Looking back on vertical software stocks’ Q3 earnings, we examine this quarter’s best and worst performers, including Doximity (NYSE: DOCS) and its peers.

Software is eating the world, and while a large number of solutions such as project management or video conferencing software can be useful to a wide array of industries, some have very specific needs. As a result, vertical software, which addresses industry-specific workflows, is growing and fueled by the pressures to improve productivity, whether it be for a life sciences, education, or banking company.

The 14 vertical software stocks we track reported a strong Q3. As a group, revenues beat analysts’ consensus estimates by 3.7% while next quarter’s revenue guidance was in line.

In light of this news, share prices of the companies have held steady. On average, they are relatively unchanged since the latest earnings results.

Doximity (NYSE: DOCS)

With over 80% of U.S. physicians as members of its digital community, Doximity (NYSE: DOCS) operates a digital platform that enables physicians and other healthcare professionals to collaborate, stay current with medical news, manage their careers, and conduct virtual patient visits.

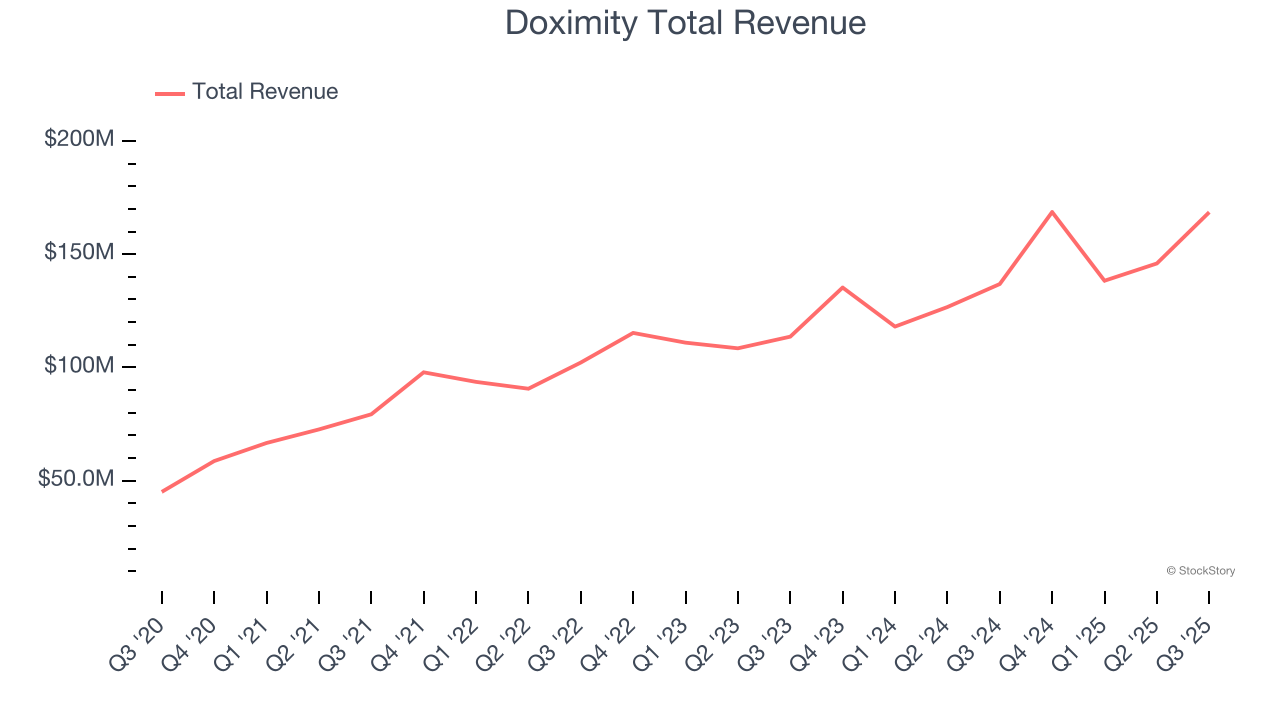

Doximity reported revenues of $168.5 million, up 23.2% year on year. This print exceeded analysts’ expectations by 7.2%. Overall, it was a strong quarter for the company with an impressive beat of analysts’ EBITDA estimates and a solid beat of analysts’ revenue estimates.

“Our platform continues to grow with new AI tools to save physicians’ time,” said Jeff Tangney, co-founder and CEO of Doximity.

The stock is down 26.5% since reporting and currently trades at $46.00.

Best Q3: nCino (NASDAQ: NCNO)

Born from the internal technology needs of a community bank in 2011, nCino (NASDAQ: NCNO) provides cloud-based software that helps financial institutions streamline client onboarding, loan origination, and account opening processes.

nCino reported revenues of $152.2 million, up 9.6% year on year, outperforming analysts’ expectations by 3.3%. The business had an exceptional quarter with an impressive beat of analysts’ billings estimates and EPS guidance for next quarter exceeding analysts’ expectations.

Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 4.1% since reporting. It currently trades at $24.53.

Is now the time to buy nCino? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q3: Upstart (NASDAQ: UPST)

Using over 2,500 data variables and trained on nearly 82 million repayment events, Upstart (NASDAQ: UPST) is an AI-powered lending platform that uses machine learning to help banks and credit unions more accurately assess borrower risk for personal loans, auto loans, and home equity lines of credit.

Upstart reported revenues of $277.1 million, up 70.9% year on year, falling short of analysts’ expectations by 1.3%. It was a softer quarter as it posted full-year revenue guidance missing analysts’ expectations.

Upstart delivered the fastest revenue growth but had the weakest performance against analyst estimates in the group. Interestingly, the stock is up 8.7% since the results and currently trades at $50.65.

Read our full analysis of Upstart’s results here.

Dolby Laboratories (NYSE: DLB)

Known for its iconic "D" logo that appears before countless movies and TV shows, Dolby Laboratories (NYSE: DLB) designs and licenses audio and video technologies that enhance entertainment experiences in movies, TV shows, music, and other media.

Dolby Laboratories reported revenues of $307 million, flat year on year. This print surpassed analysts’ expectations by 0.7%. More broadly, it was a softer quarter as it produced revenue guidance for next quarter missing analysts’ expectations significantly and EPS guidance for next quarter missing analysts’ expectations significantly.

Dolby Laboratories pulled off the highest full-year guidance raise but had the slowest revenue growth among its peers. The stock is flat since reporting and currently trades at $64.64.

Read our full, actionable report on Dolby Laboratories here, it’s free for active Edge members.

Agilysys (NASDAQ: AGYS)

With a tech stack that powers everything from check-in to checkout at some of the world's top hospitality venues, Agilysys (NASDAQ: AGYS) develops and provides cloud-based and on-premise software solutions for hotels, resorts, casinos, and restaurants to manage operations and enhance guest experiences.

Agilysys reported revenues of $79.3 million, up 16.1% year on year. This result beat analysts’ expectations by 3.1%. It was a very strong quarter as it also recorded an impressive beat of analysts’ EBITDA estimates and full-year revenue guidance topping analysts’ expectations.

The stock is up 1.8% since reporting and currently trades at $117.24.

Read our full, actionable report on Agilysys here, it’s free for active Edge members.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.