Shareholders of Ingram Micro would probably like to forget the past six months even happened. The stock dropped 33.8% and now trades at $16.29. This was partly due to its softer quarterly results and might have investors contemplating their next move.

Is there a buying opportunity in Ingram Micro, or does it present a risk to your portfolio? Get the full breakdown from our expert analysts, it’s free.

Despite the more favorable entry price, we don't have much confidence in Ingram Micro. Here are three reasons why there are better opportunities than INGM and a stock we'd rather own.

Why Do We Think Ingram Micro Will Underperform?

Operating as the crucial link in the global technology supply chain with a presence in 57 countries, Ingram Micro (NYSE: INGM) is a global technology distributor that connects manufacturers with resellers, providing hardware, software, cloud services, and logistics expertise.

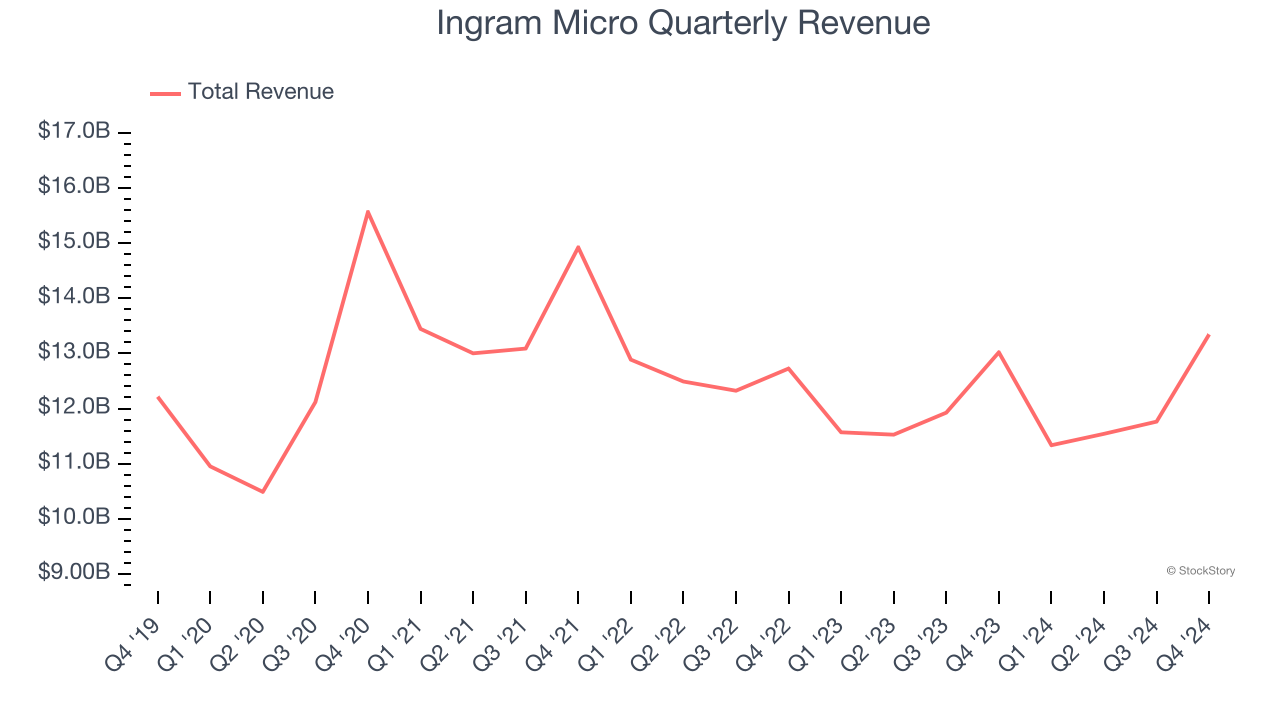

1. Long-Term Revenue Growth Flatter Than a Pancake

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Unfortunately, Ingram Micro struggled to consistently increase demand as its $47.98 billion of sales for the trailing 12 months was close to its revenue five years ago. This wasn’t a great result and is a sign of poor business quality.

