Building products company Quanex (NYSE: NX) met Wall Street’s revenue expectations in Q3 CY2024, with sales up 66.6% year on year to $492.2 million. Its GAAP loss of $0.30 per share decreased from $0.83 in the same quarter last year.

Is now the time to buy Quanex? Find out by accessing our full research report, it’s free.

Quanex (NX) Q3 CY2024 Highlights:

- Revenue: $492.2 million vs analyst estimates of $491.9 million (66.6% year-on-year growth, in line)

- Adjusted EBITDA: $81.1 million vs analyst estimates of $70.8 million (16.5% margin, 14.5% beat)

- Operating Margin: 0.6%, down from 13.4% in the same quarter last year

- Free Cash Flow was -$8.17 million, down from $29.55 million in the same quarter last year

- Market Capitalization: $1.38 billion

Company Overview

Starting in the seamless tube industry, Quanex (NYSE: NX) manufactures building products like window, door, kitchen, and bath cabinet components. Note that numbers in this report artificially jump in Q3 2024, as Quanex acquired Tyman on August 1st, 2024.

Home Construction Materials

Traditionally, home construction materials companies have built economic moats with expertise in specialized areas, brand recognition, and strong relationships with contractors. More recently, advances to address labor availability and job site productivity have spurred innovation that is driving incremental demand. However, these companies are at the whim of residential construction volumes, which tend to be cyclical and can be impacted heavily by economic factors such as interest rates. Additionally, the costs of raw materials can be driven by a myriad of worldwide factors and greatly influence the profitability of home construction materials companies.

