Medical device company Boston Scientific (NYSE: BSX) met Wall Streets revenue expectations in Q4 CY2025, with sales up 15.9% year on year to $5.29 billion. The company expects next quarter’s revenue to be around $5.19 billion, close to analysts’ estimates. Its non-GAAP profit of $0.80 per share was 2.4% above analysts’ consensus estimates.

Is now the time to buy Boston Scientific? Find out by accessing our full research report, it’s free.

Boston Scientific (BSX) Q4 CY2025 Highlights:

- Revenue: $5.29 billion vs analyst estimates of $5.27 billion (15.9% year-on-year growth, in line)

- Adjusted EPS: $0.80 vs analyst estimates of $0.78 (2.4% beat)

- Revenue Guidance for Q1 CY2026 is $5.19 billion at the midpoint, roughly in line with what analysts were expecting

- Adjusted EPS guidance for the upcoming financial year 2026 is $3.46 at the midpoint, in line with analyst estimates

- Operating Margin: 15.6%, in line with the same quarter last year

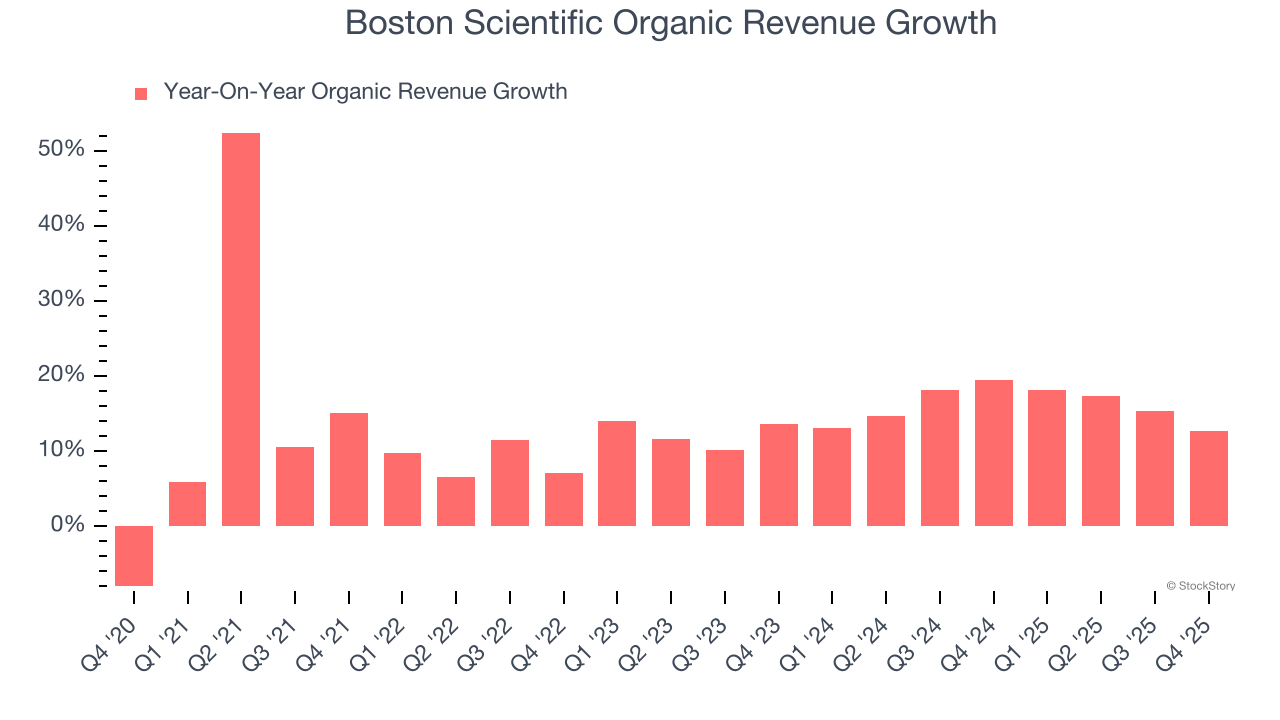

- Organic Revenue rose 12.7% year on year (beat)

- Market Capitalization: $135.9 billion

"2025 was another exceptional year for Boston Scientific, with our global teams delivering differentiated innovation and high performance that enabled us to exceed our goals," said Mike Mahoney, chairman and chief executive officer, Boston Scientific.

