Luxury hotels and casino operator Wynn Resorts (NASDAQ: WYNN) beat Wall Street’s revenue expectations in Q4 CY2025, with sales up 1.5% year on year to $1.87 billion. Its non-GAAP profit of $1.17 per share was 20.7% below analysts’ consensus estimates.

Is now the time to buy Wynn Resorts? Find out by accessing our full research report, it’s free.

Wynn Resorts (WYNN) Q4 CY2025 Highlights:

- Revenue: $1.87 billion vs analyst estimates of $1.85 billion (1.5% year-on-year growth, 0.7% beat)

- Adjusted EPS: $1.17 vs analyst expectations of $1.48 (20.7% miss)

- Adjusted EBITDA: $455.2 million vs analyst estimates of $588.9 million (24.4% margin, 22.7% miss)

- Operating Margin: 14.7%, down from 20% in the same quarter last year

- Market Capitalization: $11.89 billion

Company Overview

Founded by the former Mirage Resorts CEO, Wynn Resorts (NASDAQ: WYNN) is a global developer and operator of high-end hotels and casinos, known for its luxurious properties and premium guest services.

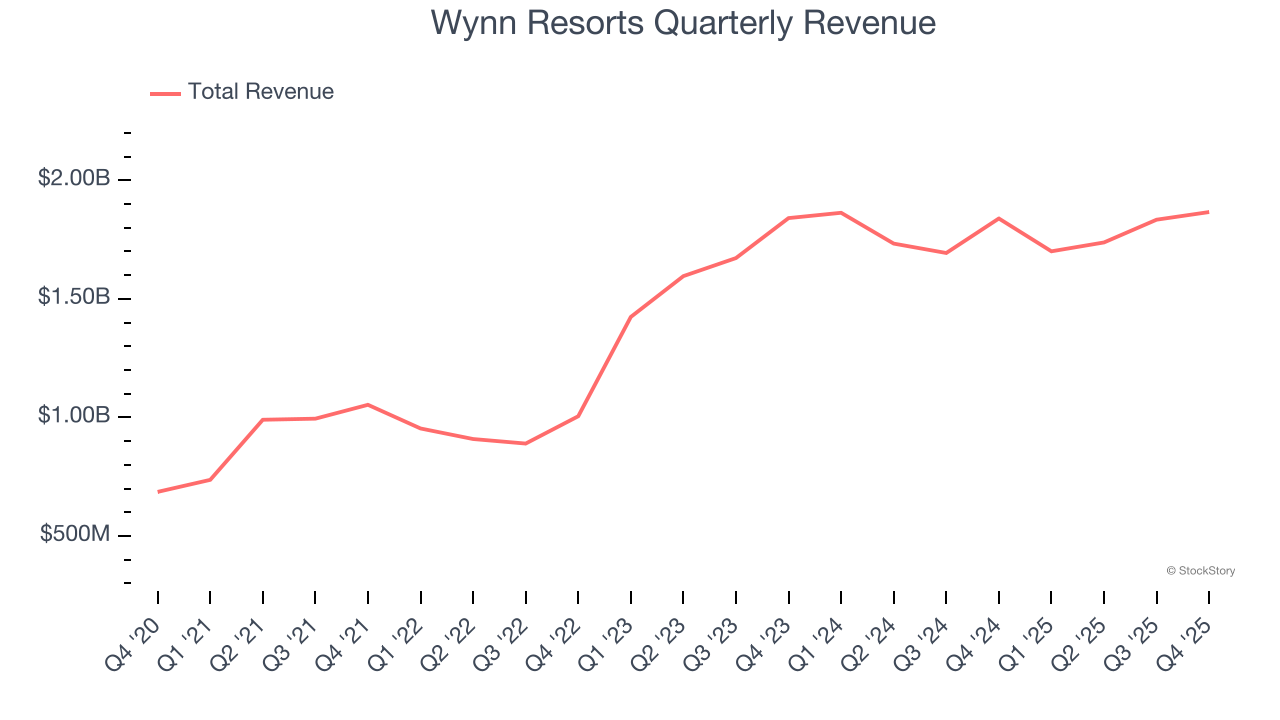

