With a market cap of around $25.1 billion, Darden Restaurants, Inc. (DRI) is one of the largest full-service restaurant operators in the United States, best known for brands such as Olive Garden, LongHorn Steakhouse, Cheddar’s Scratch Kitchen, Yard House, and The Capital Grille. Headquartered in Orlando, Florida, the company operates and franchises hundreds of locations across North America.

DRI stock has risen 7.6% over the past year, lagging the broader S&P 500 Index ($SPX) has rallied 14.4%. However, shares of DRI are up 14.3% on a YTD basis, exceeding SPX’s 1.4% gain.

Focusing more closely, the company has surpassed the State Street Consumer Discretionary Select Sector SPDR Fund’s (XLY) 4.6% return over the past 52 weeks and marginal drop in 2026.

On Feb. 3, DRI shares popped 2.3% after the company announced that it had completed its review of strategic options for its Bahama Breeze brand and will permanently close 14 locations while converting the remaining 14 into other Darden concepts. The closures are expected to operate through April 5, 2026, and the conversions will take place over the next 12–18 months. Management said the move will not have a material financial impact and believes the remaining sites will strengthen other brands in its portfolio. The company also emphasized its focus on supporting employees by placing as many as possible in roles across Darden’s restaurant network.

For the fiscal year ending in May 2026, analysts expect DRI’s adjusted EPS to grow 10.7% year over year to $10.57. The company's earnings surprise history is mixed. It topped the consensus estimates in one of the last four quarters while missing on three other occasions.

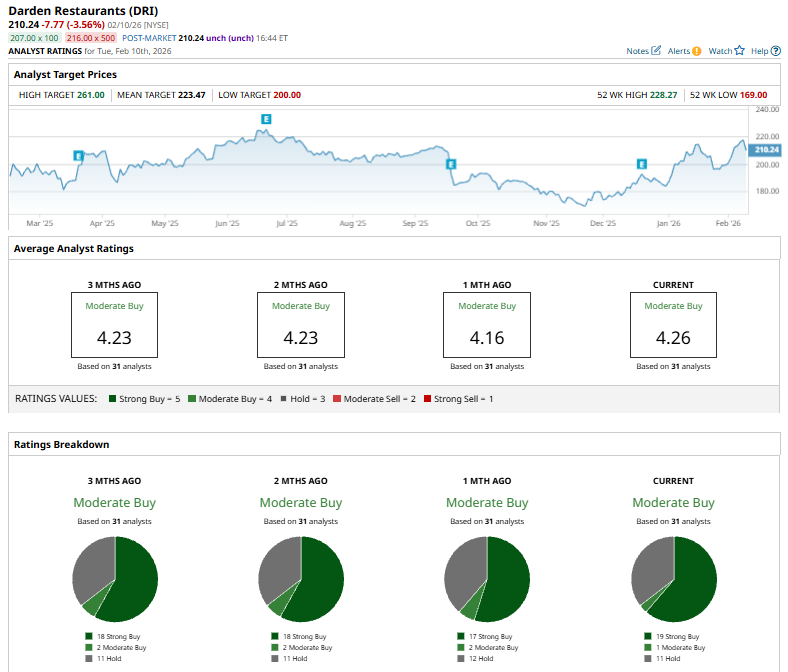

Among the 31 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 19 “Strong Buy” ratings, one “Moderate Buy,” and 11 “Holds.”

This configuration is slightly more bullish than a month ago, with 17 “Strong Buy” ratings on the stock.

On Jan. 23, Mizuho Securities upgraded Darden Restaurants to “Outperform” from “Neutral” and raised its price target to $235 from $195, citing stronger same-store sales momentum and improving margin outlook. The firm expects casual dining to outperform in 2026 and views Darden as a key beneficiary of both industry tailwinds and company-specific strengths.

The mean price target of $223.47 represents a 6.3% premium to DRI’s current price levels. The Street-high price target of $261 suggests a 24.1% potential upside.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- This Is the Top-Rated Dividend Stock to Buy in February 2026

- No, AI Isn’t Killing Software: OKTA & More Top Stocks to Pull from the Ashes of ‘SaaS-pocalypse’

- 'If People in the Rest of the World Knew What I Know': MicroStrategy's Michael Saylor's Viral Message About MSTR Stock and Bitcoin to $10 Million

- As Upwork Plunges Below Key Support Levels, Should You Buy the UPWK Stock Dip?