Semiconductor manufacturer Vishay Intertechnology (NYSE: VSH) reported revenue ahead of Wall Streets expectations in Q4 CY2025, with sales up 12.1% year on year to $800.9 million. Guidance for next quarter’s revenue was better than expected at $815 million at the midpoint, 1.2% above analysts’ estimates. Its non-GAAP profit of $0.01 per share was in line with analysts’ consensus estimates.

Is now the time to buy Vishay Intertechnology? Find out by accessing our full research report, it’s free.

Vishay Intertechnology (VSH) Q4 CY2025 Highlights:

- Revenue: $800.9 million vs analyst estimates of $795.7 million (12.1% year-on-year growth, 0.7% beat)

- Adjusted EPS: $0.01 vs analyst estimates of $0.02 (in line)

- Adjusted EBITDA: $70.27 million vs analyst estimates of $67.71 million (8.8% margin, 3.8% beat)

- Revenue Guidance for Q1 CY2026 is $815 million at the midpoint, above analyst estimates of $805.6 million

- Operating Margin: 1.8%, up from -7.9% in the same quarter last year

- Free Cash Flow was $54.87 million, up from -$75.63 million in the same quarter last year

- Inventory Days Outstanding: 107, down from 109 in the previous quarter

- Market Capitalization: $2.81 billion

“Fourth quarter financial results capped a year of steadily improving performance. Revenue was 1.3% higher than the third quarter, reflecting growing demand for a broad range of industrial and AI-related power applications, with growth in each channel, led by distribution. Orders for the quarter reached a three-year high and we ended the quarter with a book-to-bill of 1.20,” said Joel Smejkal, president and CEO. ”

Company Overview

Named after the founder's ancestral village in present-day Lithuania, Vishay Intertechnology (NYSE: VSH) manufactures simple chips and electronic components that are building blocks of virtually all types of electronic devices.

