Headquartered in Dallas, Texas, Kimberly-Clark Corporation (KMB) designs, manufactures, and markets everyday essentials that power households. With a market cap of roughly $34.7 billion, it steers category leaders such as Huggies, Kleenex, Scott, Kotex, and Depend through major retailers, distributors, and e-commerce channels.

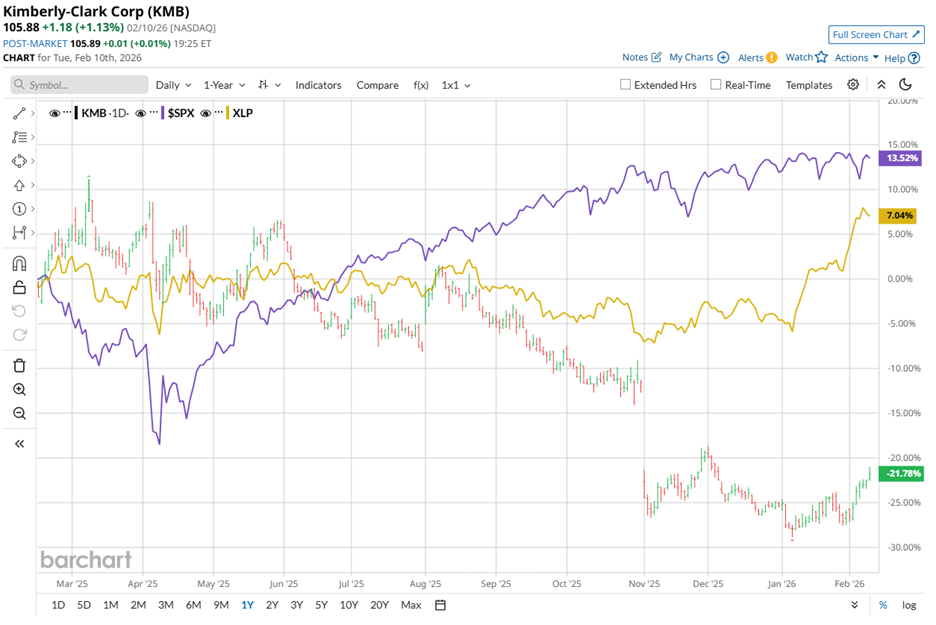

Over the past 52 weeks, KMB stock fell 19.4%, sharply lagging the S&P 500 Index’s ($SPX) 14.4% gain. Yet 2026 has opened on steadier footing, with Kimberly-Clark’s shares up nearly 5% year-to-date (YTD), outperforming the broader index’s modest 1.4% rise.

Against its sector benchmark, Kimberly-Clark has struggled to keep pace. The State Street Consumer Staples Select Sector SPDR ETF (XLP) gained 9.2% over the past 52 weeks and surged 12.2% YTD, decisively outperforming KMB stock.

On Jan. 27, Kimberly-Clark’s shares edged lower following the release of its fourth-quarter 2025 results. The stock slipped another 1.1% the next day as revenue dipped slightly year over year to $4.08 billion, roughly in line with the $4.09 billion consensus estimate. However, adjusted EPS rose 24% to $1.86 from the prior-year period, topping analysts’ $1.81 forecast.

Cost controls and steady demand for core products such as Huggies diapers and Kleenex tissues across major markets supported results. In recent years, the company cut jobs and exited lower-margin operations, including private-label diapers and personal protective equipment, reinforcing margin stability.

Building on that leaner base, Kimberly-Clark has expanded its affordable lineup, offering lower-priced products that still carry premium features and brand equity. At the same time, it has advanced its transformation through a $48.7 billion deal for Tylenol maker Kenvue Inc. (KVUE), expected to close by year-end and redefine its long-term strategic direction.

Looking ahead to fiscal 2026, which ends in December, analysts forecast diluted EPS of $7.06, a projected 6.2% decline. Even so, Kimberly-Clark has beaten EPS estimates in each of the past four quarters, establishing a pattern of operational outperformance that tempers concern about near-term pressure.

