Global pharmaceutical company Eli Lilly (NYSE: LLY) reported revenue ahead of Wall Streets expectations in Q3 CY2025, with sales up 53.9% year on year to $17.6 billion. The company’s full-year revenue guidance of $63.25 billion at the midpoint came in 2.6% above analysts’ estimates. Its non-GAAP profit of $7.02 per share was 18.6% above analysts’ consensus estimates.

Is now the time to buy Eli Lilly? Find out by accessing our full research report, it’s free for active Edge members.

Eli Lilly (LLY) Q3 CY2025 Highlights:

- Revenue: $17.6 billion vs analyst estimates of $16.06 billion (53.9% year-on-year growth, 9.6% beat)

- Adjusted EPS: $7.02 vs analyst estimates of $5.92 (18.6% beat)

- The company lifted its revenue guidance for the full year to $63.25 billion at the midpoint from $61 billion, a 3.7% increase

- Management raised its full-year Adjusted EPS guidance to $23.35 at the midpoint, a 4.4% increase

- Operating Margin: 41.8%, up from 13.3% in the same quarter last year

- Market Capitalization: $730.3 billion

"Lilly delivered another strong quarter, with 54% revenue growth year-over-year driven by continued demand for our incretin portfolio," said David A. Ricks, Lilly chair and CEO.

Company Overview

Founded in 1876 by a Civil War veteran and pharmacist frustrated with the poor quality of medicines, Eli Lilly (NYSE: LLY) discovers, develops, and manufactures pharmaceutical products for conditions including diabetes, obesity, cancer, immunological disorders, and neurological diseases.

