Looking back on media stocks’ Q2 earnings, we examine this quarter’s best and worst performers, including News Corp (NASDAQ: NWSA) and its peers.

The advent of the internet changed how shows, films, music, and overall information flow. As a result, many media companies now face secular headwinds as attention shifts online. Some have made concerted efforts to adapt by introducing digital subscriptions, podcasts, and streaming platforms. Time will tell if their strategies succeed and which companies will emerge as the long-term winners.

The 7 media stocks we track reported a strong Q2. As a group, revenues beat analysts’ consensus estimates by 2.1%.

In light of this news, share prices of the companies have held steady as they are up 3.8% on average since the latest earnings results.

News Corp (NASDAQ: NWSA)

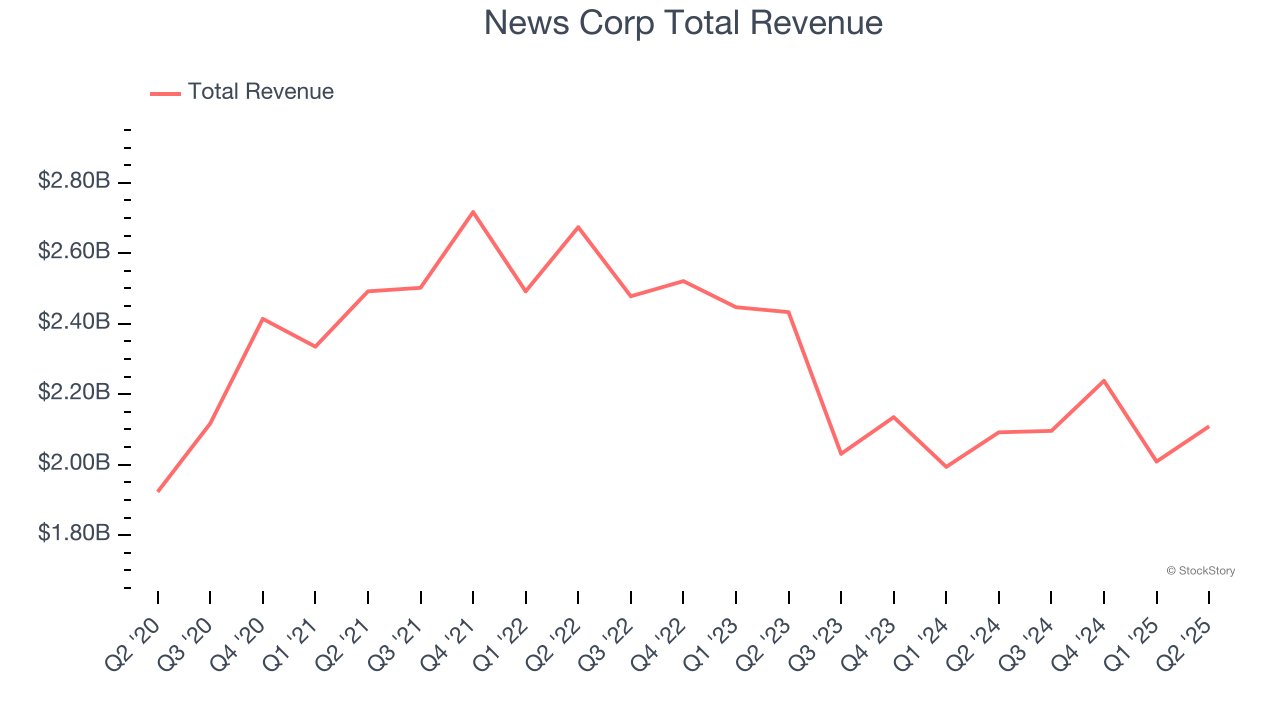

Established in 2013 after a restructuring, News Corp (NASDAQ: NWSA) is a multinational conglomerate known for its news publishing, broadcasting, digital media, and book publishing.

News Corp reported revenues of $2.11 billion, flat year on year. This print exceeded analysts’ expectations by 1%. Overall, it was a satisfactory quarter for the company with a beat of analysts’ EPS estimates but a miss of analysts’ News Media revenue estimates.

The market was likely pricing in the results, and the stock is flat since reporting. It currently trades at $29.41.

Is now the time to buy News Corp? Access our full analysis of the earnings results here, it’s free.

