Global agribusiness company Bunge Global (NYSE: BG) reported Q4 CY2025 results exceeding the market’s revenue expectations, with sales up 75.5% year on year to $23.76 billion. Its non-GAAP profit of $1.99 per share was 9.6% above analysts’ consensus estimates.

Is now the time to buy Bunge Global? Find out by accessing our full research report, it’s free.

Bunge Global (BG) Q4 CY2025 Highlights:

- Revenue: $23.76 billion vs analyst estimates of $22.39 billion (75.5% year-on-year growth, 6.1% beat)

- Adjusted EPS: $1.99 vs analyst estimates of $1.82 (9.6% beat)

- Adjusted EBITDA: $563 million vs analyst estimates of $846.4 million (2.4% margin, 33.5% miss)

- Adjusted EPS guidance for the upcoming financial year 2026 is $7.75 at the midpoint, missing analyst estimates by 13.3%

- Operating Margin: 1.1%, down from 4.7% in the same quarter last year

- Free Cash Flow Margin: 3.4%, similar to the same quarter last year

- Market Capitalization: $22.61 billion

Greg Heckman, Bunge’s Chief Executive Officer said, “2025 was a year of significant achievement for Bunge. We completed our transformational combination with Viterra, advanced major growth projects across our global network while successfully navigating evolving markets and geopolitical uncertainty. I’m incredibly proud of how our team executed, integrating two world-class organizations, aligning on our operating model, and beginning to capture operational and commercial synergies.”

Company Overview

With origins dating back to 1818 and operations spanning both hemispheres to balance seasonal harvests, Bunge Global (NYSE: BG) is an agribusiness and food company that processes oilseeds, grains, and other agricultural commodities into vegetable oils, protein meals, flours, and specialty ingredients.

Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

With $70.33 billion in revenue over the past 12 months, Bunge Global is one of the most widely recognized consumer staples companies. Its influence over consumers gives it negotiating leverage with distributors, enabling it to pick and choose where it sells its products (a luxury many don’t have). However, its scale is a double-edged sword because it’s harder to find incremental growth when your existing brands have penetrated most of the market. To accelerate sales, Bunge Global likely needs to optimize its pricing or lean into new products and international expansion.

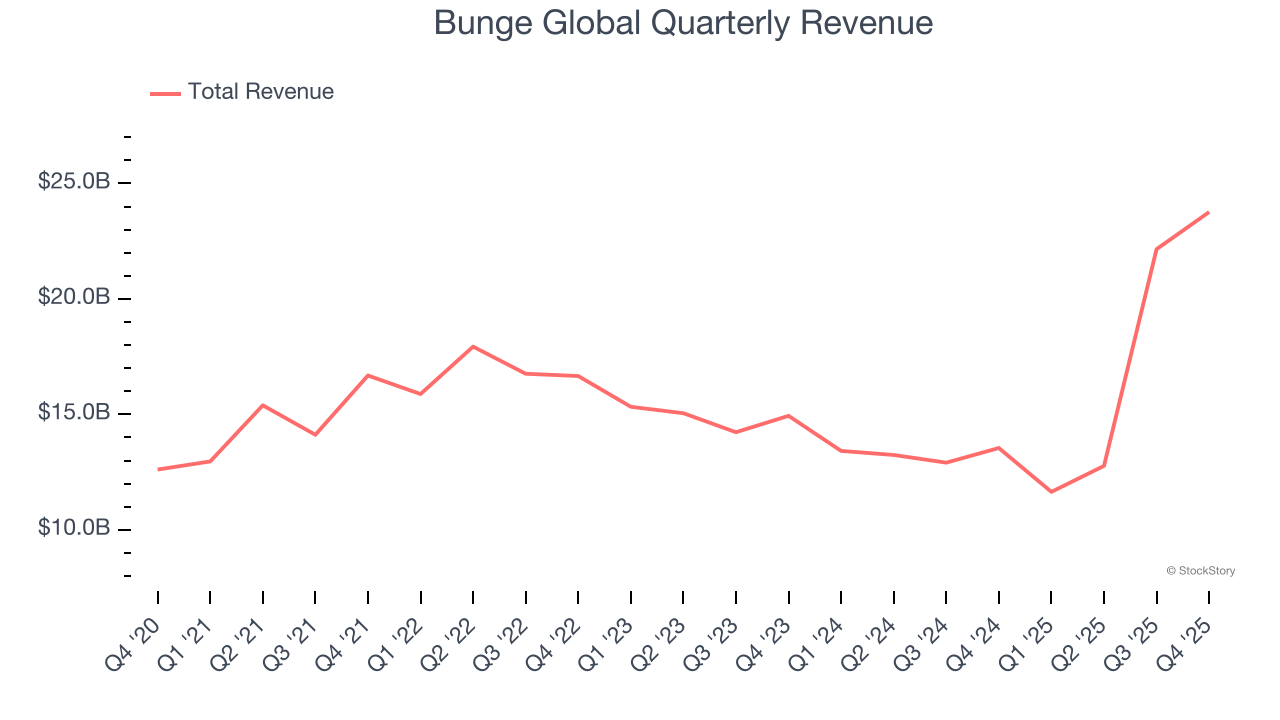

As you can see below, Bunge Global’s sales grew at a sluggish 1.5% compounded annual growth rate over the last three years. This shows it failed to generate demand in any major way and is a rough starting point for our analysis.

