Wrapping up Q2 earnings, we look at the numbers and key takeaways for the medical devices & supplies - cardiology, neurology, vascular stocks, including Artivion (NYSE: AORT) and its peers.

The medical devices and supplies industry, particularly in the fields of cardiology, neurology, and vascular care, benefits from a business model that balances innovation with relatively predictable revenue streams. These companies focus on developing life-saving devices such as stents, pacemakers, neurostimulation implants, and vascular access tools, which address critical and often chronic conditions. The recurring need for these devices, coupled with growing global demand for advanced treatments, provides stability and opportunities for long-term growth. However, the industry faces hurdles such as high research and development costs, rigorous regulatory approval processes, and reliance on reimbursement from healthcare systems, which can exert downward pressure on pricing. Looking ahead, the industry is positioned to benefit from tailwinds such as aging populations (which tend to have higher rates of disease) and technological advancements like minimally invasive procedures and connected devices that improve patient monitoring and outcomes. Innovations in robotic-assisted surgery and AI-driven diagnostics are also expected to accelerate adoption and expand treatment capabilities. However, potential headwinds include pricing pressures stemming from value-based care models and continued complexity changing from navigating regulatory frameworks that may prioritize further lowering healthcare costs.

The 4 medical devices & supplies - cardiology, neurology, vascular stocks we track reported an exceptional Q2. As a group, revenues beat analysts’ consensus estimates by 3%.

Thankfully, share prices of the companies have been resilient as they are up 6.1% on average since the latest earnings results.

Best Q2: Artivion (NYSE: AORT)

Formerly known as CryoLife until its 2022 rebranding, Artivion (NYSE: AORT) develops and manufactures medical devices and preserves human tissues used in cardiac and vascular surgical procedures for patients with aortic disease.