Company Overview

Founded in 1979 with a mission to advance less-invasive medicine, Boston Scientific (NYSE: BSX) develops and manufactures medical devices used in minimally invasive procedures across cardiovascular, urological, neurological, and gastrointestinal specialties.

Revenue Growth

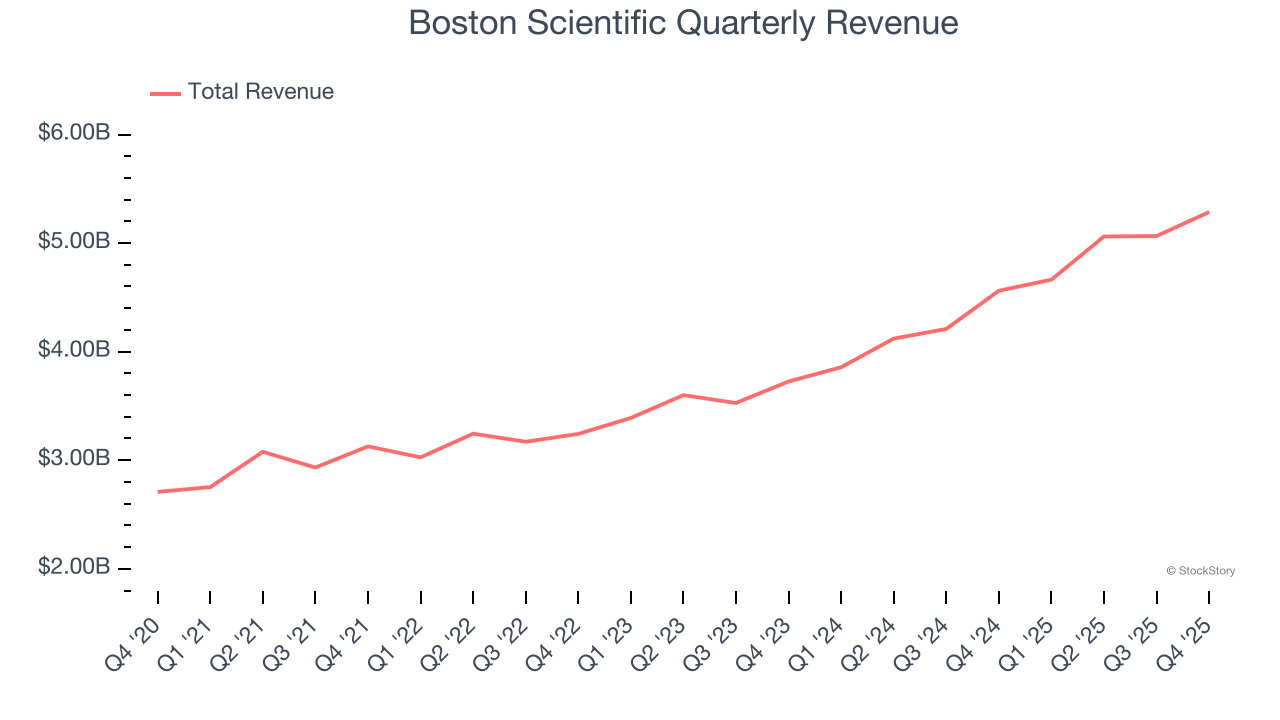

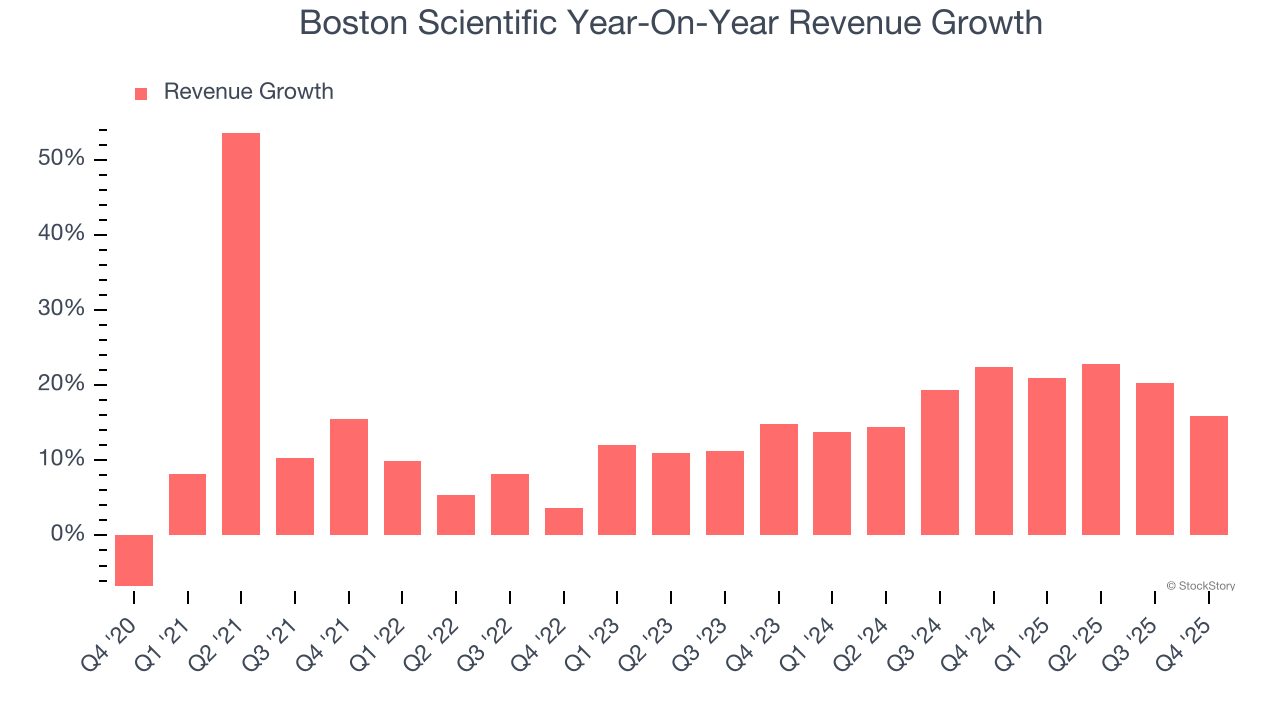

Examining a company’s long-term performance can provide clues about its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Thankfully, Boston Scientific’s 15.2% annualized revenue growth over the last five years was solid. Its growth beat the average healthcare company and shows its offerings resonate with customers, a helpful starting point for our analysis.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Boston Scientific’s annualized revenue growth of 18.7% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

Boston Scientific also reports organic revenue, which strips out one-time events like acquisitions and currency fluctuations that don’t accurately reflect its fundamentals. Over the last two years, Boston Scientific’s organic revenue averaged 16.1% year-on-year growth. Because this number is lower than its two-year revenue growth, we can see that some mixture of acquisitions and foreign exchange rates boosted its headline results.

This quarter, Boston Scientific’s year-on-year revenue growth was 15.9%, and its $5.29 billion of revenue was in line with Wall Street’s estimates. Company management is currently guiding for a 11.3% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 11.1% over the next 12 months, a deceleration versus the last two years. We still think its growth trajectory is attractive given its scale and suggests the market is forecasting success for its products and services.

