Packaged foods company General Mills (NYSE: GIS) met Wall Street’s revenue expectations in Q3 CY2025, but sales fell by 6.8% year on year to $4.52 billion. Its non-GAAP profit of $0.86 per share was 5.4% above analysts’ consensus estimates.

Is now the time to buy General Mills? Find out by accessing our full research report, it’s free.

General Mills (GIS) Q3 CY2025 Highlights:

- Revenue: $4.52 billion vs analyst estimates of $4.51 billion (6.8% year-on-year decline, in line)

- Adjusted EPS: $0.86 vs analyst estimates of $0.82 (5.4% beat)

- Operating Margin: 38.2%, up from 17.2% in the same quarter last year due to non-recurring divestiture gain of $1.1 billion (pre-tax)

- Free Cash Flow Margin: 6.4%, down from 10% in the same quarter last year

- Organic Revenue fell 3% year on year vs analyst estimates of 2.8% declines (roughly in line)

- Sales Volumes fell 8% year on year (0% in the same quarter last year)

- Market Capitalization: $26.5 billion

“Our primary goal in fiscal 2026 is to restore organic sales growth by investing in greater value, innovation, and product news for consumers,” said General Mills Chairman and Chief Executive Officer Jeff Harmening.

Company Overview

Best known for its portfolio of powerhouse breakfast cereal brands, General Mills (NYSE: GIS) is a packaged foods company that has also made a mark in cereals, baking products, and snacks.

Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

With $19.16 billion in revenue over the past 12 months, General Mills is larger than most consumer staples companies and benefits from economies of scale, enabling it to gain more leverage on its fixed costs than smaller competitors. Its size also gives it negotiating leverage with distributors, allowing its products to reach more shelves. However, its scale is a double-edged sword because it’s harder to find incremental growth when your existing brands have penetrated most of the market. To accelerate sales, General Mills likely needs to optimize its pricing or lean into new products and international expansion.

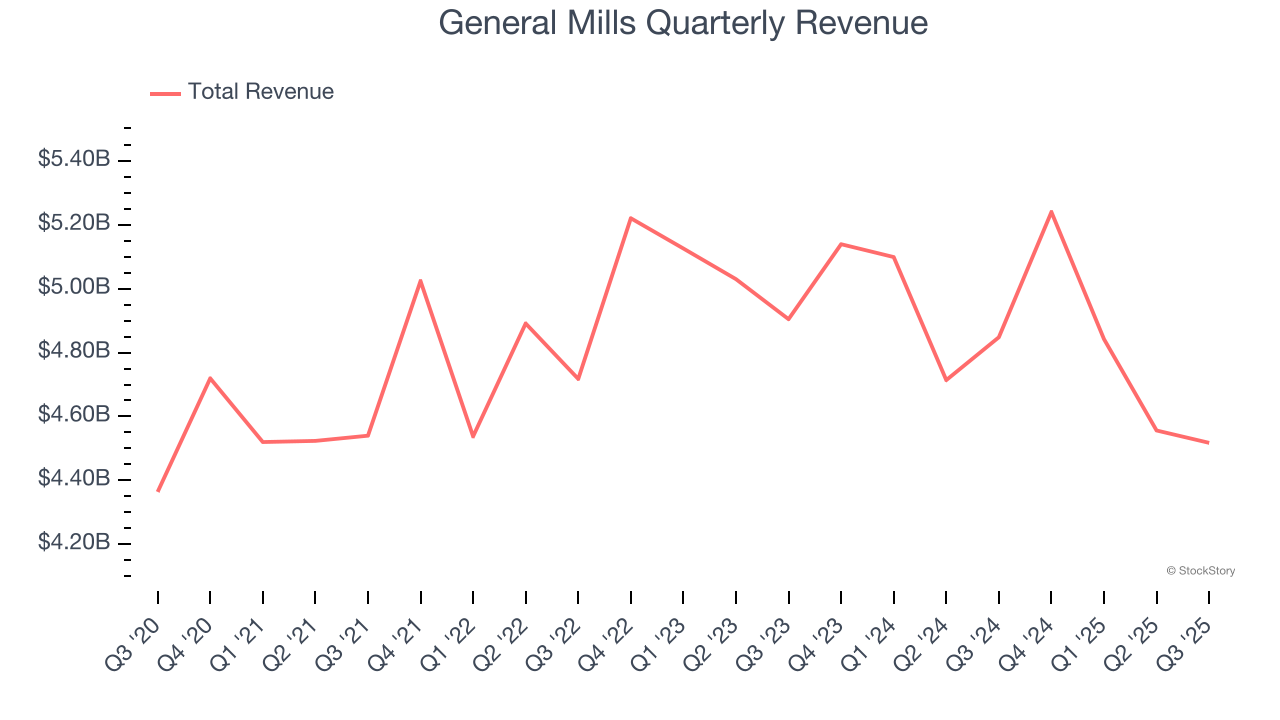

As you can see below, General Mills struggled to increase demand as its $19.16 billion of sales for the trailing 12 months was close to its revenue three years ago. This is mainly because consumers bought less of its products - we’ll explore what this means in the "Volume Growth" section.

