Shareholders of Utz would probably like to forget the past six months even happened. The stock dropped 25.6% and now trades at $10.23. This may have investors wondering how to approach the situation.

Is now the time to buy Utz, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Why Do We Think Utz Will Underperform?

Despite the more favorable entry price, we're swiping left on Utz for now. Here are three reasons why UTZ doesn't excite us and a stock we'd rather own.

1. Slow Organic Growth Suggests Waning Demand In Core Business

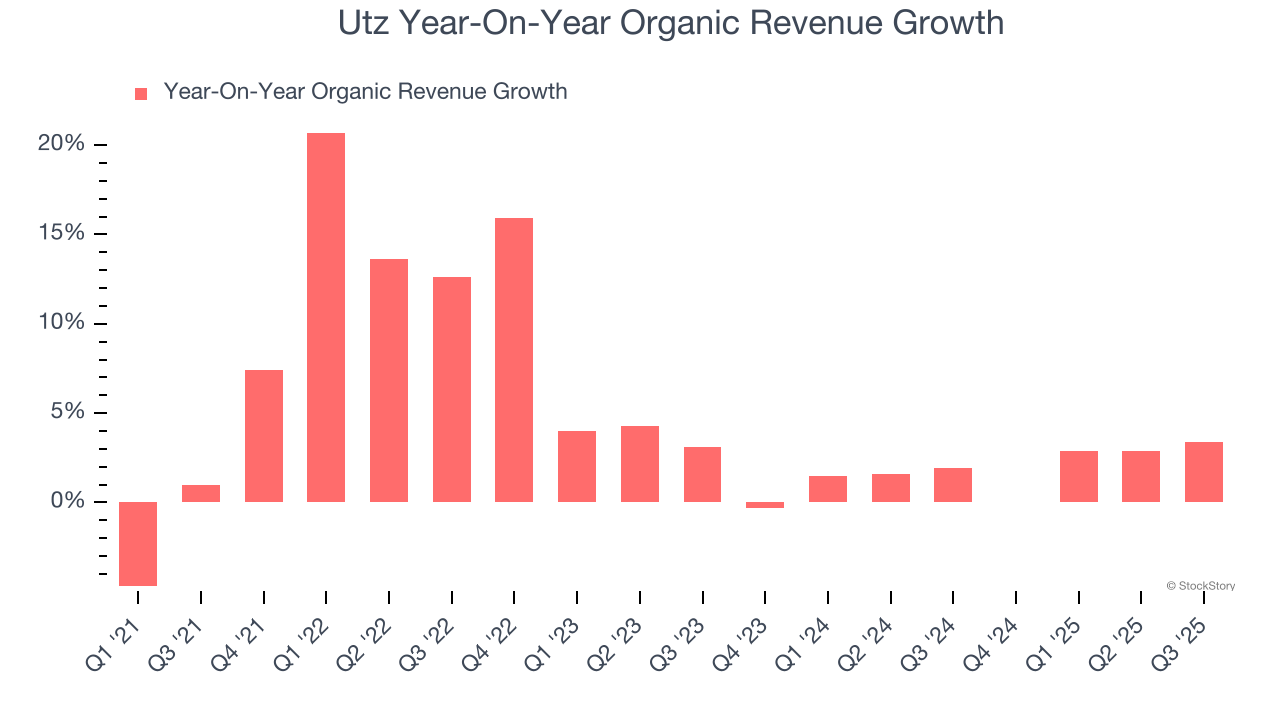

When analyzing revenue growth, we care most about organic revenue growth. This metric captures a business’s performance excluding one-time events such as mergers, acquisitions, and divestitures as well as foreign currency fluctuations.

The demand for Utz’s products has been stable over the last eight quarters but fell behind the broader sector. On average, the company has posted feeble year-on-year organic revenue growth of 1.7%.

2. Fewer Distribution Channels Limit its Ceiling

With $1.44 billion in revenue over the past 12 months, Utz is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with retailers.

3. Previous Growth Initiatives Haven’t Paid Off Yet

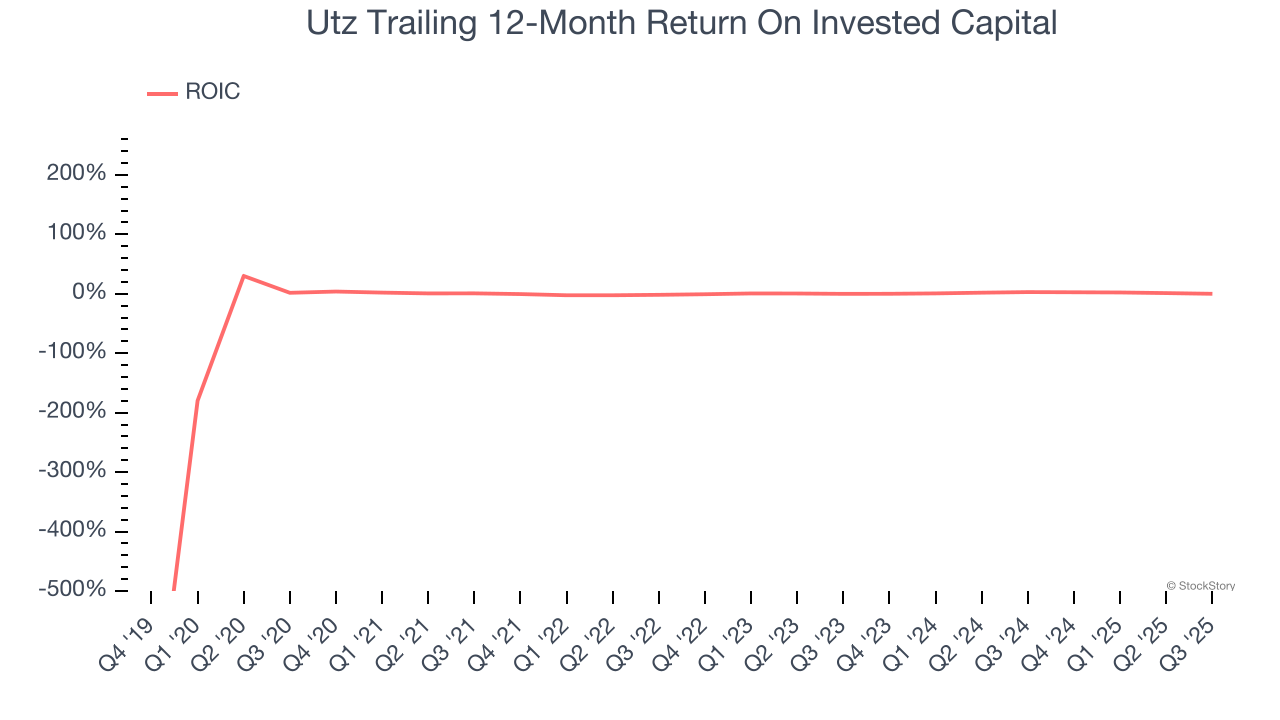

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Utz historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 0.3%, lower than the typical cost of capital (how much it costs to raise money) for consumer staples companies.

Final Judgment

We cheer for all companies serving everyday consumers, but in the case of Utz, we’ll be cheering from the sidelines. After the recent drawdown, the stock trades at 12.2× forward P/E (or $10.23 per share). While this valuation is fair, the upside isn’t great compared to the potential downside. There are better stocks to buy right now. We’d recommend looking at a fast-growing restaurant franchise with an A+ ranch dressing sauce.

High-Quality Stocks for All Market Conditions

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.