Over the past six months, Yum! Brands has been a great trade. While the S&P 500 was flat, the stock price has climbed by 10.9% to $146.51 per share. This performance may have investors wondering how to approach the situation.

Following the strength, is YUM a buy right now? Or is the market overestimating its value? Find out in our full research report, it’s free.

Why Does YUM Stock Spark Debate?

Spun off as an independent company from PepsiCo, Yum! Brands (NYSE: YUM) is a multinational corporation that owns KFC, Pizza Hut, Taco Bell, and The Habit Burger Grill.

Two Things to Like:

1. Restaurant Growth Signals an Offensive Strategy

The number of dining locations a restaurant chain operates is a critical driver of how quickly company-level sales can grow.

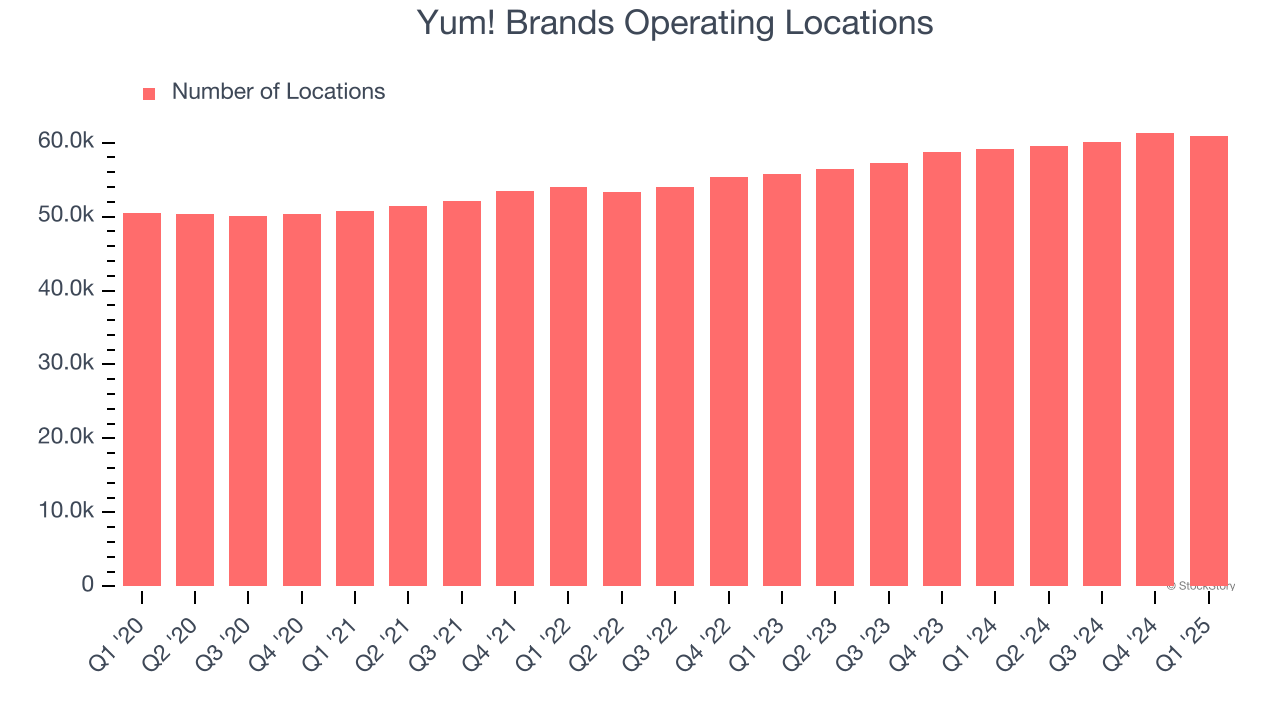

Yum! Brands sported 60,886 locations in the latest quarter. Over the last two years, it has opened new restaurants at a rapid clip by averaging 5.2% annual growth, among the fastest in the restaurant sector. Additionally, one dynamic making expansion more seamless is the company’s franchise model, where franchisees are primarily responsible for opening new restaurants while Yum! Brands provides support.

When a chain opens new restaurants, it usually means it’s investing for growth because there’s healthy demand for its meals and there are markets where its concepts have few or no locations.

