Online travel agency Expedia (NASDAQ: EXPE) announced better-than-expected revenue in Q4 CY2025, with sales up 11.4% year on year to $3.55 billion. On top of that, next quarter’s revenue guidance ($3.35 billion at the midpoint) was surprisingly good and 3.7% above what analysts were expecting. Its non-GAAP profit of $3.78 per share was 12.2% above analysts’ consensus estimates.

Is now the time to buy Expedia? Find out by accessing our full research report, it’s free.

Expedia (EXPE) Q4 CY2025 Highlights:

- Revenue: $3.55 billion vs analyst estimates of $3.42 billion (11.4% year-on-year growth, 3.8% beat)

- Adjusted EPS: $3.78 vs analyst estimates of $3.37 (12.2% beat)

- Adjusted EBITDA: $848 million vs analyst estimates of $760.6 million (23.9% margin, 11.5% beat)

- Revenue Guidance for Q1 CY2026 is $3.35 billion at the midpoint, above analyst estimates of $3.23 billion

- Operating Margin: 11.8%, up from 6.8% in the same quarter last year

- Free Cash Flow was $119 million, up from -$686 million in the previous quarter

- Room Nights Booked: 94 million, up 7.6 million year on year

- Market Capitalization: $28.62 billion

Company Overview

Originally founded as a part of Microsoft, Expedia (NASDAQ: EXPE) is one of the world’s leading online travel agencies.

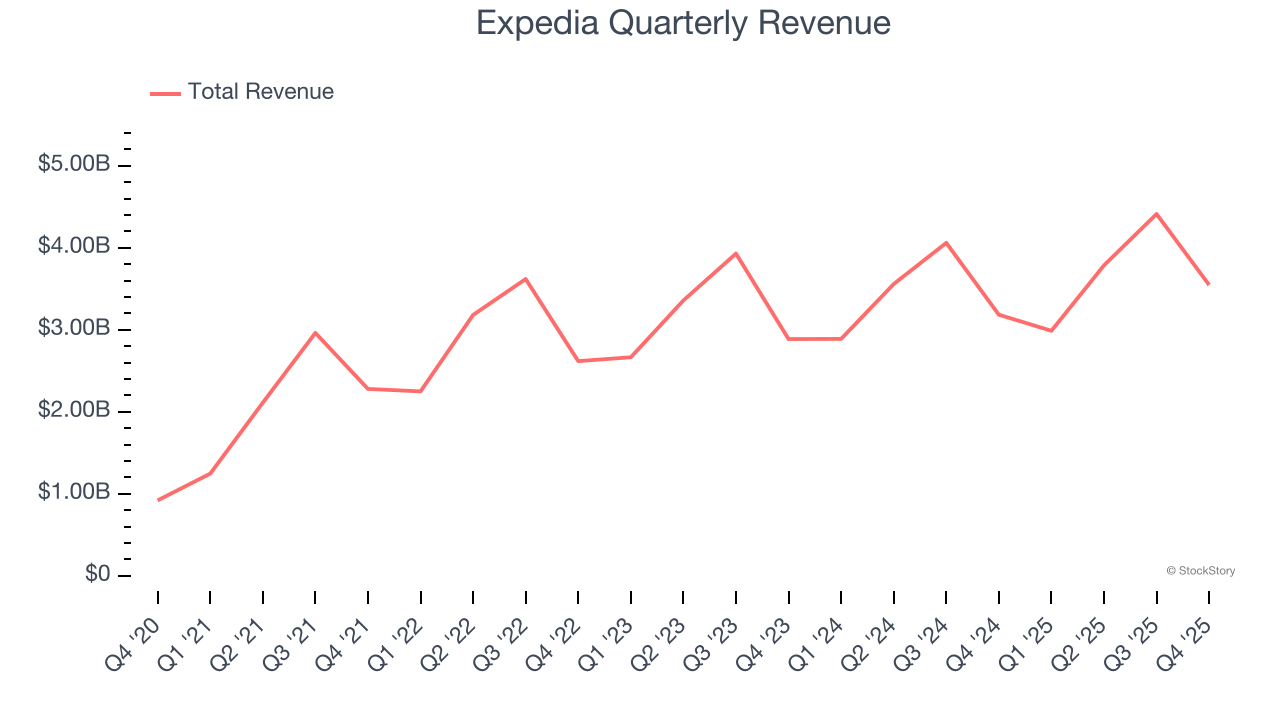

Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last three years, Expedia grew its sales at a mediocre 8.1% compounded annual growth rate. This wasn’t a great result compared to the rest of the consumer internet sector, but there are still things to like about Expedia.