The 1999 book Gorilla Game predicted Microsoft and Apple would dominate tech before it happened. Its thesis? Identify the platform winners early. Today, enterprise software companies embedding generative AI are becoming the new gorillas. a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

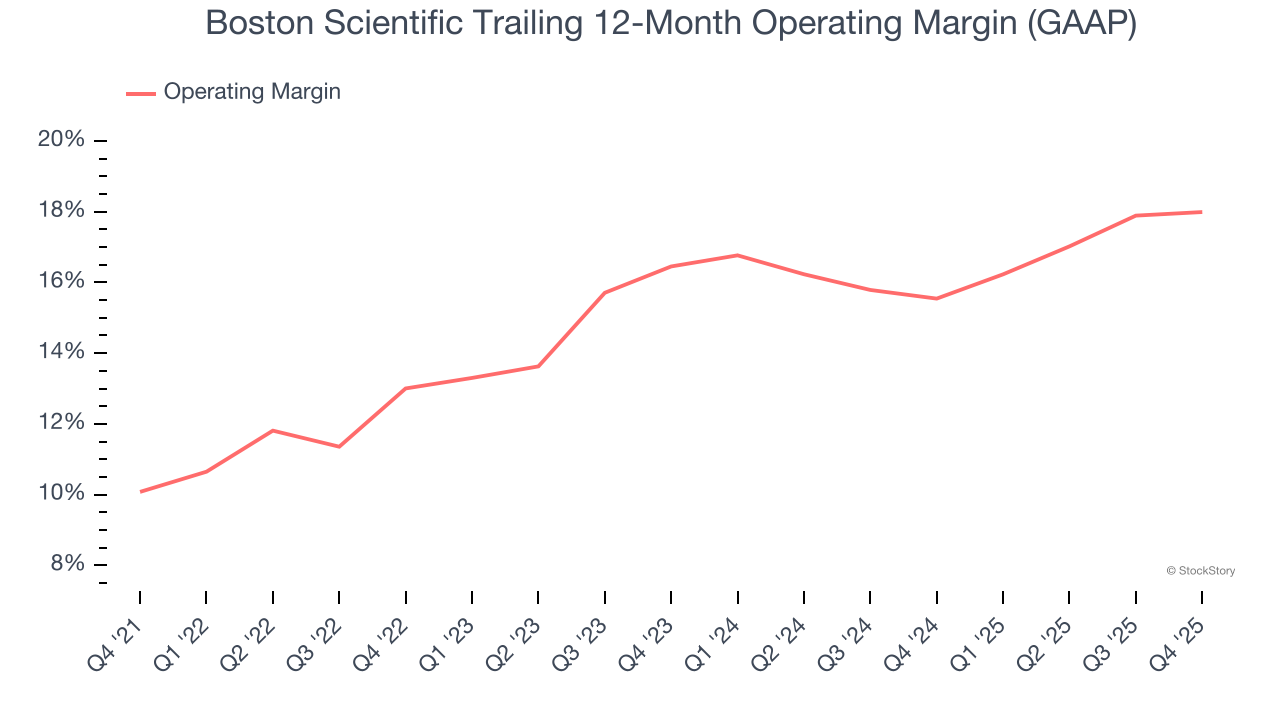

Boston Scientific has managed its cost base well over the last five years. It demonstrated solid profitability for a healthcare business, producing an average operating margin of 15.1%.

Looking at the trend in its profitability, Boston Scientific’s operating margin rose by 7.9 percentage points over the last five years, as its sales growth gave it operating leverage. Zooming in on its more recent performance, we can see the company’s trajectory is intact as its margin has also increased by 1.5 percentage points on a two-year basis. These data points are very encouraging and show momentum is on its side.

