Gold hit fresh record highs in 2025, and that has made it a lot more relevant for income investors. According to Statista, gold prices rallied by more than 50% through October 2025, which is the strongest annual gain since 1979, as the metal pushed past $4,000 per troy ounce with ongoing geopolitical uncertainty and continued monetary easing by the U.S. Federal Reserve. Forecasts for 2026 still point to gold averaging above $4,000 per ounce, and some analysts think it could get close to $5,000 at some point during the year.

As spot prices moved up, gold mining stocks generally followed, and that has opened a window where investors may be able to get both price gains and dividend income from profitable producers. Caledonia Mining Corporation (CMCL) is one of the names that fits that description.

It is a Zimbabwe-focused gold miner with a forward annual dividend of $0.56 per share and a 2.11% yield, and it also ranks as a top-rated pick on Barchart’s dividend stock screen, sitting in a part of the gold space where companies are posting positive earnings while still returning cash to shareholders.

But can a small-cap miner with a single analyst rating and a relatively modest yield truly deserve top billing in a dividend-focused portfolio for February 2026? Let’s find out.

The Numbers Behind the Rating

Caledonia Mining is a smaller gold producer that mainly runs on its long-life Blanket Mine in Zimbabwe, and it uses the steady production from that mine to support both dividends and its next stage of growth.

The stock has been a standout in performance, up about 187% over the past 52 weeks, and it is also up around 11% year-to-date (YTD) in the early part of 2026.

The valuation still looks reasonable, with CMCL trading at about 8.5x forward earnings compared with roughly 18.55x for the wider materials sector.

On the dividend side, the story is also pretty straightforward. Caledonia has a forward payout ratio of about 18.72%; it pays dividends quarterly, and it has now raised the dividend for one year in a row. The stock’s 2.11% yield is not far from the materials sector’s 2.82% average, and it sits on a business doing about $183 million in annual sales and around $18 million in annual net income.

The latest production numbers back that up. FY 2025 gold output at Blanket was 76,213 ounces, which landed at the upper end of guidance and was broadly in line with the prior two years. Q4 2025 production came in at 17,367 ounces, down from 19,841 ounces in Q4 2024, mainly due to lower tonnages from higher-grade areas and electricity supply disruptions late in the quarter, issues management is already working through.

Milling throughput stayed strong, which helped soften the impact of the grade pressure and supported the cash base that funds both dividends and growth.

What Keeps the Dividend Growing

Caledonia’s growth plan is very focused on specific projects, which makes sense for a small-cap dividend stock. The goal is to keep the dividend on track by generating more cash from its existing Blanket Mine, while also spending heavily to grow into a multi-asset producer through Bilboes and Motapa.

For 2026, management has budgeted about $162.5 million in total group capital expenditure, with roughly $132 million set aside for building out Bilboes and $3.8 million for Motapa exploration. That spending is meant to move Bilboes from a development plan into a producing asset, while Motapa is the exploration angle that could extend growth beyond the Bilboes build.

With capex at that level, funding matters just as much as the projects themselves, because weak financing can put pressure on a dividend. In January 2026, Caledonia closed an upsized $150 million convertible senior notes offering, which gives the company meaningful long-term capital to actually carry out the Bilboes plan.

The company has also added a cash-flow buffer through hedging. Caledonia has put a gold hedging program in place by purchasing put options that lock in a minimum price of $3,500 per ounce on about 3,000 ounces per month from January 2026 through December 2028. The idea is to support cash coming in from Blanket during what should be the heaviest Bilboes spending period so a weaker gold price does not force tough decisions around shareholder returns.

What Lies Ahead for CMCL

Management is guiding Blanket Mine to produce between 72,000 and 76,500 ounces of gold this year. Production is expected to be stronger in the second half, as higher-grade zones gradually come into the mine plan. That matters because it points to better volumes and cash flow at the same time as spending on Bilboes is picking up.

On costs, Caledonia expects on-mine cash costs of $1,500 to $1,700 per ounce sold and all-in sustaining costs of $2,100 to $2,300 per ounce sold. In other words, 2026 is not shaping up to be a cheap year to operate but a year when the company is taking on higher costs and investment to support future production.

