Pharmaceutical company AbbVie (NYSE: ABBV) reported Q4 CY2025 results exceeding the market’s revenue expectations, with sales up 10% year on year to $16.62 billion. Its non-GAAP profit of $2.71 per share was 2.2% above analysts’ consensus estimates.

Is now the time to buy AbbVie? Find out by accessing our full research report, it’s free.

AbbVie (ABBV) Q4 CY2025 Highlights:

- Revenue: $16.62 billion vs analyst estimates of $16.25 billion (10% year-on-year growth, 2.3% beat)

- Adjusted EPS: $2.71 vs analyst estimates of $2.65 (2.2% beat)

- Adjusted EPS guidance for the upcoming financial year 2026 is $14.47 at the midpoint, beating analyst estimates by 1.7%

- Operating Margin: 27.3%, up from -9.9% in the same quarter last year

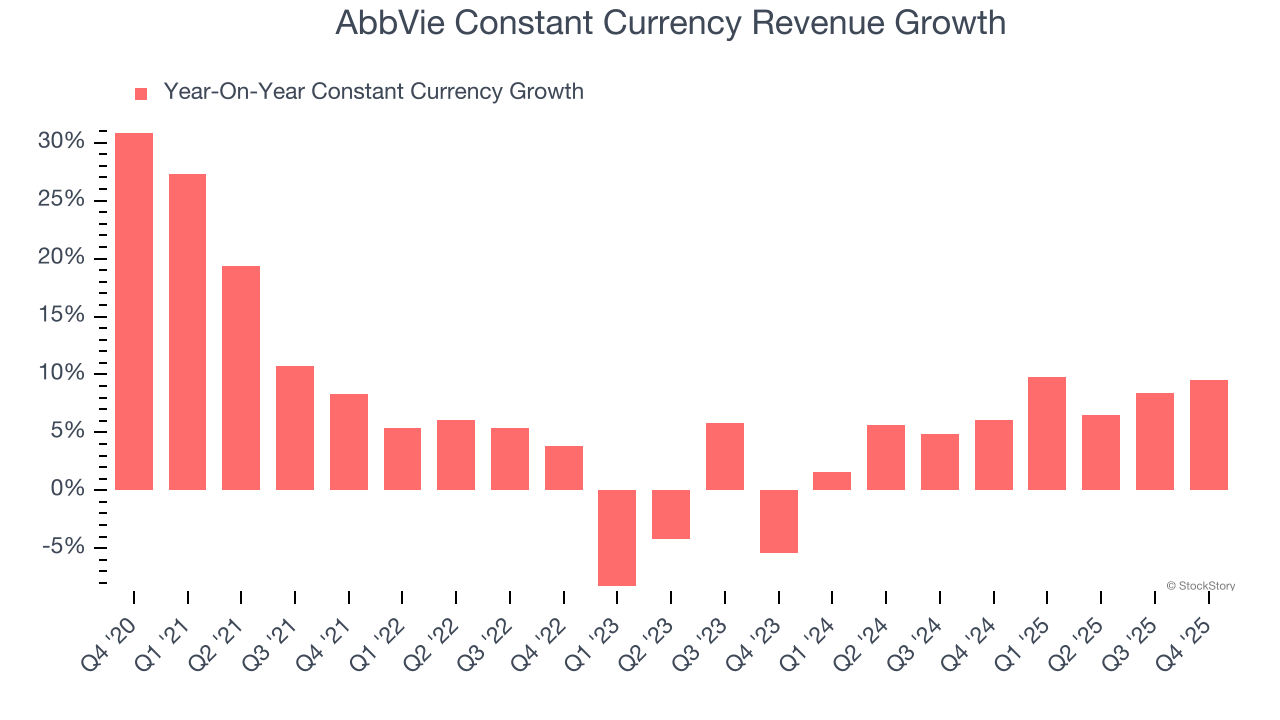

- Constant Currency Revenue rose 9.5% year on year (6.1% in the same quarter last year)

- Market Capitalization: $398.8 billion

"2025 was another outstanding year for AbbVie. We delivered record net sales in just the second full year following the U.S. Humira loss of exclusivity, underscoring the strength of our diversified growth platform. We also advanced promising new treatments for patients while enhancing the breadth and depth of our pipeline with strategic investments," said Robert A. Michael, chairman and chief executive officer, AbbVie.

Company Overview

Born from a 2013 spinoff of Abbott Laboratories' pharmaceutical business, AbbVie (NYSE: ABBV) is a biopharmaceutical company that develops and markets medications for autoimmune diseases, cancer, neurological disorders, and other complex health conditions.

