ESCO has had an impressive run over the past six months as its shares have beaten the S&P 500 by 14.3%. The stock now trades at $222.40, marking a 35.6% gain. This performance may have investors wondering how to approach the situation.

Is now still a good time to buy ESE? Or are investors being too optimistic? Find out in our full research report, it’s free for active Edge members.

Why Is ESCO a Good Business?

A developer of the communication systems used in the Batmobile of “The Dark Knight,” ESCO (NYSE: ESE) is a provider of engineered components for the aerospace, defense, and utility sectors.

1. Projected Revenue Growth Is Remarkable

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite, though some deceleration is natural as businesses become larger.

Over the next 12 months, sell-side analysts expect ESCO’s revenue to rise by 14%, an improvement versus its 8.5% annualized growth for the past five years. This projection is healthy and implies its newer products and services will spur better top-line performance.

2. Elite Gross Margin Powers Best-In-Class Business Model

Cost of sales for an industrials business is usually comprised of the direct labor, raw materials, and supplies needed to offer a product or service. These costs can be impacted by inflation and supply chain dynamics.

ESCO’s unit economics are great compared to the broader industrials sector and signal that it enjoys product differentiation through quality or brand. As you can see below, it averaged an excellent 39.1% gross margin over the last five years. Said differently, roughly $39.09 was left to spend on selling, marketing, R&D, and general administrative overhead for every $100 in revenue.

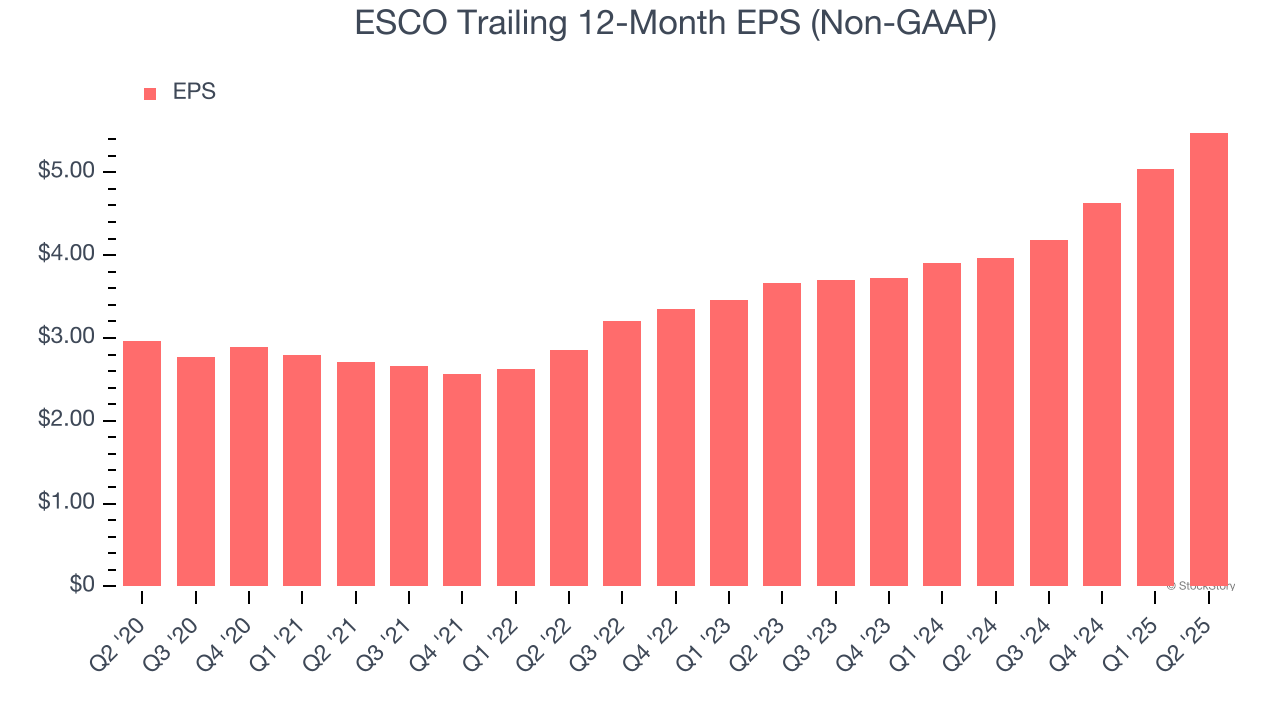

3. Outstanding Long-Term EPS Growth

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

ESCO’s EPS grew at a remarkable 13.1% compounded annual growth rate over the last five years, higher than its 8.5% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Final Judgment

These are just a few reasons why we think ESCO is a high-quality business, and with its shares topping the market in recent months, the stock trades at 31× forward P/E (or $222.40 per share). Is now the time to initiate a position? See for yourself in our full research report, it’s free for active Edge members.

High-Quality Stocks for All Market Conditions

Trump’s April 2025 tariff bombshell triggered a massive market selloff, but stocks have since staged an impressive recovery, leaving those who panic sold on the sidelines.

Take advantage of the rebound by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.