In recent weeks, small-cap “AI” names and meme‑style stocks have been in the spotlight, seeing wild swings on hype and heavy shorting. SoundHound AI (SOUN) sits squarely in that mix. This voice‑AI company’s shares have been volatile, trading between roughly $6.50 and $22 over 2025, as investors cheer AI potential but remain wary of fundamentals.

Now, news reports show 32% of SOUN’s float is sold short. That extreme positioning has fueled chatter about a possible short squeeze. The key question: Is SOUN poised for a rally from forced buybacks, or is the stock too risky on thin earnings and high valuation?

About SOUN Stock

SoundHound AI is a developer of conversational intelligence. Its voice‑AI platform powers natural language assistants and AI agents for enterprises, automakers, restaurants, and smart devices. For example, its “Amelia” AI and voice assistant products automate tasks like ordering, reservations, and customer service with high-speed speech‑to‑meaning processing.

In the past few months, SoundHound has announced several strategic partnerships and products, all aimed at driving future growth (though these have yet to move the needle on near-term results). At CES 2026, the company unveiled “Agentic Voice Commerce”: a platform that can order food, make reservations, pay for parking, and more, all via voice on cars and TVs. This is an extension of SoundHound’s Amelia AI into a broader in‑car/at‑home shopping agent.

Moreover, it also formalized deals like Five Guys, extending its rollout of SoundHound’s AI food-ordering agent. The system has now handled over one million customer interactions. In the enterprise realm, SoundHound partnered with consultancy Bridgepointe to push its Amelia 7 agentic platform into new corporations.

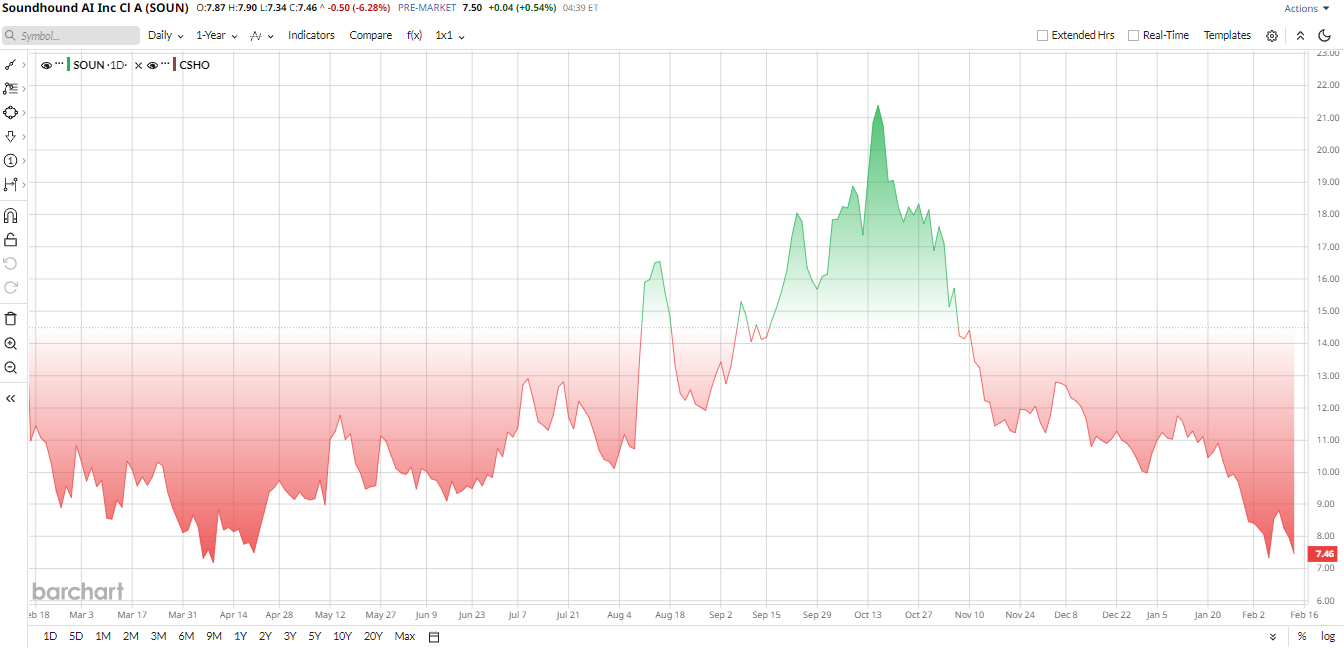

Technically speaking, SOUN had a spectacular run last year. After briefly hitting a 52‑week high around $22 in mid-Oct 2025, it gave up much of those gains through late 2025. Over the year, the stock slid roughly 50% from its peak. According to Barchart data, SOUN’s share price fell about 46% over the trailing year, underperforming broader tech indices. Pressure came from sector-wide profit-taking and a more cautious mood on speculative AI.

From a valuation standpoint, SoundHound is not cheap. As of early 2026, the stock traded at roughly 21.6× sales and 8.4× book value. Those multiples are far above typical tech or software medians. In other words, investors are already pricing in huge sales growth; there’s little margin for error. If SoundHound were simply repricing to sector levels, the stock might trade well below these multiples.

