Even though Distribution Solutions (currently trading at $28.70 per share) has gained 5.8% over the last six months, it has lagged the S&P 500’s 13.3% return during that period. This may have investors wondering how to approach the situation.

Taking into account the weaker price action, is now a good time to buy DSGR, or is it a pass? Find out in our full research report, it’s free for active Edge members.

Why Is DSGR a Good Business?

Founded in 1952, Distribution Solutions (NASDAQ: DSGR) provides supply chain solutions and distributes industrial, safety, and maintenance products to various industries.

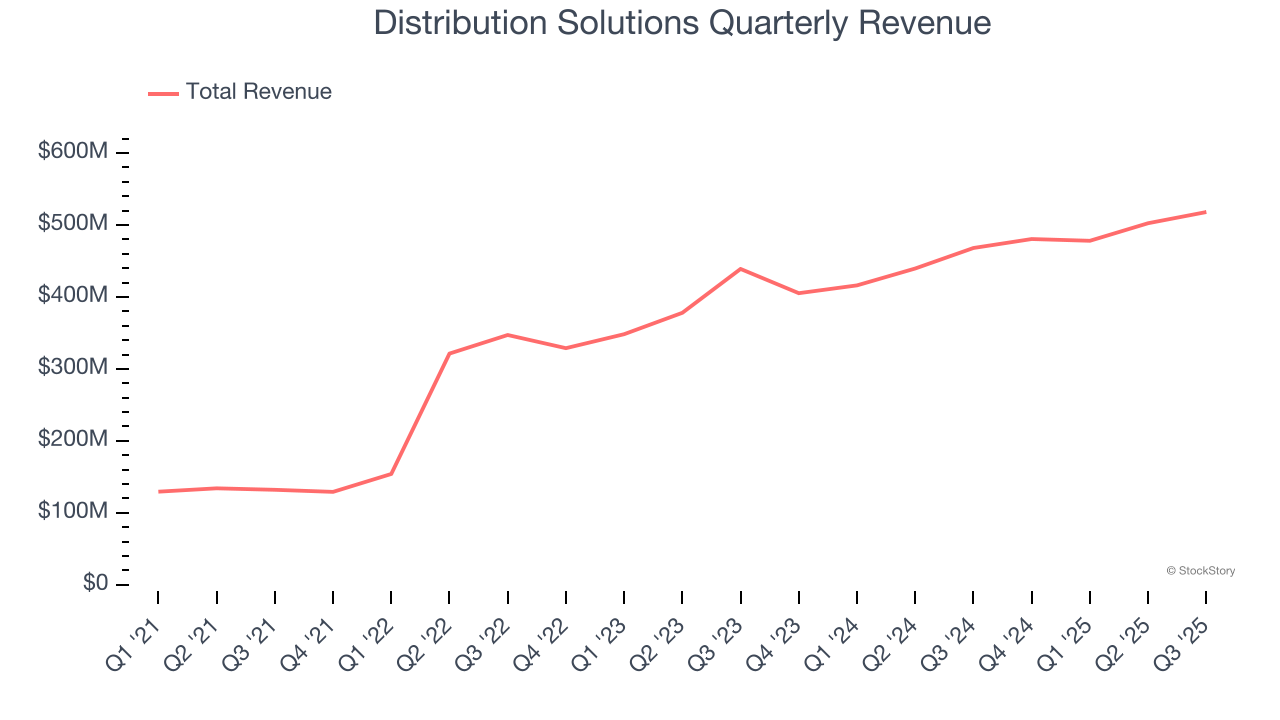

1. Skyrocketing Revenue Shows Strong Momentum

A company’s long-term sales performance is one signal of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Thankfully, Distribution Solutions’s 39.5% annualized revenue growth over the last four years was incredible. Its growth surpassed the average industrials company and shows its offerings resonate with customers.

