Over the last six months, Clorox’s shares have sunk to $100.95, producing a disappointing 18.9% loss - a stark contrast to the S&P 500’s 9.9% gain. This might have investors contemplating their next move.

Is now the time to buy Clorox, or should you be careful about including it in your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free for active Edge members.

Why Is Clorox Not Exciting?

Even with the cheaper entry price, we're swiping left on Clorox for now. Here are three reasons why CLX doesn't excite us and a stock we'd rather own.

1. Revenue Spiraling Downwards

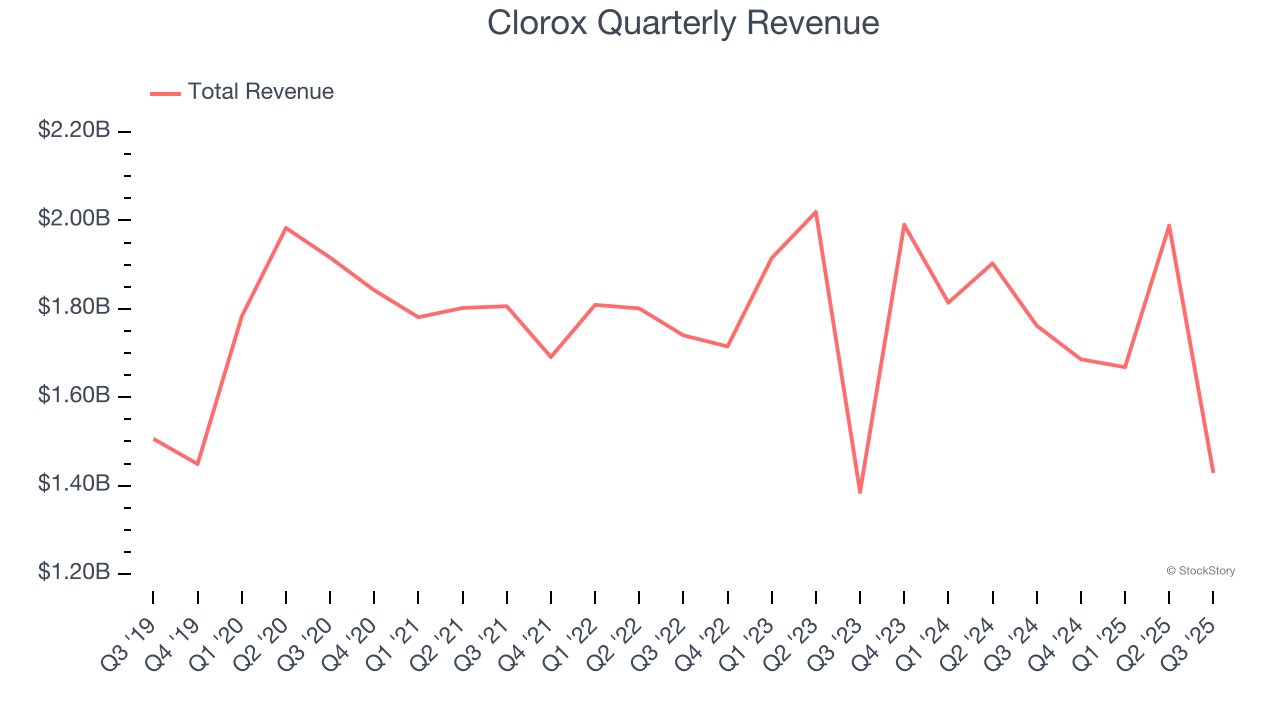

A company’s long-term sales performance can indicate its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last three years, Clorox’s demand was weak and its revenue declined by 1.3% per year. This was below our standards and is a sign of lacking business quality.

2. Slow Organic Growth Suggests Waning Demand In Core Business

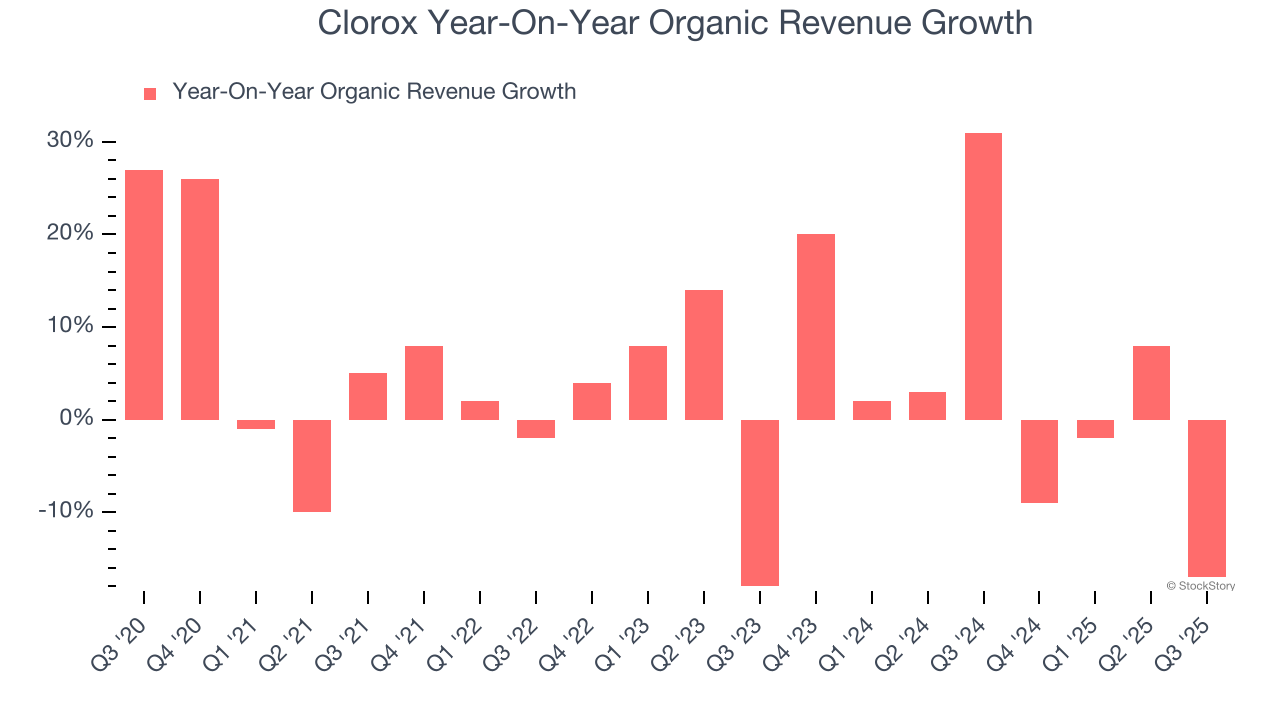

When analyzing revenue growth, we care most about organic revenue growth. This metric captures a business’s performance excluding one-time events such as mergers, acquisitions, and divestitures as well as foreign currency fluctuations.

The demand for Clorox’s products has generally risen over the last two years but lagged behind the broader sector. On average, the company’s organic sales have grown by 4.5% year on year.

3. Revenue Projections Show Stormy Skies Ahead

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Clorox’s revenue to drop by 1.3%, close to This projection is underwhelming and indicates its newer products will not catalyze better top-line performance yet.

Final Judgment

Clorox isn’t a terrible business, but it doesn’t pass our quality test. Following the recent decline, the stock trades at 15.7× forward P/E (or $100.95 per share). This valuation multiple is fair, but we don’t have much faith in the company. We're fairly confident there are better stocks to buy right now. We’d recommend looking at one of our all-time favorite software stocks.

Stocks We Like More Than Clorox

Check out the high-quality names we’ve flagged in our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.