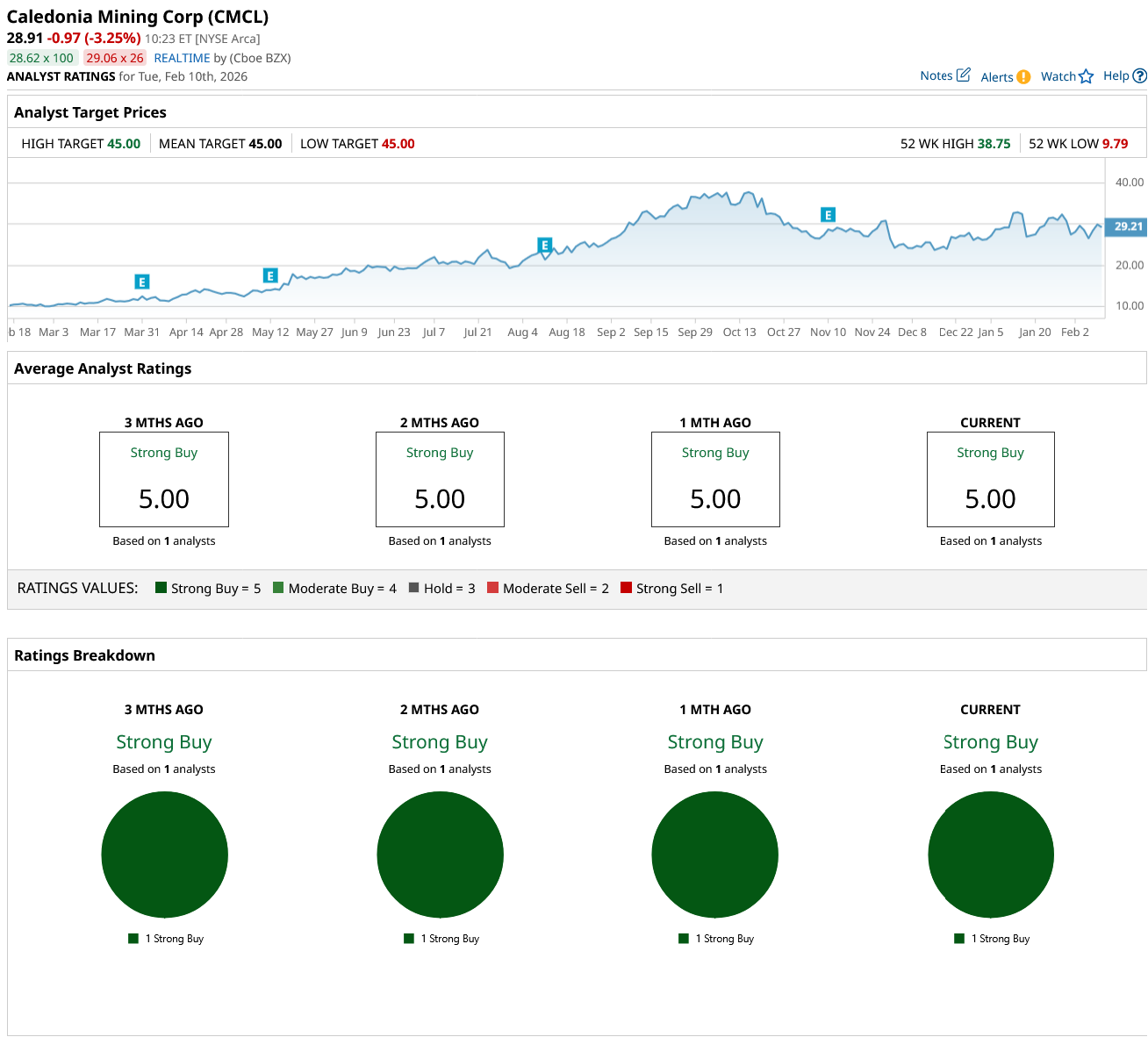

CMCL currently has a “Strong Buy” rating, based on coverage from one analyst. That lone analyst’s mean price target is $45, and against the current price of $28.91, that implies about 56% upside.

Conclusion

CMCL does deserve a spot near the top of a dividend-focused buy list for February 2026, not because it has the highest yield, but because it blends real profitability, a low payout ratio, and a clearly funded growth agenda at a valuation that still looks conservative versus its sector. The tradeoff is that you are buying a miner heading into a heavy-capex year, so execution at Blanket and discipline around Bilboes matter as much as the gold price. If gold stays firm and the company hits its second-half production step-up, the path of least resistance for the shares is higher, with volatility along the way. If costs run hot or timelines slip, the stock can cool off even in a strong gold tape.

On the date of publication, Ebube Jones did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- This Is the Top-Rated Dividend Stock to Buy in February 2026

- No, AI Isn’t Killing Software: OKTA & More Top Stocks to Pull from the Ashes of ‘SaaS-pocalypse’

- 'If People in the Rest of the World Knew What I Know': MicroStrategy's Michael Saylor's Viral Message About MSTR Stock and Bitcoin to $10 Million

- As Upwork Plunges Below Key Support Levels, Should You Buy the UPWK Stock Dip?