Revenue Growth

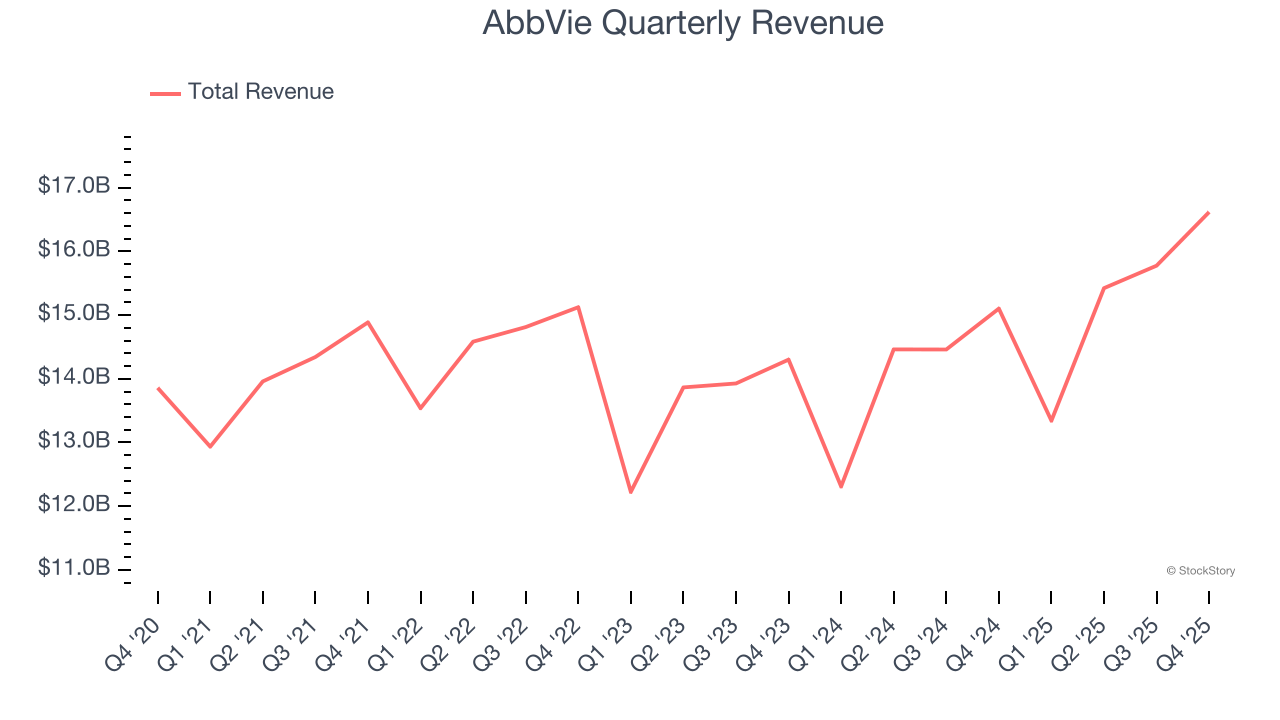

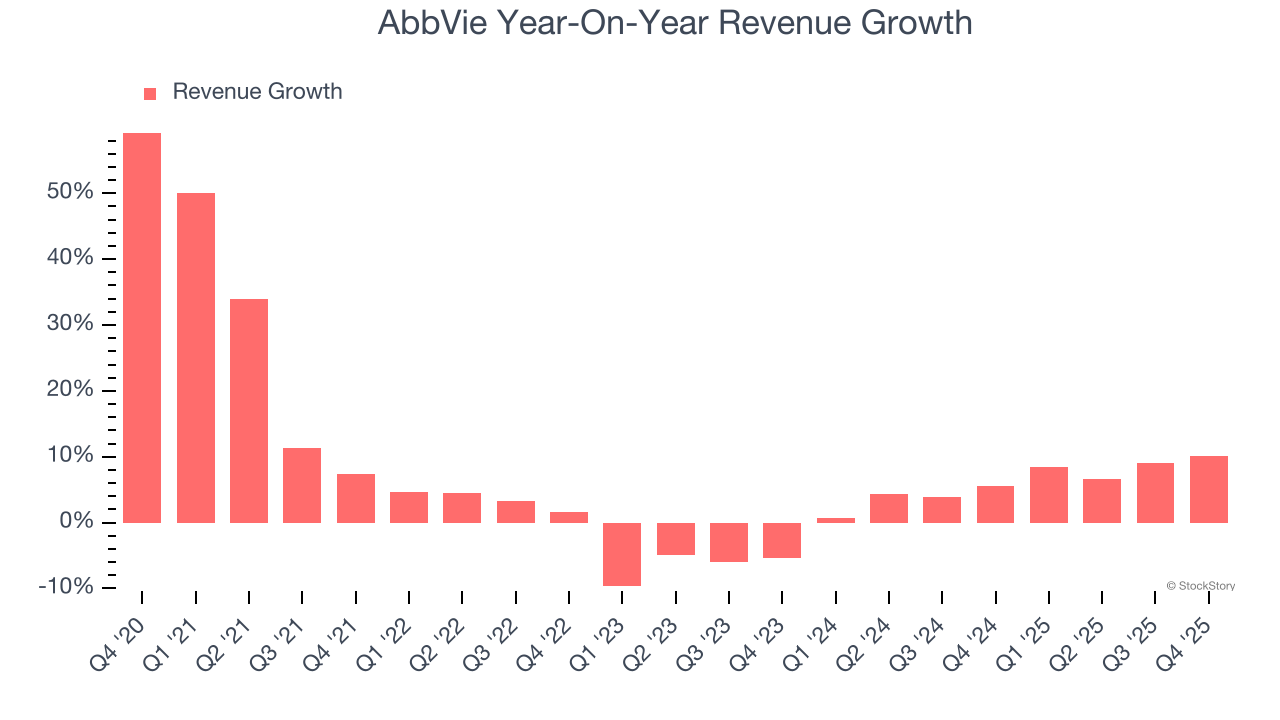

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Regrettably, AbbVie’s sales grew at a mediocre 6% compounded annual growth rate over the last five years. This fell short of our benchmark for the healthcare sector and is a tough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. AbbVie’s annualized revenue growth of 6.1% over the last two years aligns with its five-year trend, suggesting its demand was consistently weak.

We can dig further into the company’s sales dynamics by analyzing its constant currency revenue, which excludes currency movements that are outside their control and not indicative of demand. Over the last two years, its constant currency sales averaged 6.6% year-on-year growth. Because this number aligns with its normal revenue growth, we can see that AbbVie has properly hedged its foreign currency exposure.

