Healthcare software provider Health Catalyst (NASDAQ: HCAT) met Wall Street’s revenue expectations in Q2 CY2025, with sales up 6.3% year on year to $80.72 million. On the other hand, next quarter’s revenue guidance of $75 million was less impressive, coming in 12% below analysts’ estimates. Its non-GAAP profit of $0.04 per share was in line with analysts’ consensus estimates.

Is now the time to buy Health Catalyst? Find out by accessing our full research report, it’s free.

Health Catalyst (HCAT) Q2 CY2025 Highlights:

- Revenue: $80.72 million vs analyst estimates of $80.57 million (6.3% year-on-year growth, in line)

- Adjusted EPS: $0.04 vs analyst estimates of $0.04 (in line)

- Adjusted EBITDA: $9.34 million vs analyst estimates of $8.18 million (11.6% margin, 14.2% beat)

- The company dropped its revenue guidance for the full year to $310 million at the midpoint from $335 million, a 7.5% decrease

- EBITDA guidance for the full year is $41 million at the midpoint, above analyst estimates of $40.53 million

- Operating Margin: -46%, down from -20.8% in the same quarter last year

- Free Cash Flow was -$14.19 million compared to -$5.05 million in the previous quarter

- Market Capitalization: $265.9 million

“For the second quarter of 2025, I am pleased by our strong financial results, including total revenue of $80.7 million and Adjusted EBITDA of $9.3 million, with these results beating our quarterly guidance on each metric.” said Dan Burton, CEO of Health Catalyst.

Company Overview

Founded by healthcare professionals Tom Burton and Steve Barlow in 2008, Health Catalyst (NASDAQ: HCAT) provides data and analytics technology to healthcare organizations, enabling them to improve care and lower costs.

Revenue Growth

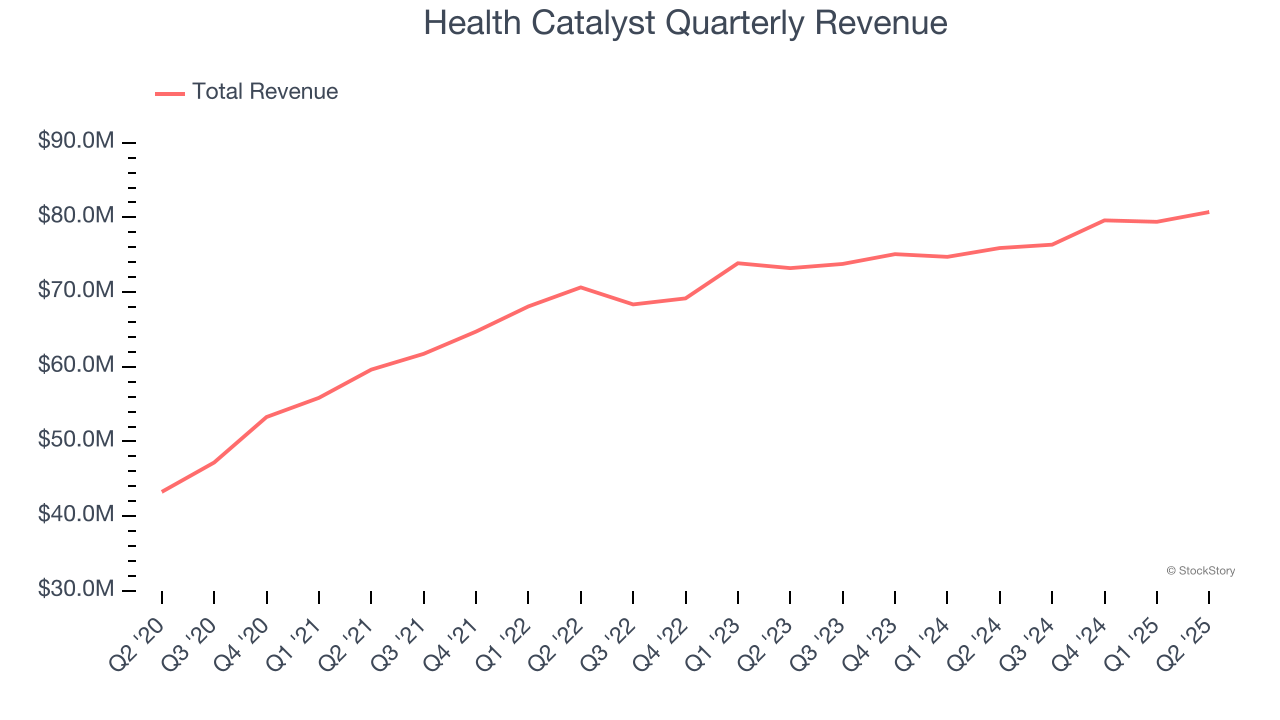

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last three years, Health Catalyst grew its sales at a weak 6% compounded annual growth rate. This was below our standard for the software sector and is a rough starting point for our analysis.

This quarter, Health Catalyst grew its revenue by 6.3% year on year, and its $80.72 million of revenue was in line with Wall Street’s estimates. Company management is currently guiding for a 1.8% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 10.6% over the next 12 months, an acceleration versus the last three years. This projection is above average for the sector and indicates its newer products and services will spur better top-line performance.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

Health Catalyst’s recent customer acquisition efforts haven’t yielded returns as its CAC payback period was negative this quarter, meaning its incremental sales and marketing investments outpaced its revenue. The company’s inefficiency indicates it operates in a highly competitive environment where there is little differentiation between Health Catalyst’s products and its peers.

Key Takeaways from Health Catalyst’s Q2 Results

We were impressed by how significantly Health Catalyst blew past analysts’ EBITDA expectations this quarter. We were also glad its full-year EBITDA guidance slightly exceeded Wall Street’s estimates. On the other hand, its full-year revenue guidance missed and its revenue guidance for next quarter fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 10% to $3.33 immediately after reporting.

Health Catalyst didn’t show it’s best hand this quarter, but does that create an opportunity to buy the stock right now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.