Luxury furniture retailer Arhaus (NASDAQ: ARHS) met Wall Street’s revenue expectations in Q4 CY2024, but sales were flat year on year at $347 million. On the other hand, next quarter’s revenue guidance of $313 million was less impressive, coming in 0.8% below analysts’ estimates. Its GAAP profit of $0.15 per share was 16.2% above analysts’ consensus estimates.

Is now the time to buy Arhaus? Find out by accessing our full research report, it’s free.

Arhaus (ARHS) Q4 CY2024 Highlights:

- Revenue: $347 million vs analyst estimates of $346.8 million (flat year on year, in line)

- EPS (GAAP): $0.15 vs analyst estimates of $0.13 (16.2% beat)

- Adjusted EBITDA: $41.18 million vs analyst estimates of $38.53 million (11.9% margin, 6.9% beat)

- Management’s revenue guidance for the upcoming financial year 2025 is $1.38 billion at the midpoint, in line with analyst expectations and implying 8.6% growth (vs -1.3% in FY2024)

- EBITDA guidance for the upcoming financial year 2025 is $145 million at the midpoint, below analyst estimates of $155.5 million

- Operating Margin: 8.2%, down from 11.9% in the same quarter last year

- Free Cash Flow was $120.4 million, up from -$13.82 million in the same quarter last year

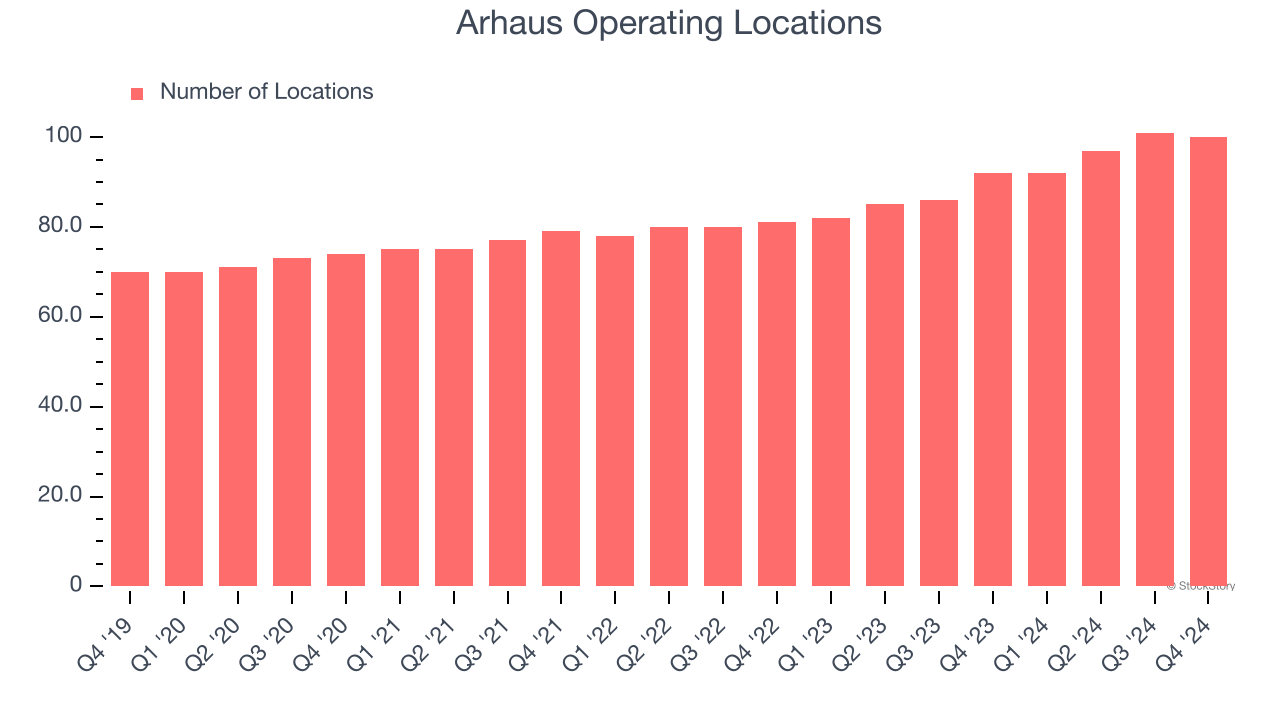

- Locations: 100 at quarter end, up from 92 in the same quarter last year

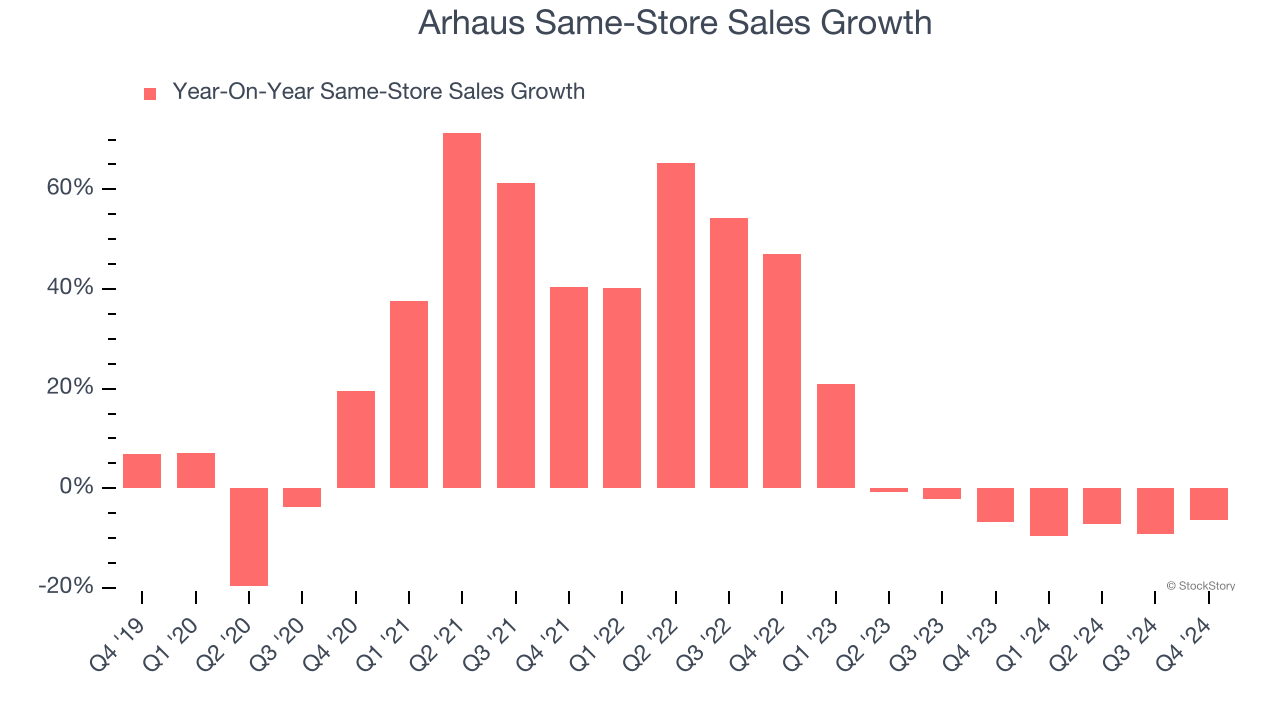

- Same-Store Sales fell 6.4% year on year, in line with the same quarter last year

- Market Capitalization: $1.67 billion

John Reed, Co-Founder and Chief Executive Officer, said, “2024 was a transformative year for Arhaus, driven by disciplined execution of our strategy, record showroom expansion, and continued brand momentum. We celebrated a historic milestone by opening our 100th showroom, expanding to a total of 103 locations across 30 states at year end—our largest one-year expansion in nearly 40 years through new openings and relocations. With $198 million in cash and a debt-free balance sheet, we are well-positioned to invest in our long-term growth strategy. Looking ahead to 2025, demand comparable growth looks solid with positive client engagement. I am incredibly proud of our team's dedication and excited about the opportunities ahead as we continue to elevate the Arhaus brand and deliver exceptional value and a premium product to our clients and shareholders.”

Company Overview

With an aesthetic that features natural materials such as reclaimed wood, Arhaus (NASDAQ: ARHS) is a high-end furniture retailer that sells everything from sofas to rugs to bookcases.

Home Furniture Retailer

Furniture retailers understand that ‘home is where the heart is’ but that no home is complete without that comfy sofa to kick back on or a dreamy bed to rest in. These stores focus on providing not only what is practically needed in a house but also aesthetics, style, and charm in the form of tables, lamps, and mirrors. Decades ago, it was thought that furniture would resist e-commerce because of the logistical challenges of shipping large furniture, but now you can buy a mattress online and get it in a box a few days later; so just like other retailers, furniture stores need to adapt to new realities and consumer behaviors.

Sales Growth

A company’s long-term performance is an indicator of its overall quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for years.

With $1.27 billion in revenue over the past 12 months, Arhaus is a small retailer, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with suppliers. On the other hand, it can grow faster because it’s working from a smaller revenue base and has more white space to build new stores.

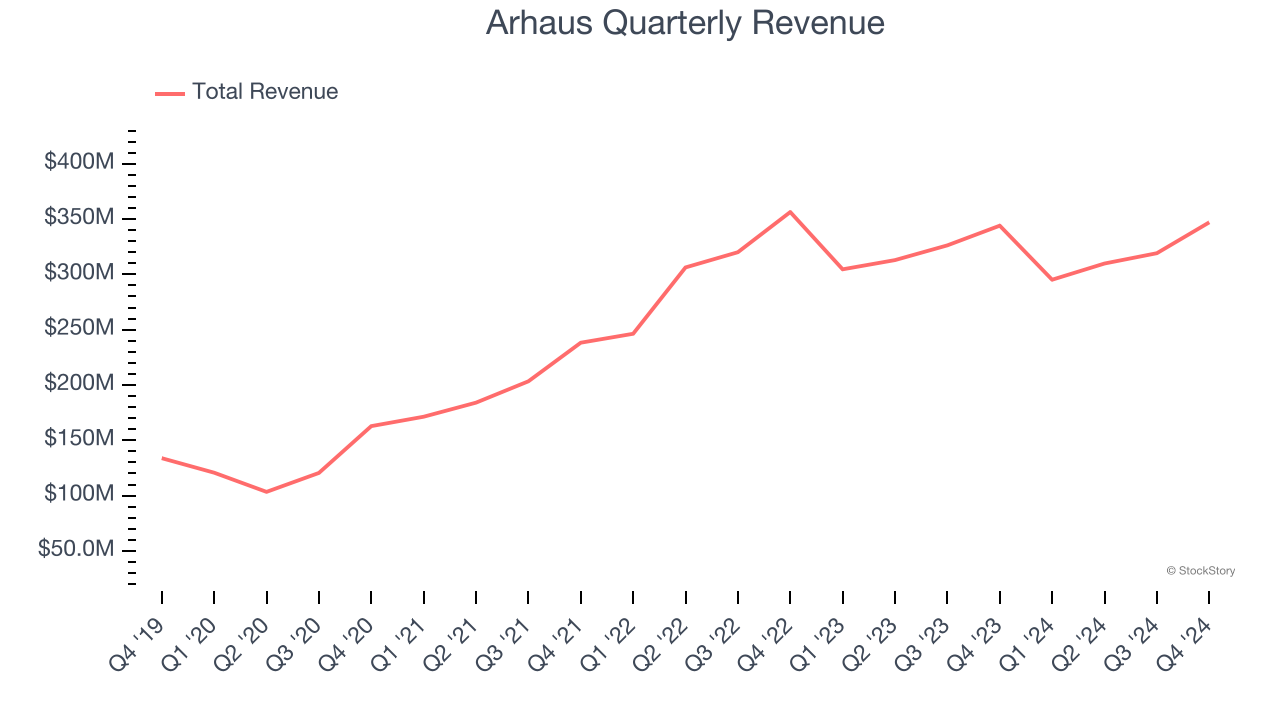

As you can see below, Arhaus’s sales grew at an exceptional 20.8% compounded annual growth rate over the last five years (we compare to 2019 to normalize for COVID-19 impacts) as it opened new stores and expanded its reach.

This quarter, Arhaus’s $347 million of revenue was flat year on year and in line with Wall Street’s estimates. Company management is currently guiding for a 6% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 8.5% over the next 12 months, a deceleration versus the last five years. Still, this projection is healthy and implies the market sees success for its products.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Store Performance

Number of Stores

Arhaus sported 100 locations in the latest quarter. Over the last two years, it has opened new stores at a rapid clip by averaging 10.6% annual growth, among the fastest in the consumer retail sector. This gives it a chance to scale into a mid-sized business over time.

When a retailer opens new stores, it usually means it’s investing for growth because demand is greater than supply, especially in areas where consumers may not have a store within reasonable driving distance.

Same-Store Sales

A company's store base only paints one part of the picture. When demand is high, it makes sense to open more. But when demand is low, it’s prudent to close some locations and use the money in other ways. Same-store sales gives us insight into this topic because it measures organic growth for a retailer's e-commerce platform and brick-and-mortar shops that have existed for at least a year.

Arhaus’s demand has been shrinking over the last two years as its same-store sales have averaged 2.6% annual declines. This performance is concerning - it shows Arhaus artificially boosts its revenue by building new stores. We’d like to see a company’s same-store sales rise before it takes on the costly, capital-intensive endeavor of expanding its store base.

In the latest quarter, Arhaus’s same-store sales fell by 6.4% year on year. This decrease represents a further deceleration from its historical levels. We hope the business can get back on track.

Key Takeaways from Arhaus’s Q4 Results

We enjoyed seeing Arhaus beat analysts’ EBITDA expectations this quarter. We were also glad its gross margin outperformed Wall Street’s estimates. On the other hand, its full-year EBITDA guidance missed significantly and its EBITDA guidance for next quarter fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 2.3% to $11.65 immediately after reporting.

So do we think Arhaus is an attractive buy at the current price? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.