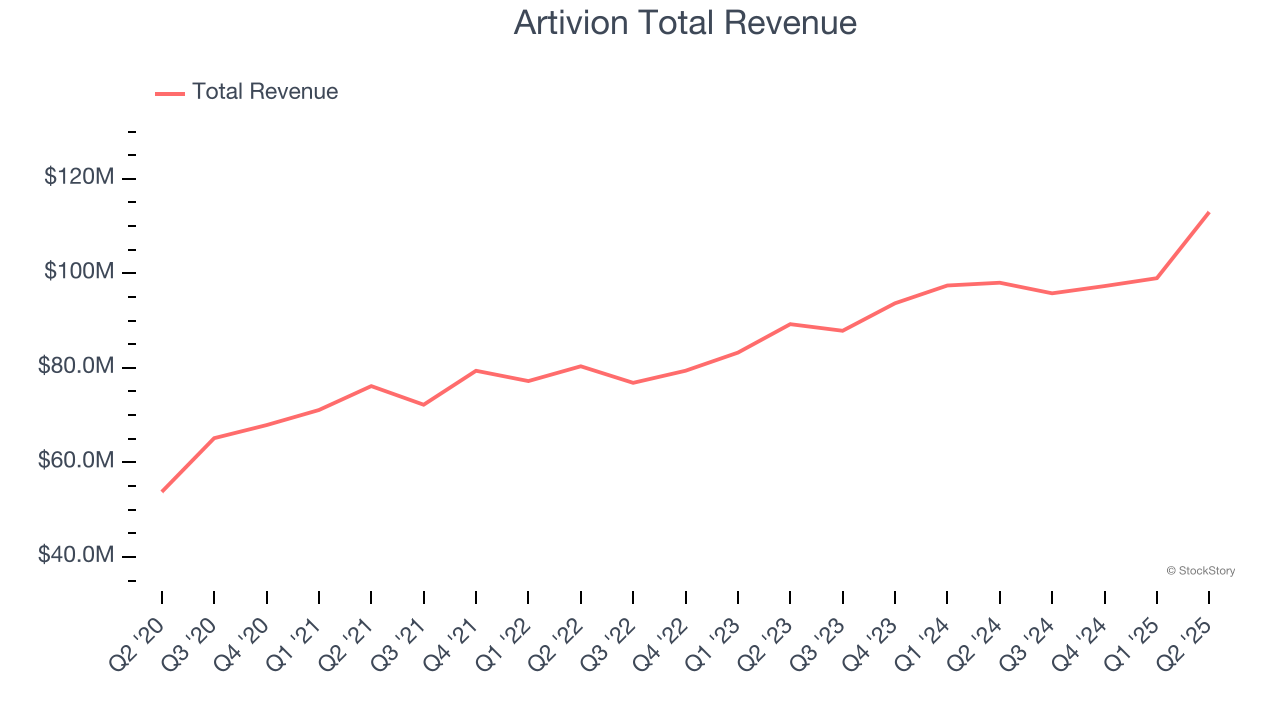

Artivion reported revenues of $113 million, up 15.3% year on year. This print exceeded analysts’ expectations by 4.4%. Overall, it was an exceptional quarter for the company with a beat of analysts’ EPS estimates and full-year revenue guidance exceeding analysts’ expectations.

"The second quarter was exceptionally strong as we made progress across each of our strategic initiatives while delivering 14% constant currency revenue growth. Revenue growth was driven by year-over-year growth in On-X of 24%, stent grafts of 24%, BioGlue of 4%, and Preservation Services of 3%, all compared to the second quarter of 2024. On a constant currency basis, year-over-year On-X, stent grafts, BioGlue and preservation services grew 24%, 22%, 4% and 3%, respectively. In addition to our strong revenue performance, adjusted EBITDA grew 33% this quarter over the same period last year, which we believe demonstrates our ability to scale the business and continue to expand adjusted EBITDA margins," said Pat Mackin, Chairman, President, and Chief Executive Officer.

Artivion scored the biggest analyst estimates beat, fastest revenue growth, and highest full-year guidance raise of the whole group. Unsurprisingly, the stock is up 27% since reporting and currently trades at $41.53.

Is now the time to buy Artivion? Access our full analysis of the earnings results here, it’s free for active Edge members.

ICU Medical (NASDAQ: ICUI)

Founded in 1984 and named for its initial focus on intensive care units, ICU Medical (NASDAQ: ICUI) develops and manufactures medical products for infusion therapy, vascular access, and vital care applications used in hospitals and other healthcare settings.