Revenue Growth

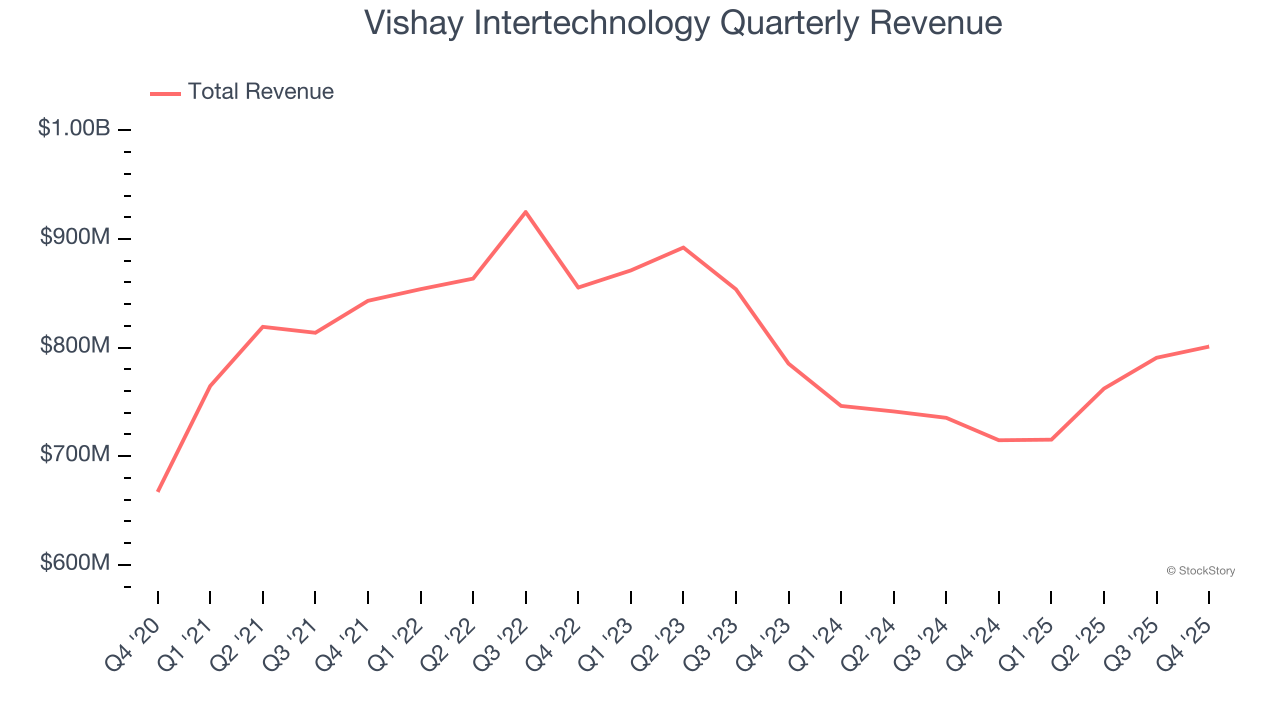

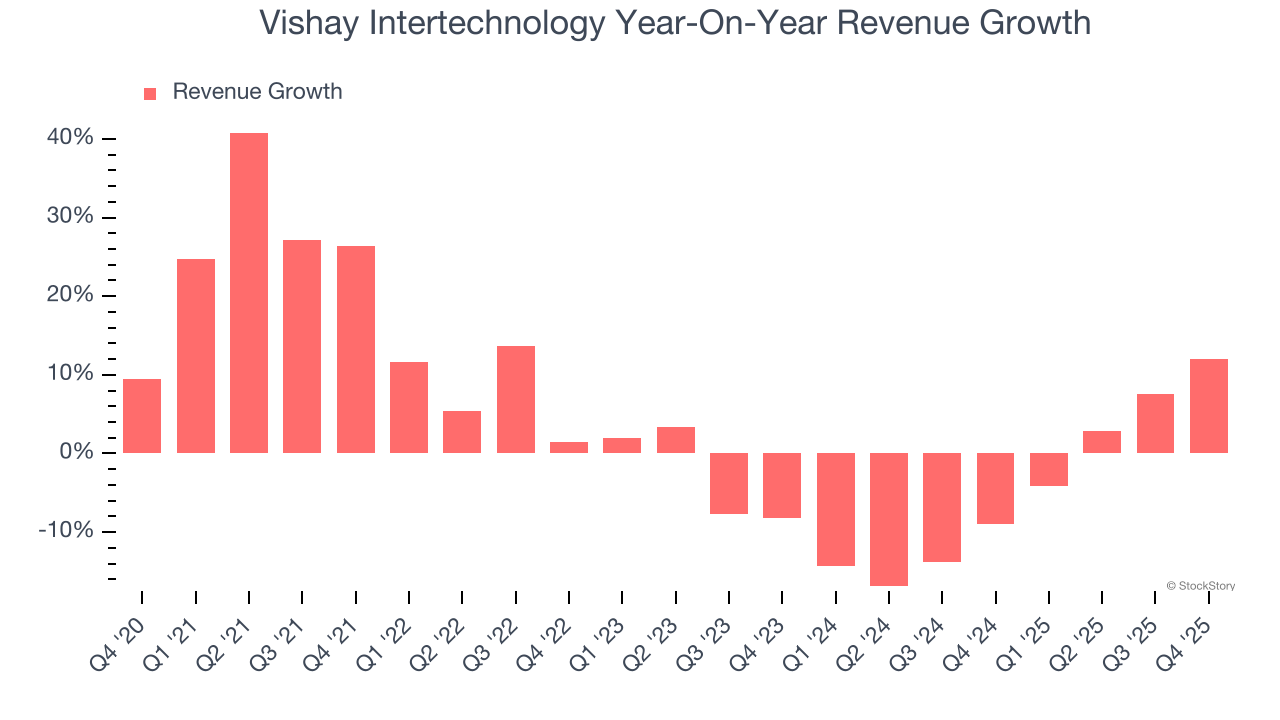

Reviewing a company’s long-term sales performance reveals insights into its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Unfortunately, Vishay Intertechnology’s 4.2% annualized revenue growth over the last five years was mediocre. This fell short of our benchmark for the semiconductor sector and is a rough starting point for our analysis. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions.

We at StockStory place the most emphasis on long-term growth, but within semiconductors, a half-decade historical view may miss new demand cycles or industry trends like AI. Vishay Intertechnology’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 5% annually.

This quarter, Vishay Intertechnology reported year-on-year revenue growth of 12.1%, and its $800.9 million of revenue exceeded Wall Street’s estimates by 0.7%. Beyond the beat, we believe the company is still in the early days of an upcycle as this was the third consecutive quarter of growth - a typical upcycle tends to last 8-10 quarters. Company management is currently guiding for a 13.9% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 9.4% over the next 12 months. Although this projection suggests its newer products and services will spur better top-line performance, it is still below average for the sector.