This quarter, General Mills reported a rather uninspiring 6.8% year-on-year revenue decline to $4.52 billion of revenue, in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to decline by 2.8% over the next 12 months, a slight deceleration versus the last three years. This projection is underwhelming and indicates its products will see some demand headwinds.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Volume Growth

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful staples business as there’s a ceiling to what consumers will pay for everyday goods; they can always trade down to non-branded products if the branded versions are too expensive.

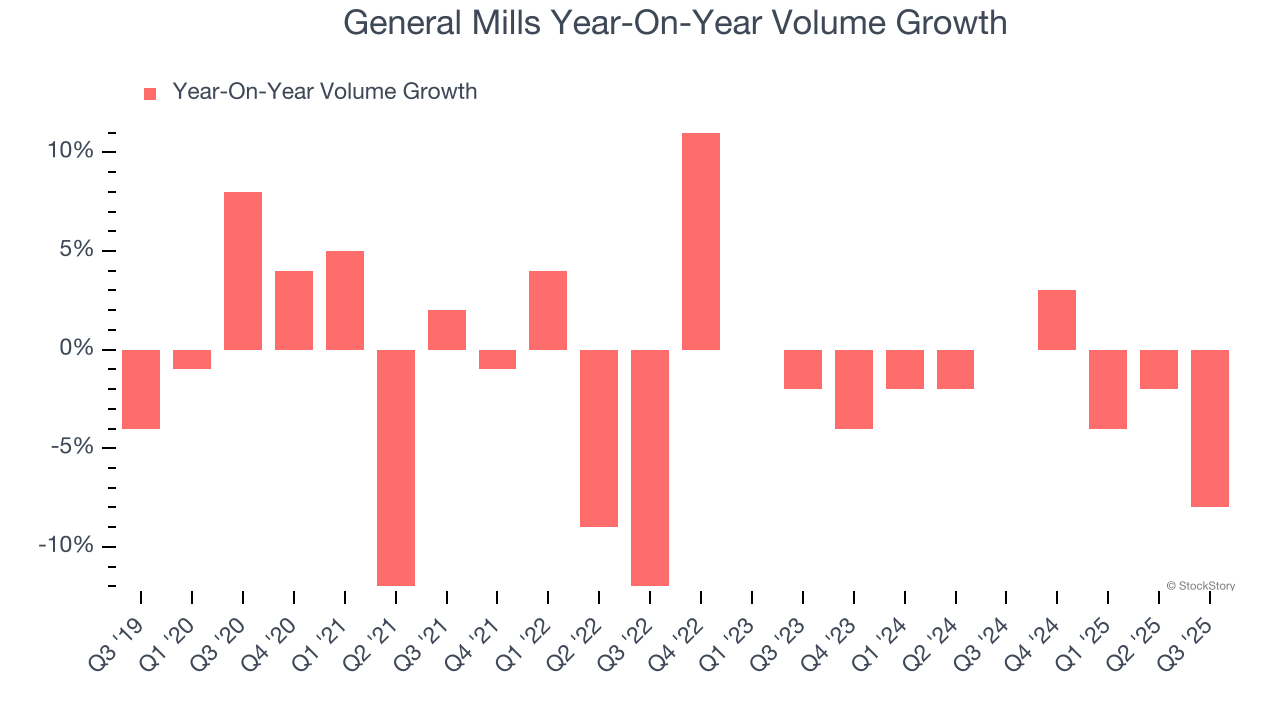

To analyze whether General Mills generated its growth (or lack thereof) from changes in price or volume, we can compare its volume growth to its organic revenue growth, which excludes non-fundamental impacts on company financials like mergers and currency fluctuations.

Over the last two years, General Mills’s average quarterly volumes have shrunk by 2.4%. This isn’t ideal for a consumer staples company, where demand is typically stable. In the context of its 2.5% average organic sales declines, we can see that most of the company’s losses have come from fewer customers purchasing its products.

In General Mills’s Q3 2026, sales volumes dropped 8% year on year. This result represents a further deceleration from its historical levels, showing the business is struggling to move its products.

Key Takeaways from General Mills’s Q3 Results

We liked that General Mills beat analysts’ EPS expectations this quarter on in-line revenue due to better-than-expected gross margin. The company also reaffirmed previously-given full-year guidance. Overall, this print had few surprises. The stock remained flat at $49.14 immediately following the results.

Big picture, is General Mills a buy here and now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.