Since March 2020, the S&P 500 has delivered a total return of 132%. But one standout stock has more than doubled the market - over the past five years, Barrett has surged 311% to $40.13 per share. Its momentum hasn’t stopped as it’s also gained 9.1% in the last six months thanks to its solid quarterly results, beating the S&P by 10.4%.

Following the strength, is BBSI a buy right now? Or is the market overestimating its value? Find out in our full research report, it’s free.

Why Does BBSI Stock Spark Debate?

Operating with a decentralized model of local business teams within 50 miles of their clients, Barrett Business Services (NASDAQ: BBSI) provides management solutions that help small and mid-sized companies handle human resources, payroll, workers' compensation, and other administrative functions.

Two Positive Attributes:

1. Stellar ROIC Showcases Lucrative Growth Opportunities

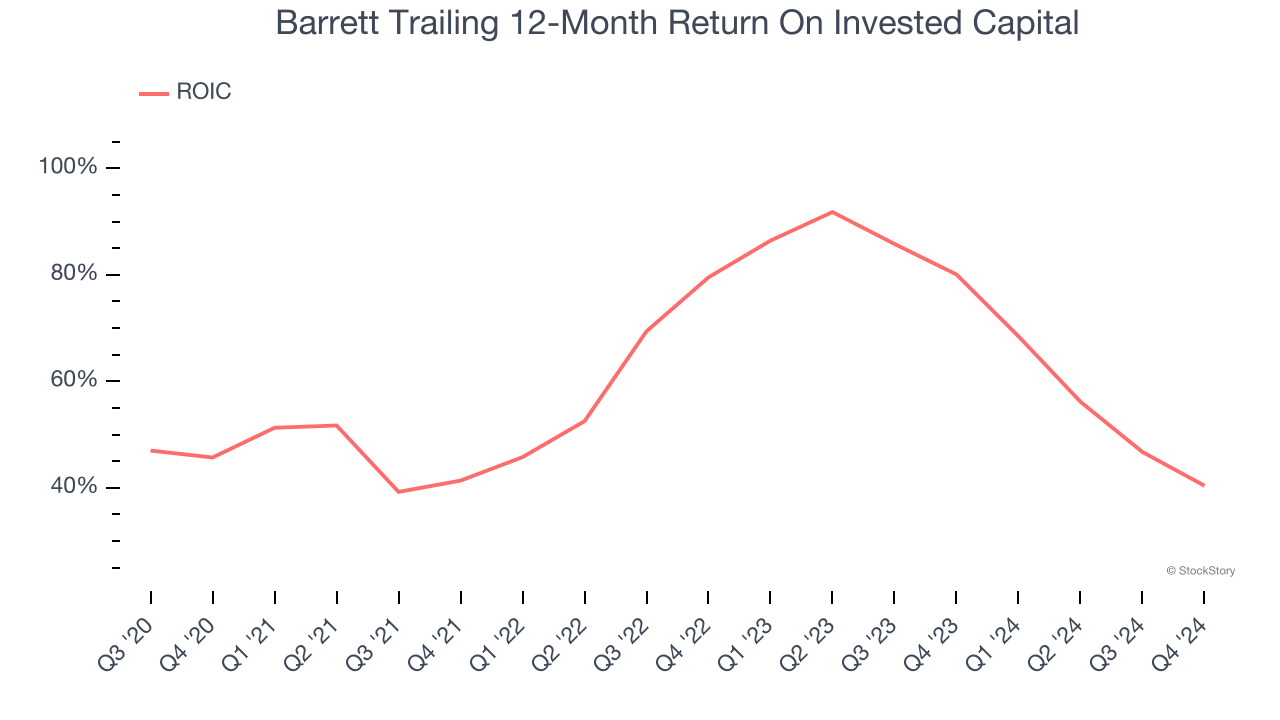

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Barrett’s five-year average ROIC was 57.4%, placing it among the best business services companies. This illustrates its management team’s ability to invest in highly profitable ventures and produce tangible results for shareholders.

