Chubb Limited (CB) is a leading global insurance and reinsurance company providing a wide range of property and casualty, accident and health, reinsurance, and life insurance products and services to individuals, businesses, and multinational corporations worldwide. The company is headquartered in Zurich, Switzerland and has a market cap of about $130.9 billion, reflecting its position as one of the world’s largest property and casualty insurers.

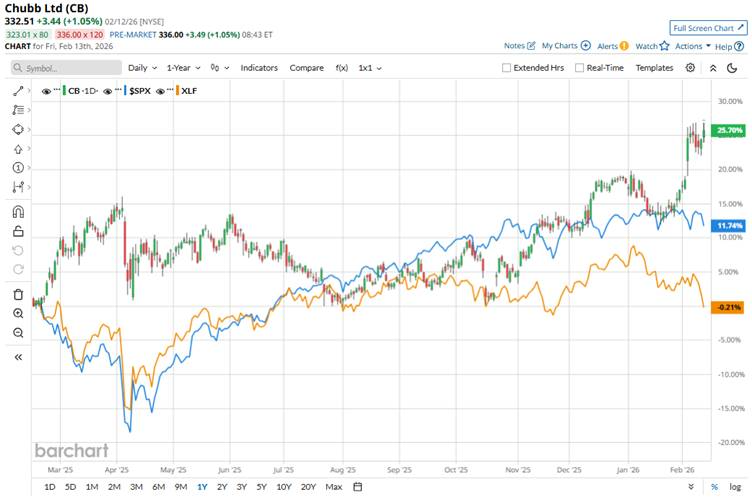

Its shares have outperformed the broader market over the past 52 weeks. CB has risen 25.5% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 12.9%. Moreover, shares of the company are up 7.7% on a YTD basis, compared to SPX’s marginal decline.

In addition, shares of Chubb have also outpaced the State Street Financial Select Sector SPDR ETF’s (XLF) marginal return over the past 52 weeks and 5.6% slump YTD.

Chubb’s shares have climbed lately due to strong earnings results and positive analyst sentiment after the company reported quarterly figures that beat expectations.

For the fourth quarter of 2025, Chubb delivered record results, reporting net income of $3.2 billion, or $8.10 per share, up about 28% year-over-year (YOY), and core operating income per share of $7.52, up 24.9% and beating the consensus expectations. Meanwhile, the company’s full-year 2025 performance featured record net income of $10.3 billion, up 11.2% YOY.

For the fiscal year ending in December 2026, analysts expect CB’s EPS to grow 5.6% year-over-year to $26.18. The company’s earnings surprise history is promising. It beat the consensus estimates in the last four quarters.

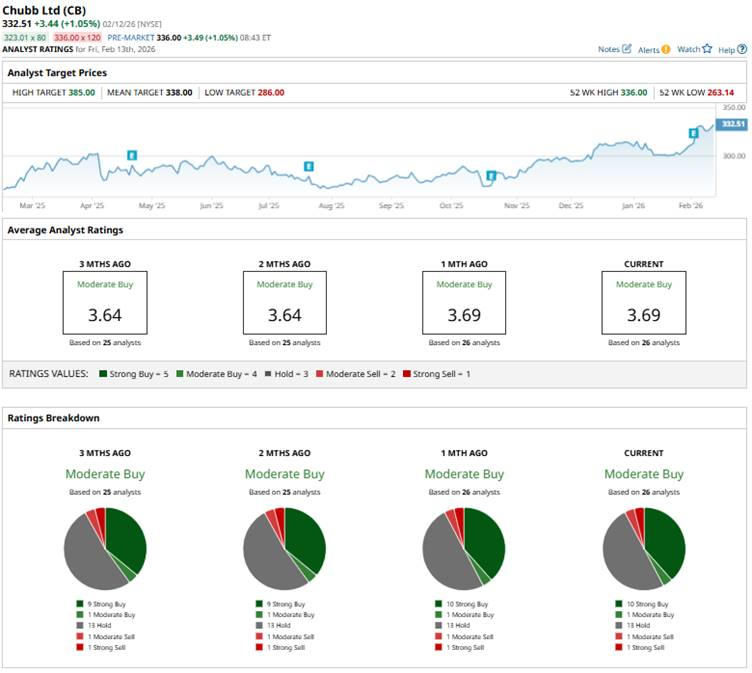

Among the 26 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 10 “Strong Buy” ratings, one “Moderate Buy,” 13 “Holds,” one “Moderate Sell,” and one “Strong Sell.”

This configuration is slightly more bullish than two months ago, when there were nine “Strong Buy” ratings.

Recently, Keefe, Bruyette & Woods raised its price target on Chubb Limited to $373 from $355 while maintaining an “Outperform” rating, following the company’s strong Q4 2025 results.

The mean price target of $338 represents a 1.7% premium to CB’s current price levels. The Street-high price target of $385 suggests a 15.8% potential upside.

On the date of publication, Subhasree Kar did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart