Over the past six months, Colgate-Palmolive’s shares (currently trading at $87.88) have posted a disappointing 15.1% loss, well below the S&P 500’s 8.9% gain. This was partly driven by its softer quarterly results and may have investors wondering how to approach the situation.

Given the weaker price action, is now the time to buy CL? Find out in our full research report, it’s free.

Why Does Colgate-Palmolive Spark Debate?

Formed after the 1928 combination between toothpaste maker Colgate and soap maker Palmolive-Peet, Colgate-Palmolive (NYSE: CL) is a consumer products company that focuses on personal, household, and pet products.

Two Positive Attributes:

1. Economies of Scale Give It Negotiating Leverage with Suppliers

With $20.1 billion in revenue over the past 12 months, Colgate-Palmolive is one of the most widely recognized consumer staples companies. Its influence over consumers gives it negotiating leverage with distributors, enabling it to pick and choose where it sells its products (a luxury many don’t have). However, its scale is a double-edged sword because there are only so many big store chains to sell into, making it harder to find incremental growth. To accelerate sales, Colgate-Palmolive must lean into newer products.

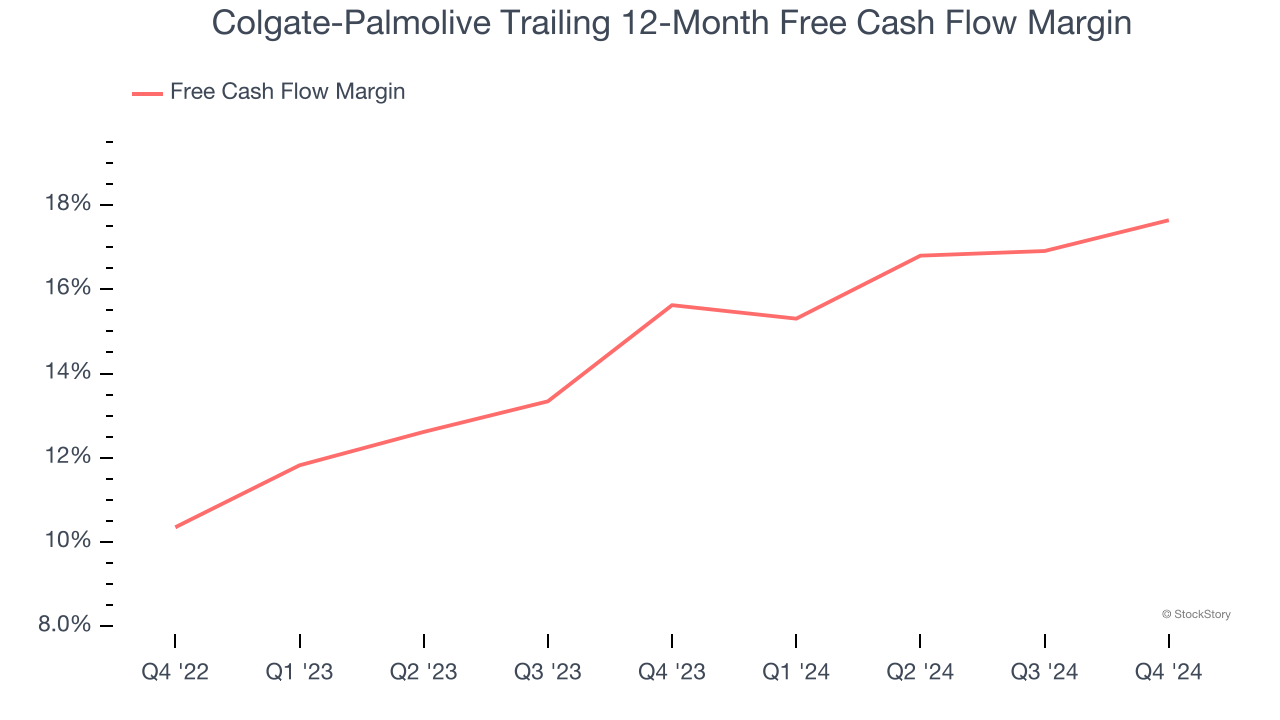

2. Excellent Free Cash Flow Margin Boosts Reinvestment Potential

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Colgate-Palmolive has shown terrific cash profitability, driven by its lucrative business model that enables it to reinvest, return capital to investors, and stay ahead of the competition. The company’s free cash flow margin was among the best in the consumer staples sector, averaging 16.6% over the last two years.