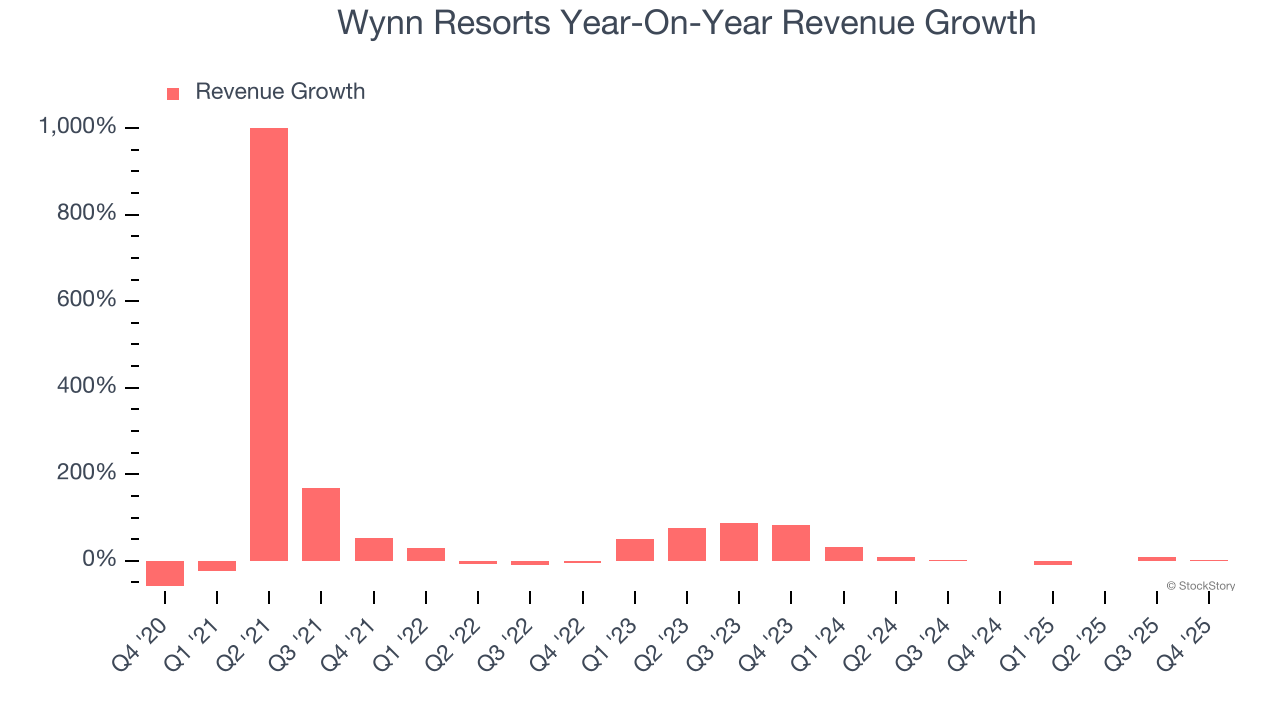

Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last five years, Wynn Resorts grew its sales at a 27.8% annual rate. Though this growth is acceptable on an absolute basis, we need to see more than just topline growth for the consumer discretionary sector, which can display significant earnings volatility. This means our bar for the sector is particularly high, reflecting the non-essential and hit-driven nature of the products and services offered. Additionally, five-year CAGR starts around Covid, when revenue was depressed then rebounded.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. Wynn Resorts’s recent performance shows its demand has slowed as its annualized revenue growth of 4.5% over the last two years was below its five-year trend. We’re wary when companies in the sector see decelerations in revenue growth, as it could signal changing consumer tastes aided by low switching costs. Note that COVID hurt Wynn Resorts’s business in 2020 and part of 2021, and it bounced back in a big way thereafter.