2. New Investments Bear Fruit as ROIC Jumps

A company’s ROIC, or return on invested capital, shows how much operating profit it makes compared to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Barrett’s ROIC has increased significantly over the last few years. This is a great sign when paired with its already strong returns. It could suggest its competitive advantage or profitable growth opportunities are expanding.

One Reason to be Careful:

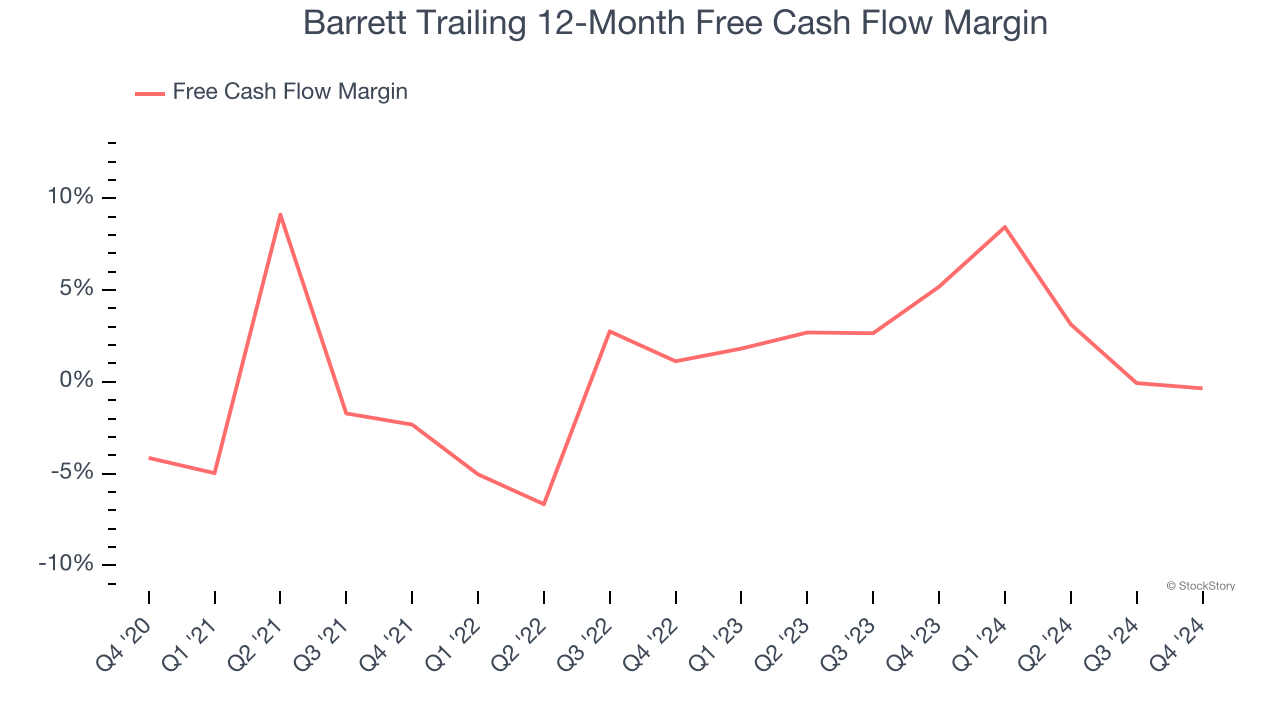

Breakeven Free Cash Flow Limits Reinvestment Potential

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Barrett broke even from a free cash flow perspective over the last five years, giving the company limited opportunities to return capital to shareholders.

Final Judgment

Barrett has huge potential even though it has some open questions, and with its shares outperforming the market lately, the stock trades at 17.6× forward price-to-earnings (or $40.13 per share). Is now the right time to buy? See for yourself in our full research report, it’s free.

Stocks We Like Even More Than Barrett

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.