This quarter, AbbVie reported year-on-year revenue growth of 10%, and its $16.62 billion of revenue exceeded Wall Street’s estimates by 2.3%.

Looking ahead, sell-side analysts expect revenue to grow 8.6% over the next 12 months, an improvement versus the last two years. This projection is particularly noteworthy for a company of its scale and indicates its newer products and services will catalyze better top-line performance.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

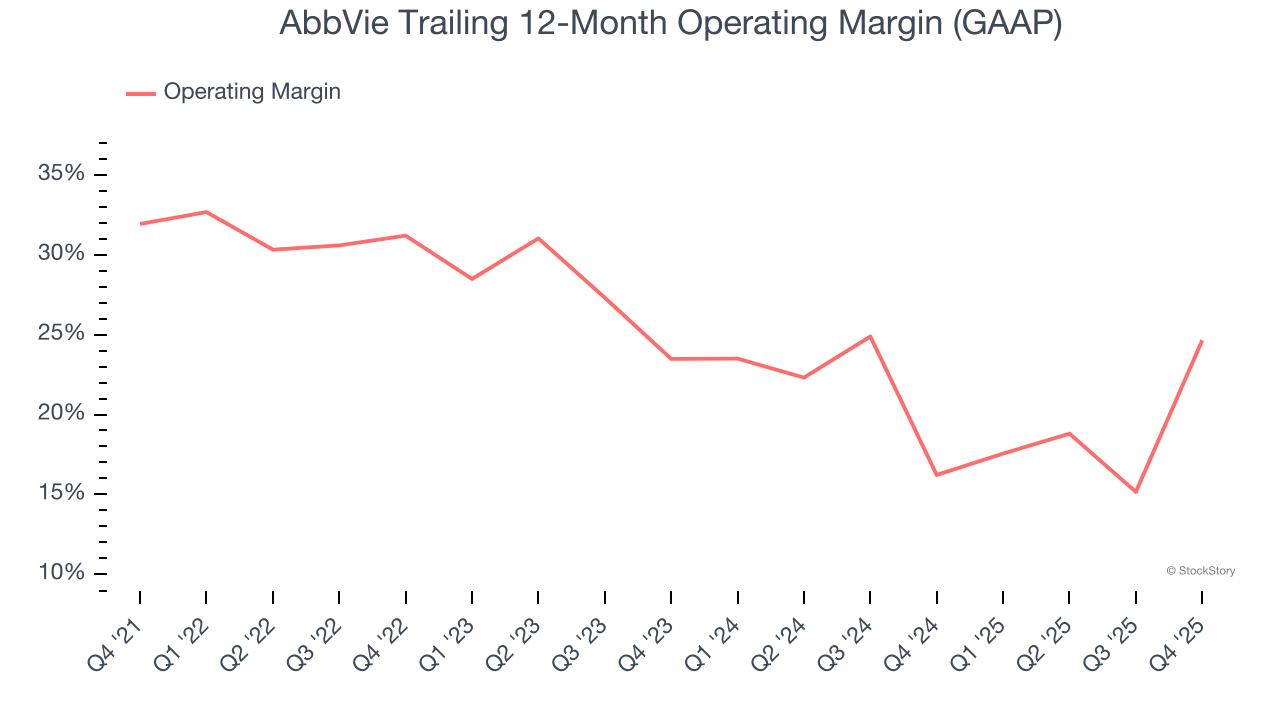

AbbVie has been an efficient company over the last five years. It was one of the more profitable businesses in the healthcare sector, boasting an average operating margin of 25.5%.