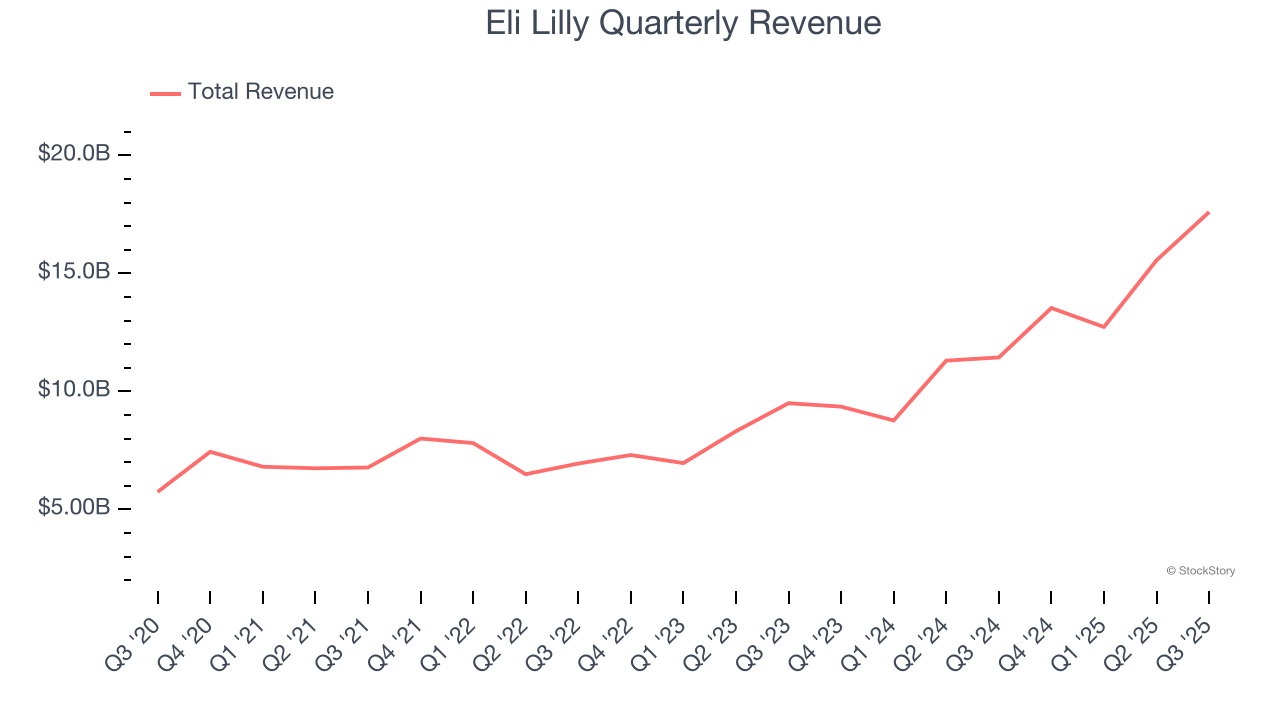

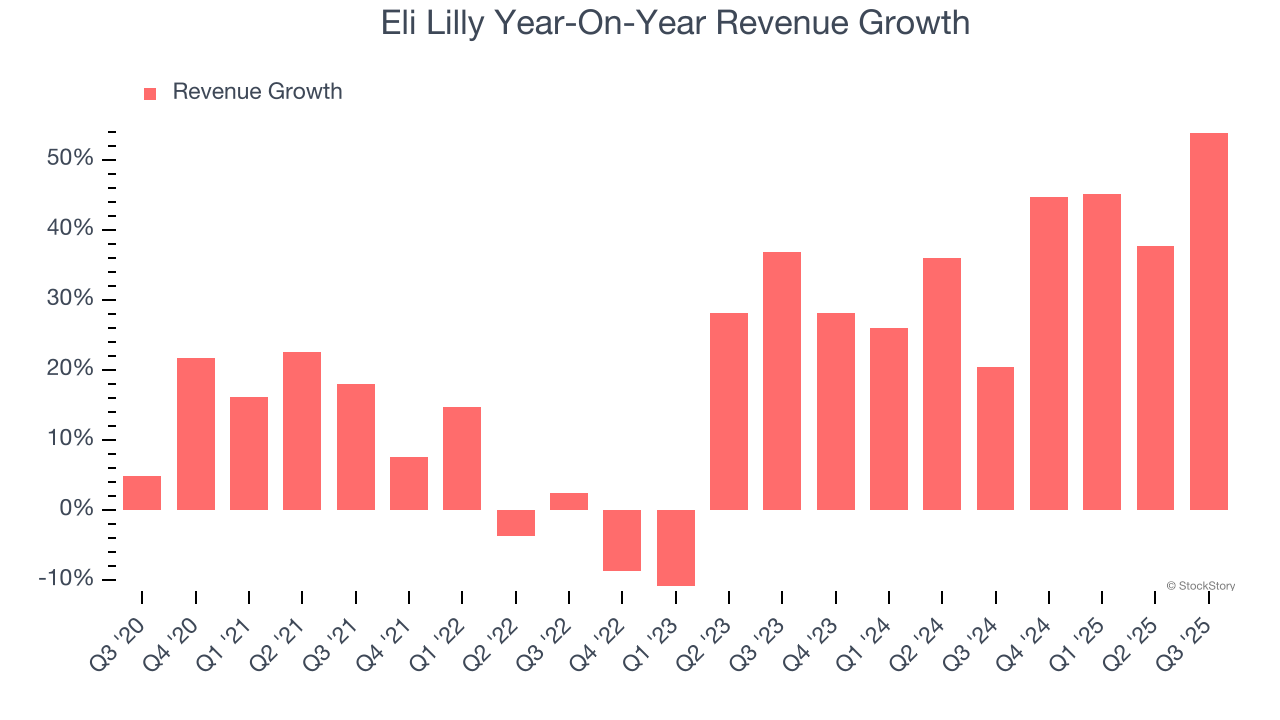

Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Thankfully, Eli Lilly’s 20.7% annualized revenue growth over the last five years was impressive. Its growth surpassed the average healthcare company and shows its offerings resonate with customers, a great starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. Eli Lilly’s annualized revenue growth of 36.1% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

This quarter, Eli Lilly reported magnificent year-on-year revenue growth of 53.9%, and its $17.6 billion of revenue beat Wall Street’s estimates by 9.6%.

Looking ahead, sell-side analysts expect revenue to grow 18.3% over the next 12 months, a deceleration versus the last two years. Still, this projection is eye-popping given its scale and implies the market is forecasting success for its products and services.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