One Reason to be Careful:

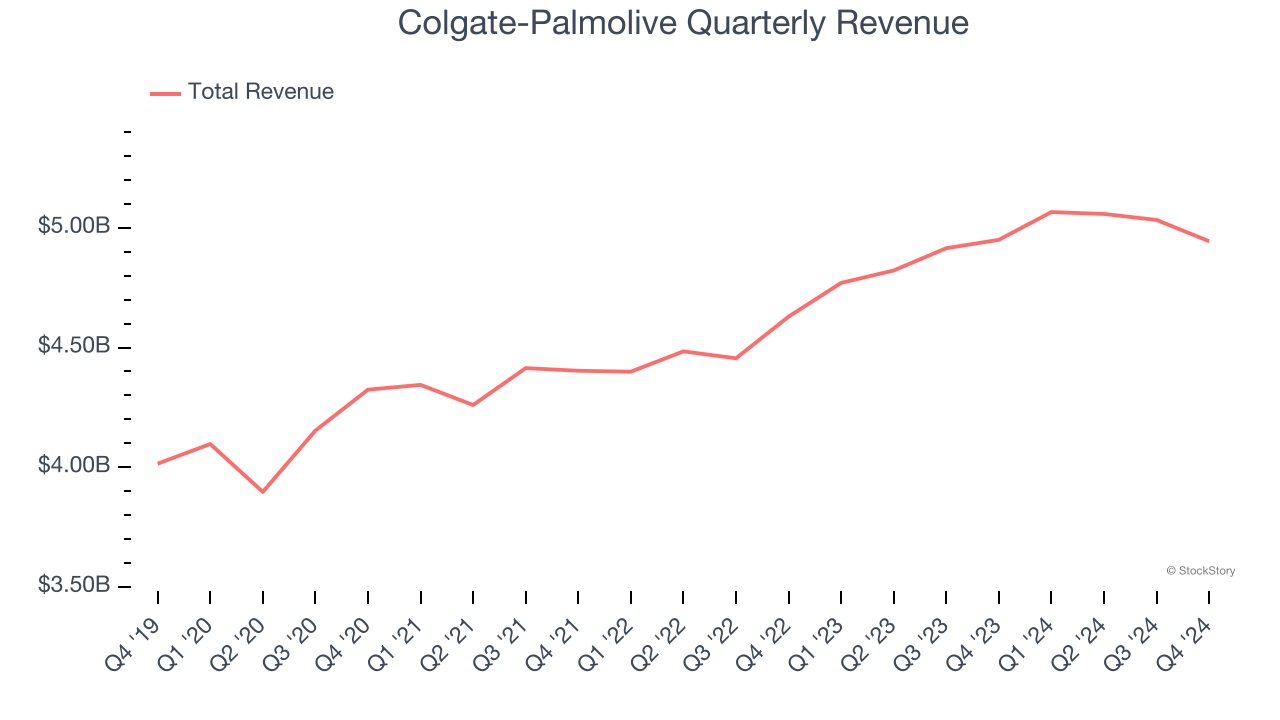

Long-Term Revenue Growth Disappoints

A company’s long-term performance is an indicator of its overall quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for years. Unfortunately, Colgate-Palmolive’s 4.9% annualized revenue growth over the last three years was tepid. This fell short of our benchmark for the consumer staples sector, but there are still things to like about Colgate-Palmolive.

Final Judgment

Colgate-Palmolive’s merits more than compensate for its flaws. With the recent decline, the stock trades at 23.5× forward price-to-earnings (or $87.88 per share). Is now the right time to buy? See for yourself in our in-depth research report, it’s free.

Stocks We Like Even More Than Colgate-Palmolive

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.