Date: February 12, 2026

Introduction

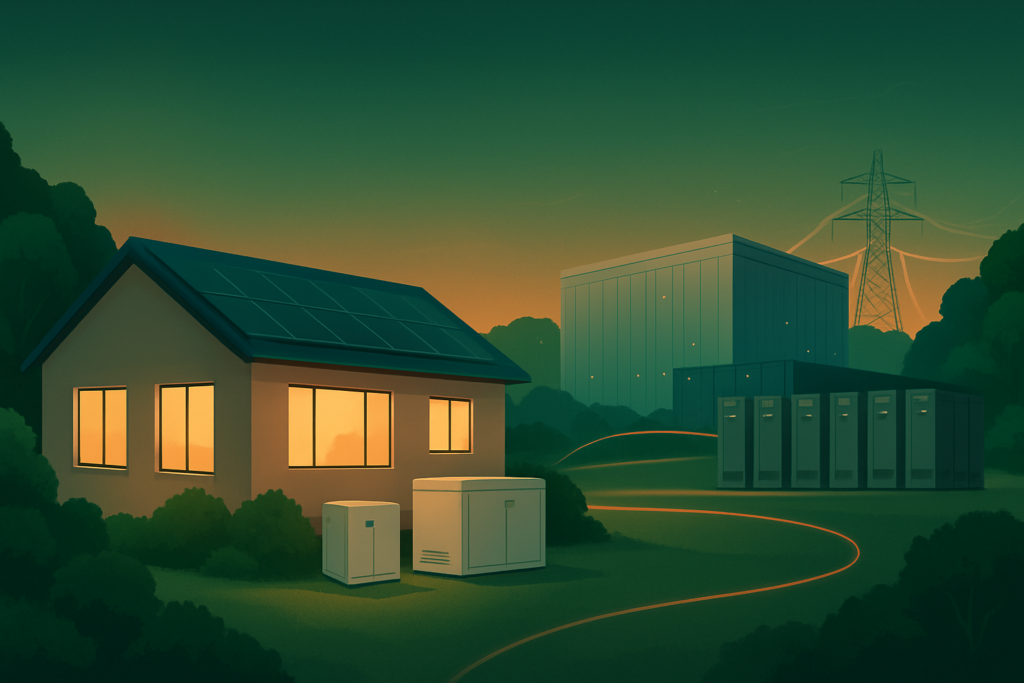

As the American power grid enters a period of unprecedented strain, few companies sit at the intersection of climate resilience and digital infrastructure as prominently as Generac Holdings (NYSE: GNRC). Long synonymous with the hum of backup generators in suburban driveways, Generac is undergoing a profound metamorphosis in early 2026. No longer just a hardware manufacturer, the company has repositioned itself as an "energy technology" leader, pivoting from purely reactive standby power to an integrated ecosystem of smart home energy management and high-stakes data center infrastructure.

The stock is currently a focal point for Wall Street as it navigates a post-pandemic correction that saw shares retreat from 2021 highs, only to find a new, more robust growth engine in the artificial intelligence (AI) boom. As of today, February 12, 2026, Generac is proving that the "Electrification of Everything" requires more than just a stable grid—it requires the decentralized resilience that Generac has spent six decades perfecting.

Historical Background

Generac’s story began in 1959 in a barn in Wales, Wisconsin. Founded by Robert Kern with just $7,500 in capital, the company initially served as the primary manufacturer for Sears, Roebuck and Co.’s portable generators under the Craftsman brand. However, Kern’s most significant innovation came in 1989 when Generac introduced the first gaseous-fueled automatic home standby (HSB) generator. This product effectively created the residential backup power category, transforming a niche industrial tool into an essential appliance for homeowners.

After a period of private equity ownership under CCMP Capital starting in 2006, Generac went public on the New York Stock Exchange in February 2010 (NYSE: GNRC). Under the leadership of Aaron Jagdfeld, who became CEO in 2008, the company has evolved through aggressive acquisitions—including ecobee, Enbala, and Pika Energy—moving beyond internal combustion engines into software, battery storage, and grid services.

Business Model

Generac operates through two primary segments: Residential and Commercial & Industrial (C&I).

- Residential (Approx. 60% of Revenue): This segment includes the legacy home standby generators where Generac maintains a dominant ~75% market share. It also encompasses the "Clean Energy" suite: PWRcell battery storage, solar inverters, and ecobee smart thermostats. The model is shifting toward a recurring services framework where these devices participate in Virtual Power Plants (VPPs).

- Commercial & Industrial (Approx. 40% of Revenue): This segment provides backup power for hospitals, telecommunications, and—most crucially in 2026—hyperscale data centers. Generac sells both gaseous and diesel-powered units, focusing on modularity and rapid deployment.

Revenue is primarily driven by a vast distribution network of over 8,000 independent dealers, which provides a significant competitive moat compared to direct-to-consumer models like Tesla (NASDAQ: TSLA).

Stock Performance Overview

Generac’s stock chart tells a tale of extreme cycles.

- 10-Year Performance: Since early 2016, GNRC has delivered a staggering total return of approximately 510%, outperforming the S&P 500 significantly despite its volatility.

- 5-Year Performance: The stock remains roughly 32% below its late 2021 all-time highs. The post-COVID "pull-forward" of demand led to a painful multi-year digestion period as interest rates rose and residential solar markets cooled.

- 1-Year Performance: Over the last 12 months, the stock has surged over 50%. This rally, culminating in a +17.8% single-day jump on February 11, 2026, reflects investor excitement over the company’s burgeoning data center backlog and a stabilization of the residential market.

