What a fantastic six months it’s been for Alphabet. Shares of the company have skyrocketed 74.6%, hitting $308.69. This was partly due to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Is now still a good time to buy GOOGL? Or are investors being too optimistic? Find out in our full research report, it’s free for active Edge members.

Why Is GOOGL a Good Business?

Started by Stanford students Larry Page and Sergey Brin in a Menlo Park garage, Alphabet (NASDAQ: GOOGL) is the parent company of the eponymous Google Search engine, Google Cloud Platform, and YouTube.

1. Skyrocketing Revenue Shows Strong Momentum

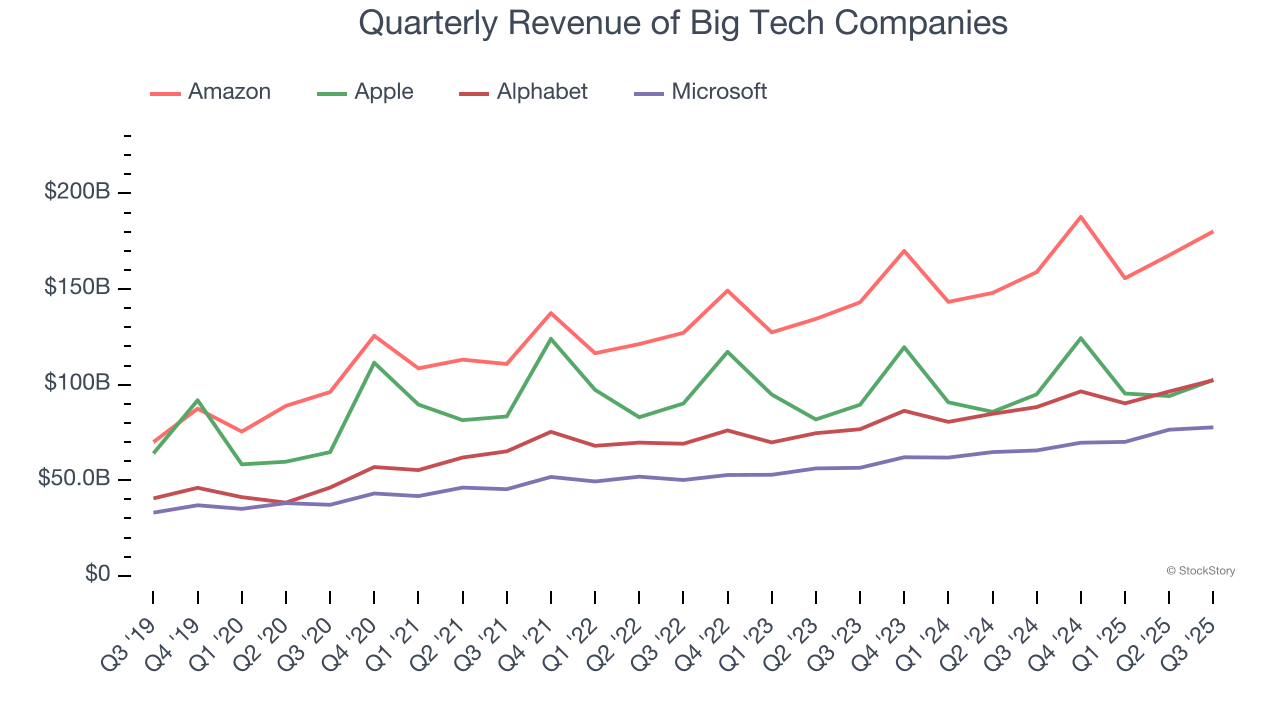

Alphabet shows that fast growth and massive scale can coexist despite conventional wisdom. The company’s revenue base of $171.7 billion five years ago has more than doubled to $385.5 billion in the last year, translating into an incredible 17.6% annualized growth rate.

Alphabet’s growth over the same period was also higher than its big tech peers, Amazon (14.7%), Microsoft (14.8%), and Apple (8.7%).

