New York-based International Flavors & Fragrances Inc. (IFF) manufactures and markets food, beverage, health and biosciences, scent, and complementary adjacent products. It is valued at a market cap of $19.7 billion.

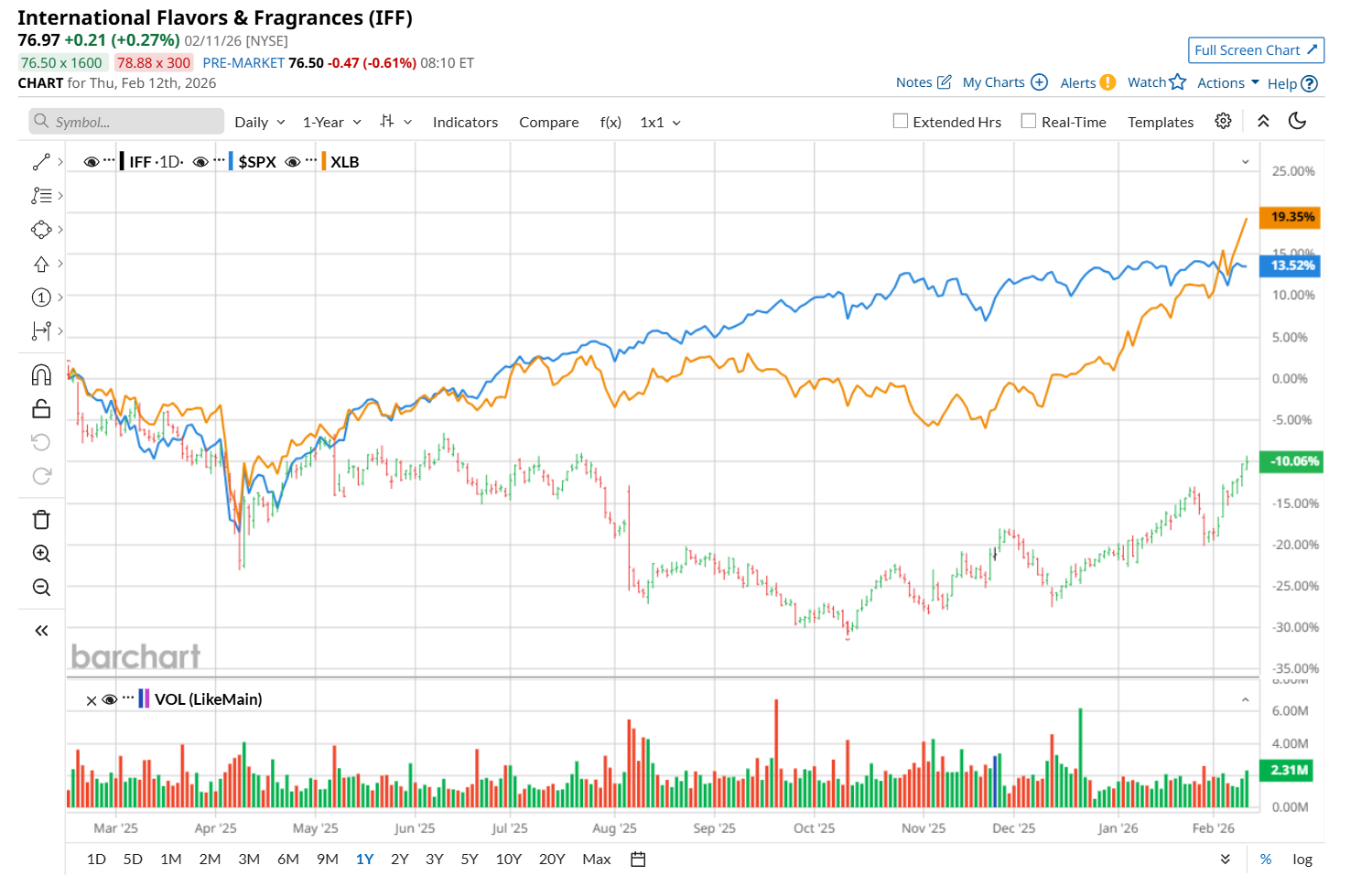

This scent company has lagged behind the broader market over the past 52 weeks. Shares of IFF have declined 9.7% over this time frame, while the broader S&P 500 Index ($SPX) has soared 14.4%. However, on a YTD basis, the stock is up 14.2%, outpacing SPX’s 1.4% return.

Narrowing the focus, IFF has also trailed the State Street Materials Select Sector SPDR ETF (XLB), which rose 20.1% over the past 52 weeks and 18.2% on a YTD basis.

On Feb. 11, IFF delivered mixed Q4 results. The company’s revenue declined 6.6% year-over-year to $2.6 billion, but topped analyst estimates by 3.2%. On the earnings front, its adjusted EPS dropped 14% from the year-ago quarter to $0.80, missing consensus estimates of $0.85.