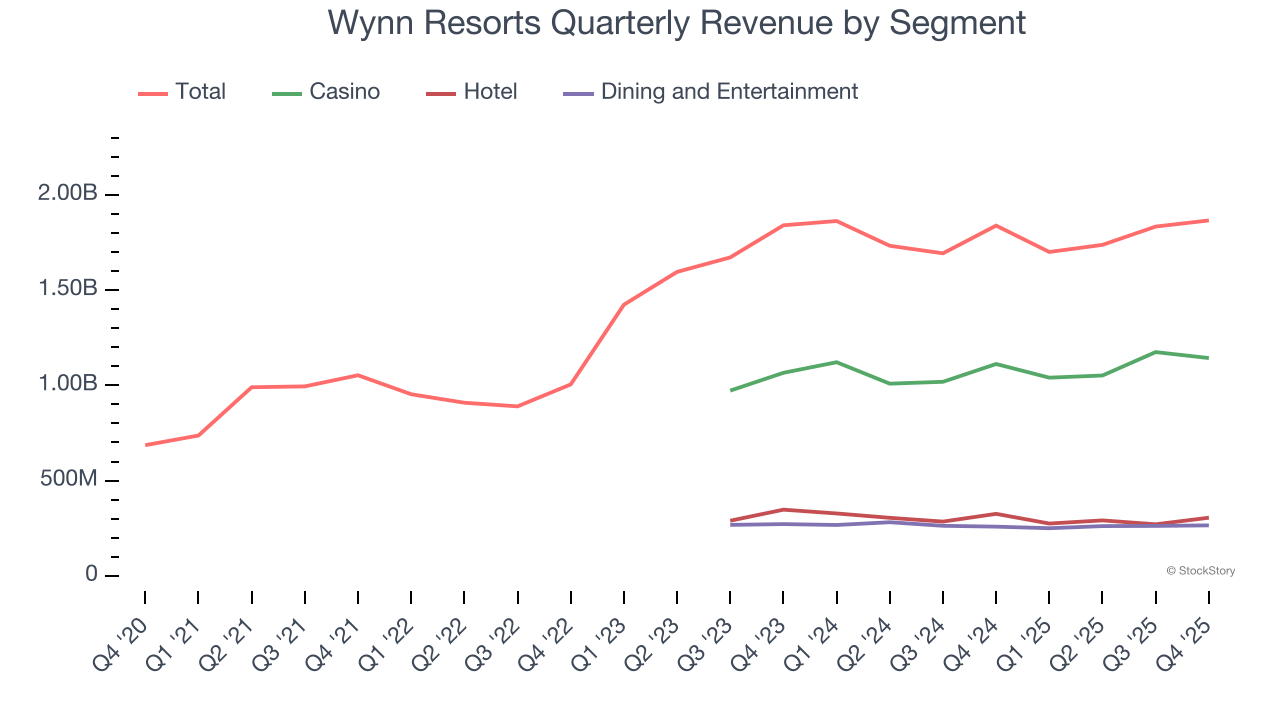

We can better understand the company’s revenue dynamics by analyzing its three most important segments: Casino, Hotel, and Dining and Entertainment, which are 61.3%, 16.4%, and 14.2% of revenue. Over the last two years, Wynn Resorts’s Casino revenue (Poker, slots) averaged 4% year-on-year growth while its Hotel (overnight bookings) and Dining and Entertainment (food, beverage, Wynn Interactive) revenues averaged declines of 6.6% and 3%.

This quarter, Wynn Resorts reported modest year-on-year revenue growth of 1.5% but beat Wall Street’s estimates by 0.7%.

Looking ahead, sell-side analysts expect revenue to grow 3.5% over the next 12 months, similar to its two-year rate. This projection doesn't excite us and implies its products and services will see some demand headwinds.

Microsoft, Alphabet, Coca-Cola, Monster Beverage—all began as under-the-radar growth stories riding a massive trend. We’ve identified the next one: a profitable AI semiconductor play Wall Street is still overlooking. Go here for access to our full report.

