Earnings results often indicate what direction a company will take in the months ahead. With Q2 behind us, let’s have a look at Driven Brands (NASDAQ: DRVN) and its peers.

Growing regulatory pressure on environmental compliance and increasing corporate ESG commitments should buoy the sector for years to come. On the other hand, environmental regulations continue to evolve, and this may require costly upgrades, volatility in commodity waste and recycling markets, and labor shortages in industrial services. As for digitization, a theme that is impacting nearly every industry, the increasing use of data, analytics, and automation will give rise to improved efficiency of operations. Conversely, though, the benefits of digitization also come with challenges of integrating new technologies into legacy systems.

The 7 industrial & environmental services stocks we track reported a mixed Q2. As a group, revenues beat analysts’ consensus estimates by 0.8% while next quarter’s revenue guidance was 1.3% below.

In light of this news, share prices of the companies have held steady. On average, they are relatively unchanged since the latest earnings results.

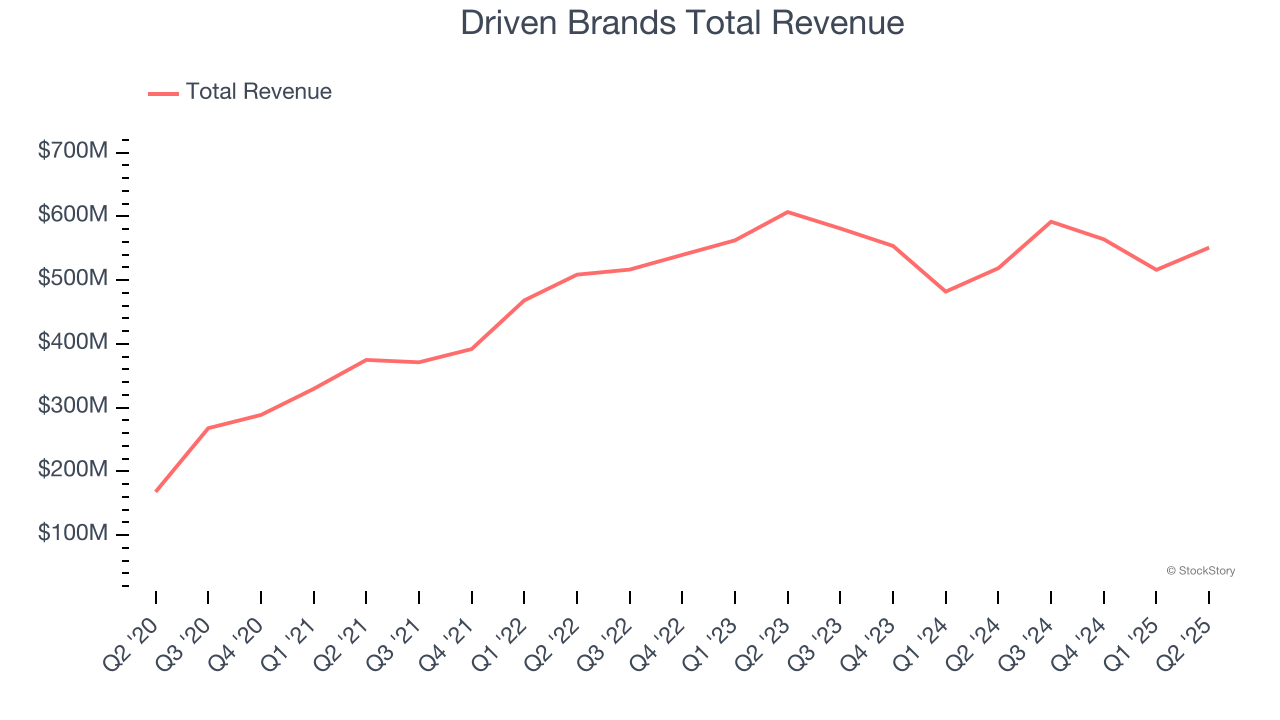

Driven Brands (NASDAQ: DRVN)

With approximately 5,000 locations across 49 U.S. states and 13 other countries, Driven Brands (NASDAQ: DRVN) operates a network of automotive service centers offering maintenance, car washes, paint, collision repair, and glass services across North America.

Driven Brands reported revenues of $551 million, up 6.2% year on year. This print exceeded analysts’ expectations by 1.9%. Despite the top-line beat, it was still a mixed quarter for the company with a beat of analysts’ EPS estimates but a miss of analysts’ full-year EPS guidance estimates.

“In the second quarter, we delivered another strong performance, with consistent results across same store sales, revenue, adjusted EBITDA, and adjusted earnings per share. We continued our disciplined debt reduction strategy and achieved pro forma net leverage of 3.9x following the sale of the U.S. car wash seller note in July. These results demonstrate the power of our diversified platform and our growth and cash playbook. Take 5 Oil Change remains at the forefront through industry-leading growth, achieving its 20th consecutive quarter of same store sales growth. I'm proud of how our team and franchise partners continue to execute with focus and discipline in this dynamic macro environment,” said Danny Rivera, President and Chief Executive Officer.

Interestingly, the stock is up 8.4% since reporting and currently trades at $18.42.

Read our full report on Driven Brands here, it’s free.

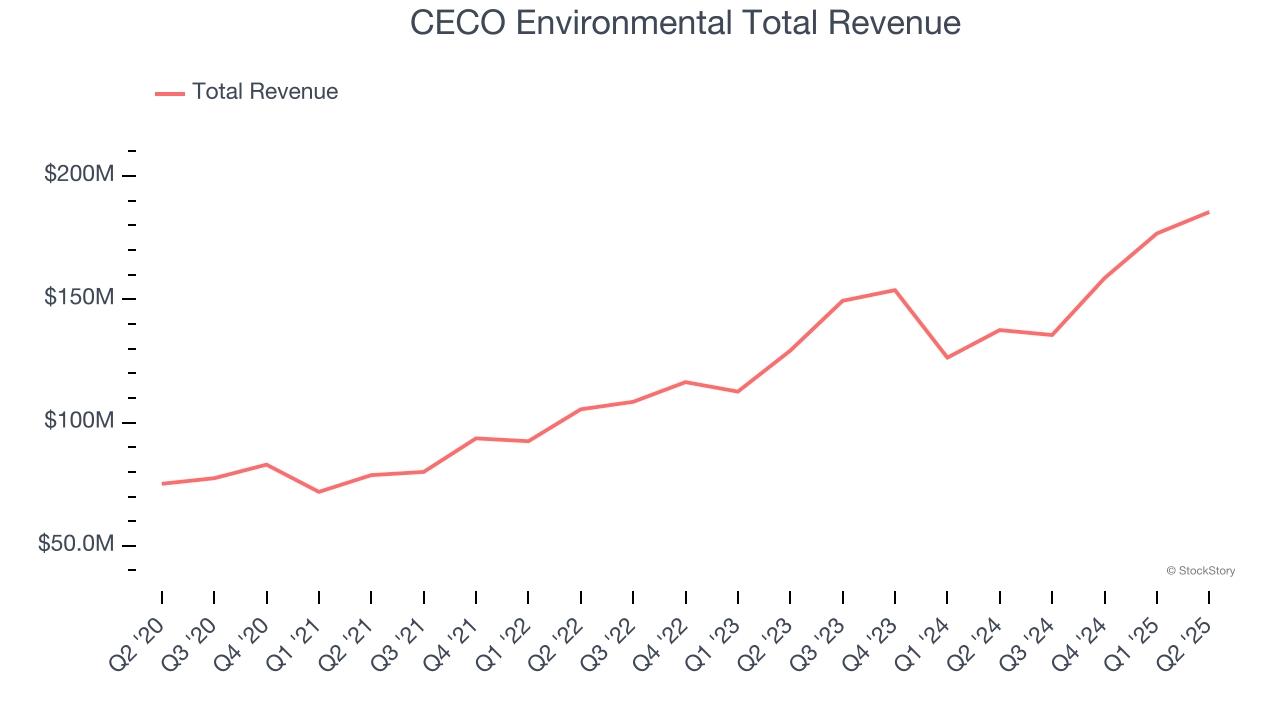

Best Q2: CECO Environmental (NASDAQ: CECO)

With roots dating back to 1869 and a focus on creating cleaner industrial operations, CECO Environmental (NASDAQ: CECO) provides technology and expertise that helps industrial companies reduce emissions, treat water, and improve energy efficiency across various sectors.

CECO Environmental reported revenues of $185.4 million, up 34.8% year on year, outperforming analysts’ expectations by 3.5%. The business had an exceptional quarter with a beat of analysts’ EPS estimates and full-year revenue guidance topping analysts’ expectations.

CECO Environmental achieved the biggest analyst estimates beat, fastest revenue growth, and highest full-year guidance raise among its peers. The market seems happy with the results as the stock is up 24.4% since reporting. It currently trades at $43.10.

Is now the time to buy CECO Environmental? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Pitney Bowes (NYSE: PBI)

With a century-long history dating back to 1920 and processing over 15 billion pieces of mail annually, Pitney Bowes (NYSE: PBI) provides shipping, mailing technology, logistics, and financial services to businesses of all sizes.

Pitney Bowes reported revenues of $461.9 million, down 5.7% year on year, falling short of analysts’ expectations by 2.9%. It was a softer quarter as it posted full-year revenue guidance missing analysts’ expectations and EPS in line with analysts’ estimates.

Pitney Bowes delivered the weakest performance against analyst estimates and slowest revenue growth in the group. Interestingly, the stock is up 6.5% since the results and currently trades at $12.12.

Read our full analysis of Pitney Bowes’s results here.

Cintas (NASDAQ: CTAS)

Starting as a family business collecting and cleaning shop rags in Cincinnati, Cintas (NASDAQ: CTAS) provides corporate identity uniforms, facility services, and safety products to over one million businesses across North America.

Cintas reported revenues of $2.67 billion, up 8% year on year. This number beat analysts’ expectations by 1.6%. Taking a step back, it was a slower quarter as it recorded full-year revenue guidance missing analysts’ expectations significantly and a slight miss of analysts’ full-year EPS guidance estimates.

Cintas had the weakest full-year guidance update among its peers. The stock is down 1.6% since reporting and currently trades at $210.54.

Read our full, actionable report on Cintas here, it’s free.

Vestis (NYSE: VSTS)

Operating a network of more than 350 facilities with 3,300 delivery routes serving customers weekly, Vestis (NYSE: VSTS) provides uniform rentals, workplace supplies, and facility services to over 300,000 business locations across the United States and Canada.

Vestis reported revenues of $673.8 million, down 3.5% year on year. This print was in line with analysts’ expectations. Overall, it was a very strong quarter as it also logged a beat of analysts’ EPS estimates.

The stock is down 23.2% since reporting and currently trades at $4.59.

Read our full, actionable report on Vestis here, it’s free.

Market Update

Thanks to the Fed’s series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.