Short Interest at Extreme Levels

The “headline news” driving the squeeze speculation is that short interest is enormous. As of now, roughly 123.4 million shares were short, about 32.3% of the float. That is one of the highest short floats among U.S. stocks. In the short term, this makes SOUN a very volatile name. A strong earnings beat or major partnership announcement could force many shorts to cover quickly, fueling a sharp pop.

Conversely, any disappointment could send the shares sharply lower as bearish traders pile on. In either case, the heavy short base means the stock’s technical moves may overwhelm fundamentals. For example, if SoundHound reports much better‑than‑expected Q4 results, some holders might rush to sell into that rally, triggering a squeeze. But if results miss expectations, the tight float gives bears extra ammo to drive down the price. Importantly, none of these changes changes SoundHound’s underlying business: it remains an unprofitable growth firm. The squeeze talk only adds a trading‑speculation overlay on top of the core story.

What to Expect From the Upcoming Report

SoundHound will report its Q4 2025 results on Feb. 26 after market close. Analysts expect roughly $54 million in revenue and an essentially loss of $0.11 EPS for the quarter, which could be, however, 84% growth year-over-year (YoY). In the prior call, management had guided full‑year 2025 revenue of $160 to $178 million and reiterated a goal of hitting adjusted EBITDA breakeven by year-end. Thus, investors will be keen to hear if management reaffirms that outlook or provides any 2026 guidance.

On the call, key items to watch include updates on their automotive deals and voice‑commerce initiatives and any comments on new markets or partners. Options traders are already bracing for a big move. SOUN’s implied volatility is very high, 100% as of early February, so a 10% plus stock swing in either direction is priced in. Historically, SOUN’s earnings have indeed sparked large gaps, so risk is elevated.

So, SoundHound’s Feb. 26 earnings could cause a wild ride; any surprise, good or bad, will likely be amplified by the heavy short interest.

What Do Analysts Say About SOUN Stock

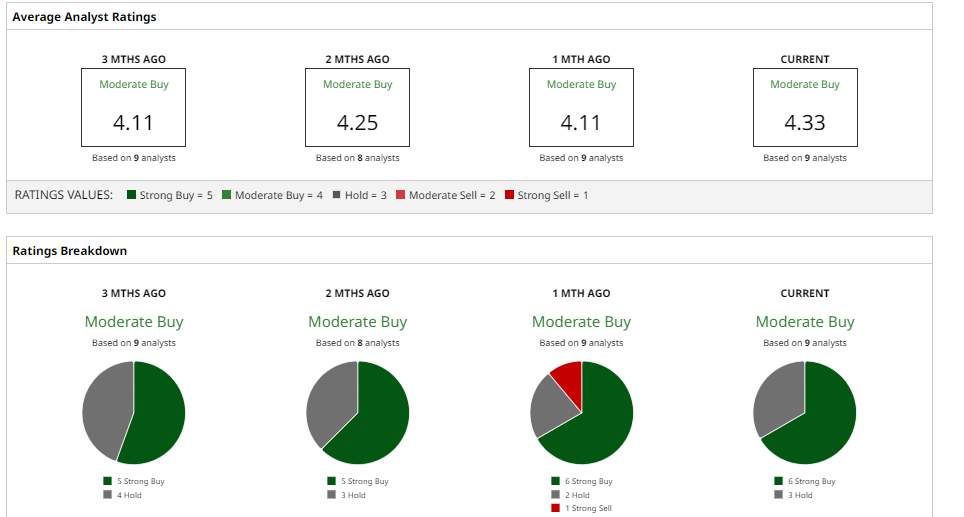

On Wall Street, analysts’ views are mixed but generally bullish. The consensus rating is a “Moderate Buy” with an average target around $16, which suggests the stock could more than double from current levels.

Separately, H.C. Wainwright’s Scott Buck reiterated a “Buy” rating with a $26 price target in mid-January, citing SoundHound as a long‑term player in voice AI.

Cantor Fitzgerald’s Tom Blakey, on the other hand, has also grown more optimistic, lifting his target to $15 in a late‑2025 upgrade.

D.A. Davidson sets a more conservative $14 target with a “Buy” rating. Other firms, including Oppenheimer and Piper Sandler, are more cautious, issuing holds or high‑risk buys around the low teens.

Recently, analysts have debated whether SOUN is still richly priced for its next phase. Any change in ratings or price targets usually comes around earnings; for instance, some are watching to see if targets get trimmed after Q4 if guidance is weak.

On the date of publication, Nauman Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Warren Buffett Warns Not To Chase Trendy Stocks, ‘I Would Rather Be Certain of a Good Result Than Hopeful of a Great One’

- Down 33% YTD, Should You Buy the Dip in Robinhood Stock in February 2026?

- Billionaire Bill Ackman Is Betting Big on Meta Platforms Stock. Should You?

- As Oracle Lands a New Air Force Win, Should You Buy, Sell, or Hold ORCL Stock?