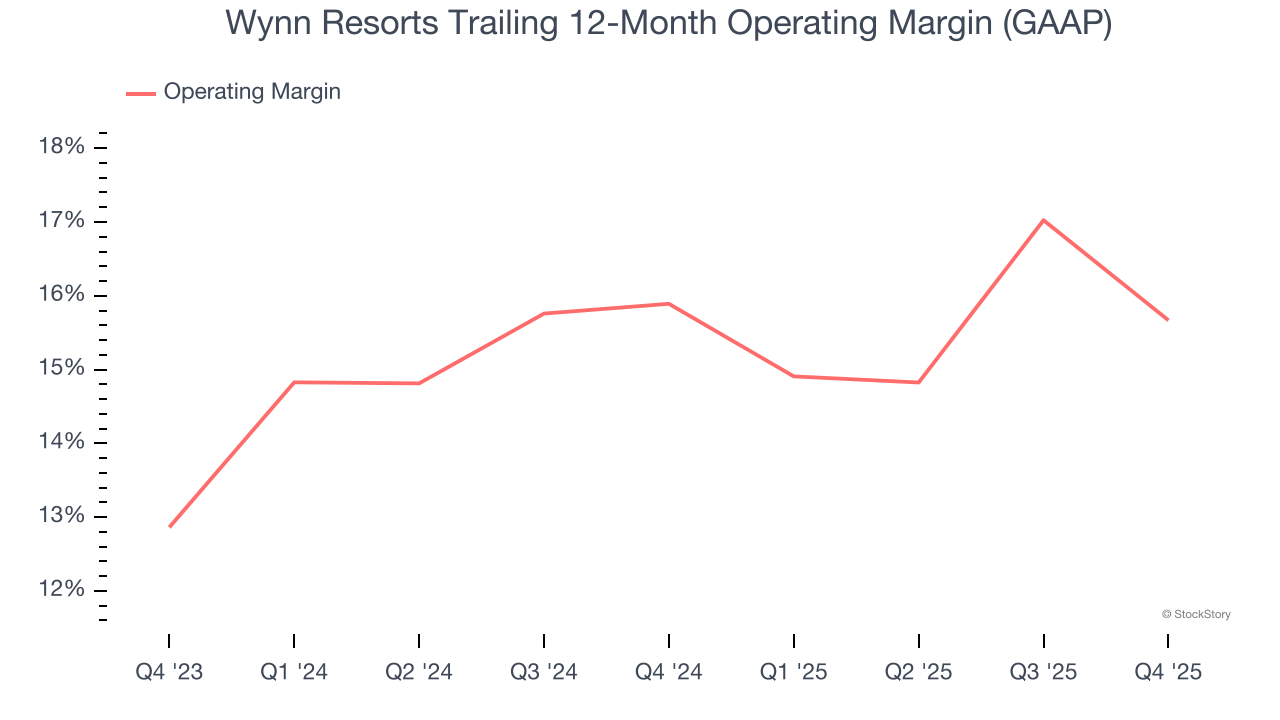

Operating Margin

Wynn Resorts’s operating margin might fluctuated slightly over the last 12 months but has generally stayed the same, averaging 15.8% over the last two years. This profitability was inadequate for a consumer discretionary business and caused by its suboptimal cost structure.

This quarter, Wynn Resorts generated an operating margin profit margin of 14.7%, down 5.2 percentage points year on year. This contraction shows it was less efficient because its expenses grew faster than its revenue.

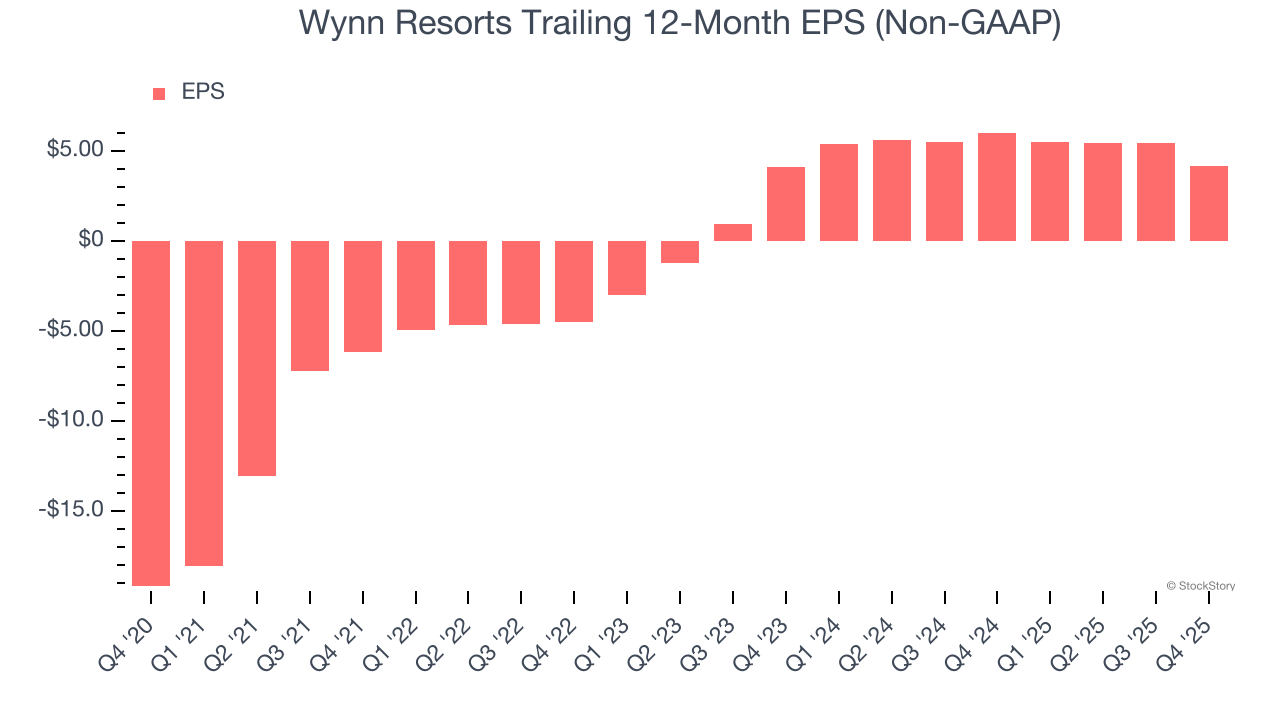

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Wynn Resorts’s full-year EPS flipped from negative to positive over the last five years. This is encouraging and shows it’s at a critical moment in its life.

In Q4, Wynn Resorts reported adjusted EPS of $1.17, down from $2.42 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects Wynn Resorts’s full-year EPS of $4.19 to grow 38.7%.

Key Takeaways from Wynn Resorts’s Q4 Results

We struggled to find many positives in these results. Its EPS missed and its EBITDA fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock remained flat at $107.07 immediately after reporting.

Wynn Resorts underperformed this quarter, but does that create an opportunity to invest right now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here (it’s free).