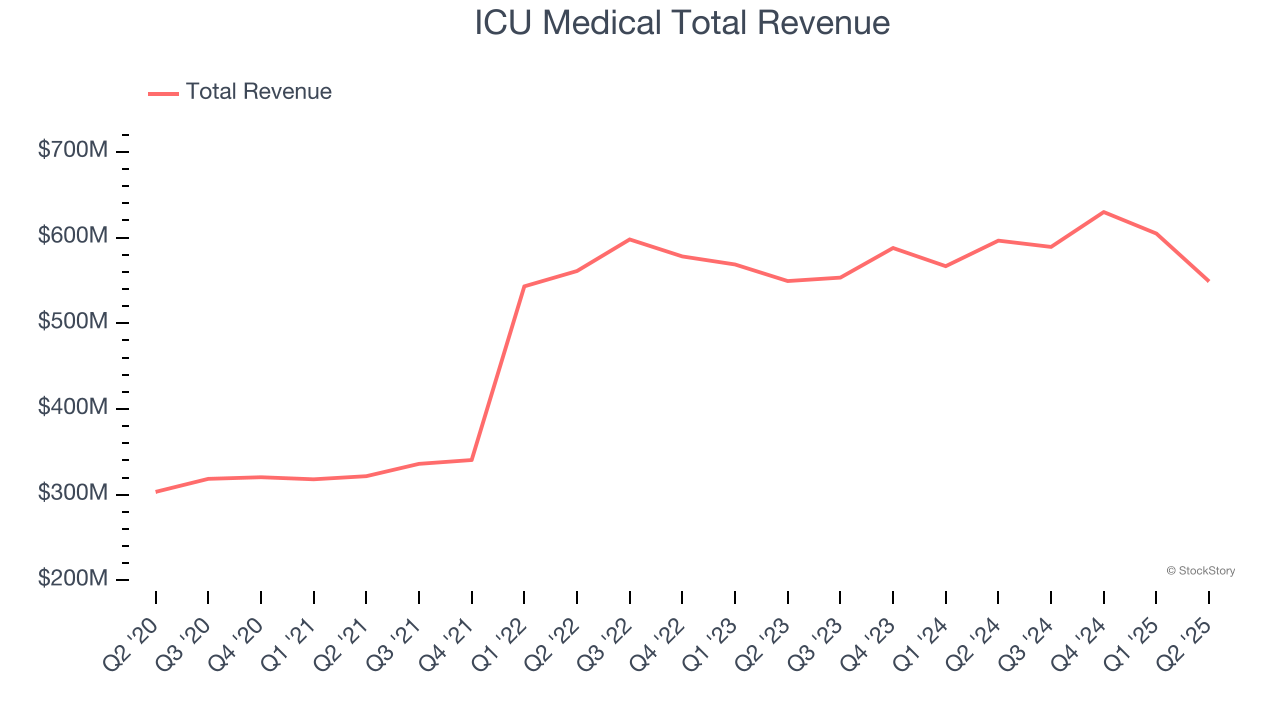

ICU Medical reported revenues of $548.9 million, down 8% year on year, outperforming analysts’ expectations by 1.7%. The business had an exceptional quarter with a beat of analysts’ EPS estimates and a solid beat of analysts’ full-year EPS guidance estimates.

Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 11% since reporting. It currently trades at $115.87.

Is now the time to buy ICU Medical? Access our full analysis of the earnings results here, it’s free for active Edge members.

Slowest Q2: Penumbra (NYSE: PEN)

Founded in 2004 to address challenging medical conditions with significant unmet needs, Penumbra (NYSE: PEN) develops and manufactures innovative medical devices for treating vascular diseases and providing immersive healthcare rehabilitation solutions.

Penumbra reported revenues of $339.5 million, up 13.4% year on year, exceeding analysts’ expectations by 3.7%. It may have had the worst quarter among its peers, but its results were still good as it also locked in a solid beat of analysts’ constant currency revenue estimates and an impressive beat of analysts’ revenue estimates.

Penumbra delivered the weakest full-year guidance update in the group. Interestingly, the stock is up 11.2% since the results and currently trades at $252.61.

Read our full analysis of Penumbra’s results here.

Merit Medical Systems (NASDAQ: MMSI)

Founded in 1987 and now offering over 1,700 patented products across global markets, Merit Medical Systems (NASDAQ: MMSI) manufactures and markets specialized medical devices used in minimally invasive procedures for cardiology, radiology, oncology, critical care, and endoscopy.

Merit Medical Systems reported revenues of $382.5 million, up 13.2% year on year. This number surpassed analysts’ expectations by 2.4%. Overall, it was a very strong quarter as it also logged an impressive beat of analysts’ full-year EPS guidance estimates and a beat of analysts’ EPS estimates.

The stock is down 2.9% since reporting and currently trades at $80.47.

Read our full, actionable report on Merit Medical Systems here, it’s free for active Edge members.

Market Update

In response to the Fed’s rate hikes in 2022 and 2023, inflation has been gradually trending down from its post-pandemic peak, trending closer to the Fed’s 2% target. Despite higher borrowing costs, the economy has avoided flashing recessionary signals. This is the much-desired soft landing that many investors hoped for. The recent rate cuts (0.5% in September and 0.25% in November 2024) have bolstered the stock market, making 2024 a strong year for equities. Donald Trump’s presidential win in November sparked additional market gains, sending indices to record highs in the days following his victory. However, debates continue over possible tariffs and corporate tax adjustments, raising questions about economic stability in 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.