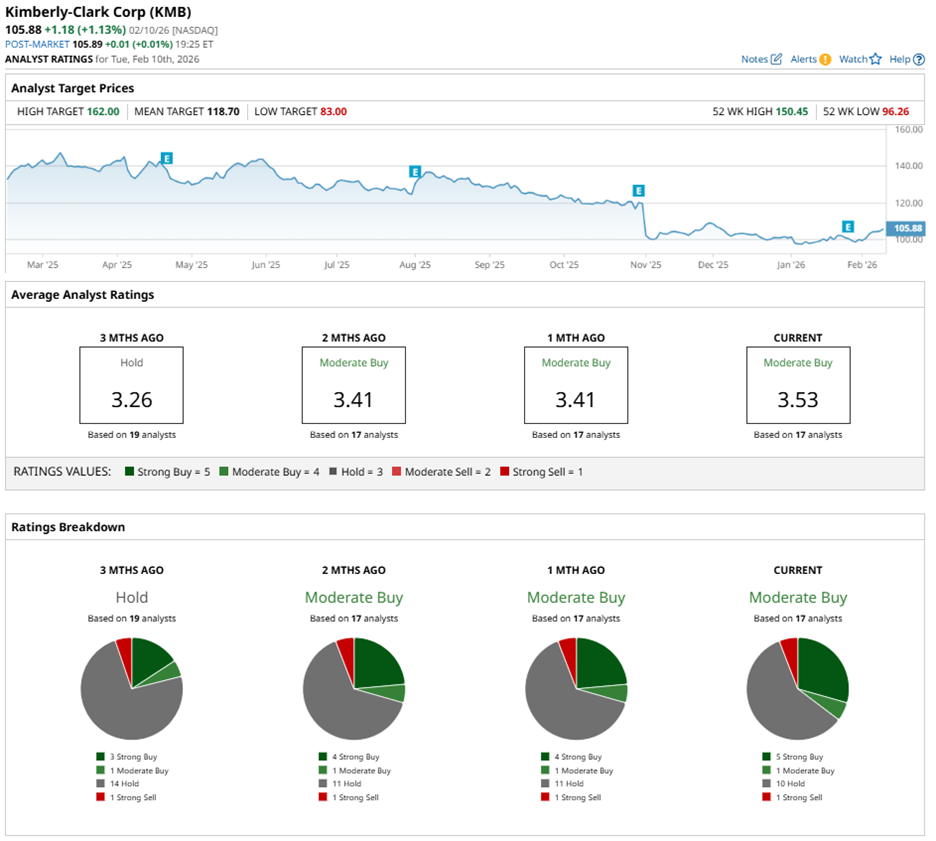

Wall Street sentiment remains firmly supportive, assigning KMB stock an overall “Moderate Buy” rating. Among 17 analysts, five have issued a “Strong Buy” rating, one recommends “Moderate Buy,” 10 advises “Hold,” while one has assigned a “Strong Sell.”

Importantly, analyst sentiment has improved from three months ago, when only three analysts rated it “Strong Buy.”

Encouragingly, analysts continue to express confidence in the company’s long-term trajectory, even as they fine-tune their models. On Jan. 28, Bank of America Corporation (BAC) analyst Anna Lizzul trimmed her price target to $130 from $148 while reiterating a “Buy” rating.

She cited valuation compression across the sector, applying a lower P/E multiple to 2027 EPS estimates. However, she acknowledged steady progress in the company’s transformation plan.

Turning to forward expectations, analyst targets provide a concise gauge of sentiment. KMB’s average price target of $118.70 implies potential upside of 12.1%. Meanwhile, the Street-high target of $162 suggests a gain of 53% from current levels.

On the date of publication, Aanchal Sugandh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- This Is the Top-Rated Dividend Stock to Buy in February 2026

- No, AI Isn’t Killing Software: OKTA & More Top Stocks to Pull from the Ashes of ‘SaaS-pocalypse’

- 'If People in the Rest of the World Knew What I Know': MicroStrategy's Michael Saylor's Viral Message About MSTR Stock and Bitcoin to $10 Million

- As Upwork Plunges Below Key Support Levels, Should You Buy the UPWK Stock Dip?