Financial Performance

In its most recent reporting cycle ending in late 2025, Generac posted annual revenue of $4.21 billion. While this was a slight decline from 2024 due to a "low outage" weather environment, the underlying quality of earnings has improved.

AI-Generated 2026 Earnings Estimates:

- Projected Revenue: $4.85 billion (+15% YoY).

- Projected Adjusted EBITDA Margin: 18.5% (up from 17% in 2025).

- Estimated EPS: $7.85 per share.

- Free Cash Flow: Expected to reach $350M+ as inventory levels normalize.

The company’s balance sheet remains healthy, supported by a newly authorized $500 million share repurchase program as of February 2026, signaling management’s belief that the stock remains undervalued relative to its industrial-tech peers.

Leadership and Management

CEO Aaron Jagdfeld is one of the longest-tenured leaders in the sector, having been with Generac since 1994. He is credited with the "Powering a Smarter World" strategy, which moved the company into the energy technology space.

The board of directors, led by Jagdfeld and Lead Director Bennett Morgan (formerly of Polaris (NYSE: PII)), is notable for its industrial expertise. While the company faced some criticism in 2022-2023 for its handling of the solar-storage transition and warranty issues, the management team has regained investor trust by streamlining operations and successfully tapping into the AI infrastructure trade in 2025.

Products, Services, and Innovations

Generac’s current product portfolio is designed to bridge the gap between "off-grid" and "smart-grid."

- PWRcell 2 MAX: Launched in 2025, this battery system offers 11.5 kW of continuous power, allowing homeowners to run heavy loads (like central A/C) entirely on stored energy.

- ecobee Smart Home: Beyond thermostats, ecobee now acts as the central command for the home’s energy. It can automatically shed non-essential loads when a storm is approaching or when electricity prices peak.

- Data Center Megawatt Units: Generac has innovated in "Modular Power Systems" (MPS), allowing data centers to add backup capacity in increments. This is a direct challenge to the large-scale diesel incumbents.

Competitive Landscape

Generac faces a bifurcated competitive field:

- Traditional Rivals: In the home standby market, Kohler (private) remains the primary competitor, though it lacks Generac's scale and software ecosystem. Cummins (NYSE: CMI) competes heavily in the industrial space.

- Energy Tech Rivals: In solar and storage, Generac battles Enphase Energy (NASDAQ: ENPH) and Tesla (NASDAQ: TSLA). While Tesla leads in battery market share, Generac’s advantage is its ability to offer a "Triple Threat" solution: Solar + Battery + Generator, all integrated through a single software platform.

Industry and Market Trends

Three macro trends are currently favoring Generac:

- Grid Fragility: The U.S. electrical grid is aging while demand is spiking. This "gap" creates a permanent tailwind for backup solutions.

- AI Data Center Boom: AI training requires massive, uninterrupted power. The urgency of these builds has led data center operators to seek more modular, quickly-deployable power units—Generac’s specialty.

- Virtual Power Plants (VPPs): Utilities are increasingly paying homeowners to use their batteries and generators to stabilize the grid. Generac’s Concerto

platform is at the forefront of this monetization.

platform is at the forefront of this monetization.

Risks and Challenges

Despite the optimism, risks remain:

- Interest Rate Sensitivity: High rates make financing for residential solar and generators more expensive for consumers.

- Weather Dependency: Generac’s residential sales are still highly correlated with "major power outage events" (hurricanes, ice storms). A mild weather year can lead to inventory bloat.

- Execution Risk in Clean Energy: The transition to solar/storage has been rocky, with previous product reliability issues (SnapRS) lingering in some investors' minds.

Opportunities and Catalysts

- Data Center Backlog: Generac enters 2026 with a $400 million backlog in C&I products specifically for data centers. Converting this to revenue is the primary near-term catalyst.

- Electrification of Heat: As more homes move to heat pumps and EVs, the "penalty" for a power outage increases, potentially expanding the HSB market penetration from ~6% of U.S. homes to over 10% by 2030.

Investor Sentiment and Analyst Coverage

The current sentiment on Wall Street is "Cautiously Bullish." Most analysts have a "Moderate Buy" or "Outperform" rating on GNRC, with price targets ranging between $210 and $235. Institutional ownership remains high (~85%), with recent filings showing increased positions from tech-focused growth funds who now view Generac as an "AI Picks and Shovels" play rather than just a cyclical industrial.

Regulatory, Policy, and Geopolitical Factors

The Inflation Reduction Act (IRA) continues to be a massive tailwind. The 30% Investment Tax Credit (ITC) for battery storage and solar inverters has been extended through 2032 under "tech-neutral" guidelines. Furthermore, Generac’s emphasis on domestic manufacturing (Wisconsin and South Carolina) allows it to qualify for "Made in America" bonuses, providing a pricing advantage over imports from China.

Conclusion

Generac Holdings (NYSE: GNRC) is a company in the midst of a successful second act. While its roots are in the internal combustion engine, its future lies in being the "Energy Orchestrator" for a digital world. The pivot toward the data center market in 2025-2026 has fundamentally changed the stock's narrative, providing a growth floor that is less dependent on hurricane seasons.

For investors, Generac offers a unique way to play the AI infrastructure boom and the decarbonization of the home simultaneously. However, the path will likely remain volatile, dictated by the speed of grid upgrades and the macro-economic environment. As of February 2026, Generac is no longer just waiting for the lights to go out—it is building the tech to keep them on.

This content is intended for informational purposes only and is not financial advice.