Over the last six months, The Real Brokerage’s shares have sunk to $5.55, producing a disappointing 9.6% loss - a stark contrast to the S&P 500’s 8.9% gain. This may have investors wondering how to approach the situation.

Is there a buying opportunity in The Real Brokerage, or does it present a risk to your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Despite the more favorable entry price, we don't have much confidence in The Real Brokerage. Here are three reasons why you should be careful with REAX and a stock we'd rather own.

Why Is The Real Brokerage Not Exciting?

Founded in Toronto, Canada in 2014, The Real Brokerage (NASDAQ: REAX) is a technology-driven real estate brokerage firm combining a tech-centric model with an agent-centric philosophy.

1. Operating Losses Sound the Alarms

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

The Real Brokerage’s operating margin has risen over the last 12 months, but it still averaged negative 2.5% over the last two years. This is due to its large expense base and inefficient cost structure.

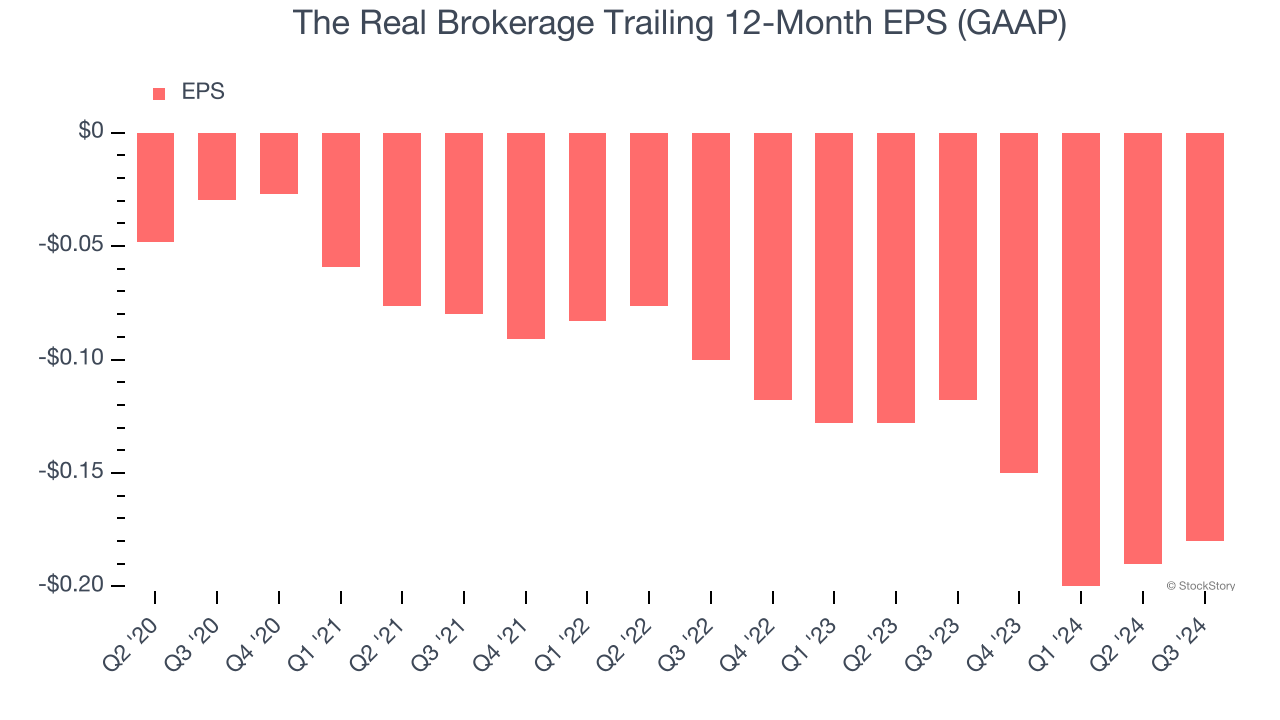

2. EPS Trending Down

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

The Real Brokerage’s earnings losses deepened over the last four years as its EPS dropped 57.1% annually. We tend to steer our readers away from companies with falling EPS, where diminishing earnings could imply changing secular trends and preferences. Consumer Discretionary companies are particularly exposed to this, and if the tide turns unexpectedly, The Real Brokerage’s low margin of safety could leave its stock price susceptible to large downswings.

3. Mediocre Free Cash Flow Margin Limits Reinvestment Potential

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

The Real Brokerage has shown poor cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 3.4%, lousy for a consumer discretionary business.

Final Judgment

The Real Brokerage isn’t a terrible business, but it doesn’t pass our bar. After the recent drawdown, the stock trades at 29× forward EV-to-EBITDA (or $5.55 per share). This valuation tells us a lot of optimism is priced in - we think there are better opportunities elsewhere. We’d suggest looking at one of our all-time favorite software stocks.

Stocks We Would Buy Instead of The Real Brokerage

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.