This quarter, Boston Scientific generated an operating margin profit margin of 15.6%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

Earnings Per Share

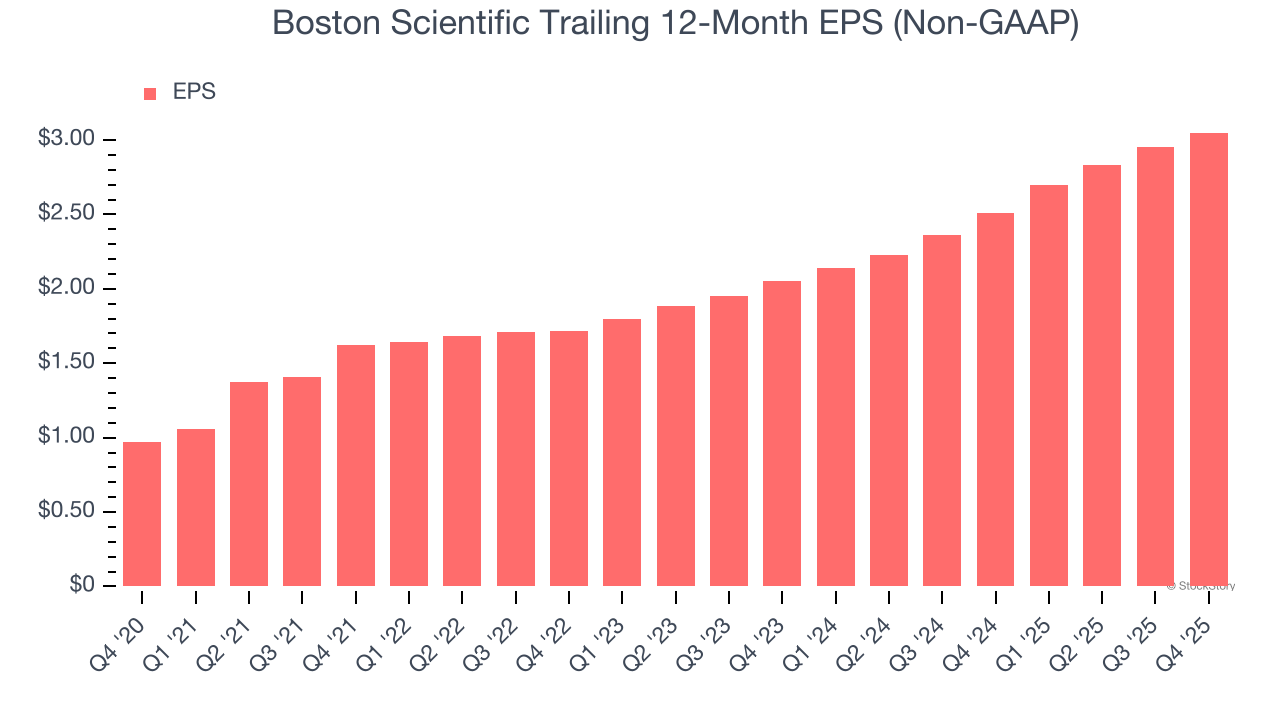

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Boston Scientific’s EPS grew at an astounding 25.8% compounded annual growth rate over the last five years, higher than its 15.2% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

We can take a deeper look into Boston Scientific’s earnings quality to better understand the drivers of its performance. As we mentioned earlier, Boston Scientific’s operating margin was flat this quarter but expanded by 7.9 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q4, Boston Scientific reported adjusted EPS of $0.80, up from $0.70 in the same quarter last year. This print beat analysts’ estimates by 2.4%. Over the next 12 months, Wall Street expects Boston Scientific’s full-year EPS of $3.05 to grow 13.7%.

Key Takeaways from Boston Scientific’s Q4 Results

It was good to see Boston Scientific narrowly top analysts’ organic revenue expectations this quarter. On the other hand, its EPS guidance for next quarter slightly missed and its full-year EPS guidance was in line with Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 4.9% to $87.09 immediately after reporting.

So do we think Boston Scientific is an attractive buy at the current price? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here (it’s free).