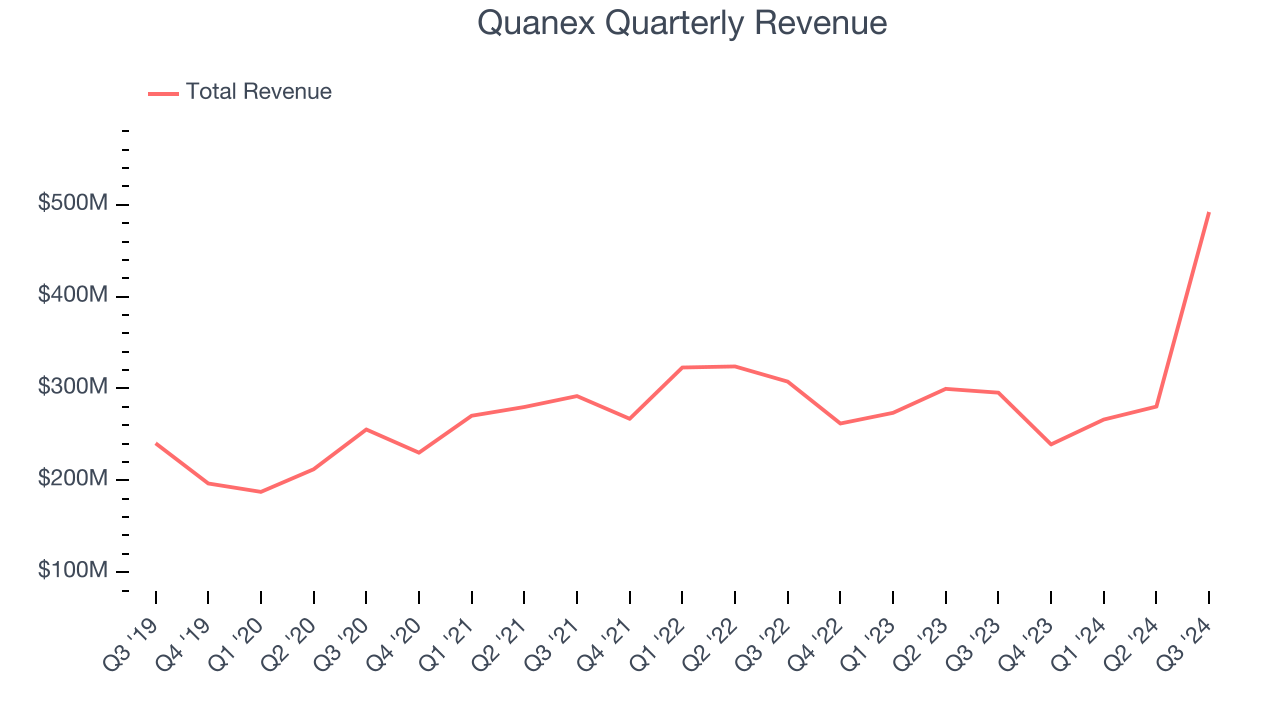

Sales Growth

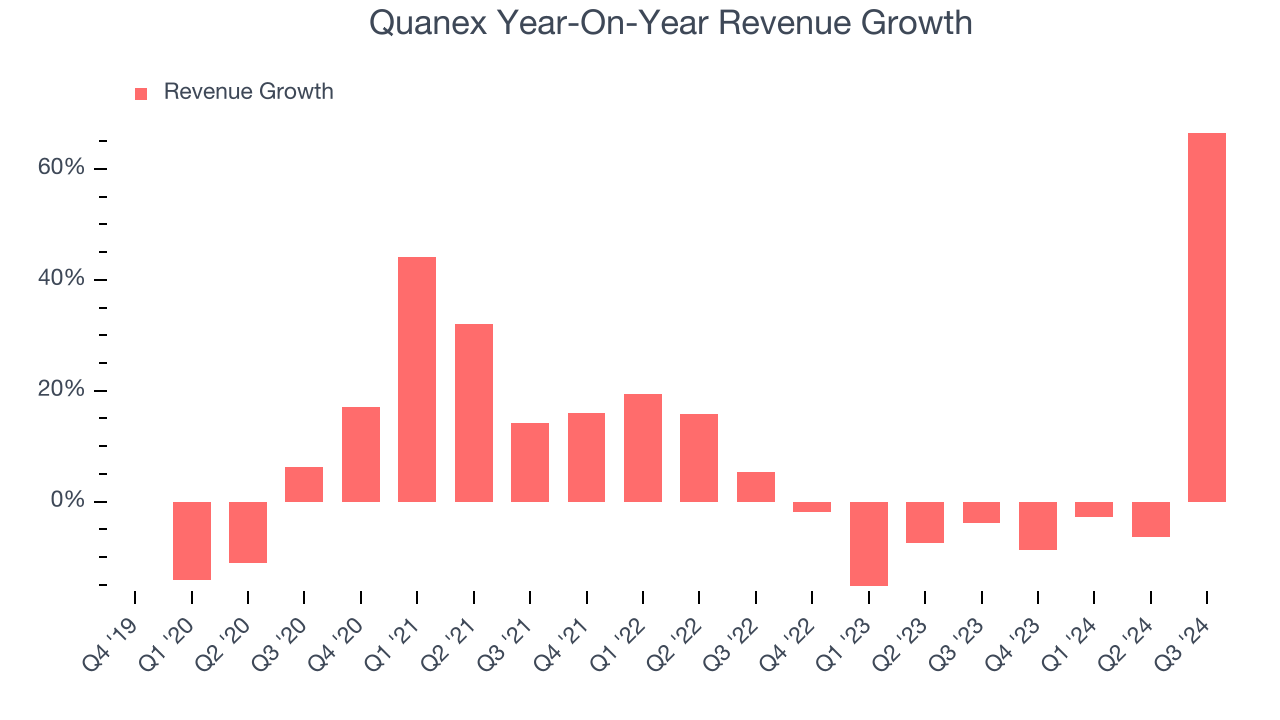

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, Quanex grew its sales at a mediocre 7.4% compounded annual growth rate. This fell short of our benchmark for the industrials sector and is a tough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Quanex’s recent history shows its demand slowed as its annualized revenue growth of 2.3% over the last two years is below its five-year trend.