This quarter, Expedia reported year-on-year revenue growth of 11.4%, and its $3.55 billion of revenue exceeded Wall Street’s estimates by 3.8%. Company management is currently guiding for a 12% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 6.5% over the next 12 months, a slight deceleration versus the last three years. This projection is underwhelming and implies its products and services will face some demand challenges. At least the company is tracking well in other measures of financial health.

The 1999 book Gorilla Game predicted Microsoft and Apple would dominate tech before it happened. Its thesis? Identify the platform winners early. Today, enterprise software companies embedding generative AI are becoming the new gorillas. a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

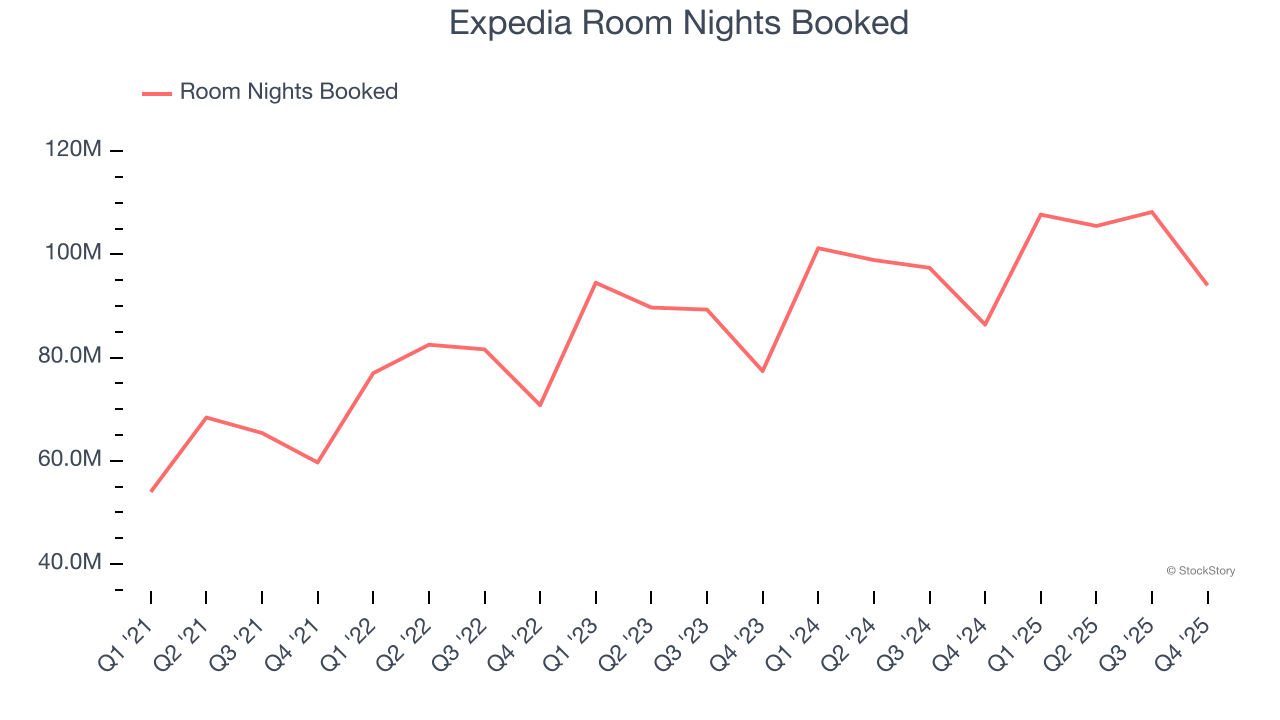

Room Nights Booked

Booking Growth

As an online travel company, Expedia generates revenue growth by increasing both the number of stays (or experiences) booked and the commission charged on those bookings.

Over the last two years, Expedia’s room nights booked, a key performance metric for the company, increased by 8.9% annually to 94 million in the latest quarter. This growth rate is decent for a consumer internet business and indicates people enjoy using its offerings.

In Q4, Expedia added 7.6 million room nights booked, leading to 8.8% year-on-year growth. The quarterly print isn’t too different from its two-year result, suggesting its new initiatives aren’t accelerating booking growth just yet.

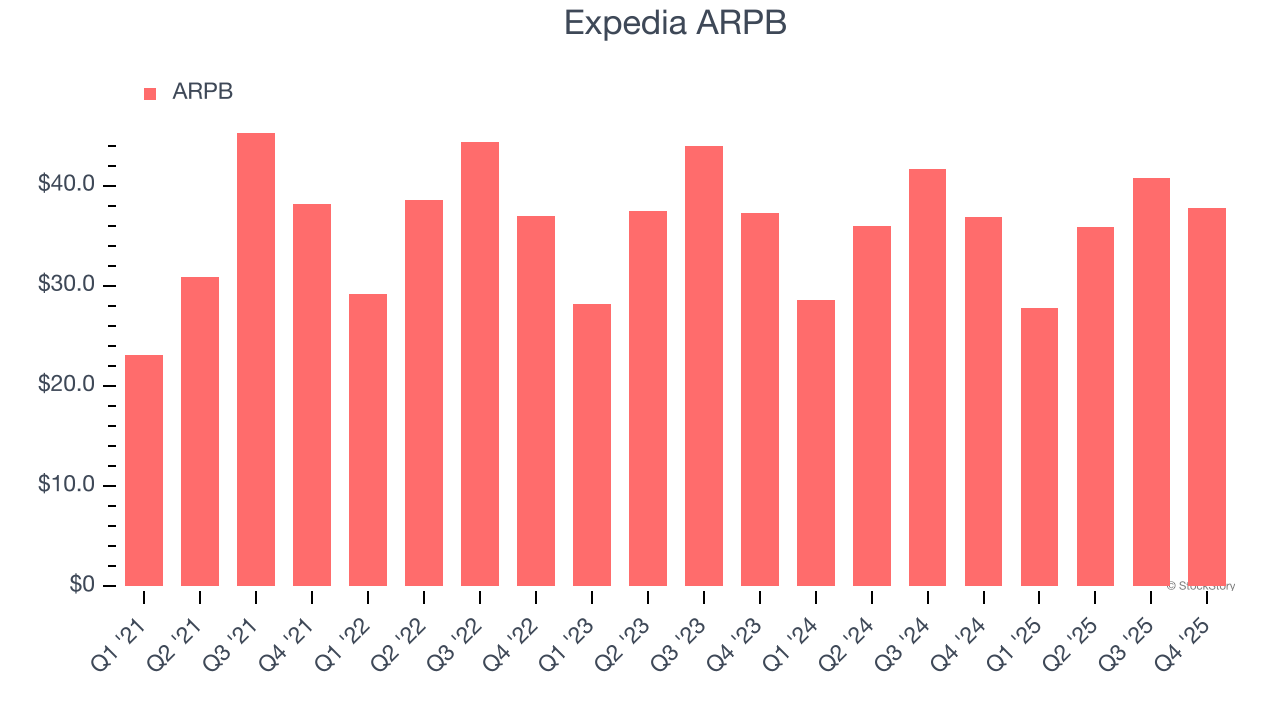

Revenue Per Booking

Average revenue per booking (ARPB) is a critical metric to track because it not only measures how much users book on its platform but also the commission that Expedia can charge.

Expedia’s ARPB fell over the last two years, averaging 1.5% annual declines. This isn’t great, but the increase in room nights booked is more relevant for assessing long-term business potential. We’ll monitor the situation closely; if Expedia tries boosting ARPB by taking a more aggressive approach to monetization, it’s unclear whether bookings can continue growing at the current pace.

This quarter, Expedia’s ARPB clocked in at $37.73. It grew by 2.4% year on year, slower than its booking growth.

Key Takeaways from Expedia’s Q4 Results

We were impressed by how significantly Expedia blew past analysts’ EBITDA expectations this quarter. We were also glad its revenue guidance for next quarter exceeded Wall Street’s estimates. Zooming out, we think this quarter featured some important positives. Investors were likely hoping for more, and shares traded down 1.8% to $224.57 immediately after reporting.

Is Expedia an attractive investment opportunity right now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here (it’s free).