This quarter, Bunge Global reported magnificent year-on-year revenue growth of 75.5%, and its $23.76 billion of revenue beat Wall Street’s estimates by 6.1%.

Looking ahead, sell-side analysts expect revenue to grow 33.6% over the next 12 months, an acceleration versus the last three years. This projection is eye-popping for a company of its scale and suggests its newer products will fuel better top-line performance.

The 1999 book Gorilla Game predicted Microsoft and Apple would dominate tech before it happened. Its thesis? Identify the platform winners early. Today, enterprise software companies embedding generative AI are becoming the new gorillas. a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

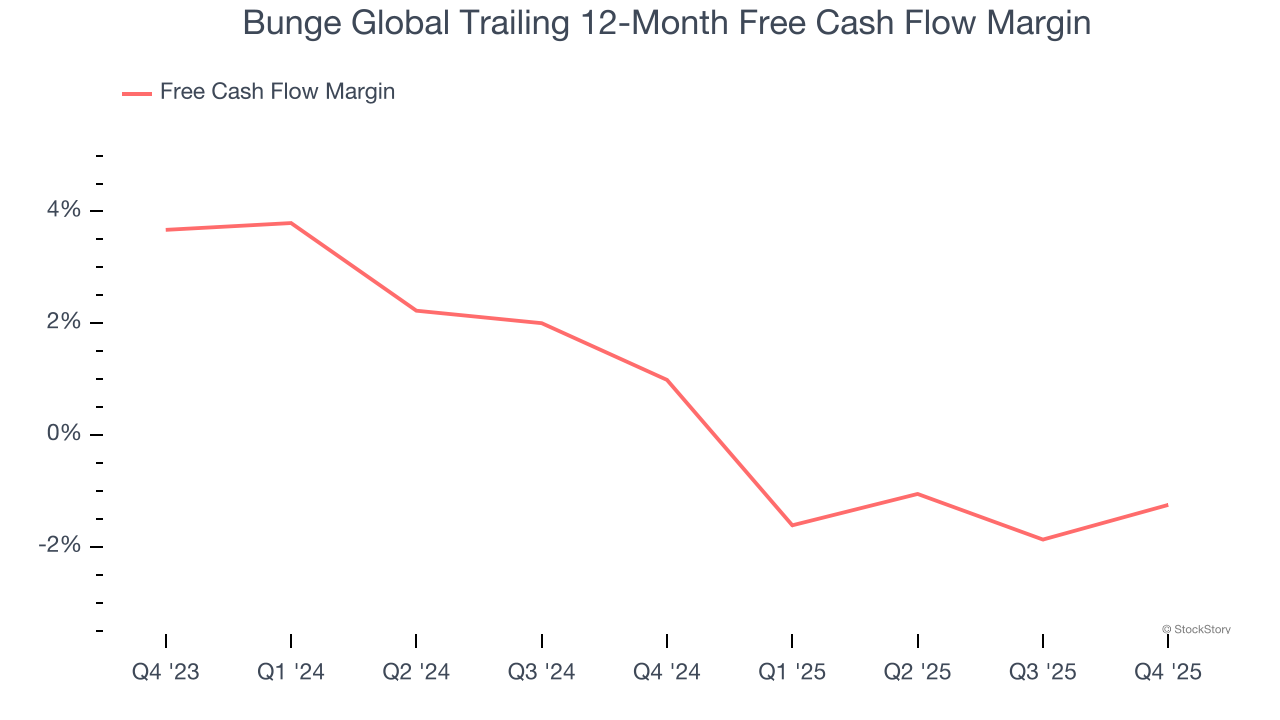

Bunge Global broke even from a free cash flow perspective over the last two years, giving the company limited opportunities to return capital to shareholders.

Taking a step back, we can see that Bunge Global’s margin dropped by 2.2 percentage points over the last year. Almost any movement in the wrong direction is undesirable because of its already low cash conversion. If the trend continues, it could signal it’s in the middle of an investment cycle.

Bunge Global’s free cash flow clocked in at $809 million in Q4, equivalent to a 3.4% margin. This cash profitability was in line with the comparable period last year and above its two-year average.

Key Takeaways from Bunge Global’s Q4 Results

We were impressed by how significantly Bunge Global blew past analysts’ revenue expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. On the other hand, its full-year EPS guidance missed and its EBITDA fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 4.3% to $111.87 immediately following the results.

Bunge Global didn’t show it’s best hand this quarter, but does that create an opportunity to buy the stock right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here (it’s free).