Since January 2021, the S&P 500 has delivered a total return of 77%. But one standout stock has more than doubled the market - over the past five years, WisdomTree has surged 188% to $15.66 per share. Its momentum hasn’t stopped as it’s also gained 17.4% in the last six months thanks to its solid quarterly results, beating the S&P by 9.6%.

Is now still a good time to buy WT? Or are investors being too optimistic? Find out in our full research report, it’s free.

Why Is WT a Good Business?

Originally founded as a financial media company before pivoting to ETF management in 2006, WisdomTree (NYSE: WT) is a financial services company that creates and manages exchange-traded funds (ETFs) and other investment products for individual and institutional investors.

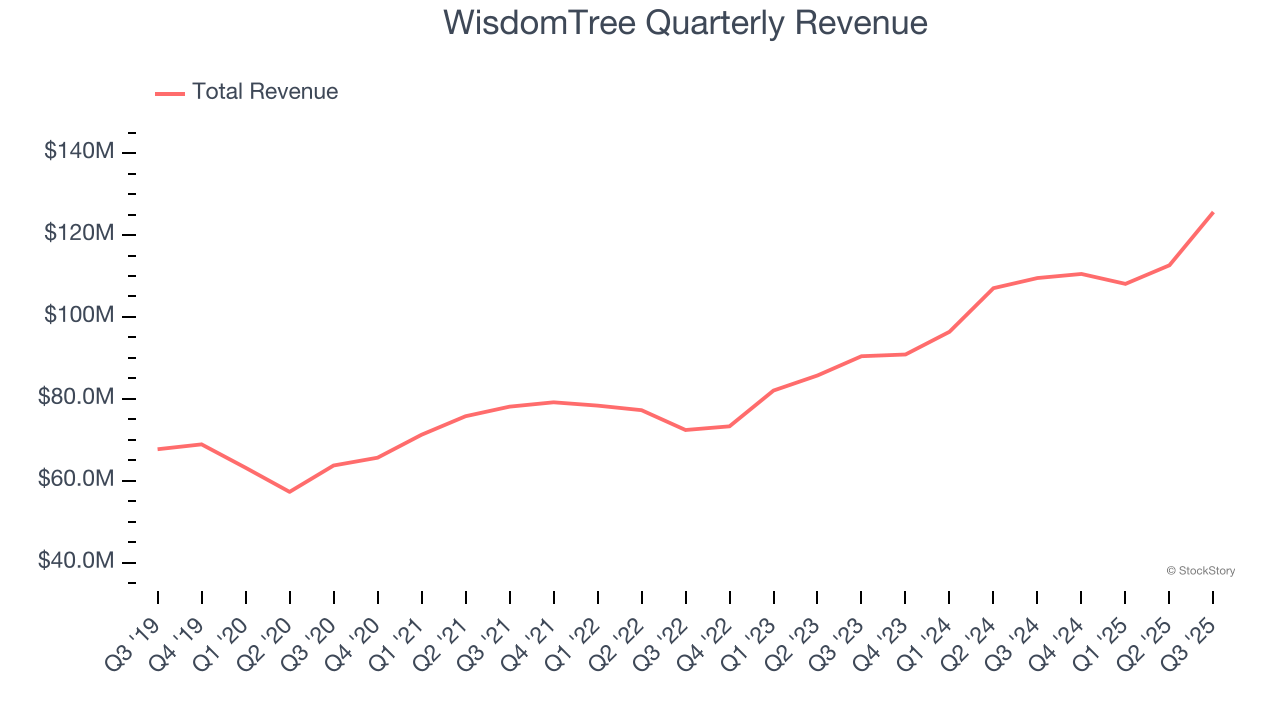

1. Long-Term Revenue Growth Shows Strong Momentum

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years.

Luckily, WisdomTree’s revenue grew at a solid 12.5% compounded annual growth rate over the last five years. Its growth surpassed the average financials company and shows its offerings resonate with customers.

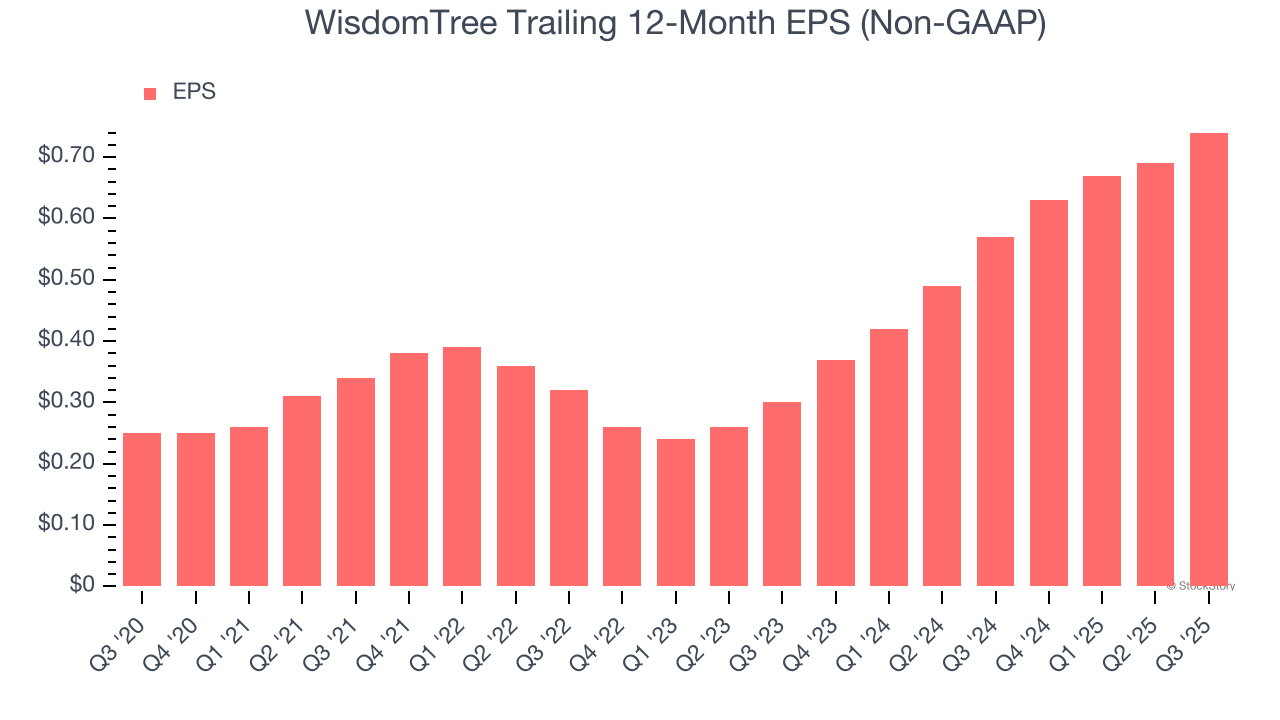

2. Outstanding Long-Term EPS Growth

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

WisdomTree’s EPS grew at a spectacular 24.2% compounded annual growth rate over the last five years, higher than its 12.5% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

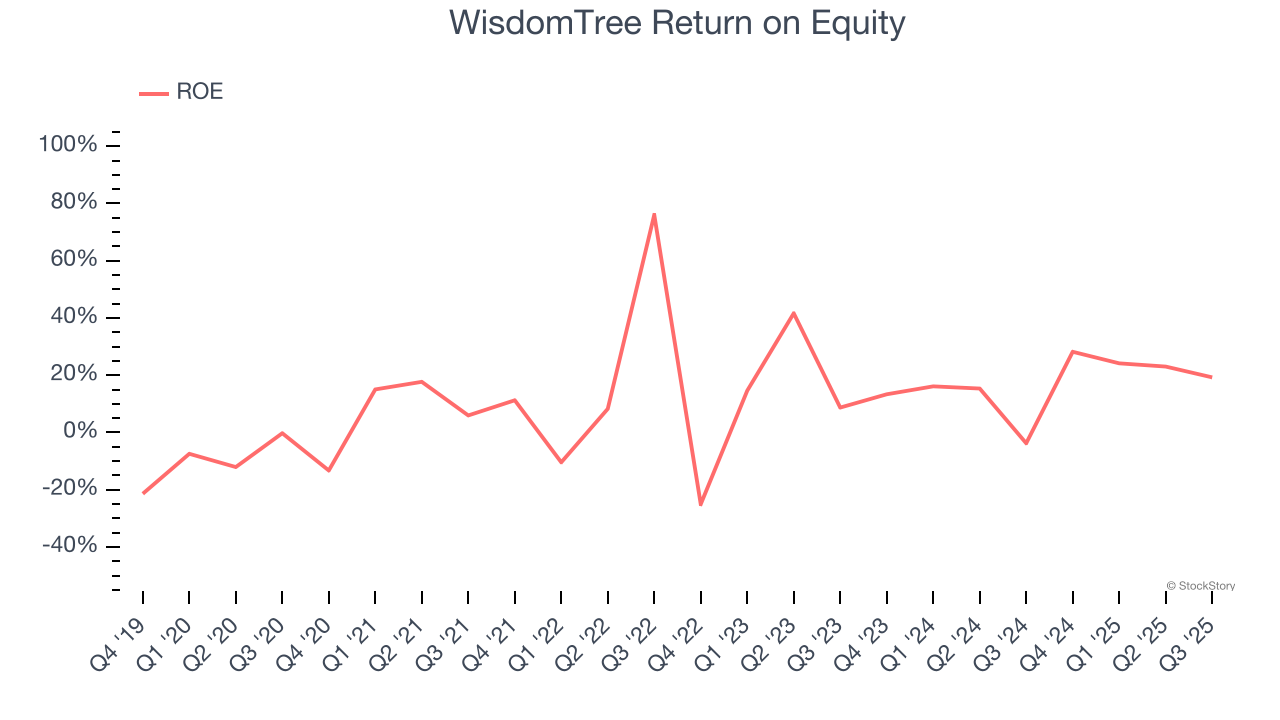

3. Market-Beating ROE Showcases Attractive Growth Opportunities

Return on equity (ROE) measures how effectively banks generate profit from each dollar of shareholder equity - a critical funding source. High-ROE institutions typically compound shareholder wealth faster over time through retained earnings, share repurchases, and dividend payments.

Over the last five years, WisdomTree has averaged an ROE of 14.3%, healthy for a company operating in a sector where the average shakes out around 10% and those putting up 25%+ are greatly admired. This shows WisdomTree has a decent competitive moat.

Final Judgment

These are just a few reasons why WisdomTree is one of the best financials companies out there, and with its shares outperforming the market lately, the stock trades at 16.2× forward P/E (or $15.66 per share). Is now the right time to buy? See for yourself in our full research report, it’s free.

Stocks We Like Even More Than WisdomTree

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.