Best Q2: fuboTV (NYSE: FUBO)

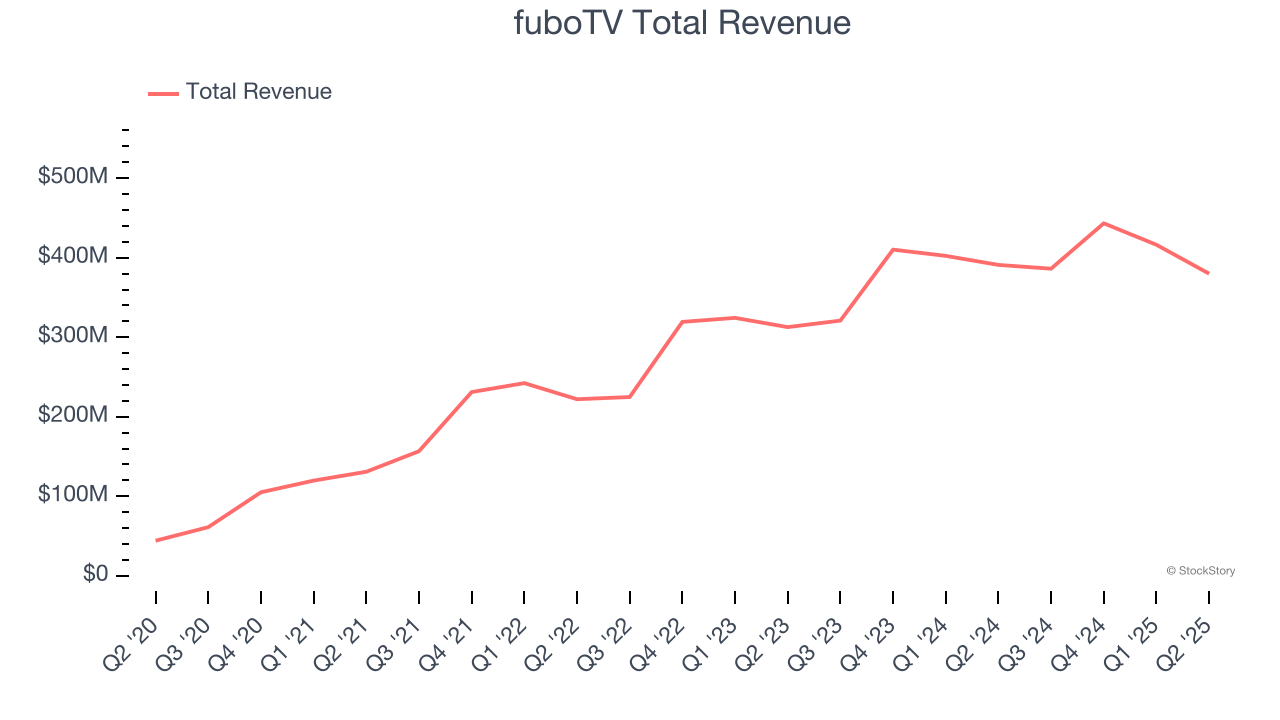

Originally launched as a soccer streaming platform, fuboTV (NYSE: FUBO) is a video streaming service specializing in live sports, news, and entertainment content.

fuboTV reported revenues of $380 million, down 2.8% year on year, outperforming analysts’ expectations by 3%. The business had a very strong quarter with a beat of analysts’ EPS estimates and an impressive beat of analysts’ adjusted operating income estimates.

Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 2.9% since reporting. It currently trades at $3.58.

Is now the time to buy fuboTV? Access our full analysis of the earnings results here, it’s free.

Scholastic (NASDAQ: SCHL)

Creator of the legendary Scholastic Book Fair, Scholastic (NASDAQ: SCHL) is an international company specializing in children's publishing, education, and media services.

Scholastic reported revenues of $508.3 million, up 7% year on year, exceeding analysts’ expectations by 2.8%. Still, it was a slower quarter as it posted full-year EBITDA guidance missing analysts’ expectations significantly.

Interestingly, the stock is up 16.7% since the results and currently trades at $25.15.

Read our full analysis of Scholastic’s results here.

Disney (NYSE: DIS)

Founded by brothers Walt and Roy, Disney (NYSE: DIS) is a multinational entertainment conglomerate, renowned for its theme parks, movies, television networks, and merchandise.

Disney reported revenues of $23.65 billion, up 2.1% year on year. This number was in line with analysts’ expectations. Taking a step back, it was a satisfactory quarter as it also recorded a solid beat of analysts’ adjusted operating income estimates but a miss of analysts’ Experiences revenue estimates.

Disney had the weakest performance against analyst estimates among its peers. The stock is flat since reporting and currently trades at $118.35.

Read our full, actionable report on Disney here, it’s free.

Warner Bros. Discovery (NASDAQ: WBD)

Formed from the merger of WarnerMedia and Discovery, Warner Bros. Discovery (NASDAQ: WBD) is a multinational media and entertainment company, offering television networks, streaming services, and film and television production.

Warner Bros. Discovery reported revenues of $9.81 billion, up 1% year on year. This result met analysts’ expectations. Overall, it was a strong quarter as it also put up a beat of analysts’ EPS estimates and a decent beat of analysts’ EBITDA estimates.

The stock is down 8.8% since reporting and currently trades at $11.68.

Read our full, actionable report on Warner Bros. Discovery here, it’s free.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.