.

Whether it translates into revenue growth and margin expansion, or exposes the Nasdaq-listed firm to execution risks may be what sets the overall tone for SHOP after the fourth-quarter results.

Longer-term derivatives data is skewed to the positive, though. Contracts expiring mid-May have the upper price set at $155, signaling potential upside of more than 20% over the next three months.

MoffettNathanson Recommends Buying SHOP Shares

MoffettNathanson analysts believe Shopify shares are trading at a rare discount following the recent rout in software stocks.

According to MoffettNathanson, the multinational is an “aggressive adopter” of artificial intelligence, which is why AI chatbots are driving more traffic to its merchants compared to conventional marketplaces like Amazon (AMZN) or eBay (EBAY).

Direct commerce is gaining market share, and SHOP’s integration with protocols from Google and OpenAI serves as a powerful merchant acquisition tool, the investment firm told clients.

Heading into the earnings release, MoffettNathanson upgraded the Canadian firm to “Buy,” with a $150 price target indicating its share price could rally another 17% from here.

How to Play Shopify Heading Into its Q4 Earnings Release

Note that MoffettNathanson is still among the more conservative firms on SHOP shares.

According to Barchart, the consensus rating on Shopify heading into its Feb. 11, quarterly print sits at a “Moderate Buy,” with a mean price target of an even higher $175.

This article was created with the support of automated content tools from our partners at Sigma.AI. Together, our financial data and AI solutions help us to deliver more informed market headline analysis to readers faster than ever.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- As Upwork Plunges Below Key Support Levels, Should You Buy the UPWK Stock Dip?

- Is GoPro Stock a Buy, Sell, or Hold in February 2026?

- Short Sellers Are Making Bank on Oracle Stock. Should You Bet Against ORCL Too?

- What Options Traders Expect from SHOP Stock When Shopify Reports Earnings on February 11