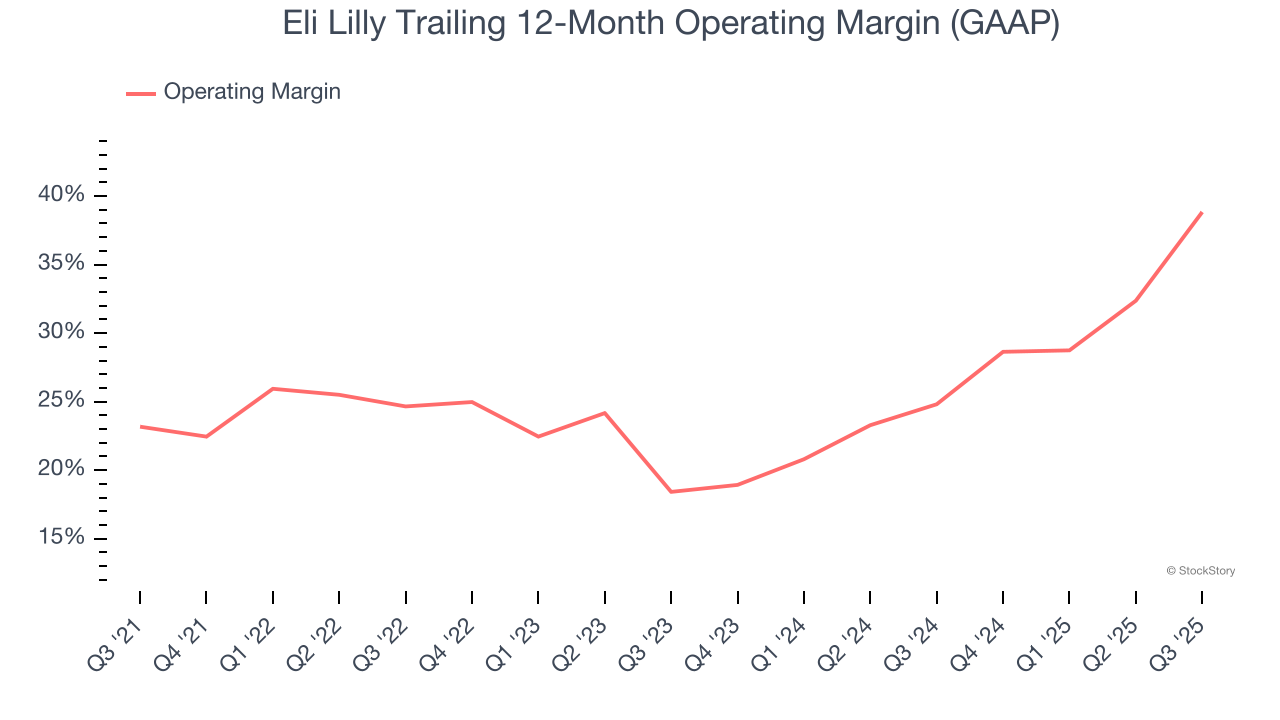

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Eli Lilly has been an efficient company over the last five years. It was one of the more profitable businesses in the healthcare sector, boasting an average operating margin of 27.9%.

Analyzing the trend in its profitability, Eli Lilly’s operating margin rose by 15.7 percentage points over the last five years, as its sales growth gave it immense operating leverage. This performance was mostly driven by its recent improvements as the company’s margin has increased by 20.4 percentage points on a two-year basis. These data points are very encouraging and show momentum is on its side.

In Q3, Eli Lilly generated an operating margin profit margin of 41.8%, up 28.5 percentage points year on year. This increase was a welcome development and shows it was more efficient.