Quanex also breaks out the revenue for its most important segments, Fenestration and Cabinet Components, which are 35% and 10.7% of revenue. Over the last two years, Quanex’s Fenestration revenue (window and door components, North America only) averaged 2.5% year-on-year declines while its Cabinet Components revenue (cabinet parts, North America only) averaged 14.7% declines.

This quarter, Quanex’s year-on-year revenue growth of 66.6% was magnificent, and its $492.2 million of revenue was in line with Wall Street’s estimates.

We also like to judge companies based on their projected revenue growth, but not enough Wall Street analysts cover the company for it to have reliable consensus estimates.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Operating Margin

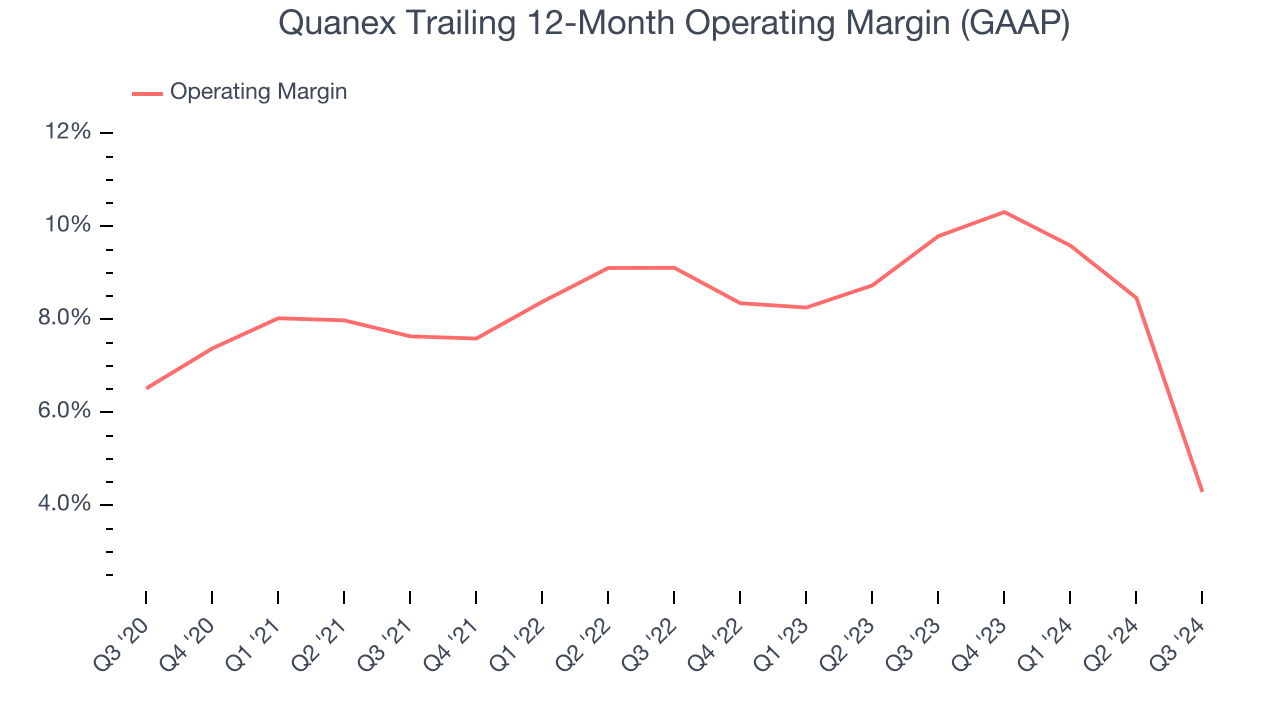

Quanex was profitable over the last five years but held back by its large cost base. Its average operating margin of 7.5% was weak for an industrials business. This result isn’t too surprising given its low gross margin as a starting point.