For fiscal 2026, ending in December, analysts expect IFF’s EPS to grow 7.4% year over year to $4.51. The company’s earnings surprise history is mixed. It exceeded the consensus estimates in three of the last four quarters, while missing on another occasion.

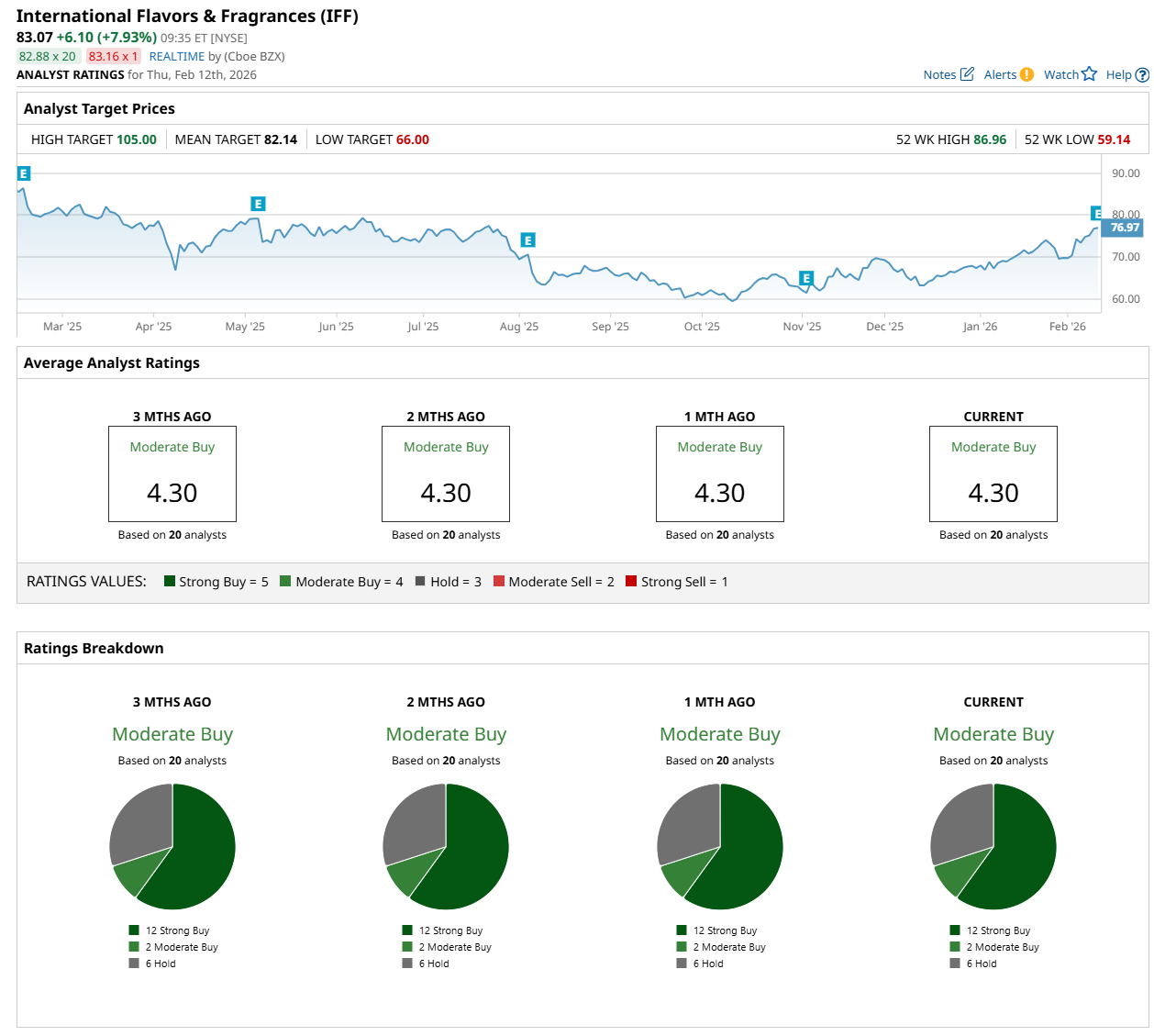

Among the 20 analysts covering the stock, the consensus rating is a "Moderate Buy,” which is based on 12 “Strong Buy,” two “Moderate Buy,” and six "Hold” ratings.

The configuration has remained stable over the past three months.

On Jan. 21, Argus Research analyst Alexandra Yates maintained a “Buy" rating on IFF and set a price target of $80.

While the company is trading above its mean price target of $82.14, its Street-high price target of $105 suggests a 26.4% potential upside from the current levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- What Does Alphabet’s $31.5 Billion Bond Sale Really Mean for GOOGL Stock Investors?

- As Salesforce Acquires AI Startup Cimulate, Should You Buy, Sell, or Hold CRM Stock?

- Investors in Search of Alpha Are Fleeing Tech Stocks for These 3 High-Yield Sectors Instead

- 200 Years Later, This Stock Is Still Setting New All-Time Highs