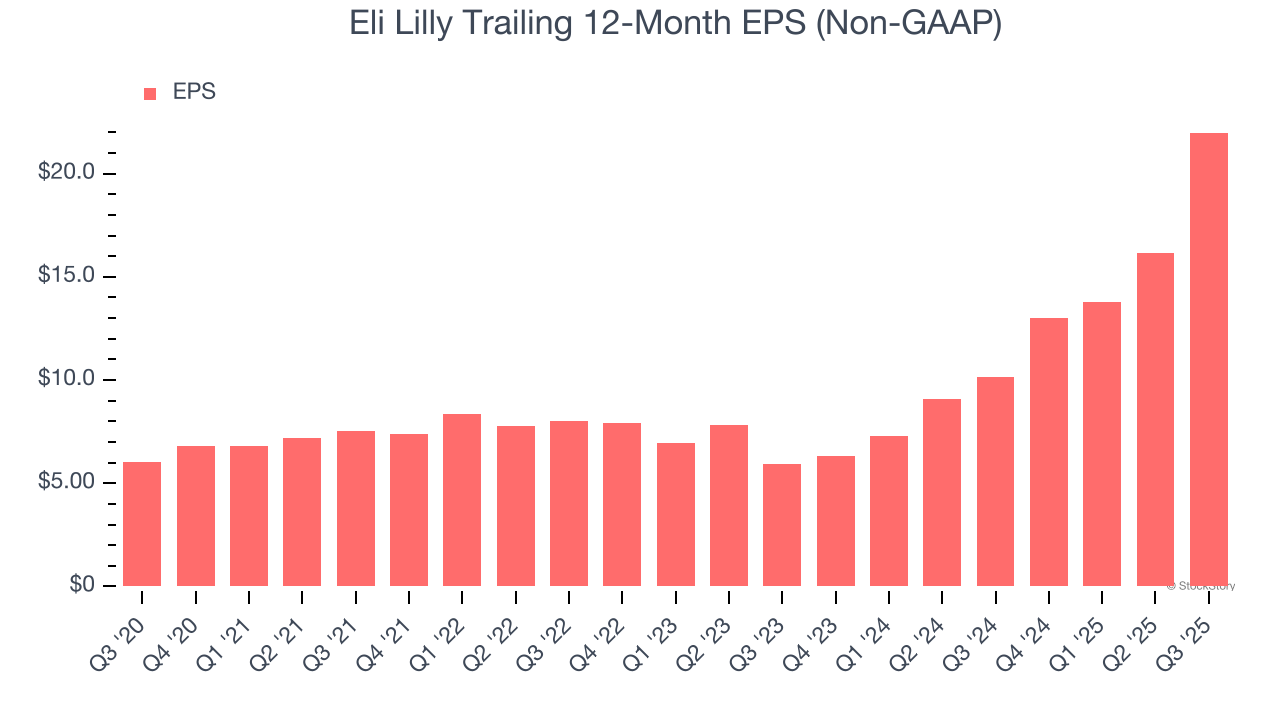

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Eli Lilly’s EPS grew at an astounding 29.5% compounded annual growth rate over the last five years, higher than its 20.7% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

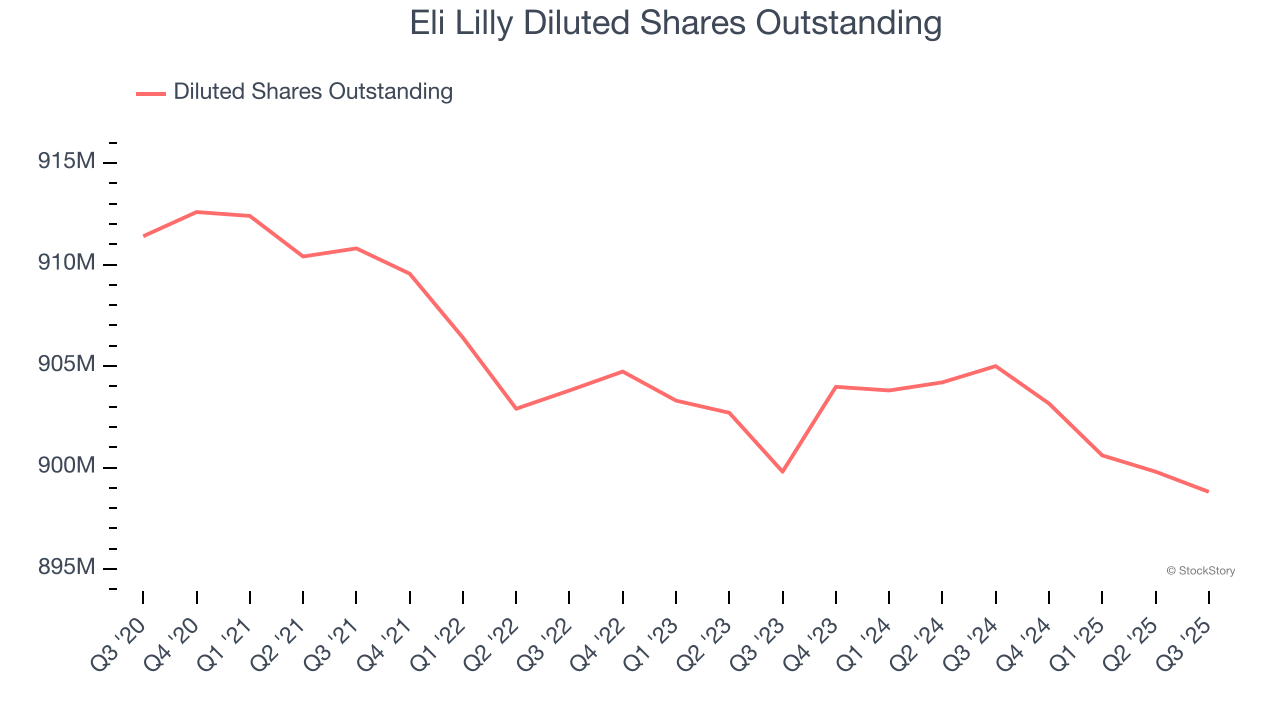

We can take a deeper look into Eli Lilly’s earnings quality to better understand the drivers of its performance. As we mentioned earlier, Eli Lilly’s operating margin expanded by 15.7 percentage points over the last five years. On top of that, its share count shrank by 1.4%. These are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

In Q3, Eli Lilly reported adjusted EPS of $7.02, up from $1.18 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Eli Lilly’s full-year EPS of $21.99 to grow 32.7%.

Key Takeaways from Eli Lilly’s Q3 Results

This was a beat and raise quarter. Specifically, we were impressed by how significantly Eli Lilly blew past analysts’ revenue and EPS expectations this quarter, showing both better-than-expected growth and operating leverage thanks for Zepbound and Mounjaro sales. We were also glad its full-year revenue guidance was lifted and exceeded Wall Street’s estimates. Zooming out, we think this quarter featured some important positives. The stock traded up 5.9% to $861.29 immediately after reporting.

Eli Lilly put up rock-solid earnings, but one quarter doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.