Waltham, Massachusetts-based Thermo Fisher Scientific Inc. (TMO) provides life sciences solutions, analytical instruments, specialty diagnostics, laboratory products, and biopharma services. It is valued at a market cap of $202.8 billion.

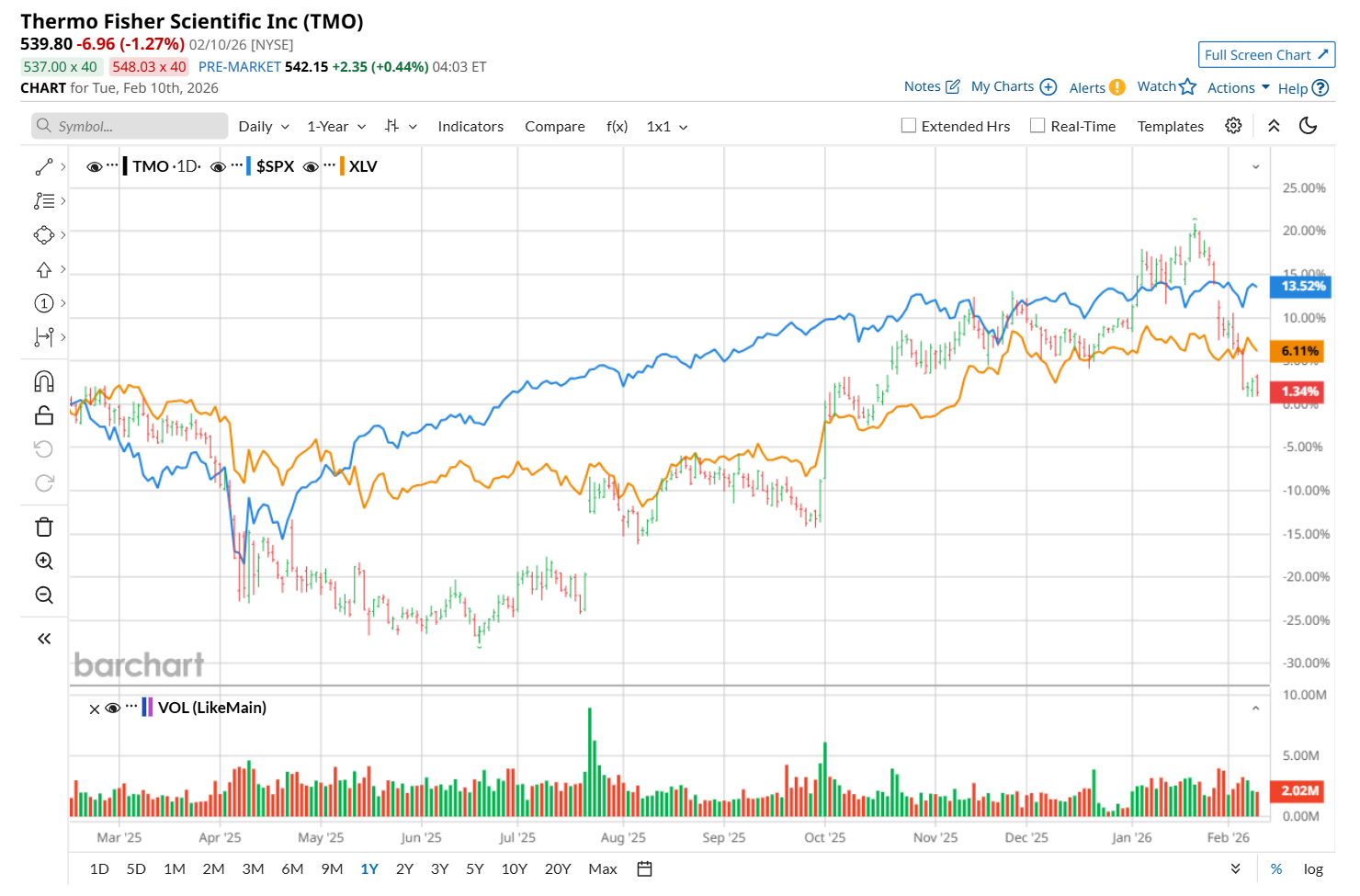

This healthcare company has trailed the broader market over the past 52 weeks. Shares of TMO have declined 2.4% over this time frame, while the broader S&P 500 Index ($SPX) has gained 14.4%. Moreover, on a YTD basis, the stock is down 6.8%, compared to SPX’s 1.4% rise.

Narrowing the focus, TMO has also underperformed the State Street Health Care Select Sector SPDR ETF (XLV), which soared 6.2% over the past 52 weeks and rose marginally on a YTD basis.

On Jan. 29, shares of TMO plunged 2.6% despite delivering better-than-expected Q4 results. Both its revenue of $12.2 billion and adjusted EPS of $6.57 topped analyst estimates. Moreover, its top line increased 7.2% from the year-ago quarter, while its bottom line grew 7.7% year-over-year. However, its adjusted operating margin declined by 30 basis points, which might have made investors jittery.

