Household products company WD-40 (NASDAQ: WDFC) met Wall Streets revenue expectations in Q4 CY2025, but sales were flat year on year at $154.4 million. On the other hand, the company’s full-year revenue guidance of $642.5 million at the midpoint came in 1% below analysts’ estimates. Its GAAP profit of $1.28 per share was 11.4% below analysts’ consensus estimates.

Is now the time to buy WD-40? Find out by accessing our full research report, it’s free.

WD-40 (WDFC) Q4 CY2025 Highlights:

- Revenue: $154.4 million vs analyst estimates of $155.1 million (flat year on year, in line)

- EPS (GAAP): $1.28 vs analyst expectations of $1.45 (11.4% miss)

- Adjusted EBITDA: $27.09 million vs analyst estimates of $28.3 million (17.5% margin, 4.3% miss)

- The company reconfirmed its revenue guidance for the full year of $642.5 million at the midpoint

- EPS (GAAP) guidance for the full year is $5.95 at the midpoint, missing analyst estimates by 2.1%

- Operating Margin: 15.1%, down from 16.4% in the same quarter last year

- Free Cash Flow Margin: 5.9%, down from 9.3% in the same quarter last year

- Market Capitalization: $2.69 billion

Company Overview

Short for “Water Displacement perfected on the 40th try”, WD-40 (NASDAQ: WDFC) is a renowned American consumer goods company known for its iconic and versatile spray, WD-40 Multi-Use Product.

Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

With $620.9 million in revenue over the past 12 months, WD-40 is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with retailers.

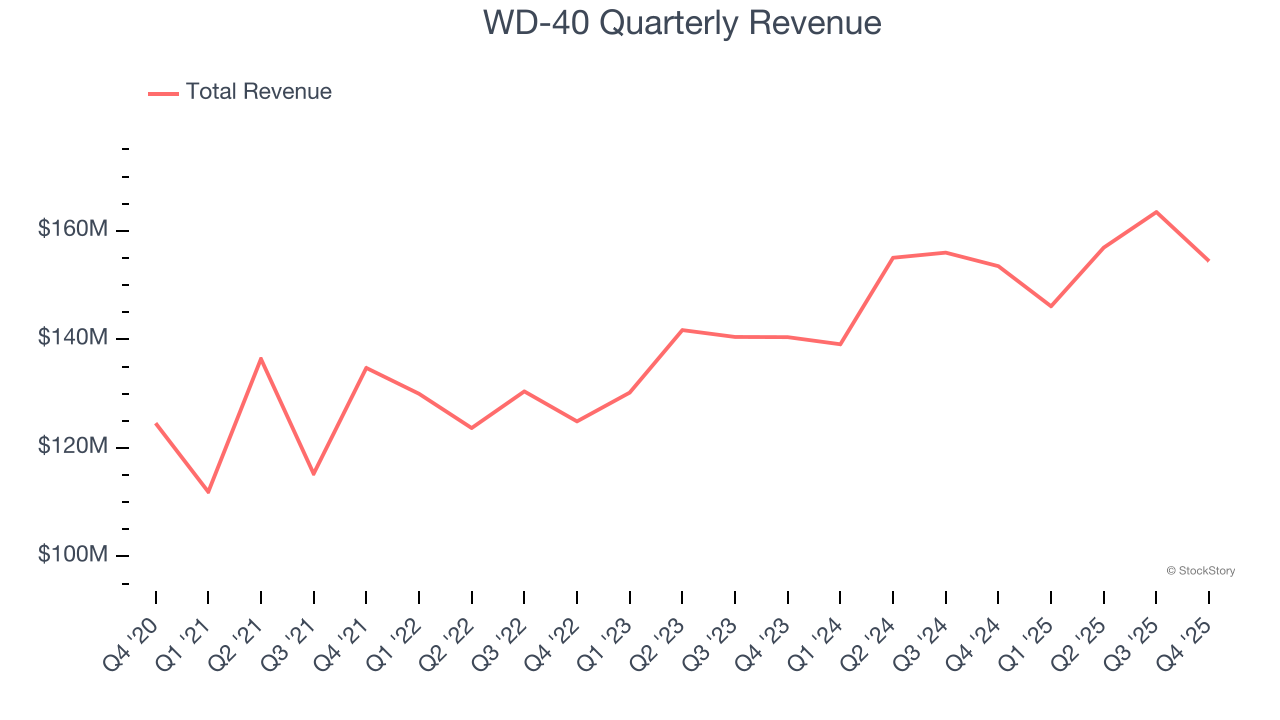

As you can see below, WD-40 grew its sales at a mediocre 6.9% compounded annual growth rate over the last three years. This shows it couldn’t generate demand in any major way and is a tough starting point for our analysis.

This quarter, WD-40’s $154.4 million of revenue was flat year on year and in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 5.7% over the next 12 months, similar to its three-year rate. Still, this projection is above average for the sector and suggests the market sees some success for its newer products.

The 1999 book Gorilla Game predicted Microsoft and Apple would dominate tech before it happened. Its thesis? Identify the platform winners early. Today, enterprise software companies embedding generative AI are becoming the new gorillas. a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

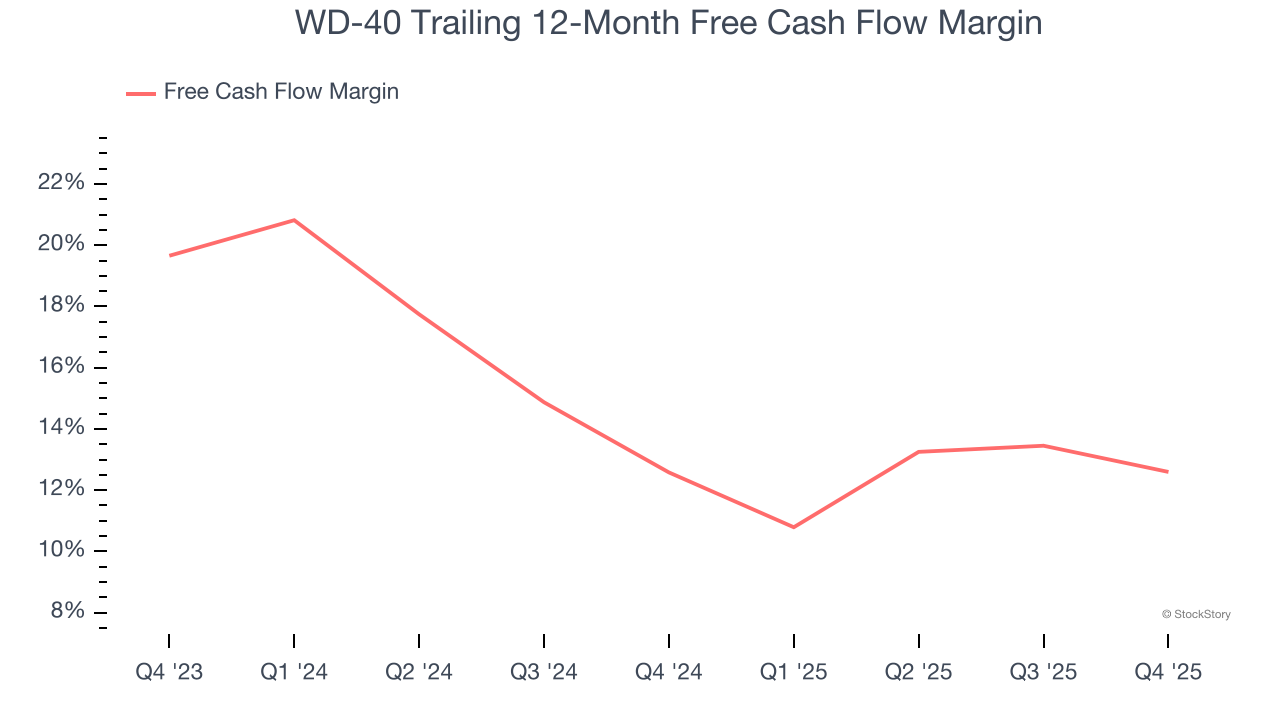

WD-40 has shown robust cash profitability, driven by its attractive business model that enables it to reinvest or return capital to investors. The company’s free cash flow margin averaged 12.6% over the last two years, quite impressive for a consumer staples business.

WD-40’s free cash flow clocked in at $9.05 million in Q4, equivalent to a 5.9% margin. The company’s cash profitability regressed as it was 3.4 percentage points lower than in the same quarter last year, but we wouldn’t read too much into it because capital expenditures can be seasonal and companies often stockpile inventory in anticipation of higher demand, leading to quarter-to-quarter swings. Long-term trends are more important.

Key Takeaways from WD-40’s Q4 Results

It was good to see WD-40 narrowly top analysts’ gross margin expectations this quarter. On the other hand, its EPS missed and its EBITDA fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock traded down 4.5% to $194.35 immediately after reporting.

WD-40’s earnings report left more to be desired. Let’s look forward to see if this quarter has created an opportunity to buy the stock. When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here (it’s free).