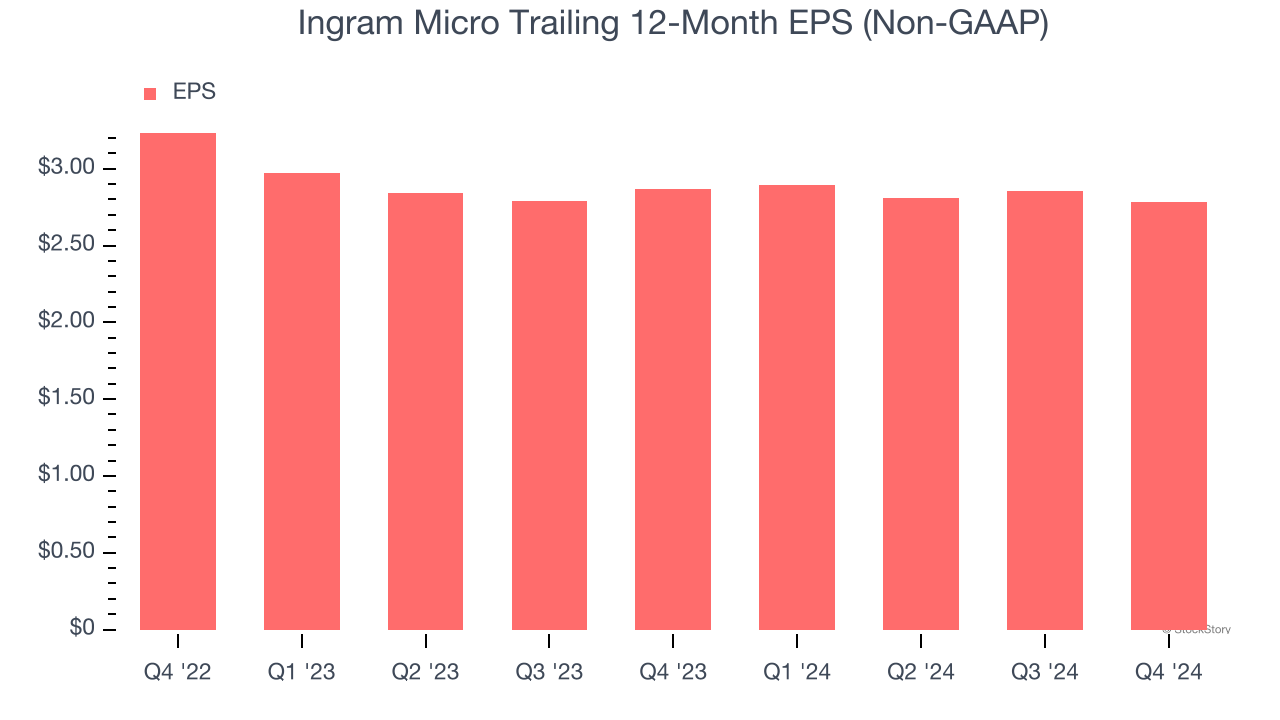

2. EPS Trending Down

We track the change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Ingram Micro’s full-year EPS dropped 14.9%, or 7.2% annually, over the last two years. We tend to steer our readers away from companies with falling revenue and EPS, where diminishing earnings could imply changing secular trends and preferences. If the tide turns unexpectedly, Ingram Micro’s low margin of safety could leave its stock price susceptible to large downswings.

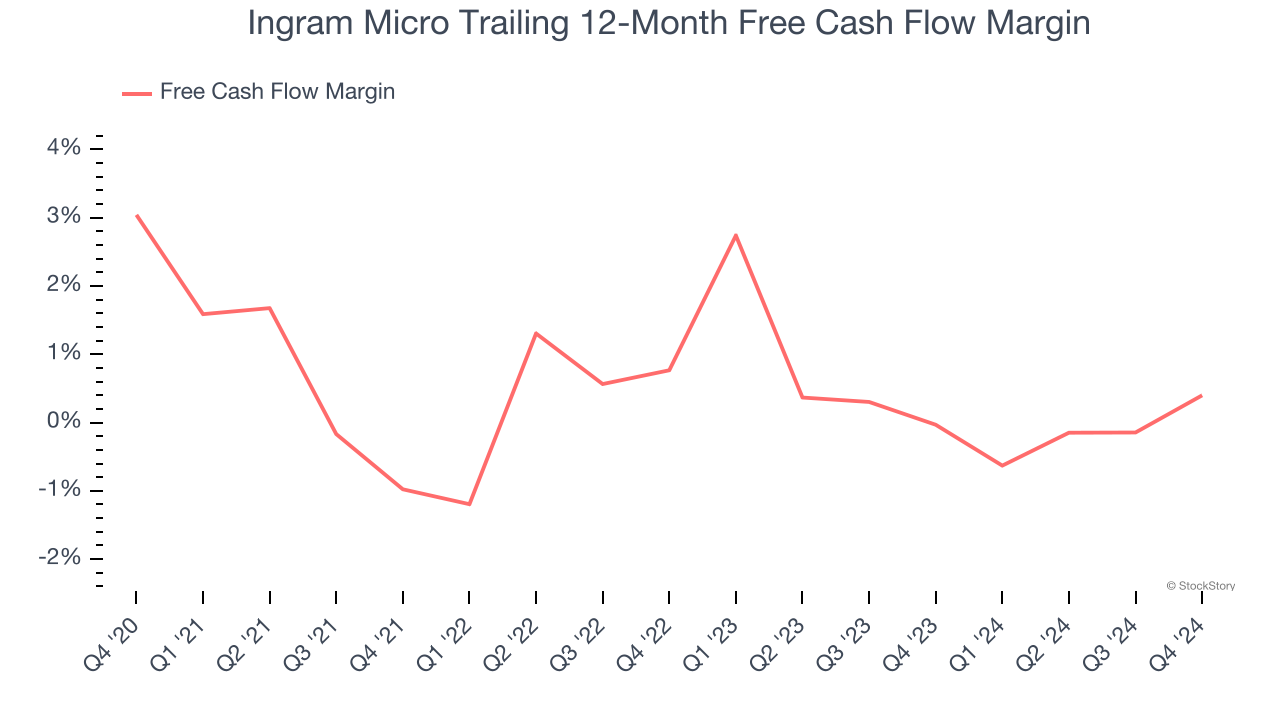

3. Breakeven Free Cash Flow Limits Reinvestment Potential

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Ingram Micro broke even from a free cash flow perspective over the last five years, giving the company limited opportunities to return capital to shareholders.

Final Judgment

Ingram Micro doesn’t pass our quality test. After the recent drawdown, the stock trades at 5.1× forward price-to-earnings (or $16.29 per share). While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are superior stocks to buy right now. We’d suggest looking at a fast-growing restaurant franchise with an A+ ranch dressing sauce.

Stocks We Like More Than Ingram Micro

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.