2. Excellent Free Cash Flow Margin Boosts Reinvestment Potential

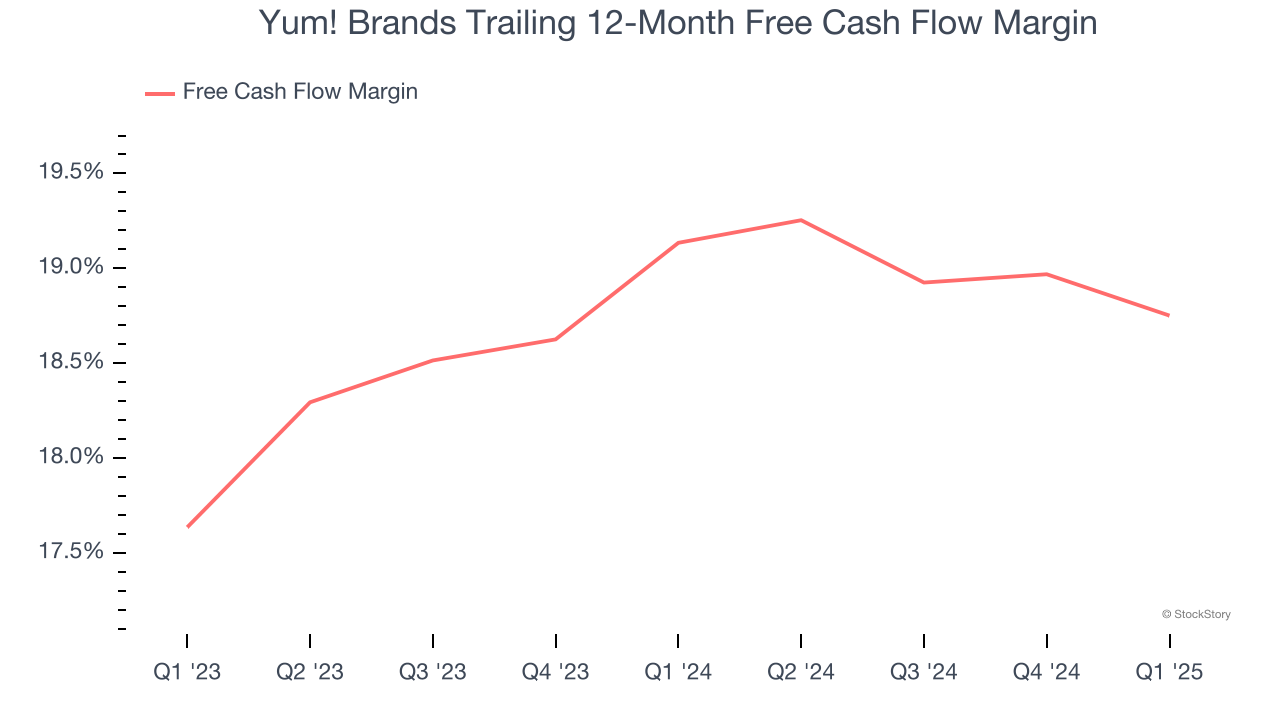

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Yum! Brands has shown terrific cash profitability, driven by its lucrative business model that enables it to reinvest, return capital to investors, and stay ahead of the competition. The company’s free cash flow margin was among the best in the restaurant sector, averaging 18.9% over the last two years.

One Reason to be Careful:

Same-Store Sales Falling Behind Peers

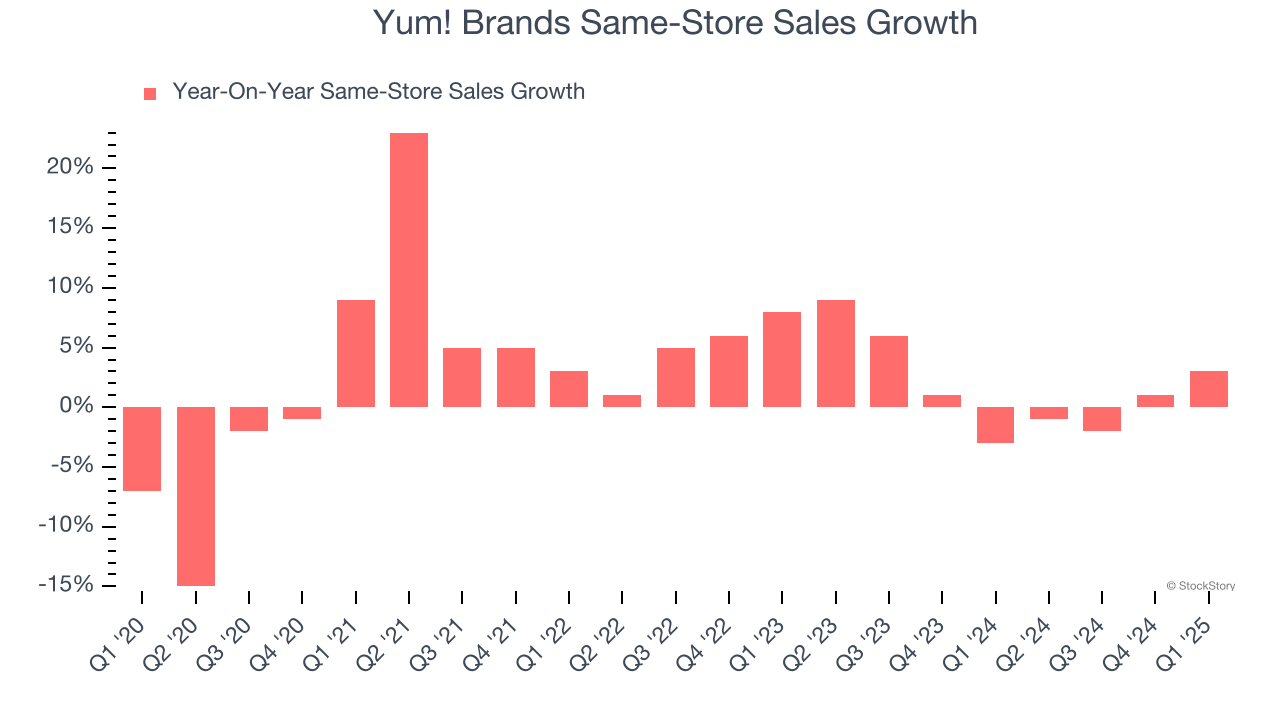

Same-store sales is a key performance indicator used to measure organic growth at restaurants open for at least a year.

Yum! Brands’s demand within its existing dining locations has been relatively stable over the last two years but was below most restaurant chains. On average, the company’s same-store sales have grown by 1.8% per year.

Final Judgment

Yum! Brands has huge potential even though it has some open questions, and with its shares topping the market in recent months, the stock trades at 24× forward P/E (or $146.51 per share). Is now a good time to buy? See for yourself in our in-depth research report, it’s free.

Stocks We Like Even More Than Yum! Brands

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.

While this has caused many investors to adopt a "fearful" wait-and-see approach, we’re leaning into our best ideas that can grow regardless of the political or macroeconomic climate. Take advantage of Mr. Market by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 176% over the last five years.

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.