The pace of artificial intelligence infrastructure investment is showing no signs of slowing, and investors are increasingly looking to companies outside the chipmakers like Nvidia (NVDA) and into the companies enabling next-generation networking. One such company, which is seeing renewed interest, is Lumentum Holdings (LITE), as GF Securities highlighted it as one of the key beneficiaries of Nvidia’s co-packaged optics push.

Nvidia used this year’s GTC 2025 conference to launch its Quantum-X and Spectrum-X scale-out switch, which will likely be the precursor to further adoption of optical interconnection technology. This, in turn, should see the next-generation 115.2T CPO switch arrive in 2026, with supply chain acceleration through 2027, which should be a boon to optical component companies such as Lumentum.

About Lumentum Stock

Lumentum Holdings is an optical and photonic products company based in San Jose, California, that provides products to the cloud, networking, and industrial sectors. The company, which has a market capitalization of around $40.1 billion and an enterprise value of $42.1 billion, has clearly established itself as a “mission critical” supplier to the buildout of artificial intelligence infrastructure.

The stock has seen an explosive move over the last year, trading at $556, with a 52-week range of $45.65-$599.50. The stock has seen an increase of over 600% in weighted alpha, significantly outperforming the broader S&P 500 Index ($SPX). Relative strength is sitting at 74.39, which highlights the stock’s strong performance.

The stock’s valuation has clearly expanded with the move, and investors seem willing to pay the premium to own this stock as it relates to next-generation artificial intelligence networking infrastructure growth. The stock has seen over 94% of institutional ownership, with a short float of 15.8%.

The company does not pay a dividend, as it is choosing to reinvest the money into further capacity expansion and next-generation product development.

Lumentum Beats on Earnings as AI Demand Accelerates

Lumentum’s fiscal second quarter 2026 results were a significant turning point for the company. Revenue was $665.5 million, up considerably from $402.2 million in the year-ago period. Moreover, Lumentum’s GAAP diluted EPS was $0.89, whereas its non-GAAP diluted EPS was $1.67, compared with $0.42 in the year-ago period. Lumentum’s margins also improved considerably. GAAP gross margin was 36.1%, while its non-GAAP gross margin was 42.5%, up considerably from the year-ago period.

What is more surprising is the fact that Lumentum’s non-GAAP operating margin was 25.2%, an increase of more than 1,700 points from the year-ago period. It appears the company is entering a new era of high volume and high value related to AI optical demand. Lumentum has identified two significant opportunities in the market, which are optical circuit switches (OCS) and co-packaged optics (CPO).

Lumentum’s backlog for OCS is more than $400 million, whereas the company has announced a multi-hundred-million-dollar CPO order, which is due for the first half of calendar year 2027. Moreover, GF Securities has announced that Nvidia’s supply chain is expected to start ramping up in the second quarter of 2026, with acceleration in the second half of 2026 and into 2027.

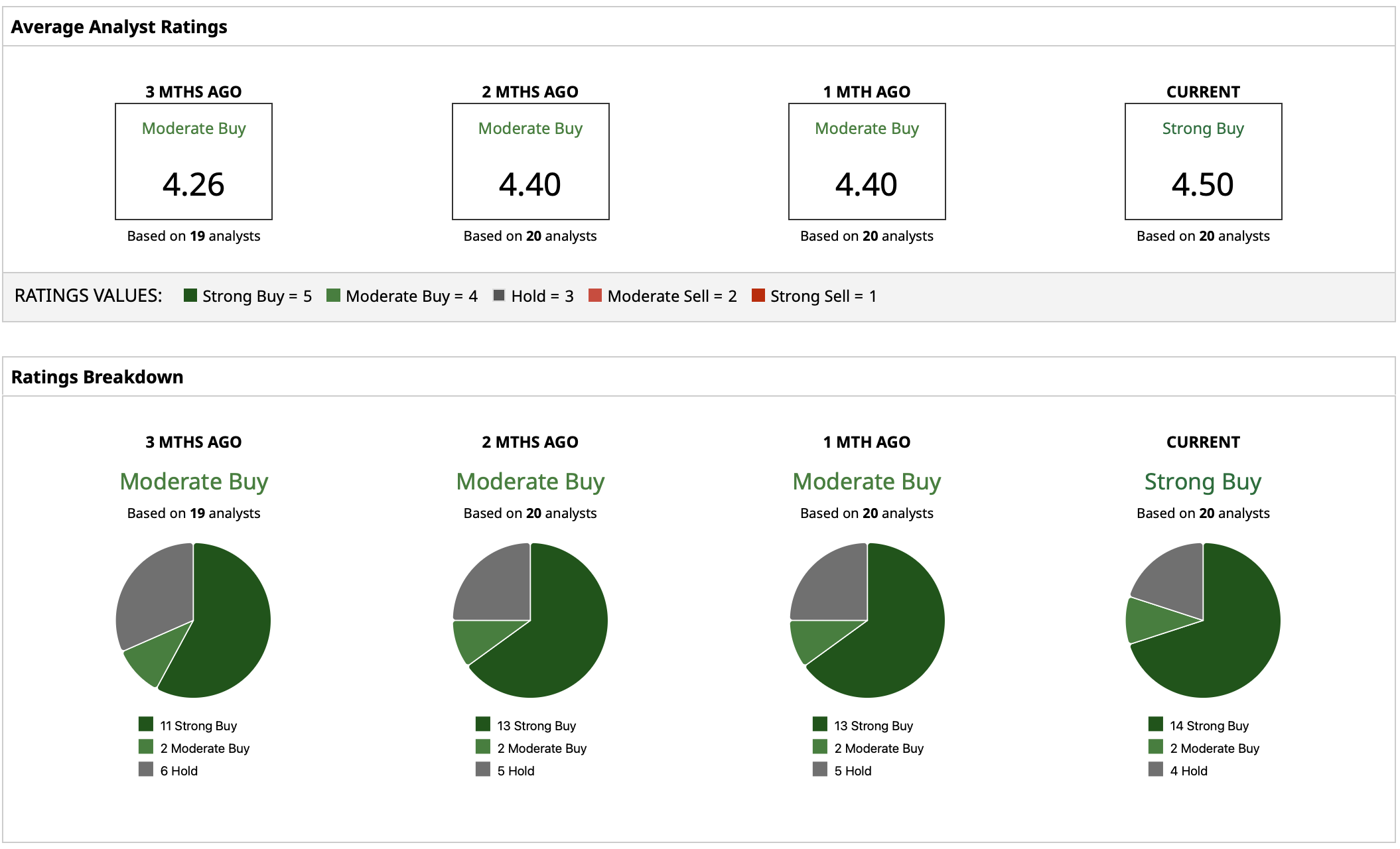

What Do Analysts Expect for LITE Stock?

Analysts hold positive expectations towards the stock with a “Strong Buy” rating consensus for LITE; however, the current price targets don't quite factor in the stock’s recent run-up. The stock’s current mean target price is $525.11, which it has already surpassed, and it has a high price target of $600 and a low price target of $420.

Considering the stock’s recent price of around $556, the stock’s mean price target of $525.11 translates into a potential downside of around 5.6%. However, the stock’s street-high price target of $600 implies a potential upside of around 7.9% if AI networking demand continues to surprise on the upside.

On the date of publication, Yiannis Zourmpanos had a position in: NVDA , LITE . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart