Data streaming platform provider Confluent (NASDAQ: CFLT) announced better-than-expected revenue in Q4 CY2025, with sales up 20.5% year on year to $314.8 million. Its non-GAAP profit of $0.12 per share was 21.1% above analysts’ consensus estimates.

Is now the time to buy Confluent? Find out by accessing our full research report, it’s free.

Confluent (CFLT) Q4 CY2025 Highlights:

- As announced on December 8, 2025, Confluent and International Business Machines Corporation (“IBM”) (NYSE: IBM) have entered into a definitive agreement under which IBM will acquire Confluent for $31.00 per share in cash, representing an enterprise value of $11 billion. The transaction is expected to close by the middle of 2026, subject to approval by Confluent shareholders, regulatory approvals, and other customary closing conditions.

- Revenue: $314.8 million vs analyst estimates of $307.9 million (20.5% year-on-year growth, 2.2% beat)

- Adjusted EPS: $0.12 vs analyst estimates of $0.10 (21.1% beat)

- Adjusted Operating Income: $27.6 million vs analyst estimates of $21.96 million (8.8% margin, 25.7% beat)

- Operating Margin: -31.5%, up from -40.5% in the same quarter last year

- Free Cash Flow Margin: 11.3%, up from 8.2% in the previous quarter

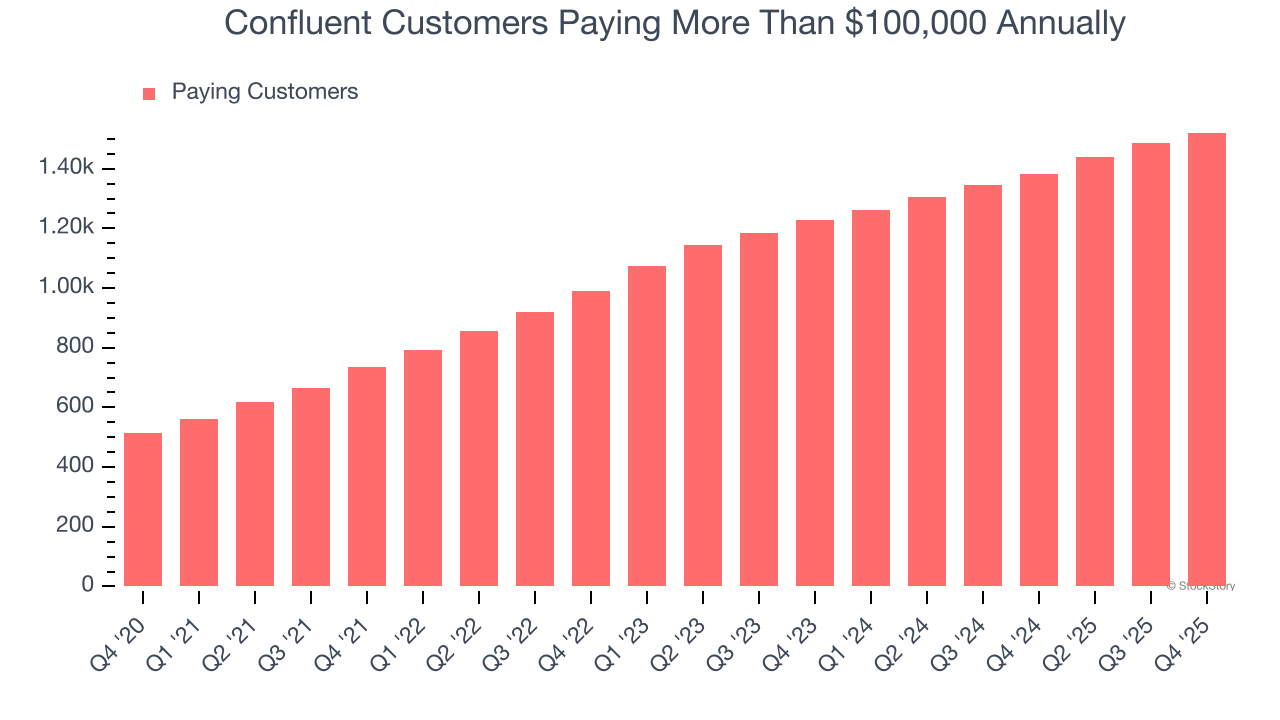

- Customers: 1,521 customers paying more than $100,000 annually

- Market Capitalization: $10.9 billion

Company Overview

Built by the original creators of Apache Kafka, the popular open-source messaging system, Confluent (NASDAQ: CFLT) provides a data infrastructure platform that enables organizations to connect their applications, systems, and data layers around real-time data streams.

Revenue Growth

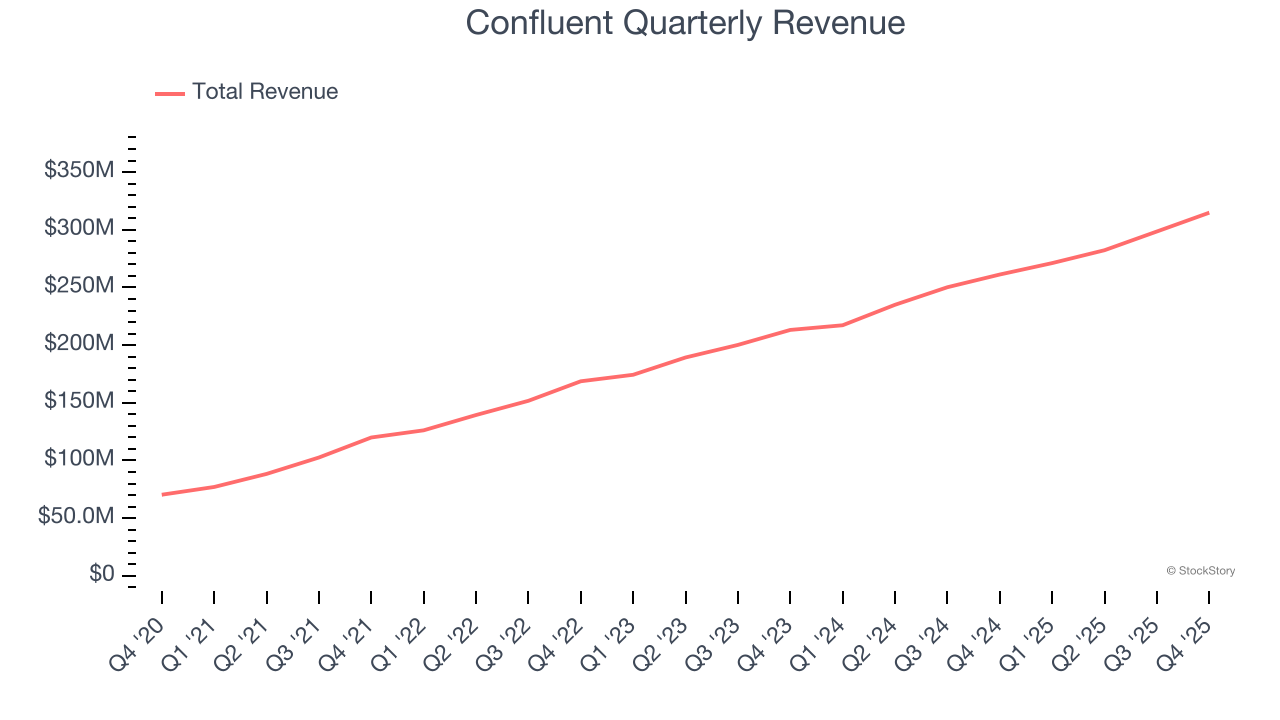

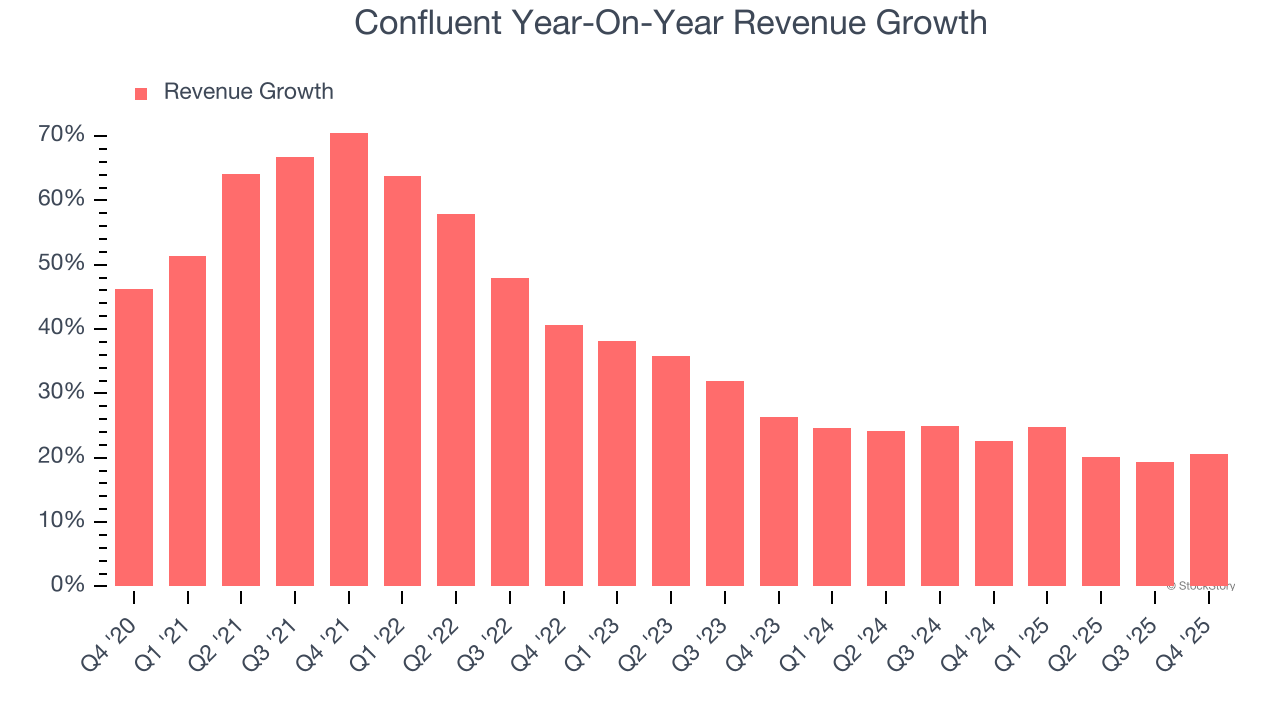

A company’s long-term sales performance is one signal of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last five years, Confluent grew its sales at an exceptional 37.6% compounded annual growth rate. Its growth beat the average software company and shows its offerings resonate with customers, a helpful starting point for our analysis.

Long-term growth is the most important, but within software, a half-decade historical view may miss new innovations or demand cycles. Confluent’s annualized revenue growth of 22.5% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

This quarter, Confluent reported robust year-on-year revenue growth of 20.5%, and its $314.8 million of revenue topped Wall Street estimates by 2.2%.

Looking ahead, sell-side analysts expect revenue to grow 15.8% over the next 12 months, a deceleration versus the last two years. Despite the slowdown, this projection is above average for the sector and suggests the market sees some success for its newer products and services.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Enterprise Customer Base

This quarter, Confluent reported 1,521 enterprise customers paying more than $100,000 annually, an increase of 34 from the previous quarter. That’s a bit fewer contract wins than last quarter and quite a bit below what we’ve observed over the previous year, suggesting its sales momentum with new enterprise customers is slowing. It also implies that Confluent will likely need to upsell its existing large customers or move down market to accelerate its top-line growth.

Key Takeaways from Confluent’s Q4 Results

It was encouraging to see Confluent beat analysts’ revenue expectations this quarter. The company also beat adjusted operating profit and adjusted EPS estimates. Overall, this was a solid quarter. The stock remained flat at $30.43 immediately following the results.

As announced on December 8, 2025, Confluent and International Business Machines Corporation (“IBM”) (NYSE: IBM) have entered into a definitive agreement under which IBM will acquire Confluent for $31.00 per share in cash, representing an enterprise value of $11 billion. The transaction is expected to close by the middle of 2026, subject to approval by Confluent shareholders, regulatory approvals, and other customary closing conditions.

Confluent’s earnings report left more to be desired. Let’s look forward to see if this quarter has created an opportunity to buy the stock. What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here (it’s free).