Microsoft, Alphabet, Coca-Cola, Monster Beverage—all began as under-the-radar growth stories riding a massive trend. We’ve identified the next one: a profitable AI semiconductor play Wall Street is still overlooking. Go here for access to our full report.

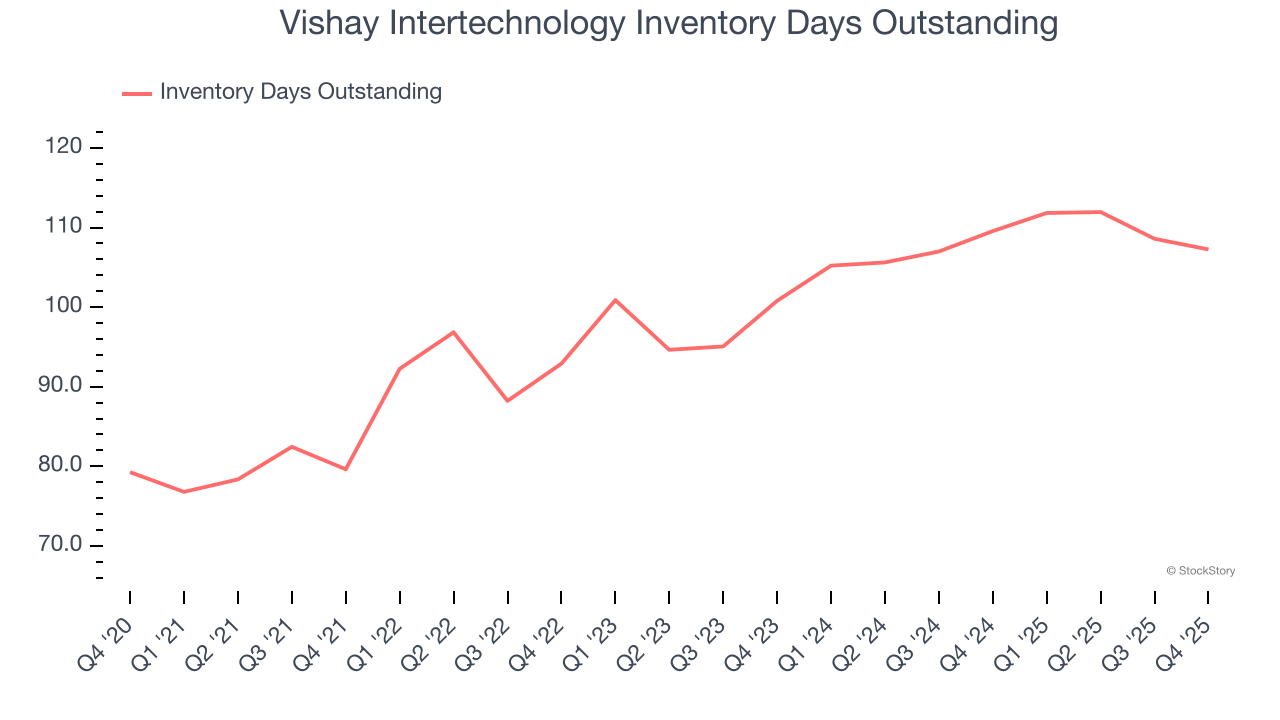

Product Demand & Outstanding Inventory

Days Inventory Outstanding (DIO) is an important metric for chipmakers, as it reflects a business’ capital intensity and the cyclical nature of semiconductor supply and demand. In a tight supply environment, inventories tend to be stable, allowing chipmakers to exert pricing power. Steadily increasing DIO can be a warning sign that demand is weak, and if inventories continue to rise, the company may have to downsize production.

This quarter, Vishay Intertechnology’s DIO came in at 107, which is 10 days above its five-year average. These numbers suggest that despite the recent decrease, the company’s inventory levels are higher than what we’ve seen in the past.

Key Takeaways from Vishay Intertechnology’s Q4 Results

It was good to see Vishay Intertechnology provide revenue guidance for next quarter that slightly beat analysts’ expectations. On the other hand, its EPS was in line. Overall, this was a weaker quarter. The stock traded down 1.5% to $20.43 immediately after reporting.

Vishay Intertechnology didn’t show it’s best hand this quarter, but does that create an opportunity to buy the stock right now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here (it’s free).