Online community and discussion platform Reddit (NYSE: RDDT) reported Q3 CY2024 results topping the market’s revenue expectations, with sales up 67.9% year on year to $348.4 million. On top of that, next quarter’s revenue guidance ($392.5 million at the midpoint) was surprisingly good and 8.5% above what analysts were expecting. Its GAAP profit of $0.16 per share was also 344% above analysts’ consensus estimates.

Is now the time to buy Reddit? Find out by accessing our full research report, it’s free.

Reddit (RDDT) Q3 CY2024 Highlights:

- Revenue: $348.4 million vs analyst estimates of $314.8 million (10.6% beat)

- EPS: $0.16 vs analyst estimates of -$0.07 ($0.23 beat)

- EBITDA: $94.15 million vs analyst estimates of $60.04 million (56.8% beat)

- Revenue Guidance for Q4 CY2024 is $392.5 million at the midpoint, above analyst estimates of $361.6 million

- EBITDA guidance for Q4 CY2024 is $117.5 million at the midpoint, above analyst estimates of $88.16 million

- Gross Margin (GAAP): 90.1%, up from 87.3% in the same quarter last year

- Operating Margin: 2%, up from -9.4% in the same quarter last year

- EBITDA Margin: 27%, up from -3.3% in the same quarter last year

- Free Cash Flow Margin: 20.2%, up from 9.7% in the previous quarter

- Daily Active Unique Visitors: 97.2 million (slight miss vs. expectations of 97.6 million)

- Market Capitalization: $13.56 billion

“It was another strong quarter for Reddit and our communities as we achieved important milestones, including new levels of user traffic, revenue growth, and profitability,” said Steve Huffman, Co-Founder and CEO of Reddit.

Company Overview

Reddit's largest revenue generator is its advertising services, which enable companies to target its engaged user base across subreddits, particularly appealing to brands wanting to reach niche or hard-to-reach audiences. In addition to ads, Reddit offers a subscription service that removes ads and grants access to exclusive features like the "Coins" system, which lets users reward content creators.

After its founding, the company was acquired by Conde Nast in 2006. Reddit eventually became an independent subsidiary of its parent. After funding rounds in August 2019 and August 2021 led by Tencent and Fidelity Investments, respectively, the company went public in March 2024.

Social Networking

Businesses must meet their customers where they are, which over the past decade has come to mean on social networks. In 2020, users spent over 2.5 hours a day on social networks, a figure that has increased every year since measurement began. As a result, businesses continue to shift their advertising and marketing dollars online.

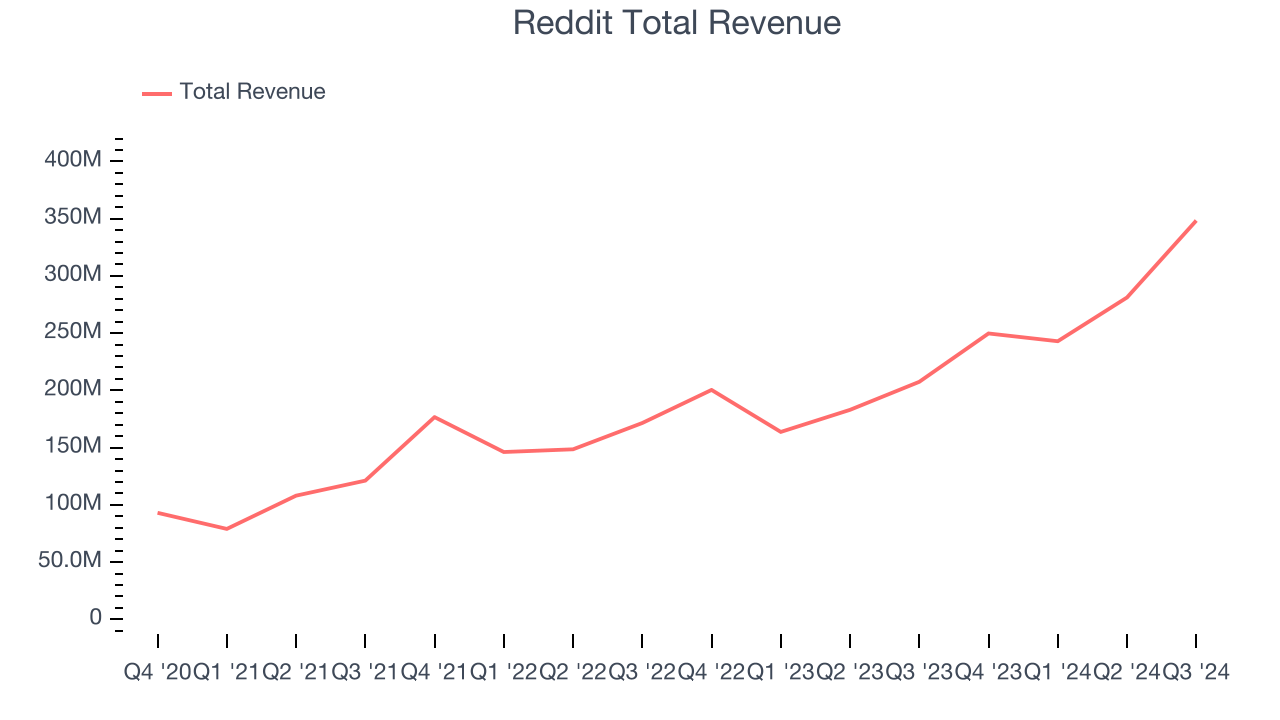

Sales Growth

Reviewing a company’s long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one sustains growth for years. Thankfully, Reddit’s 40.9% annualized revenue growth over the last three years was incredible. This is a great starting point for our analysis because it shows Reddit’s offerings resonate with customers.

This quarter, Reddit reported magnificent year-on-year revenue growth of 67.9%, and its $348.4 million of revenue beat Wall Street’s estimates by 10.6%. Management is currently guiding for a 57.2% year-on-year increase next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 25.7% over the next 12 months. This projection is still commendable and indicates the market is factoring in success for its products and services.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Key Takeaways from Reddit’s Q3 Results

This was a near-perfect quarter, with a slight miss on DAUs as the only blemish. As for positives, there were many. We were impressed by how much Reddit beat revenue and EBITDA, especially despite the DAU slight underperformance. The company’s optimistic EBITDA forecast for next quarter also blew past analysts’ expectations. Again, this was a great quarter. The stock traded up 40.5% to $114.86 immediately following the results.

Reddit may have had a good quarter, but does that mean you should invest right now?When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.