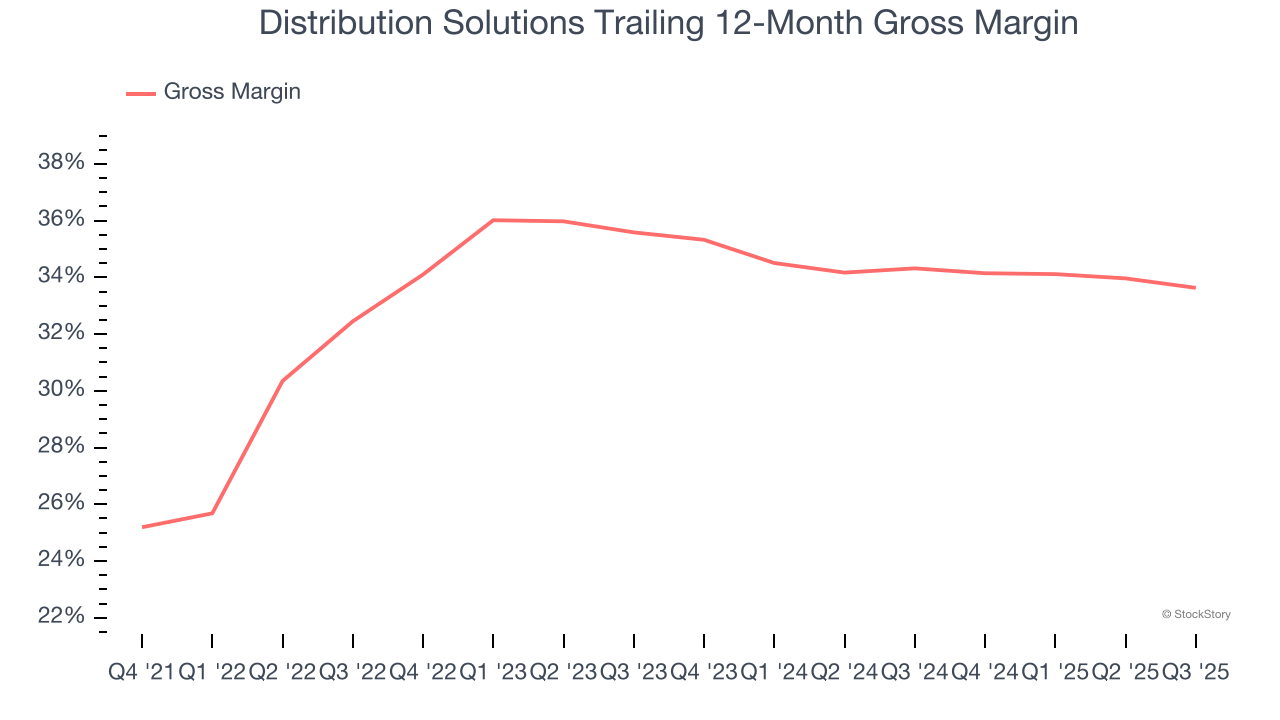

2. High Gross Margin Supports Long-Term Profitability

For industrials businesses, cost of sales is usually comprised of the direct labor, raw materials, and supplies needed to offer a product or service. These costs can be impacted by inflation and supply chain dynamics in the short term and a company’s purchasing power and scale over the long term.

Distribution Solutions’s gross margin is good compared to other industrials businesses and signals it sells differentiated products, not commodities. As you can see below, it averaged an impressive 33.6% gross margin over the last five years. Said differently, Distribution Solutions paid its suppliers $66.41 for every $100 in revenue.

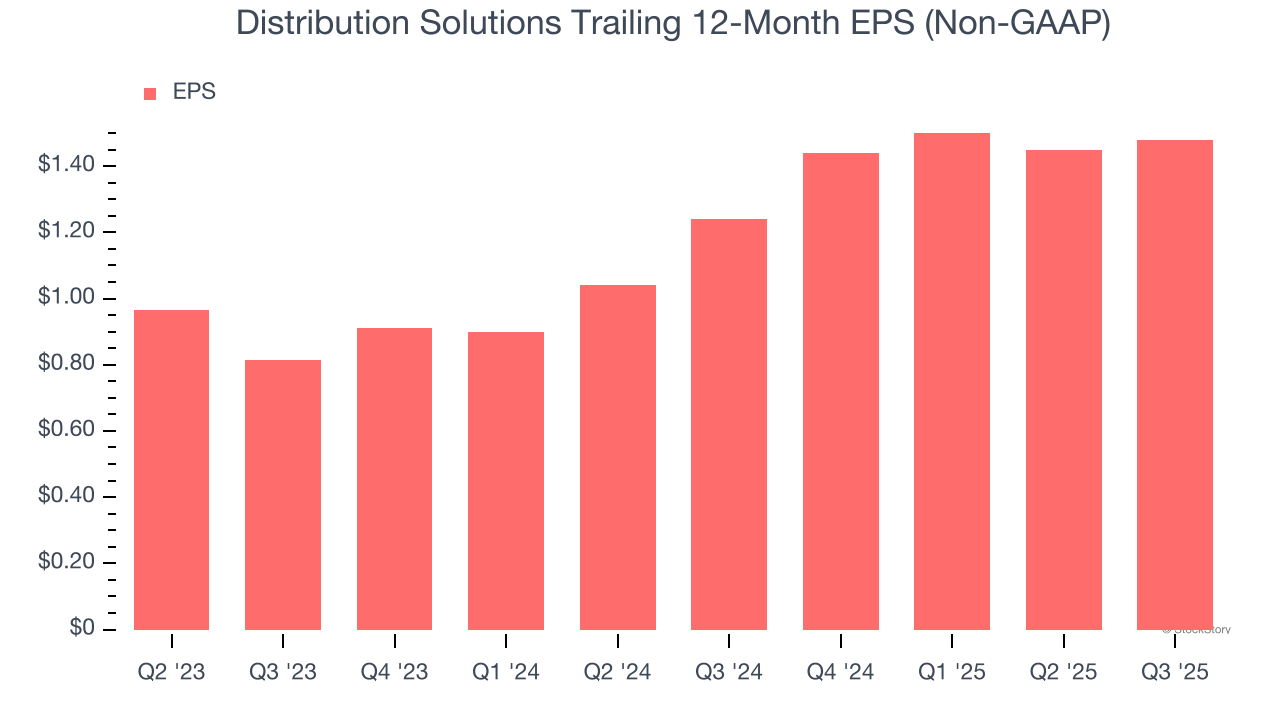

3. EPS Surges Higher Over the Last Two Years

While long-term earnings trends give us the big picture, we also track EPS over a shorter period because it can provide insight into an emerging theme or development for the business.

Distribution Solutions’s EPS grew at an astounding 34.8% compounded annual growth rate over the last two years, higher than its 15.1% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Final Judgment

These are just a few reasons Distribution Solutions is a high-quality business worth owning. With its shares trailing the market in recent months, the stock trades at 18× forward P/E (or $28.70 per share). Is now the time to initiate a position? See for yourself in our full research report, it’s free for active Edge members.

Stocks We Like Even More Than Distribution Solutions

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.