Looking at the trend in its profitability, AbbVie’s operating margin decreased by 7.3 percentage points over the last five years, but it rose by 1.2 percentage points on a two-year basis. We like AbbVie and hope it can right the ship.

This quarter, AbbVie generated an operating margin profit margin of 27.3%, up 37.2 percentage points year on year. This increase was a welcome development and shows it was more efficient.

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

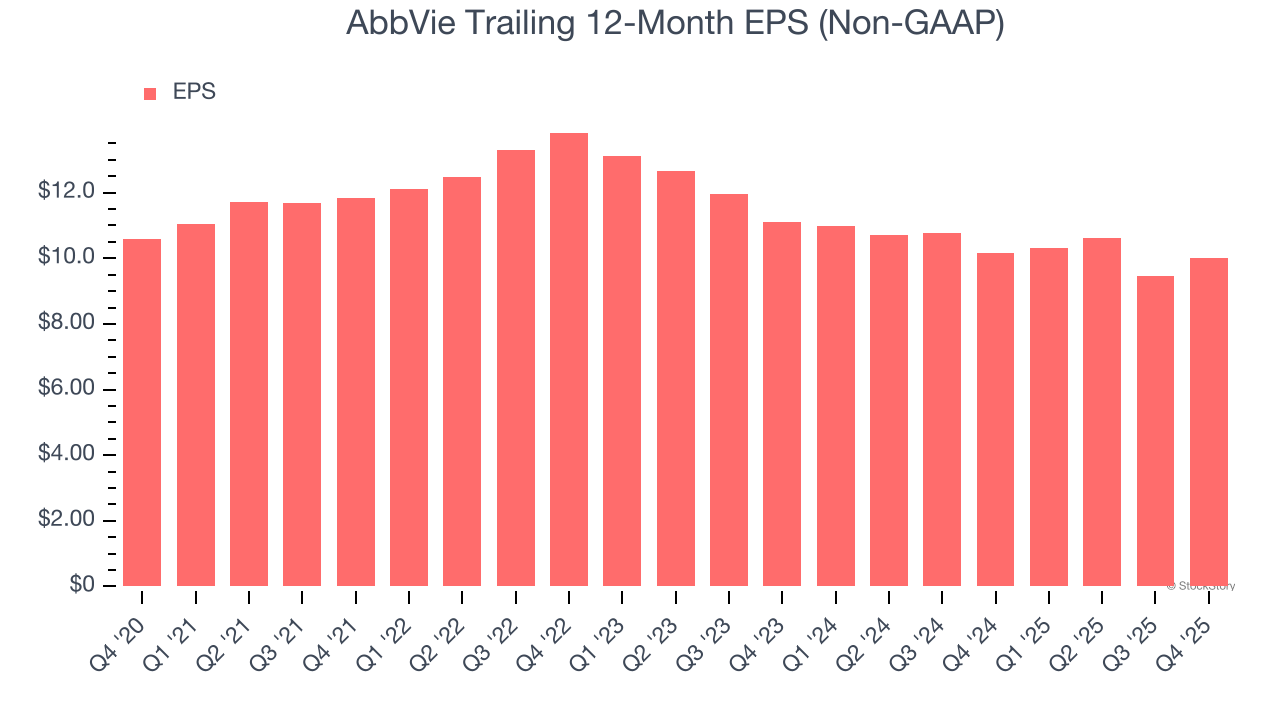

Sadly for AbbVie, its EPS declined by 1.1% annually over the last five years while its revenue grew by 6%. This tells us the company became less profitable on a per-share basis as it expanded.

Diving into the nuances of AbbVie’s earnings can give us a better understanding of its performance. As we mentioned earlier, AbbVie’s operating margin expanded this quarter but declined by 7.3 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q4, AbbVie reported adjusted EPS of $2.71, up from $2.17 in the same quarter last year. This print beat analysts’ estimates by 2.2%. Over the next 12 months, Wall Street expects AbbVie’s full-year EPS of $10.00 to grow 43.3%.

Key Takeaways from AbbVie’s Q4 Results

We enjoyed seeing AbbVie beat analysts’ constant currency revenue expectations this quarter. We were also happy its revenue outperformed Wall Street’s estimates. Overall, we think this was a solid quarter with some key areas of upside. Investors were likely hoping for more, and shares traded down 1.8% to $221.60 immediately following the results.

Is AbbVie an attractive investment opportunity right now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here (it’s free).