Hong Kong - July 24, 2025 - Top Wealth Group Holding Limited (Nasdaq: TWG or "the Company"), a Nasdaq-listed company, has finalized critical capital restructuring and disclosed a major strategic cooperation initiative.

Key Developments:

Reverse Stock Split Effective: TWG announced that its proposed 1-for-90 reverse share split will take effect on July 21, 2025. This move is primarily aimed at elevating the Company's share price above the Nasdaq's minimum $1.00 bid price requirement (Rule 5550(a)(2)), thereby mitigating potential delisting risks. The Board of Directors' resolution approving the split was passed earlier.

Binding MoU Signed: Ahead of the reverse split taking effect, TWG announced the signing of a legally-binding Memorandum of Understanding (MoU) with Jilin Xiuzheng Agriculture & Animal Husbandry Technology Co., Ltd. ("Jilin Xiuzheng"), a group company of China's leading privately-owned pharmaceutical conglomerate, Xiuzheng Pharmaceutical Group. Under the MoU, Jilin Xiuzheng proposes to inject its animal health business - encompassing pharmaceuticals, foods, and supplements for both pets and livestock - into TWG. In exchange, Jilin Xiuzheng would receive a controlling stake in the combined entity.

Proposed Transaction Details (Per MoU):

Asset Injection: Jilin Xiuzheng plans to contribute its animal health-related business assets.

Consideration: Jilin Xiuzheng would receive a controlling ownership interest in the post-transaction TWG.

Governance: Should the deal close, Jilin Xiuzheng is expected to nominate a majority of the new company's board of directors and appoint key members of the management team.

Existing Operations: TWG's core existing business of premium sturgeon caviar production and sales (under the brand "Imperial Cristal Caviar") would continue to be operated independently by its current management team.

Next Steps: The parties have agreed to a 120-day period to conduct due diligence, negotiate valuation, and other key terms, with the goal of reaching a final, binding definitive agreement. The MoU signifies a significant step towards a formal partnership.

Partner Backgrounds:

Xiuzheng Pharmaceutical Group: Public information identifies the group as one of China's leading private pharmaceutical enterprises, reporting 2024 sales revenue of approximately USD9.42 billion (RMB 67.7 billion). Its subsidiary, Jilin Xiuzheng, focuses on the animal health sector, possessing R&D capabilities, manufacturing facilities, and a nationwide distribution network.

TWG Group: The Company's current core business is the production and sale of premium sturgeon caviar. Its "Imperial Cristal Caviar" brand holds a degree of market recognition.

Potential Synergies and Market Opportunity:

Analysts suggest this potential collaboration, if successfully executed, could yield the following impacts:

For TWG: The Company could leverage Jilin Xiuzheng's brand value, pharmaceutical R&D expertise, manufacturing licenses, and established distribution channels to rapidly enter China's fast-growing pet healthcare market. TWG's business structure would diversify from a single luxury food segment to include pet health, creating a dual-core business model.

For Jilin Xiuzheng/Xiuzheng Pharma: Injecting the animal health business into a Nasdaq-listed entity would achieve asset securitization for this division, providing a capital markets valuation platform and potentially accelerating its international expansion. This move will be Xiuzheng Group's first significant step to enter into international capital markets.

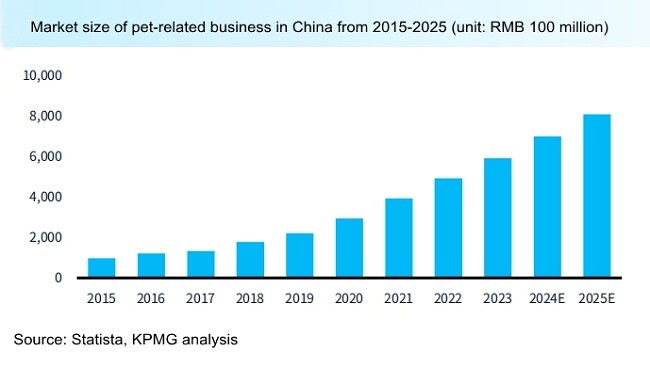

Target Market: The partners are targeting China's rapidly expanding pet market. Data from KPMG China indicates this market has surged from approximately USD13.61 billion (RMB 97.8 billion) in 2015 to nearly USD82.5 billion (RMB 592.8 billion) in 2023, representing a compound annual growth rate (CAGR) of about 25.4%. It is projected to exceed USD113.0 billion (RMB 811.4 billion) by 2025. Demand from pet owners for health-related products (such as medicines and supplements) is seen as a core growth driver.

Market Observations:

Market observers note the close timing of TWG's reverse split announcement and the major strategic MoU, highlighting management's coordinated capital strategy:

Capital Structure Optimization: The successful reverse split addresses an urgent exchange compliance issue, stabilizes the listing status, and provides a clearer equity valuation basis for potential large-scale M&A.

Strategic Pivot Signal: The potential deal with Jilin Xiuzheng signals TWG's intent to utilize its capital markets platform for industrial upgrading and diversification, expanding from premium foods into the even larger and growing pets sector, thereby uplifting TWG's enterprise value.

Balancing Risks & Opportunities: While the signing of the binding MoU is a positive step, finalizing the transaction still requires navigating due diligence, valuation negotiations, and definitive agreement signing. Business integration and managing operations across distinct industries also present inherent challenges.

Outlook:

The next four months represent a critical period for this potential transaction. Should a definitive agreement be signed and the deal close, TWG would transform into a dual-core company encompassing premium consumer goods (caviar) and pet pharmaceuticals. This would also mark a significant attempt by Xiuzheng Pharmaceutical Group to bring assets to the international capital markets. Market participants will closely monitor subsequent negotiations and the potential impact of the deal on TWG's future fundamentals and share price performance.

Disclaimer: This press release may contain forward-looking statements. Forward-looking statements describe future expectations, plans, results, or strategies (including product offerings, regulatory plans and business plans) and may change without notice. You are cautioned that such statements are subject to a multitude of risks and uncertainties that could cause future circumstances, events, or results to differ materially from those projected in the forward-looking statements, including the risks that actual results may differ materially from those projected in the forward-looking statements.

Media Contact

Company Name: Nanjing Tonews Information Technology Co., Ltd.

Contact Person: Harker

Email: Send Email

Phone: 18751894863

Country: China

Website: http://www.tonews.cn