Analyzing the trend in its profitability, Quanex’s operating margin decreased by 2.2 percentage points over the last five years. The company’s performance was poor no matter how you look at it. It shows operating expenses were rising and it couldn’t pass those costs onto its customers.

In Q3, Quanex’s breakeven margin was down 12.8 percentage points year on year. Since Quanex’s operating margin decreased more than its gross margin, we can assume it was recently less efficient because expenses such as marketing, R&D, and administrative overhead increased.

Earnings Per Share

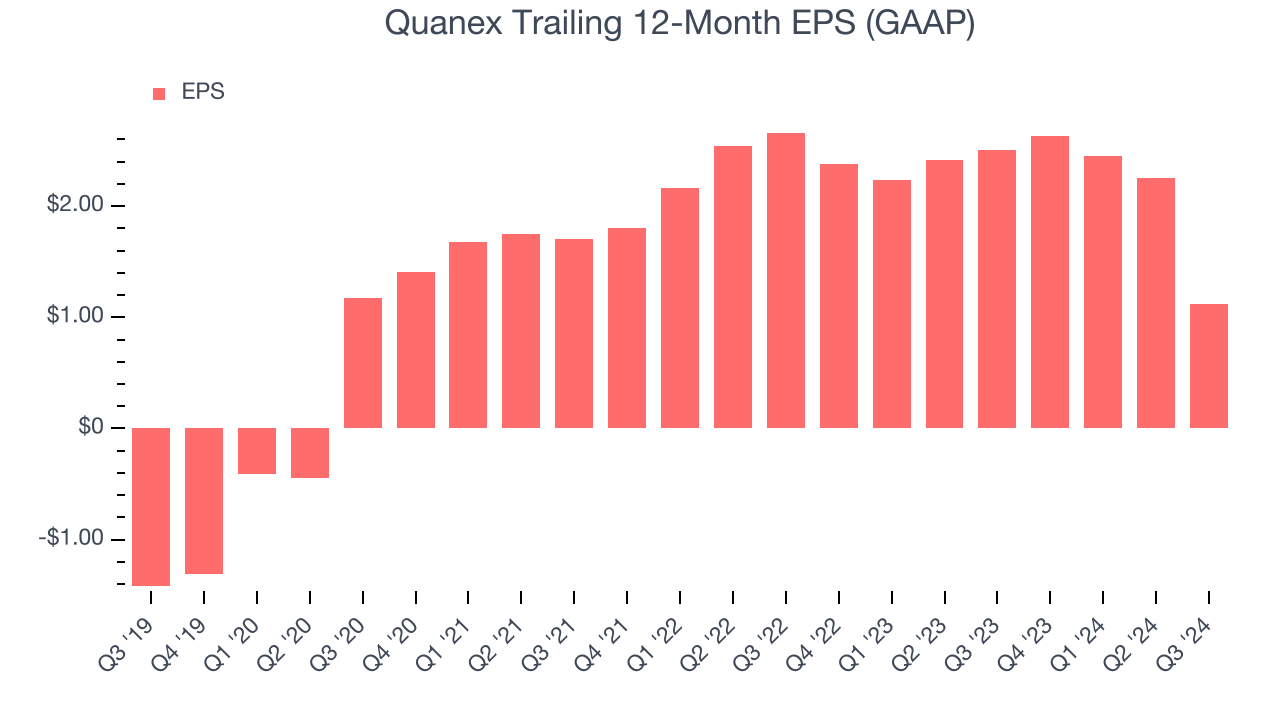

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Quanex’s full-year EPS flipped from negative to positive over the last five years. This is encouraging and shows it’s at a critical moment in its life.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

Sadly for Quanex, its EPS declined by 35.1% annually over the last two years while its revenue grew by 2.3%. This tells us the company became less profitable on a per-share basis as it expanded.