2. Operating Reveals a Well-Run Organization

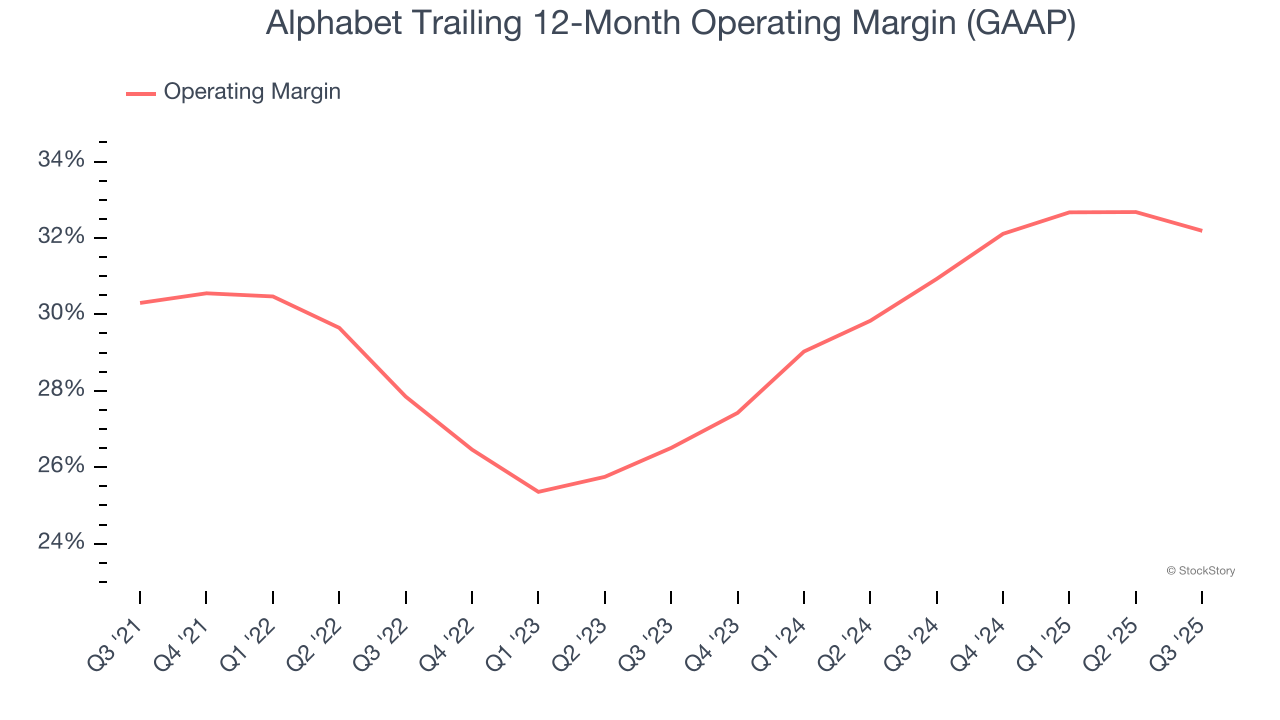

Operating margin is the key profitability measure for Alphabet. It’s the portion of revenue left after accounting for all operating expenses – everything from the IT infrastructure powering online searches to product development and administrative expenses.

Alphabet has been a well-oiled machine over the last five years. It demonstrated elite profitability for a consumer internet business, boasting an average operating of 29.7%. A closer examination is required, however, because the company’s individual business lines have very different margin profiles.

3. Outstanding Long-Term EPS Growth

We track the long-term change in earnings per share (EPS) because it shows whether a company’s growth is profitable. It also explains how taxes and interest expenses affect the bottom line.

Alphabet’s EPS grew at an astounding 31.2% compounded annual growth rate over the last five years, higher than its 17.6% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Final Judgment

These are just a few reasons why we think Alphabet is a high-quality business, and with the recent rally, the stock trades at 29.3× forward price-to-earnings (or $308.69 per share). Is now the time to buy despite the apparent froth? See for yourself in our in-depth research report, it’s free for active Edge members.

Stocks We Like Even More Than Alphabet

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.