With a market cap of $83.8 billion, Marsh & McLennan Companies, Inc. (MRSH) is a leading global professional services company providing insurance brokerage, reinsurance, risk management, and consulting services through its major brands Marsh, Guy Carpenter, Mercer, and Oliver Wyman. Headquartered in New York, it serves clients in over 130 countries and is known for its diversified, fee-based business model and strong presence in risk and advisory services.

Top of Form

Bottom of Form

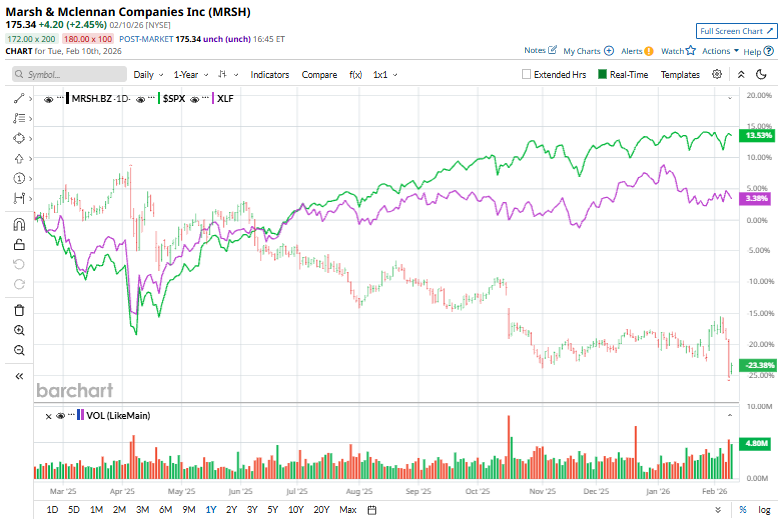

MRSH shares have lagged the broader market over the past year, declining 23.1% compared to the S&P 500 Index ($SPX) 14.4% surge. Moreover, in 2026, the stock has dipped 5.5% outpacing the SPX’s 1.4% advance.

Focusing on its industry benchmark, the State Street Financial Select Sector SPDR Fund (XLF) has risen 4.2% over the past year and plunged 2.2% on a YTD basis, surpassing the stock.

On Jan. 29, MRSH shares climbed 5.5% after the company released its fiscal 2025 fourth quarter earnings. The firm posted revenue of $6.6 billion, up 9% year over year, with underlying growth of 4%, reflecting steady demand across its risk and consulting businesses. Adjusted operating income rose 12% to $1.6 billion, signaling margin expansion and adjusted EPS climbed 10% to $2.12, supported by favorable tax and foreign exchange impacts.

For the current year ending in December, analysts expect MRSH’s EPS to grow 6.1% to $10.34 on a diluted basis. The company’s earnings surprise history is solid. It surpassed the consensus estimate in each of the last four quarters.

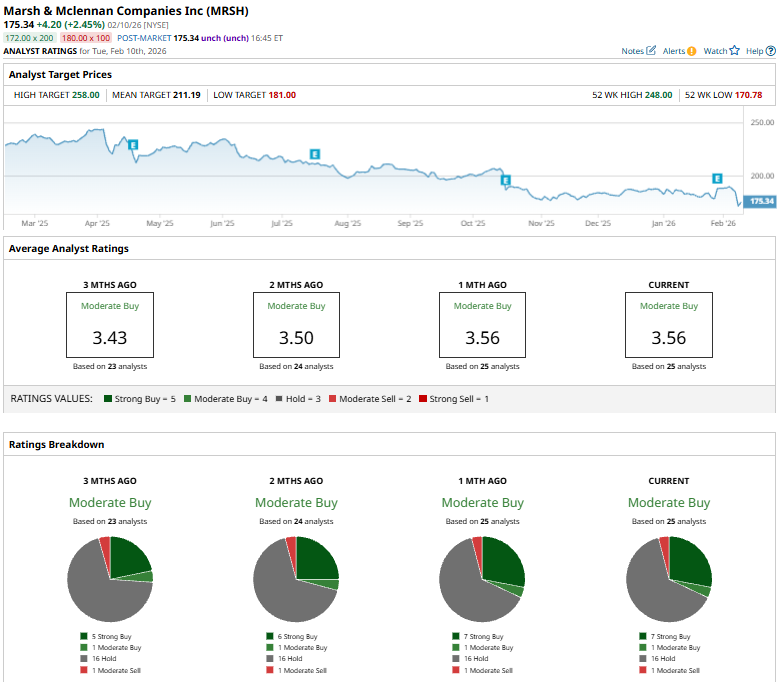

Among the 25 analysts covering MRSH stock, the consensus is a “Moderate Buy.” That’s based on seven “Strong Buy” ratings, one “Moderate Buys,” 16 “Holds,” and one “Moderate Sell.”

The configuration is bullish than two months ago when the stock had six “Strong Buy” suggestions.

On Feb. 2, Cantor Fitzgerald raised its price target on Marsh & McLennan to $212 from $208 and maintained an “Overweight” rating, citing the company’s strong and clean Q4 results despite weaker peer data. The firm said Marsh’s performance supports a compelling investment case, though it noted that while mid-single-digit organic growth in 2026 appears achievable, commercial lines margins, especially in the E&S segment, may face pressure.

MRSH’s mean price target of $211.19 indicates a premium of 20.4% from the current market prices. While the Street-high target of $258 suggests a robust 47.1% upside potential.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- This Is the Top-Rated Dividend Stock to Buy in February 2026

- No, AI Isn’t Killing Software: OKTA & More Top Stocks to Pull from the Ashes of ‘SaaS-pocalypse’

- 'If People in the Rest of the World Knew What I Know': MicroStrategy's Michael Saylor's Viral Message About MSTR Stock and Bitcoin to $10 Million

- As Upwork Plunges Below Key Support Levels, Should You Buy the UPWK Stock Dip?