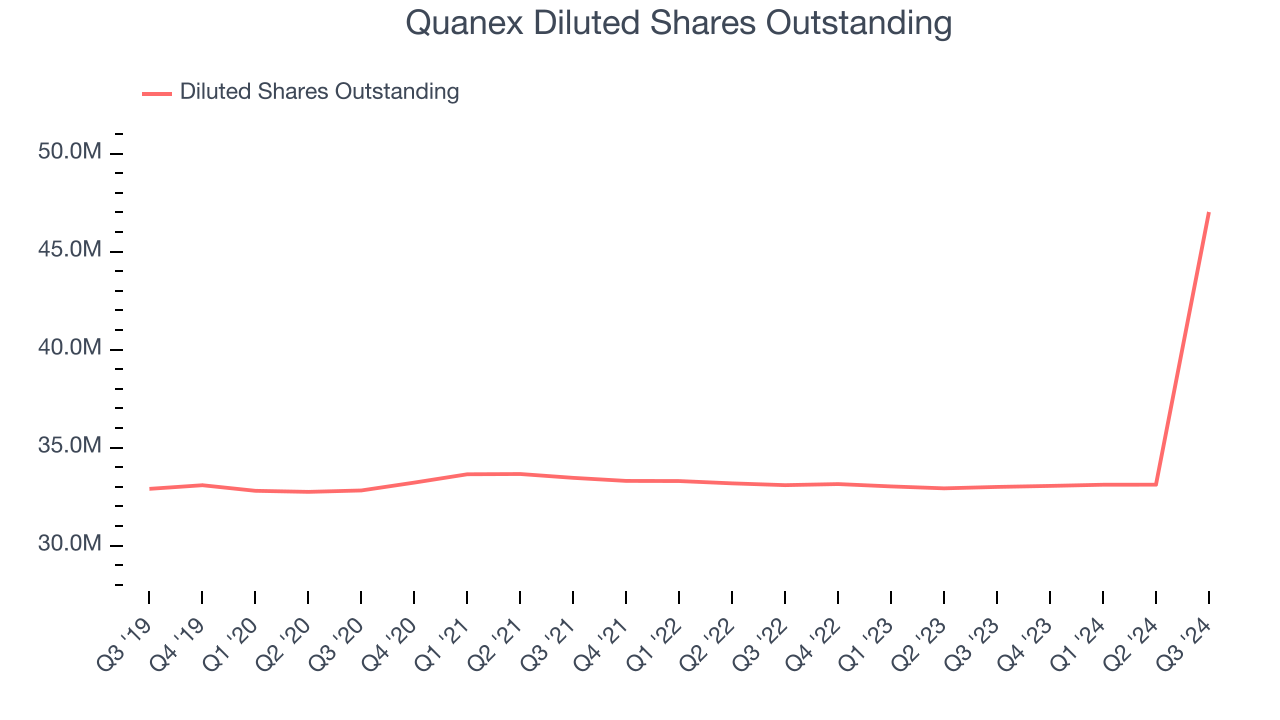

Diving into the nuances of Quanex’s earnings can give us a better understanding of its performance. Quanex’s operating margin has declined by 8.7 percentage points over the last two yearswhile its share count has grown 42.1%. This means the company not only became less efficient with its operating expenses but also diluted its shareholders.

In Q3, Quanex reported EPS at negative $0.30, down from $0.83 in the same quarter last year. We also like to analyze expected EPS growth based on Wall Street analysts’ consensus projections, but there is insufficient data.

Key Takeaways from Quanex’s Q3 Results

We were impressed by how significantly Quanex blew past analysts’ EBITDA expectations this quarter. We were also glad its Cabinet Components revenue topped Wall Street’s estimates. Zooming out, we think this was a solid quarter. The stock remained flat at $28.84 immediately following the results.

Big picture, is Quanex a buy here and now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.