With a market cap of $155.3 billion, Lowe's Companies, Inc. (LOW) is one of the largest home improvement retailers in the world, serving both professional contractors and do-it-yourself consumers. Headquartered in Mooresville, North Carolina, the company operates thousands of stores across the United States and Canada, offering products for home renovation, construction, maintenance, and décor. Lowe’s sells a wide range of merchandise, including appliances, tools, building materials, flooring, paint, and outdoor equipment.

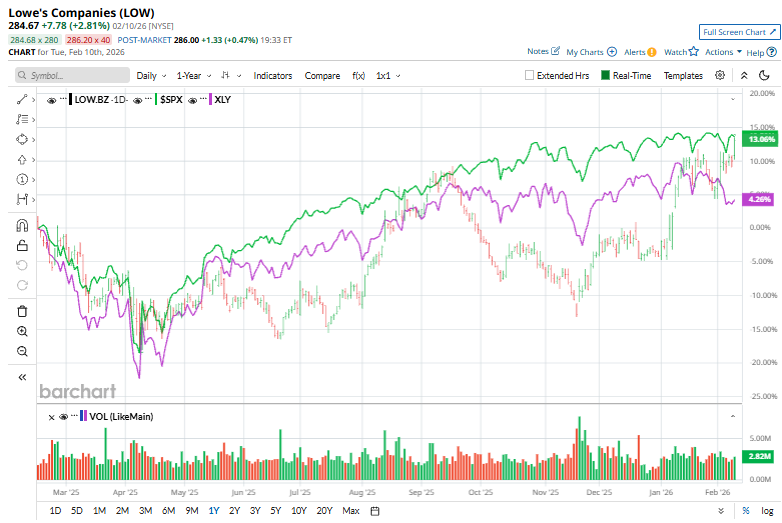

LOW stock prices have increased 11% over the past 52 weeks, trailing the S&P 500 Index’s ($SPX) 14.4% returns. In 2026, however, the stock is up 18%, surpassing the index’s 1.4% rise.

Zooming in further, Lowe’s has also underperformed the sector-focused State Street Consumer Discretionary Select Sector SPDR Fund’s (XLY) 4.6% uptick over the past 52 weeks and marginal dip on a YTD basis.

On Feb. 5, Lowe’s launched MyLowe’s Rewards™ Kids Club, a new family-focused platform that builds on its long-running Kids Workshops program to help children develop practical skills, confidence, and creativity. The initiative allows families to track progress through digital badges, manage multiple children’s registrations in one account, and participate in free monthly workshops and in-store activities. Backed by research showing rising screen time and strong interest in shared DIY projects, the program aims to promote screen-free, hands-on experiences. Its shares climbed 1.2% in the next trading session.

For FY2026 that ended in January, analysts expect Lowe’s to deliver an adjusted EPS of $12.26, up 2.2% year over year. Moreover, the company has a solid earnings surprise history. It has surpassed the Street’s bottom-line estimates in each of the past four quarters.

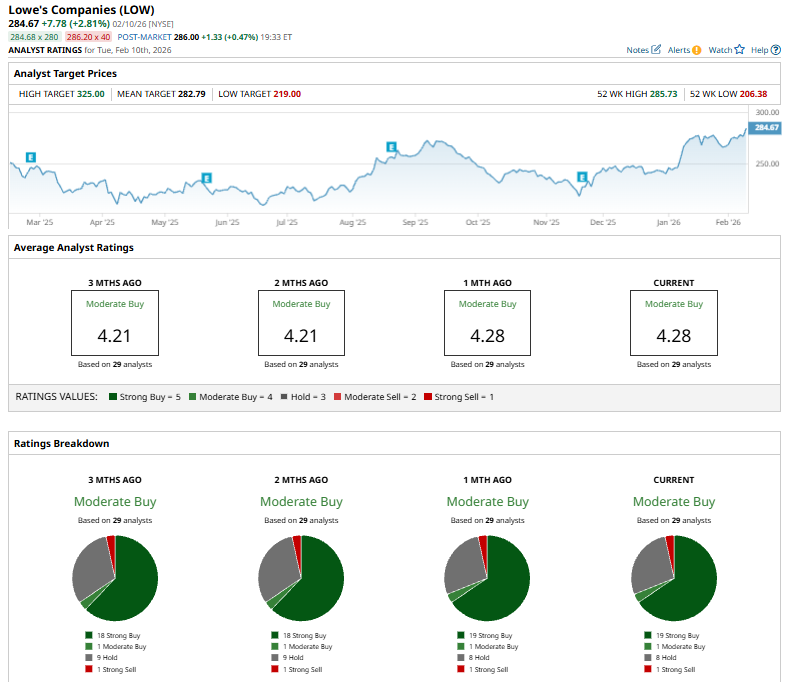

Among the 29 analysts covering the LOW stock, the consensus rating is a “Moderate Buy.” That’s based on 19 “Strong Buys,” one “Moderate Buy,” eight “Holds,” and one “Strong Sell.”

This configuration is bullish than two months ago, when 18 analysts gave “Strong Buy” recommendations.

On Jan. 13, Chuck Grom of Gordon Haskett upgraded Lowe's to “Buy” from “Hold” and set a $325 price target, which is also the Street-high target. Earlier, on Jan. 7, Seth Sigman of Barclays plc (BCS) raised his rating to “Overweight” from “Equal-Weight” with a $285 target, reflecting improving analyst sentiment toward the stock.

Lowe’s currently trades above the mean price target of $282.79.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- This Is the Top-Rated Dividend Stock to Buy in February 2026

- No, AI Isn’t Killing Software: OKTA & More Top Stocks to Pull from the Ashes of ‘SaaS-pocalypse’

- 'If People in the Rest of the World Knew What I Know': MicroStrategy's Michael Saylor's Viral Message About MSTR Stock and Bitcoin to $10 Million

- As Upwork Plunges Below Key Support Levels, Should You Buy the UPWK Stock Dip?