For fiscal 2026, ending in December, analysts expect TMO’s EPS to grow 7.8% year over year to $24.65. The company’s earnings surprise history is promising. It exceeded the consensus estimates in each of the last four quarters.

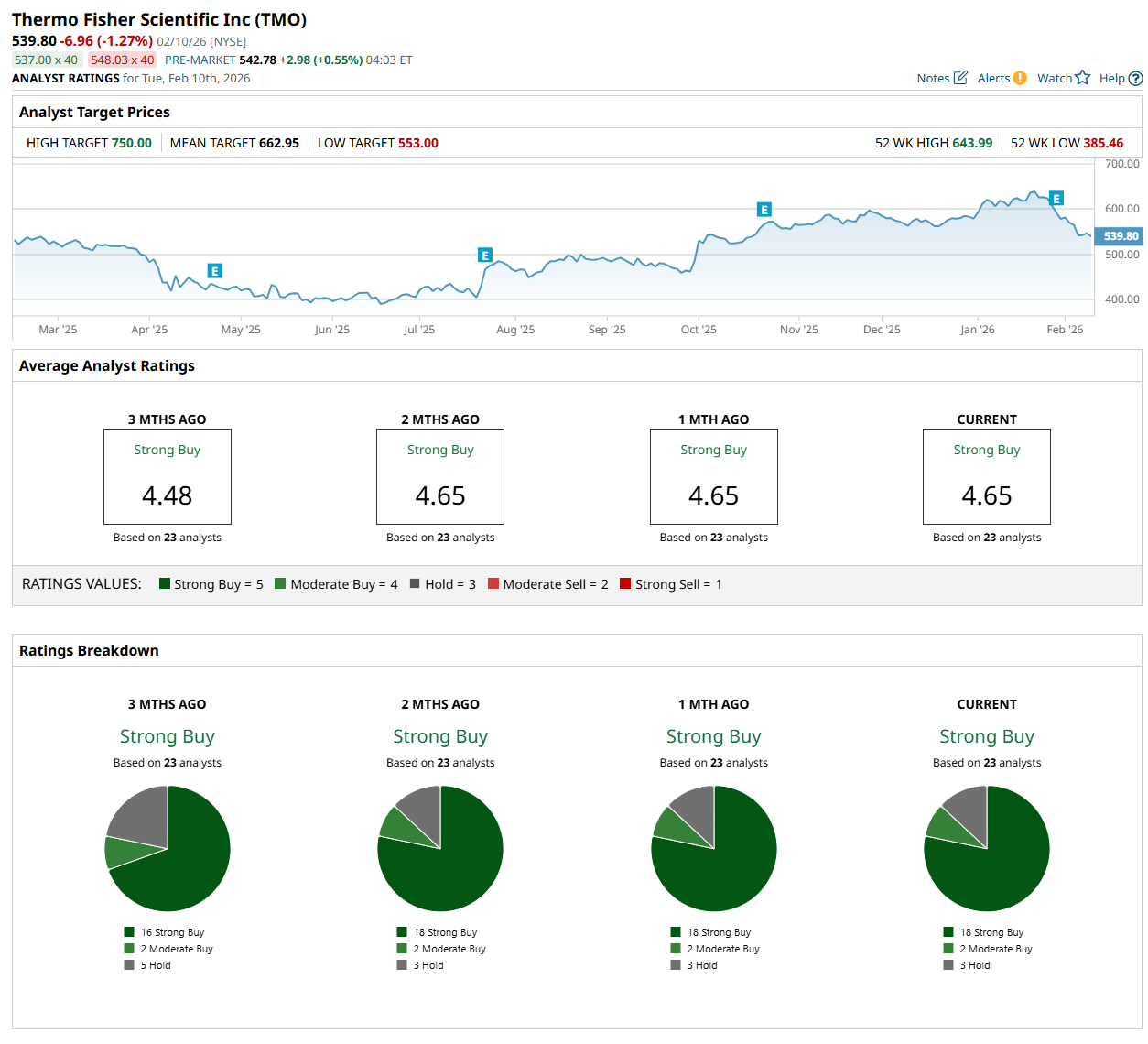

Among the 23 analysts covering the stock, the consensus rating is a "Strong Buy,” which is based on 18 “Strong Buy,” two “Moderate Buy,” and three "Hold” ratings.

The configuration is more bullish than three months ago, with 16 analysts suggesting a “Strong Buy” rating.

On Feb. 2, Casey Woodring from JPMorgan Chase & Co. (JPM) maintained a “Buy" rating on TMO, with a price target of $710, indicating a 31.5% potential upside from the current levels.

The mean price target of $662.95 represents a 22.8% premium to its current price levels, while its Street-high price target of $750 suggests a 38.9% potential upside from the current levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart